- Announced that since the start of June 2020, the Company has raised over $1,452,401 through the exercise of various financial instruments.

- During the period ended June 30, 2020, $182,277 was raised, at an average price of $0.122 per share, through the exercise of 1,087,000 warrants, 178,000 broker warrants and 175,000 broker units.

- Furthermore, since the start of Q3 another $1,270,124 was raised, at an average price of $0.121 per share, through the exercise of 7,959,588 warrants, 81,430 brokers warrant and 2,400,000 options.

- During the same period the 11,881,738 financial instruments were exercise, HPQ traded 156,507,300 shares for a value of $55,789,137 at an average price of $0.356.

- While the volume generated represented 60% of HPQ outstanding shares, the shares issued on exercise represented only 7.6% of the trading volume.

MONTREAL, Aug. 12, 2020 — HPQ Silicon Resources Inc. (“HPQ” or the “Company”) TSX-V: HPQ; FWB: UGE; Other OTC : URAGF; is pleased to announced that since the start of June 2020, the Company has raised over $1,452,401 through the exercise of various financial instruments.

During the period ended June 30, 2020, $182,277 was raised, at an average price of $0.122 per share, through the exercise of 1,087,000 warrants, 178,000 broker warrants and 175,000 broker units. Furthermore, since the start of Q3 another $1,270,124 was raised, at an average price of $0.121 per share, through the exercise of 7,959,588 warrants, 81,430 brokers warrant and 2,400,000 options.

During the same period the 11,881,738 financial instruments were exercise, HPQ traded 156,507,300 shares for a value of $55,789,137 at an average price of $0.356. While the volume generated represented 60% of HPQ outstanding shares, the shares issued on exercise represented only 7.6% of the trading volume.

Presently HPQ cash on hand, liquid investment in public companies, and cash reserved for the PUREVAPTM QRR pilot plant project, total $4,725,221. In addition, the $11,482,557 cash value of outstanding in the money warrants and options, (80% of those are owned by PyroGenesis, Investisement Québec (IQ), insiders and strategic investors), provides HPQ access to over $16M. This is enough sources of funds to develop, to commercial scale, the game changing PUREVAP™ family of processes HPQ is developing with Pyrogenesis namely:

- The PUREVAP™ “Quartz Reduction Reactors” (QRR), an innovative process (patent pending), which will permit the one step transformation of quartz (SiO2) into high purity silicon (Si) at reduced costs, energy input, and carbon footprint that will propagate its considerable renewable energy potential; and

- The PUREVAP™ Nano Silicon Reactor (NSiR), a new proprietary process that use PUREVAPTM QRR silicon (Si) as feedstock, to make spherical silicon nanopowders and nanowires.”

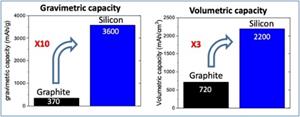

“Since the start of the year, HPQ has made great strides toward its goal of becoming a leader in the field of Nano silicon materials production, and we very grateful for the market support we have received over the last few months and the resultant financings.” said Bernard Tourillon, President & CEO of HPQ Silicon. “Our PUREVAPTM processes open up unique multibillion-dollar business opportunity for HPQ and PyroGenesis, as we strive to deliver the critical and economically viable Silicon nano- materials required by the surging Li-ion battery market and other large renewable energy markets.”

POTENTIAL OF OUR PUREVAPTM NANO SILICON (Si) REACTOR GETTING NOTICED

The PUREVAPTM NSiR process is purposely being developed to address the fact that current manufacturing processes to make Nano Silicon (Si) Powders are not very scalable and simply too expensive to be commercially feasible, requiring up to US$ 30,000/kg1 selling prices to justify production. HPQ and partner Pyrogenesis are working to develop commercially scalable Nano Silicon powder production and have caught the attention of significant industry players. The company continues to evaluate and discuss potential opportunities under Confidentiality Agreements and cannot provide further commentary at this time.

About Silicon

Silicon (Si), also known as silicon metal, is one of today’s strategic materials needed to fulfil the Renewable Energy Revolution (“RER”) presently under way. Silicon does not exist in its pure state; it must be extracted from quartz (SiO2), in what has historically been a capital and energy intensive process.

About HPQ Silicon

HPQ Silicon Resources Inc. (TSX-V: HPQ) is a Canadian producer of Innovative Silicon Solutions, based in Montreal, building a portfolio of unique high value specialty silicon products needed for the coming RER.

Working with PyroGenesis Canada Inc. (TSX-V: PYR), a high-tech company that designs, develops, manufactures and commercializes plasma – based processes, HPQ is developing:

- The PUREVAPTM “Quartz Reduction Reactors” (QRR), an innovative process (patent pending), which will permit the one step transformation of quartz (SiO2) into high purity silicon (Si) at reduced costs, energy input, and carbon footprint that will propagate its considerable renewable energy potential;

- HPQ believes it will become the lowest cost (Capex and Opex) producer of silicon (Si) and high purity silicon metal (3N – 4N Si);

- HPQ believes it will become the lowest cost (Capex and Opex) producer of silicon (Si) and high purity silicon metal (3N – 4N Si);

- The PUREVAPTM Nano Silicon Reactor (NSiR), a new proprietary process that can use different purities of silicon (Si) as feedstock, to make spherical silicon nanopowders and nanowires;

- HPQ believes it can also become the lowest cost manufacturer of spherical Si nanopowders and silicon-based composites needed by manufacturers of next-generation lithium-ion batteries;

- During the coming months, spherical Si nanopowders and nanowires silicon-based composite samples requested by industry participants and research institutions’ will be produced using PUREVAPTM SiNR.

- HPQ believes it can also become the lowest cost manufacturer of spherical Si nanopowders and silicon-based composites needed by manufacturers of next-generation lithium-ion batteries;

HPQ is also working with industry leader Apollon Solar of France to:

- Use their patented process and develop a capability to produce commercially porous silicon (Si) wafers and porous silicon (Si) powders;

- The collaboration will allow HPQ to become the lowest cost producer of porous silicon wafers for all-solid -state batteries and porous silicon powders for Li-ion batteries.

- The plan is to deliver porous Si wafer to a battery manufacturer (under NDA) for testing in 2020.

- The collaboration will allow HPQ to become the lowest cost producer of porous silicon wafers for all-solid -state batteries and porous silicon powders for Li-ion batteries.

This News Release is available on the company’s CEO Verified Discussion Forum, a moderated social media platform that enables civilized discussion and Q&A between Management and Shareholders.

Disclaimers:

The Corporation’s interest in developing the PUREVAP™ QRR and any projected capital or operating cost savings associated with its development should not be construed as being related to the establishing the economic viability or technical feasibility of any of the Company’s Quartz Projects.

This press release contains certain forward-looking statements, including, without limitation, statements containing the words “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “in the process” and other similar expressions which constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking statements reflect the Company’s current expectation and assumptions and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. These forward-looking statements involve risks and uncertainties including, but not limited to, our expectations regarding the acceptance of our products by the market, our strategy to develop new products and enhance the capabilities of existing products, our strategy with respect to research and development, the impact of competitive products and pricing, new product development, and uncertainties related to the regulatory approval process. Such statements reflect the current views of the Company with respect to future events and are subject to certain risks and uncertainties and other risks detailed from time-to-time in the Company’s on-going filings with the security’s regulatory authorities, which filings can be found at www.sedar.com. Actual results, events, and performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements either as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information contact

Bernard J. Tourillon, Chairman, President and CEO Tel (514) 907-1011

Patrick Levasseur, Vice-President and COO Tel: (514) 262-9239

http://www.hpqsilicon.com Email: [email protected]