Agoracom Blog Home

Archive for the ‘AGORACOM Client Feature’ Category

AMK: TSX-V

WHY AMERICAN CREEK RESOURCES?

- Mineralization in the Treaty Creek claims area lies within the same broad hydrothermal system that generated the several deposits on the Seabridge Gold KSM and the Pretivm Brucejack properties that lie immediately southwest of the Treaty Creek claims

- So far over 130 million ounces of gold, 800 million ounces of silver and 20 billion pounds of copper (all categories included), representing one of the greatest concentrations of metal value on the planet, have been delineated within the geological system shared by KSM, Brucejack, and Treaty Creek.

RECENT HIGHLIGHTS

- Specimens from the structure averages 27,092 gm/tonne silver and 248 gm/tonne gold

- Results from outcrop specimens of high grade material collected on its Electrum property from the Shiny Cliff vein on the North Face Showing Read More

- TSX Venture Exchange approved the Amended and Restated Purchase Agreement regarding the Treaty Creek NSR that was previously announced April 13, 2016. Read Our Recent Blog

Exceptional Properties

Electrum Gold-Silver Property, British Columbia – 100% owned

The Electrum property has a rich history with some of the highest grade hand-mined ore mined in North America combined with excellent logistics. The property is located directly between two high-grad vein gold/silver mines; the past producing Silbak Premier mine and Pretiums high-grade Brucejack mine (production in 2017).All three lie within the Iskut mineral district (a particularly prolific part of the Canadian Cordillera) with numerous geological similarities between them.

The Electrum Property holds significant potential to attract mining companies when considering its high-grade nature combined with the exceptional logistics in place.

- Located in the prolific Golden Triangle of northwestern British Columbia, an area encompassing mineral rich belts that host more than 43 past producing mines including Eskay Creek, Silbak Premier, Granduc and Big Missouri.It is a hotbed of activity with one new mine having come online in 2015 (Imperial Mines Red Chris) and another scheduled for 2017 (Pretium Brucejack) and at least three more world-class mining projects headed toward production.

- Located in a particularly rich valley with 4 past producing commercial mines and a 5th in the adjacent valley.

- Includes the historic East Gold Mine that had intermittent small-scale production of approximately 46 tonnes of ore with grades averaging 1,661 grams of gold per tonne and 2,596 grams of silver per tone (roughly 50oz gold with 75oz silver).

- Mineralization is believed to be very similar to the silver-gold-base metal veins responsible for the precious metal mineralization found in the Silbak Premier Mine and the Big Missouri mines (located in same extended valley).

- Pretiums Brucejack Summary Report (for exploration) compares itself geologically to the Silbak Premier mine as well.

- Exceptional gold and silver assays including 440 g/t gold with 400 g/t silver over 0.52m, with numerous silver intervals of 583g/t, 501 g/t, 420 g/t, 384 g/t in core, and surface samples of 80.96 g/t gold with 80,818 g/t silver, 694 g/t gold with 550 g/t silver, 54.77 g/t gold with 14,903 g/t silver, 615 g/t gold with 616 g/t silver.

- A very successful program was run in 2015 wherein:

- A new approach focusing on high-grade was employed very successfully

- A new zone of gold / silver mineralization was discovered

- A better understanding of the property geology was obtained

- Surface samples from the structure averages 27,092 gm/tonne silver and 248 gm/tonne gold

- The program proved the Electrum Property has multiple high-grade gold-silver epithermal breccia vein systems and gave us a better understating of their sequencing.

- Excellent logistics including road access, power located 2 km away and a bulk tonnage shipping port and supportive mining town located just40 km away in a mining friendly jurisdiction.

The high-grade ELECTRUM PROPERTY recently had a program run on it. CLICK HERE for the Electrum presentation and HERE for the 2015 drill program presentation. The highly mineralized gossans on the Electrum are shown in the image at the top of this page.

2015 Drill Program Presentation

Treaty Creek Gold-Copper Property, British Columbia – 51% Joint Venture

Treaty Creek Property

Treaty Creek is located in British Columbia’s prolific Golden Triangle; one of the richest areas of mineralization in the world with one new mine having come online in 2015 (Imperial Mines Red Chris) and another scheduled for 2017 (Pretium Brucejack) and at least three more world-class mining projects headed toward production.

Mineralization in the Treaty Creek claims area lies within the same broad hydrothermal system that generated the several deposits on the Seabridge Gold KSM and the Pretivm Brucejack properties that lie immediately southwest of the Treaty Creek claims. So far over 130 million ounces of gold, 800 million ounces of silver and 20 billion pounds of copper (all categories included), representing one of the greatest concentrations of metal value on the planet, have been delineated within the geological system shared by KSM, Brucejack, and Treaty Creek.

Seabridge Gold’s KSM is the world’s largest undeveloped gold/silver project by reserves while Pretium’s Brucejack is the highest grading undeveloped large-scale gold project in the world.KSM has just past the environmental and permitting stage while the Brucejack is in construction phase.

Treaty Creek is part of the same large hydrothermal system as it’s neighbours, hosts the same bedrock geology as its neighbours, the same magneto-telluric (MT) anomalies that proved to be large deposits on the neighbours claims, the same major fault system (Sulphurets) that is responsible for KSM’s deposits, and initial exploration and drilling show similar results to initial drilling on KSM.

The Treaty Creek property is in a strategic location as it’s included in Seabridge’s plan for the KSM to go into production. Seabridge has proposed twin tunnels that would take the KSM ore through American Creek’s Treaty Creek property to a processing plant and tailings pond.

Tags: #mining, #silver, #smallcapstocks, $TSXV, copper, gold, Pretium Resources (PVG.T), Seabridge Gold (SEA.T)

Posted in AGORACOM Client Feature, All Recent Posts, American Creek Resources Ltd. | Comments Off on CLIENT FEATURE: American Creek’s Treaty Creek adjacent area host to Over 130M Oz of Gold, 800 million ounces of silver and 20 billion pounds of copper $AMK.Ca

AMK: TSX-V

RECENT HIGHLIGHTS

- Specimens from the structure averages 27,092 gm/tonne silver and 248 gm/tonne gold

- Results from outcrop specimens of high grade material collected on its Electrum property from the Shiny Cliff vein on the North Face Showing Read More

Exceptional Properties

Electrum Gold-Silver Property, British Columbia – 100% owned

The Electrum property has a rich history with some of the highest grade hand-mined ore mined in North America combined with excellent logistics. The property is located directly between two high-grad vein gold/silver mines; the past producing Silbak Premier mine and Pretiums high-grade Brucejack mine (production in 2017).All three lie within the Iskut mineral district (a particularly prolific part of the Canadian Cordillera) with numerous geological similarities between them.

The Electrum Property holds significant potential to attract mining companies when considering its high-grade nature combined with the exceptional logistics in place.

- Located in the prolific Golden Triangle of northwestern British Columbia, an area encompassing mineral rich belts that host more than 43 past producing mines including Eskay Creek, Silbak Premier, Granduc and Big Missouri.It is a hotbed of activity with one new mine having come online in 2015 (Imperial Mines Red Chris) and another scheduled for 2017 (Pretium Brucejack) and at least three more world-class mining projects headed toward production.

- Located in a particularly rich valley with 4 past producing commercial mines and a 5th in the adjacent valley.

- Includes the historic East Gold Mine that had intermittent small-scale production of approximately 46 tonnes of ore with grades averaging 1,661 grams of gold per tonne and 2,596 grams of silver per tone (roughly 50oz gold with 75oz silver).

- Mineralization is believed to be very similar to the silver-gold-base metal veins responsible for the precious metal mineralization found in the Silbak Premier Mine and the Big Missouri mines (located in same extended valley).

- Pretiums Brucejack Summary Report (for exploration) compares itself geologically to the Silbak Premier mine as well.

- Exceptional gold and silver assays including 440 g/t gold with 400 g/t silver over 0.52m, with numerous silver intervals of 583g/t, 501 g/t, 420 g/t, 384 g/t in core, and surface samples of 80.96 g/t gold with 80,818 g/t silver, 694 g/t gold with 550 g/t silver, 54.77 g/t gold with 14,903 g/t silver, 615 g/t gold with 616 g/t silver.

- A very successful program was run in 2015 wherein:

- A new approach focusing on high-grade was employed very successfully

- A new zone of gold / silver mineralization was discovered

- A better understanding of the property geology was obtained

- Surface samples from the structure averages 27,092 gm/tonne silver and 248 gm/tonne gold

- The program proved the Electrum Property has multiple high-grade gold-silver epithermal breccia vein systems and gave us a better understating of their sequencing.

- Excellent logistics including road access, power located 2 km away and a bulk tonnage shipping port and supportive mining town located just40 km away in a mining friendly jurisdiction.

The high-grade ELECTRUM PROPERTY recently had a program run on it. CLICK HERE for the Electrum presentation and HERE for the 2015 drill program presentation. The highly mineralized gossans on the Electrum are shown in the image at the top of this page.

2015 Drill Program Presentation

Treaty Creek Gold-Copper Property, British Columbia – 51% Joint Venture

Treaty Creek Property

Treaty Creek is located in British Columbia’s prolific Golden Triangle; one of the richest areas of mineralization in the world with one new mine having come online in 2015 (Imperial Mines Red Chris) and another scheduled for 2017 (Pretium Brucejack) and at least three more world-class mining projects headed toward production.

Mineralization in the Treaty Creek claims area lies within the same broad hydrothermal system that generated the several deposits on the Seabridge Gold KSM and the Pretivm Brucejack properties that lie immediately southwest of the Treaty Creek claims. So far over 130 million ounces of gold, 800 million ounces of silver and 20 billion pounds of copper (all categories included), representing one of the greatest concentrations of metal value on the planet, have been delineated within the geological system shared by KSM, Brucejack, and Treaty Creek.

Seabridge Gold’s KSM is the world’s largest undeveloped gold/silver project by reserves while Pretium’s Brucejack is the highest grading undeveloped large-scale gold project in the world.KSM has just past the environmental and permitting stage while the Brucejack is in construction phase.

Treaty Creek is part of the same large hydrothermal system as it’s neighbours, hosts the same bedrock geology as its neighbours, the same magneto-telluric (MT) anomalies that proved to be large deposits on the neighbours claims, the same major fault system (Sulphurets) that is responsible for KSM’s deposits, and initial exploration and drilling show similar results to initial drilling on KSM.

The Treaty Creek property is in a strategic location as it’s included in Seabridge’s plan for the KSM to go into production. Seabridge has proposed twin tunnels that would take the KSM ore through American Creek’s Treaty Creek property to a processing plant and tailings pond.

Tags: #mining, #silver, #smallcapstocks, $TSXV, CSE, gold, Golden Triangle

Posted in AGORACOM Client Feature, All Recent Posts, American Creek Resources Ltd. | Comments Off on CLIENT FEATURE: American Creek (AMK: TSX-V) – Recent samples average 27,092 gm/tonne silver and 248 gm/tonne gold

BY BEING A DOMESTIC FERTILIZER PRODUCER, DUSOLO IS ABLE TO OFFER A PREMIUM PRODUCT AT A SIGNIFICANTLY LOWER COST

MANY NEAR TERM CATALYSTS EXPECTED

- Entering into additional DANF product sales contracts

- Doubling capacity at our processing facility to 160,000 tonnes per year

- Updating the National Instrument 43-101 Resource Estimate to include results from the 2015 drill campaign – Recent drill results confirm presence of additional high-grade phosphate mineralization beyond areas identified in initial resource estimate

- Third Party Economic Evaluation of Operations Planned for 2015

- Strong Financial Backing

Company entered into an agreement with Mineração Batalha e Participações Ltda. to acquire the São Roque Phosphate Project in southeast Brazil.

The Project’s highlights include:

- Located within the agribusiness region of Minas Gerais and São Paulo states, with many coffee, orange and sugar-cane (ethanol) plantations in the surrounding area.

- At surface, high-grade phosphate mineralization has been identified with multiple grab samples from outcrops confirming >20% P2O5.

- Geophysics anomalies very well defined and confirmed by surface sampling.

- Close proximity to infrastructure, including roads, rail, water and power, and existing fertilizer producers. City of Piumhi is 40 km from the Project.

- 70% interest earned through commitment to invest in exploration and project development. No direct payment to JV Partner.

BRAZIL’S DOMESTIC FERTILIZER SUPPLY DOES NOT MEET CURRENT DEMANDS

FLAGSHIP ASSET LOCATED IN ONE OF THE WORLD’S LARGEST AGRICULTURAL REGIONS

STRONG DEMAND FOR DANF EXISTS IN THE REGION

Within a 500 km radius of DuSolo’s processing facility:

Tags: #mining, #smallcapstocks, $TSXV, brazil, farming, fertilizer

Posted in AGORACOM Client Feature, All Recent Posts, DuSolo Fertilizers Inc. | Comments Off on CLIENT FEATURE: Dusolo (DSF: TSX-V) Capitalizing on Brazil’s Growing Demand for Fertilizer

BY BEING A DOMESTIC FERTILIZER PRODUCER, DUSOLO IS ABLE TO OFFER A PREMIUM PRODUCT AT A SIGNIFICANTLY LOWER COST

Â

MANY NEAR TERM CATALYSTS EXPECTED

-

Entering into additional DANF product sales contracts

-

Doubling capacity at our processing facility to 160,000 tonnes per year

- Updating the National Instrument 43-101 Resource Estimate to include results from the 2015 drill campaign – Recent drill results confirm presence of additional high-grade phosphate mineralization beyond areas identified in initial resource estimate

- Third Party Economic Evaluation of Operations Planned for 2015

- Strong Financial Backing

Company entered into an agreement with Mineração Batalha e Participações Ltda. to acquire the São Roque Phosphate Project in southeast Brazil.

The Project’s highlights include:

- Located within the agribusiness region of Minas Gerais and São Paulo states, with many coffee, orange and sugar-cane (ethanol) plantations in the surrounding area.

- At surface, high-grade phosphate mineralization has been identified with multiple grab samples from outcrops confirming >20% P2O5.

- Geophysics anomalies very well defined and confirmed by surface sampling.

- Close proximity to infrastructure, including roads, rail, water and power, and existing fertilizer producers. City of Piumhi is 40 km from the Project.

- 70% interest earned through commitment to invest in exploration and project development. No direct payment to JV Partner.

BRAZIL’S DOMESTIC FERTILIZER SUPPLY DOES NOT MEET CURRENT DEMANDS

FLAGSHIP ASSET LOCATED IN ONE OF THE WORLD’S LARGEST AGRICULTURAL REGIONS

STRONG DEMAND FOR DANF EXISTS IN THE REGION

Within a 500 km radius of DuSolo’s processing facility:

Tags: #mining, #smallcapstocks, $TSXV, brazil, farming, fertilizer

Posted in AGORACOM Client Feature, All Recent Posts, DuSolo Fertilizers Inc. | Comments Off on CLIENT FEATURE: (DSF: TSX-V) Capitalizing on Brazil’s Growing Demand for Fertilizer

EXCLUSIVE GLOBAL PARTNERSHIP PUTS URAGOLD IN POSITION TO TURN QUARTZ PROJECTS INTO LOWEST COST SUPPLIER TO SOLAR INDUSTRY

- Patent Filed

- Worldwide Exclusive Rights Granted

- Pilot Plant Already Funded

- Technology Partner Takes First Royalty Payment In Stock

- In Position To Become Vertically Integrated Producer Of Solar Grade Silicon Metal & Major Participant In Global Solar Industry

“There is no other way to say it. This technology represents a potential quantum leap forward for the solar panel industry.” (URAGOLD CEO QUOTE)

Why Uragold?

- High Purity Silica (HPS) and Silicon Metal are key strategic minerals

- Applications in high-tech industries that include semiconductors, LCD displays, solar silicon applications and recently, Silicon Anode Lithium Batteries

- Major silicon metal producer has confirmed interest in purchasing a significant tonnage of High Purity Quartz

- (MOU) between its 100% owned subsidiary Quebec Quartz and Dorfner Anzaplan (Anzaplan) regarding the development of property specific beneficiation processes for the production of ultra high purity quartz sands (99.99+% SiO2).

What are High Purity Quartz and Silicon Metal?

High Purity Quartz

- High Purity Quartz (HPQ) has a purity level in excess of 99.997% and is extremely rare.

-

High purity quartz deposits with low impurities are rare, world supplies are tightening and HPS prices are rising [Source ].

-

Demand for HPQ is growing with the high tech industry and the price for premium HPQ can vary between US$ 8,000 to US$ 25,000 or more per ton depending on the specifications needed for the final application [Source ].

Metallurgical Silicon Metal

-

Metallurgical Silicon Metal has a purity of 98.5% or higher and is used as an alloying agent in the aluminum industry due to its ability to increase the strength of aluminum [Source].

-

Adding Silicon Metal to aluminum alloys makes them strong and light [Source].

-

As a result they are increasingly used in the automotive industry to replace heavier cast iron components [Source].

-

Allows weight reductions and a reduction in fuel consumption [Source].

-

Demand for aluminium has increased 5% CAGR over the past 20 years [Source].

-

It has also been reported that the solar industry will have it’s first global panel shortage since 2006 [Source].

-

It has become one of today’s key strategic minerals with applications in high-tech industries that include semiconductors, LCD displays, fused quartz tubing, microelectronics, solar silicon applications and recently, Silicon Anode Lithium Batteries

-

Silicon Metal with 98.50% SiO2 purity sells for about US$ 3,200 per ton (or US$ 1.45 US a pound) [Source].

Martinville, Malvina and the Montpetit Quarry Silica Properties

Quebec Quartz, has successfully finish the sampling programs over the historical quartz and quartzite showings on the Montpetit Quarry, and the Martinville and Malvina Silica properties. A map of the properties can be viewed here: http://www.uragold.com/Quebec-Quartz.php.

The Montpetit Property is located in the Monteregie Region of Quebec, some 40 km south of Montreal and 7 km south of Saint-Clotilde-de-Chateauguay. The Quebec-New-York border is 10 km from the property. The property is located on NTS map sheets 31H/04 (1:50,000 scale). Farms fields and forest, owned by private landowners, mostly cover the region.

A review of the historical work indicates that the quarry operated for one (1) year and that the deposit is composed of consolidated beach sand that was highly purified by segregation, sorting and leaching. Through natural Diagenesis, overtime the sand was transformed into a quartzite.

Acquired, through map staking, two silica claims directly adjacent to Sitec Silicium Quebec quartz mine located in the Charlevoix region of Quebec

Sitec Silicium Quebec quartz mine supplies silica for Sitec silicon metal foundry in Becancour and for the Elkem Metal Canada ferrosilicium foundry in Chicoutimi Quebec.

Quebec Quart, Uragold’s wholly owned subsidiary, intends to explore the claims for quartzite extensions to the north of the Silicium Quebec Mine. The Galette sector of the Charlevoix region is knows to hold high purity quartzites. The regional geology is comprised of a paragenesis and pink garnetiferous granite with units of discernable quartzites within the paragenesis.

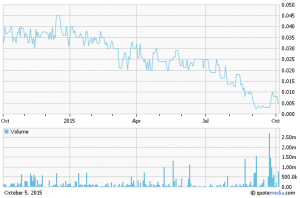

12 Month Stock Chart

Tags: #mining, #smallcapstocks, $TSXV, High Purity Quartz, High Purity silica, solar industry

Posted in AGORACOM Client Feature, All Recent Posts, Uragold, URagold Bay Resources | Comments Off on AGORACOM CLIENT FEATURE: (UBR:TSX-V) – Exclusive Global Partnership Puts Uragold in Position to Turn Quartz Projects into Lowest Cost Supplier To Solar Industry

What is Cubic Farming?

-

A revolution in Controlled Environment Agriculture (CEA)

-

Propriety, patent-pending, looped conveyer growing system

-

Advanced uniform LED technology

-

Automated watering and nutrients

-

Optimal conditions for crops to transition from seeds to maturity through pre-set germination, growing and harvesting phases.

Why Urban Barns Foods?

- Unknown story due to no previous IR = best opportunity to get in

- Tier-1 Customers = Commercial Acceptance

- 320 square feet = 3 acres of farm production

- $6M Market Cap = Great Risk/Reward

- Watch this video clip to see what production looks like

- Watch this video clip to see what the Executive Chef at Chateau Frontenac has to say

Marquee Customers Include:

Strong Institutional Ownership, 39% Owned By:

Modern Agriculture Needs Green Innovation

The Cubic Farming Advantage

-

100% controlled environment

-

Growing 365 days a year

-

No pesticides, herbicides or fungicides

-

No GMOs

-

Minimal water requirements

-

Superior nutritional values

-

Longer shelf life

-

Consistency

Consumers Demand Clean Food

-

Globally, the BFY (BETTER FOR YOU) food category is projected to grow by 25% to over $199.8 billion in 2015.

-

GMOs, a major concern for North American consumers

-

72% of consumers say it is important to avoid GMOs when they shop

-

40% of consumers say they look for non-GMO claims on food

-

Natural & clean foods are increasingly mainstream

-

Not only for higher income, most educated privileged segment. It is becoming a social movement.

Urban Barns Is the Solution

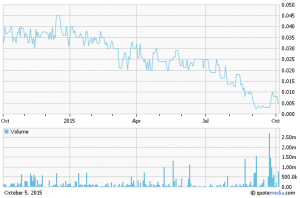

12 Month Stock Chart

Loading…

Loading…

Tags: #smallcapstocks, $TSXV, california draught, Cubic Farming, farming, otcqb

Posted in AGORACOM Client Feature, All Recent Posts, Urban Barns Foods Inc. | Comments Off on CLIENT FEATURE: Urban Barns (URBF: OTCQB) Capitalizing on Evolution of Cubic Farming

Recent Highlights

- Acquired two limestone properties in north western British Columbia which have been strategically chosen in an effort to coincide with the LNG projects near Kitimat and Prince Rupert.

- Both the Mayner’s Fortune property and the Smith Island property have historical occurrences of limestone which will fast track the exploration to production timeline since they are near term producing properties.

- Mayner’s Fortune property is located 50km away via CN Rail line from the Kitimat Shell Consortium LNG proposed site and hosts a series of 6 north east striking limestone beds which have been reported to be grades as high as 96%.

- Historical workings have indicated a preliminary 454,000 tonnes of limestone in the first limestone bed nearest to the rail road. The Company has been contacted by CN Rail and they look forward to working with Durango to help move the project forward.

PROJECTS

Decouverte (Discovery) property

- Over 51km(2), is located 100km north of Chibougamau in the Frotet – Evans greenstone belt.

- Company carried out a 439 line kilometer helicopter borne DIGHEM EM/magnetic airborne geophysical survey on the property in 2011 (NR Nov 24, 2011).

- Property benefits from very favorable infrastructure including road accessibility (within 10km of Route du Nord and a myriad of logging roads), and a power line which bisects the property.

- Mineralized target area is located to the east of Lac Pasquale and consists of two significant aero-magnetic anomalies, with some electromagnetic coincidence possibly associated with linear structural features, in the Frotet-Evans greenstone belt

Robert Creek Property

- 1,222 hectares located near the Alberta / Saskatchewan border.

- Company holds a 100% interest in a property in the emerging, southwest portion, of the Athabasca Basin in Saskatchewan adjacent to NexGen Energy Ltd. (TSX.V-NXE).

- Athabasca Basin proving to the world to be a premier uranium district with average grades that are ten times greater than elsewhere in the world, highly skilled labour and infrastructure in place for milling and transport.

- Historical GSC lake sediment values of 1.6 ppm, 1.2 ppm and 0.8 ppm uranium were reported with two samples only one kilometre apart. developing a major uranium deposit, was 3.5 ppm uranium as reported in the news release on April 12, 2010.

Trove, Quebec

- 100% interest in a 1,500 hectare property located approximately 15km to the southwest of Eagle Hill’s (EAG – TSX.V) Windfall Lake Gold Property.

- Eagle Hill has completed over 330 diamond drill holes with results as high as 52.3 oz/t over 4.8 metres.

- 2010 summer drill program hit wide gold mineralization showing 14.51 g/t gold over 52.0 metres (hole EAG 10-196) and 3.35 g/t of gold over 24.6 metres (hole EAG 10-238).

Tags: #mining, #smallcapstocks, $TSXV, limestone, LNG, LNG infrastructure

Posted in AGORACOM Client Feature, All Recent Posts, Durango Resources | Comments Off on CLIENT FEATURE: Durango Resources (DGO: TSX:V) Capitalizing on the Future of LNG

BY BEING A DOMESTIC FERTILIZER PRODUCER, DUSOLO IS ABLE TO OFFER A PREMIUM PRODUCT AT A SIGNIFICANTLY LOWER COST

MANY NEAR TERM CATALYSTS EXPECTED

- Entering into additional DANF product sales contracts

- Doubling capacity at our processing facility to 160,000 tonnes per year

- Updating the National Instrument 43-101 Resource Estimate to include results from the 2015 drill campaign – Recent drill results confirm presence of additional high-grade phosphate mineralization beyond areas identified in initial resource estimate

- Third Party Economic Evaluation of Operations Planned for 2015

- Strong Financial Backing

Company entered into an agreement with Mineração Batalha e Participações Ltda. to acquire the São Roque Phosphate Project in southeast Brazil.

The Project’s highlights include:

- Located within the agribusiness region of Minas Gerais and São Paulo states, with many coffee, orange and sugar-cane (ethanol) plantations in the surrounding area.

- At surface, high-grade phosphate mineralization has been identified with multiple grab samples from outcrops confirming >20% P2O5.

- Geophysics anomalies very well defined and confirmed by surface sampling.

- Close proximity to infrastructure, including roads, rail, water and power, and existing fertilizer producers. City of Piumhi is 40 km from the Project.

- 70% interest earned through commitment to invest in exploration and project development. No direct payment to JV Partner.

BRAZIL’S DOMESTIC FERTILIZER SUPPLY DOES NOT MEET CURRENT DEMANDS

FLAGSHIP ASSET LOCATED IN ONE OF THE WORLD’S LARGEST AGRICULTURAL REGIONS

STRONG DEMAND FOR DANF EXISTS IN THE REGION

Within a 500 km radius of DuSolo’s processing facility:

Tags: #mining, #smallcapstocks, $TSXV, brazil, farming, fertilizer

Posted in AGORACOM Client Feature, All Recent Posts, DuSolo Fertilizers Inc. | Comments Off on CLIENT FEATURE: Dusolo (DSF: TSX-V) Capitalizing on Brazil’s Growing Demand for Fertilizer

What is Cubic Farming?

-

A revolution in Controlled Environment Agriculture (CEA)

-

Propriety, patent-pending, looped conveyer growing system

-

Advanced uniform LED technology

-

Automated watering and nutrients

-

Optimal conditions for crops to transition from seeds to maturity through pre-set germination, growing and harvesting phases.

Why Urban Barns Foods?

- Unknown story due to no previous IR = best opportunity to get in

- Tier-1 Customers = Commercial Acceptance

- 320 square feet = 3 acres of farm production

- $6M Market Cap = Great Risk/Reward

- Watch this video clip to see what production looks like

- Watch this video clip to see what the Executive Chef at Chateau Frontenac has to say

Marquee Customers Include:

Strong Institutional Ownership, 39% Owned By:

Modern Agriculture Needs Green Innovation

The Cubic Farming Advantage

-

100% controlled environment

-

Growing 365 days a year

-

No pesticides, herbicides or fungicides

-

No GMOs

-

Minimal water requirements

-

Superior nutritional values

-

Longer shelf life

-

Consistency

Consumers Demand Clean Food

-

Globally, the BFY (BETTER FOR YOU) food category is projected to grow by 25% to over $199.8 billion in 2015.

-

GMOs, a major concern for North American consumers

-

72% of consumers say it is important to avoid GMOs when they shop

-

40% of consumers say they look for non-GMO claims on food

-

Natural & clean foods are increasingly mainstream

-

Not only for higher income, most educated privileged segment. It is becoming a social movement.

Urban Barns Is the Solution

12 Month Stock Chart

Tags: $TSXV, california draught, Cubic Farming, farming, otcqb

Posted in AGORACOM Client Feature, Urban Barns Foods Inc. | Comments Off on CLIENT FEATURE: Urban Barns (URBF: OTCQB) Capitalizing on Evolution of Cubic Farming

Avalon recently received a letter from NYSE MKT LLC dated July 30, 2015 which states that due to the Company’s recent low selling share price, it has been deemed to be not in compliance with the continued listing standards of the Exchange. The Company’s continued listing is contingent upon the Company effecting a share consolidation within a reasonable period of time or upon a sustained increase in its share price. The company goes “Beyond The Press Release†to discuss this matter further.

Hub On AGORACOM / Corporate Profile / Read Release

Tags: #mining, #smallcapstocks, NYSE MKT, tin, tsx

Posted in AGORACOM Client Feature, AGORACOM Via Satellite, All Recent Posts, Avalon Rare Metals, Avalon Rare Metals Inc. | Comments Off on Avalon Discusses Continued Listing Standards Notice from NYSE MKT