Introduction: The resurgence of gold as a dominant player in the global monetary system has captured the attention of investors and financial institutions worldwide. With leading banks like BMO Capital Markets forecasting a significant rise in gold prices, driven by de-dollarization and central bank policies, the outlook for the precious metal has never been stronger. For companies like Green River Gold, which is engaged in placer mining, this bullish trend offers immense opportunities.

Gold’s Growing Role as a Global Currency BMO’s recent forecast highlighted gold’s transformation from a mere store of value to an essential part of the global trade system. The Federal Reserve’s move to cut interest rates has injected fresh momentum into gold, further reinforced by geopolitical shifts such as China’s pivot to trading in renminbi. As international trade increasingly moves away from the U.S. dollar, gold’s role as a global currency is set to grow, offering price stability and security.

Countries in the BRICS alliance, including major economies like China and India, are accelerating their use of gold-backed trade. Additionally, new initiatives like the mBridge project, which seeks to create a multi-central bank digital currency platform, are expected to dramatically increase demand for gold reserves. Analysts predict that the use of gold in international trade will only intensify as countries seek alternatives to the U.S. dollar.

BMO’s Optimistic Gold Price Forecast BMO’s analysts raised their gold price forecast to an average of $2,700 per ounce in the fourth quarter, marking a 15% increase from earlier estimates. They also expect long-term prices to stabilize around $1,900 per ounce, a significant boost from their previous forecast of $1,650. This bullish outlook is driven not only by central bank policies but also by gold’s strengthening role in global trade.

For Green River Gold, which is positioned to produce significant quantities of the precious metal, this shift in global economics comes at an opportune time. The company’s gold exploration and extraction operations are poised to benefit from the rising demand for gold in monetary transactions and international trade.

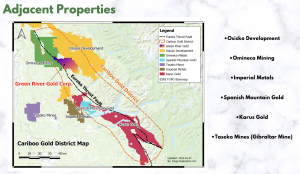

Green River Gold’s Strategic Position Green River Gold’s substantial 200-square-kilometer property in British Columbia offers the company a unique advantage. With gold prices projected to continue climbing, the value of the gold deposits they are working to extract is set to rise significantly. The company’s operations focus on placer mining, an efficient method for extracting gold from alluvial deposits, which is highly relevant in today’s market conditions.

By capitalizing on the growing role of gold as a global currency and the favorable macroeconomic trends, Green River Gold is well-positioned to thrive in this bullish market. The company’s gold mining initiatives align perfectly with the rising demand for gold, driven by international efforts to diversify away from the U.S. dollar and the adoption of gold-backed currencies.

Impact of Federal Reserve Policies on Gold The Federal Reserve’s recent decision to cut interest rates, part of its broader monetary easing strategy, is another catalyst driving gold prices upward. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, making it more attractive for investors seeking safe-haven assets during times of economic uncertainty. This trend benefits companies like Green River Gold, whose business revolves around the production and sale of gold.

Furthermore, the weakening U.S. dollar, as countries increasingly turn to gold-backed trade, pushes up the prices of gold and other commodities. This creates a perfect storm for gold producers like Green River Gold to maximize their profits and capitalize on rising prices in both the short and long term.

Looking Forward: Green River Gold’s Potential As the global economy transitions into a new era, gold is set to play an even more significant role in international trade and monetary systems. With central banks and emerging economies diversifying away from the U.S. dollar, demand for gold will continue to soar. Green River Gold is uniquely positioned to benefit from this evolving market. Their strategic focus on placer mining, combined with their substantial property holdings, places them at the forefront of gold production in Canada.

Moreover, Green River Gold’s long-term strategy aligns with the broader trends highlighted by BMO’s analysts, who foresee gold becoming increasingly crucial in global trade. As the world’s reliance on gold grows, so too will the opportunities for companies like Green River Gold to flourish.

Conclusion: Green River Gold Positioned for Success With gold prices forecasted to remain strong well into the future, and with its growing role as a global currency, the outlook for gold producers like Green River Gold is undeniably positive. BMO’s bullish forecast and the global de-dollarization trend further solidify gold’s importance in the monetary system.

YOUR NEXT STEPS

Visit $CCR HUB On AGORACOM: https://agoracom.com/ir/GreenRiverGoldCorp

Visit $CCR 5 Minute Research Profile On AGORACOM:https://agoracom.com/ir/GreenRiverGoldCorp/profile

Visit $CCR Official Verified Discussion Forum On AGORACOM:

https://agoracom.com/ir/GreenRiverGoldCorp/forums/discussion

Watch $CCR Videos On AGORACOM YouTube Channel:

https://youtube.com/playlist?list=PLfL457LW0vdLJgdyN9gnd7VKr4xMKBpQ7&si=DumfF-sMw_Uat7Ce

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.