TORONTO, October 3, 2008 – AGORACOM (http://www.agoracom.com), Canada’s largest small-cap investment community and only provider of monitored online communities to public companies, is proud to announce the acquisition of www.Grandich.com, the home of The Grandich Letter, a leading newsletter analyzing the metals and mining markets within global stock and bond markets. The Grandich Letter has been published since 1984, has over 11,000 subscribers and also serves as an investor relations vehicle for Grandich clients.

In addition, AGORACOM is very pleased to announce that Peter Grandich, publisher of the Grandich Letter, has been appointed Chief Commentator and can be found at http://grandich.agoracom.com

ACQUISITION COMBINES POWERFUL SMALL-CAP COMMUNITY WITH LEADING COMMENATARY

The combination of AGORACOM and Peter Grandich represents the next generation of financial communities, in which investors read in-depth leading commentary and then have the ability to interact with both management and investors in a monitored, professional and courteous environment.

Over the past 12 months, the AGORACOM small-cap community has attracted over 1,200,000 investors that have read over 101,000,000 pages of information, while Peter Grandich commentary has been quoted in major financial media such as The Wall Street Journal, Marketwatch, CNN, GlobeInvestor, Financial Post and BNN.

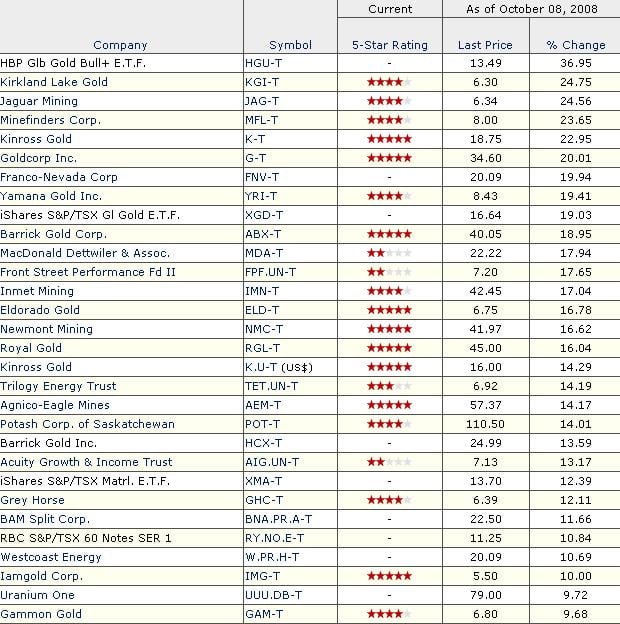

George Tsiolis, Founder of AGORACOM, stated “This is a momentous occasion for two reasons. First, from a personal point of view, I have admired Peter Grandich for several years for both his integrity and his analytical abilities. I’ve never met someone with such an uncanny ability to perfectly call tops and bottoms, only to then go out and publish them despite not always being in the best interests of his clients. His calls on the perilous state of the US stock market and financial industry were well documented long before the public had any hint of the problem – and don’t start me on his crystal ball for the gold market. His value to AGORACOM is immeasurable.”

“Secondly, from a business point of view, you could not find a more complementary combination. Investors need access to consistent and high-quality commentary, as well as, the ability to then collaborate and exchange ideas with other investors and CEO’s. We now have that.”

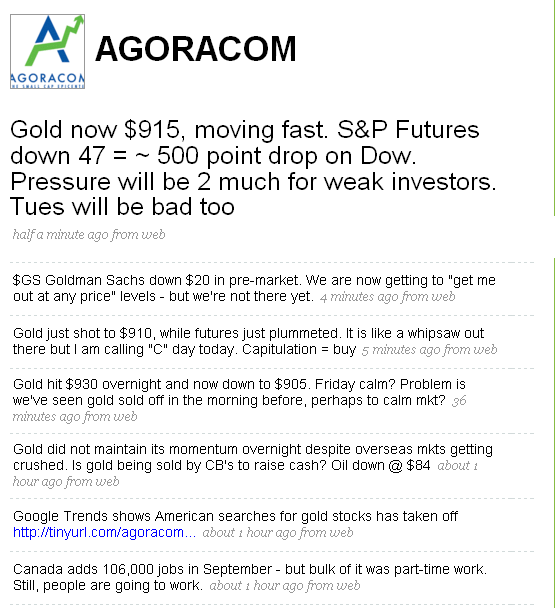

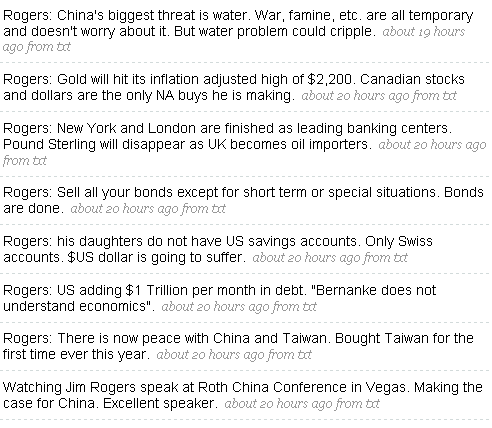

Peter Grandich, Founder of Grandich Publications stated “Today’s news marks a significant step forward for both Grandich readers and clients. The importance of not just the internet but Web 2.0 capabilities can not be overstated. We live in a world where investors demand both the ability to interact and the option to receive information on their own terms. AGORACOM provides both a blog and monitored forums format that provides the best interaction tools I have ever seen. At the same time, my commentary will now be available for consumption via web postings, e-mail, RSS Feeds and even Twitter. Moreover, through the use of tagging and search engine techniques developed by AGORACOM, my commentary will reach a new audience that I could never have dreamed of ever reaching. Grandich readers and clients should be very happy today.”

Grandich went on to add “On a personal note, I have invested a significant portion of my life, time and energy into my work. George Tsiolis and his team at AGORACOM are the perfect fit for this next step of mine because they put integrity above all else. They have mastered Web 2.0 and ushered in the next phase of communications and investor relations – but they did it by truly caring about their audience and clients first – a rare combination today. As such, I have no doubt that we are going to accomplish great things together for many years to come.”

About AGORACOM – No Profanity, No Spam, No Stock Bashing, No Stock Hyping

AGORACOM (http://www.Agoracom.com) is North America’s only small-cap community built to serve the needs of serious small-cap and micro-cap investors. No rumours, profanity, stock bashing or hyping. Over the past 12 months, AGORACOM has attracted over 1,200,000 that have read over 100,000,000 pages of information.

AGORACOM Investor Relations (http://www.AgoracomIR.com) is North America’s largest online investor relations firm for small-cap companies. We have partnered with the world’s biggest internet companies, including Globe Investor, Yahoo, AOL, Google and Blackberry to market our clients to a massive audience of new small-cap investors. We have served over 250 companies since 1997.

About Peter Grandich

With no formal education or training, Peter Grandich entered Wall Street and within three years was appointed Vice President of Investment Strategy for a leading New York Stock Exchange member firm. A prolific and often-quoted writer, he edited and published four investment newsletters.

Labeled the Wall Street Whiz Kid, Grandich gained national notoriety by being among the very few who not only forecasted the 1987 stock market crash just weeks before it happened, but on the very next day he predicted that within two years the market would reach a new all-time high – which it did. Proving his 1987 forecast was no fluke, Mr. Grandich said in January 2000 that the year 2000 will go down as the year the great mega bull market of the 80s and 90s came to an end.

He appears almost daily in the financial media on TV, radio, the web and in print. Grandich also speaks at major investment conferences worldwide and has been awarded Best Speaker Award eight times. His company, Grandich Publications, also provides a variety of services to publicly-held corporations on a compensation basis.

CONTACT INFORMATION

MEDIA INQUIRIES

Mitchell Fanning

Director of Marketing / Communications

[email protected]

Jo Schloeder

Creative Approach, inc.

Phone 732-751-1004

E-Mail: [email protected]

CORPORATE INQUIRIES

George Tsiolis, LL.B

President

AGORACOM

[email protected]

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)

![[Most Recent XAU from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_xau_en_2.gif)

Flash Player 9 or higher is required to view the chart Click here to download Flash Player now

Flash Player 9 or higher is required to view the chart Click here to download Flash Player now