- Entered into a definitive agreement to acquire all of the issued and outstanding shares of 495 Communications, LLC

- 495 is a leading advertising and content marketing company based in New York City and Santa Monica, California.

VANCOUVER, Dec. 4, 2018 – Good Life Networks Inc. (“GLN“, or the “Company“) (TSXV: GOOD) (FSE: 4G5), a programmatic advertising technology company, announced today that it has entered into a definitive agreement (the “Agreement“) to acquire all of the issued and outstanding shares (the “Purchased Shares“) of 495 Communications, LLC (“495“). 495 is a leading advertising and content marketing company based in New York City and Santa Monica, California. According to a third-party unaudited Quality of Earnings prepared by CohnReznick LLP in New York, as at August 31, 2018; 495’s Trailing Twelve Month revenue was reported at approximately USD$14.4M (CDN$18.1M equivalent), and adjusted EBITDA came in at USD$1.9M (CDN$3.3M equivalent).

“I’m thrilled to announce our second acquisition for 2018, which is also accretive to earnings,” stated CEO Jesse Dylan. “495 Communications is a content publisher with an impressive list of partners that includes more than 2,000 premium websites, as well as proprietary mobile and connected TV applications. This acquisition, along with the recently announced acquisition of ImpressionX, sets GLN up to achieve our aggressive earnings growth objectives for 2019 and beyond.”

Under the terms of the Agreement, consideration for the Purchased Shares will consist of the following:

a)Â Â Â Â Â US$3,500,000 in cash, payable to the members of 495 less the amount of outstanding indebtedness;

b)Â Â Â Â Â a cash earn-out, up to a maximum of US$5,500,000 for hitting performance benchmarks; and

c)Â Â Â Â Â a share/cash earn-out, to be satisfied, at the sole discretion of the Company, in cash or through the issuance of common shares of the Company (“GLN Shares“) up to a maximum amount of US$6,000,000 for hitting performance benchmarks, such GLN Shares to be issued at a per share price based upon the greater of (i) the 20-day volume weighted average trading price of the GLN Shares on the TSX Venture Exchange (the “TSX-V“) immediately prior to the date of issuance and (ii) the lowest price permitted by the policies of the TSX-V.

The Agreement was negotiated at arm’s length. 495 was advised by CREO | Montminy & Co. as financial advisor and Foundation Law Group served as legal counsel. GLN was advised by Oakhill Financial as financial advisor and Wang Legal served as legal counsel.

“GLN’s technology and growth strategy is in perfect alignment with our team at 495,” stated CEO Bret Polansky. “495 delivers compelling content and advertising across multiple devices, we have set the industry standard by which this is consumed on today’s cross market platforms. We look forward to adding our impressive suite of services, technology and large client and publisher rosters to the GLN family.”

Completion of the acquisition is subject to the Company obtaining debt financing on terms satisfactory to the Company. The Company expects to enter into a debt facility with a Schedule One bank on or before closing of the acquisition.

The Company anticipates the completion of the acquisition by the end of December 2018, pending TSX-V acceptance.

In connection with the acquisition of 495, the Company intends to issue Oak Hill Financial, Inc. (“Oak Hill“) 650,000 non-transferable finder’s warrants (the “Finder Warrants“) as a finder’s fee upon completion of the acquisition. The Finder Warrants will be exercisable into common shares of the Company at an exercise price of $0.34 per common share until the date that is 2 years after the date of issuance. The issuance of the Finder Warrants to Oak Hill is subject to the acceptance by the TSX-V.

The GLN Story

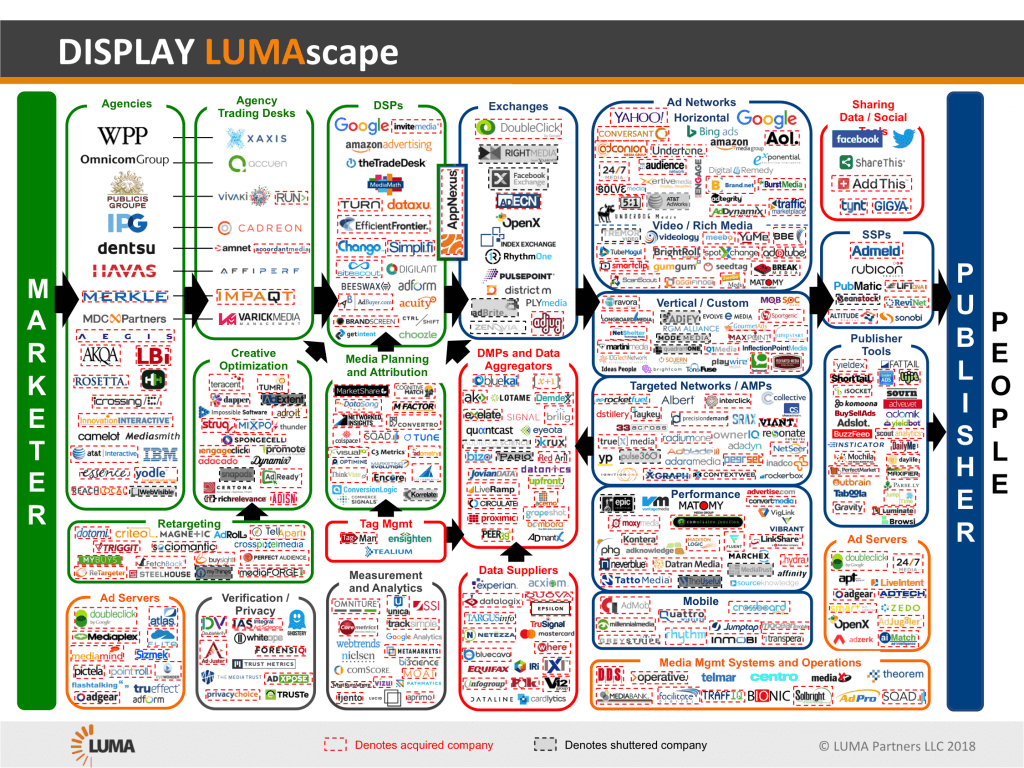

GLN’s technology is the engine that sits between advertisers and publishers. The GLN platform is built for cross device video advertising: mobile, in-app, desktop and CTV (Connected Television). The Programmatic Video Marketing Platform is powered by GLN’s proprietary machine learning technology that uses “Big Data” to intelligently target and connect digital advertisers with consumers without collecting PII (Personal Identifiable Information).

The platform is the cornerstone of GLN’s business, providing industry leading insights, data and revenue. This allows GLN to match advertisers to publishers in a way that provides significant and sustainable value to both. GLN’s patent pending machine learning algorithm can forecast the needs and wants of the brands they represent, maximizing the efficiency for their partners while increasing their margins and profitability.

The Programmatic Video Technology Platform features integrations at the server level with both publishers and advertisers. Our technology quickly finds the most valuable advertisement for every consumer. Publishers make more money through improved CPM (advertising fill rate) combined with a more engaged consumer experience. Advertisers make more money by reaching their target audience more effectively. GLN makes money by retaining a percentage of the advertiser’s fee. GLN is headquartered in Vancouver, Canada with offices in the US and UK and trades on the TSX Venture Exchange under the stock symbol “GOOD” and The Frankfurt Stock Exchange under the stock symbol 4G5.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements:

Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs regarding future events of management of GLN. This information and these statements, referred to herein as “forwardâ€looking statements”, are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, including the timing, approval and completion of the acquisition of the Purchased Shares, TSX-V approval, ability of the company to secure debt financing, estimates and forecasts and statements as to management’s expectations and intentions with respect to the Company’s acquisition of 495. These statements generally can be identified by use of forward-looking words such as “may”, “will”, “expect”, “estimate”, “anticipate”, “intends”, “believe” or “continue” or the negative thereof or similar variations. These forwardâ€looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. Important factors that may cause actual results to vary include without limitation, risks relating to the timing of the acquisition of the Purchased Shares, risk related to securing a debt facility, successful completion of the acquisition of the Purchased Shares, fulfillment of all conditions to closing set forth in the Agreement, the number of securities of GLN that may be issued in connection with the transaction; GLN realizing on the anticipated value of acquiring the Purchased Shares, GLN maintaining its projected growth, acceptance of the TSX-V and general economic conditions or conditions in the financial markets. In making the forwardâ€looking statements in this news release, the Company has applied several material assumptions, including without limitation that the acquisition of the Purchased Shares will be successfully completed in the time expected by management and will generate the anticipated revenue and expand GLN’s global reach per management’s expectations. GLN does not assume any obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those reflected in the forward looking-statements, unless and until required by applicable securities laws. Additional information identifying risks and uncertainties is contained in GLN’s filings with the Canadian securities regulators, which filings are available at www.sedar.com.

Fortunately, rather than yet another regulation or tougher prosecution — which become barriers to entry for individual artists, inventors and start-ups — there is now a better deterrent to counterfeiting, fraud and IP theft: it is the blockchain, the technology behind cryptocurrencies like bitcoin.

Fortunately, rather than yet another regulation or tougher prosecution — which become barriers to entry for individual artists, inventors and start-ups — there is now a better deterrent to counterfeiting, fraud and IP theft: it is the blockchain, the technology behind cryptocurrencies like bitcoin. Provenance and geographical indicators

Provenance and geographical indicators Ethereum inventor Vitalik Buterin in Toronto. Some of the world’s most successful blockchain projects — Ethereum, Aion, and Cosmos, to name a few — were started in Canada. J.P. Moczulski for National PostImagine instead a world where artists decide how they’d like their music to be shared or experienced — simply by uploading a verified, searchable piece of music and all its related content online. Through the triggering of smart contracts, a song could become its own business, collecting royalties and allocating them to the digital wallets of rights owners such as songwriters and studio musicians. Artists and other creators would get paid first and fairly, rather than last and least.

Ethereum inventor Vitalik Buterin in Toronto. Some of the world’s most successful blockchain projects — Ethereum, Aion, and Cosmos, to name a few — were started in Canada. J.P. Moczulski for National PostImagine instead a world where artists decide how they’d like their music to be shared or experienced — simply by uploading a verified, searchable piece of music and all its related content online. Through the triggering of smart contracts, a song could become its own business, collecting royalties and allocating them to the digital wallets of rights owners such as songwriters and studio musicians. Artists and other creators would get paid first and fairly, rather than last and least.