SPONSOR: American Creek owns a 20% Carried Interest to Production at the Treaty Creek Project in the Golden Triangle. 2019’s first hole averaged 0.683 g/t Au over 780m in a vertical intercept. 2020 drilling plans 18,000 to 20,000 metres from 7-10 drill platforms with four diamond drill rigs. The Treaty Creek property is located in the same hydrothermal system as the Pretivm and Seabridge’s KSM deposits and is fully funded for exploration in 2020. Click Here For More Info

If you think gold GC00, +1.85% has jumped about 10% in a couple of days to $1,638 an ounce, the official price quoted on Wall Street, think again.

The real price? Nearer $1,800. If you can get it.

“There’s no gold,†says Josh Strauss, partner at money manager Pekin Hardy Strauss in Chicago (and a bullion fan). “There’s no gold. There’s roughly a 10% premium to purchase physical gold for delivery. Usually it’s like 2%. I can buy a one ounce American Eagle for $1,800,†said Josh Strauss. “$1,800!â€

Major gold dealers have sold out of coins and gold bars amid panic buying as the U.S. economy plunges and the government agreed to a record $2 trillion emergency lifeline.

Kitco, the Canadian gold dealing giant, reported Wednesday that it was out of almost all standard one ounce gold coins. American Eagles and Buffaloes, issued by the U.S. Mint, were out of stock, it reported. Ditto Canadian “Maple Leafs,†issued by the Royal Canadian Mint, “Britannias†issued by the Royal Mint of Great Britain, and “Kangaroos†issued by Australia.

It was out of Krugerrands, issued by the South African government. Those are by far the most widely traded gold coins in the world.

Kitco did not immediately return an email for comment.

Read: Gold faces unique pricing, supply and delivery challenges amid COVID-19 shutdowns

“Due to extreme order volumes, please expect shipping delays of 15+ business days,†warned gold dealer JM Bullion.

Giant U.S. dealer Apmex admits Krugerrands are also out of stock. Deliveries of other coins, including Maple Leafs and Eagles, are delayed “due to extreme demand.†And it is charging a hefty premium for physical gold.

For a one ounce American Eagle: $1,788.

Meanwhile, over at the U.S. Mint, customer service reports they have Eagles available but to buy them direct will cost you $2,175. The media relations team could not immediately be reached.

Almost nobody on Wall Street has noticed the full price surge for actual gold bars and coins. That’s because financial traders mostly just deal in paper “contracts†for gold. Those are basically gold IOUs—a mere promise to deliver gold if the buyer ever wants.

Gold is among the most contentious financial topics around. It pits passionate true believers against total skeptics. People get heated and angry on both sides. Some say it is “the only true money.†Others call it little better than an unproductive superstition. The late British economist John Maynard Keynes called the gold standard, which pegged paper currency to the value of gold, a “barbarous relic†of a bygone age.

What should the average investor make of it? More critically, right now: Is there a case for putting holding some of your retirement account in gold? If so, how and how much?

“We’ve sold most of our gold as interest rates are rising and gold hasn’t liked that for a long time,†says Dennis Nolte, a financial adviser at Seacoast Bank. He adds: “As an asset class gold does best in certain environments, like declining interest rates. We like to own it tactically but not “all weather†as a core ETF (exchange-traded fund) or mutual fund holding.â€

“We don’t view gold as a building block when constructing portfolios,†says Rob Greenman, a financial planner at Vista Capital Partners. “The hopes of appreciation are rooted in speculation—perhaps somebody is willing to pay more per ounce in the future versus the price per ounce today. Gold doesn’t produce any interest or earnings. We believe in building portfolios with mix of productive asset classes like stocks, real estate, and bonds around the globe.â€

On the other hand, Thomas McCarthy, a financial planner at McCarthy & Cox, a firm that specializes in retirement planning and estates, says putting some of your retirement portfolio into gold isn’t crazy. “Gold can be a hedge against fear and holding a small 5% position of gold in an IRA or 401(k) (very few offer it) is not a bad hedge,†he says. “For clients looking to do so, we use a gold [exchange-traded fund] as opposed to actually buying the physical gold because its significantly less costly and easier to trade.â€

But, he warns, “Investors in gold need to remember that gold doesn’t pay interest, doesn’t earn dividends and you make money only if the demand pushes the price higher. Many gold bugs who invested heavily in gold at its peak are still waiting many years later just to break even.â€

There is no perfect answer because investing in gold ultimately requires someone else to want to buy it from you. It goes not generate income, like a stock or bond. And it’s not useful either—like food or, as people recently discovered, toilet paper.

Gold requires faith.

The good news? In this crisis you don’t have to choose one side definitely. You can be agnostic and keep your options open.

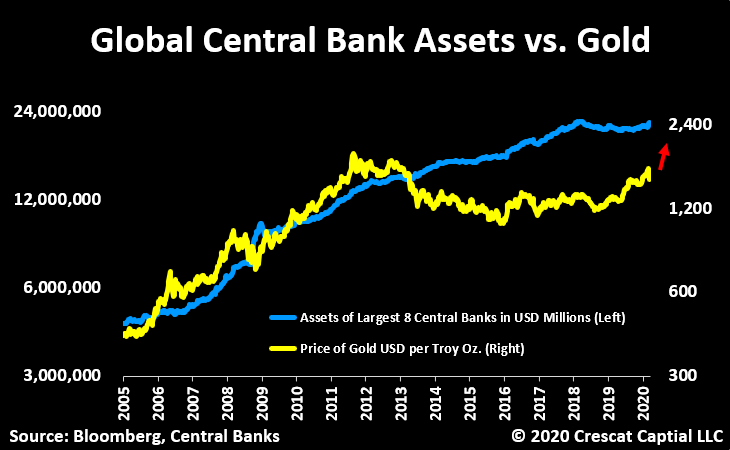

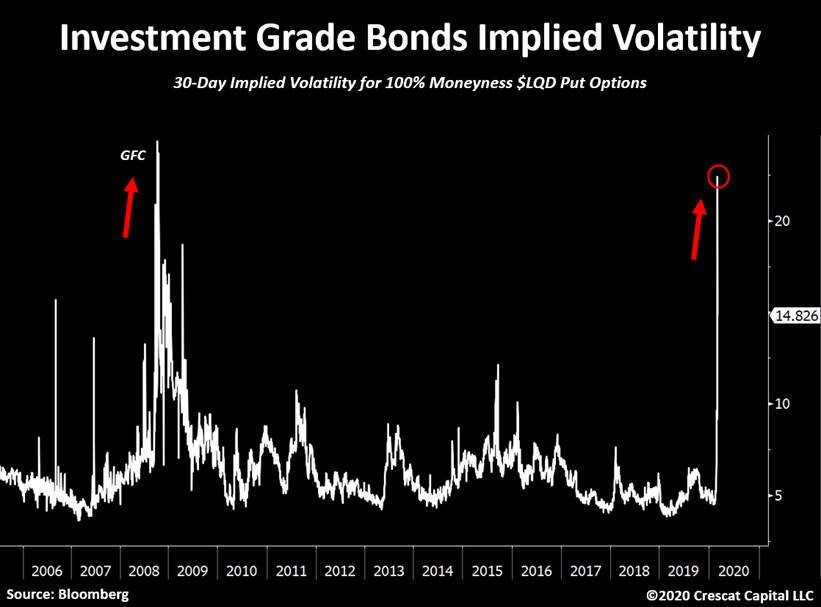

The events of the past month have upended the financial system. The Federal Reserve—and central banks overseas—have promised to print as much money as is needed to keep economies alive. The U.S. government has agreed to spend $2 trillion propping up the economy, and unless the crisis dissipates quickly that may not be the end of it.

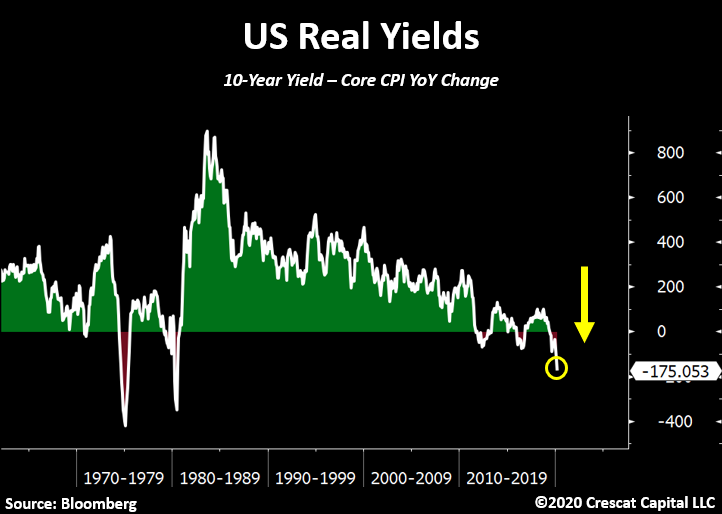

Ordinarily, investors who wanted to protect their accounts from the twin perils of depression and inflation would look to appropriate Treasury bonds. But they are already extremely expensive by any historic measure, so they may offer limited protection. So-called “nominal†or regular Treasury bonds, the type most people own, now sport minuscule interest rates. Even the longest dated, 30 year Treasurys, yield just 1.4%. That is below most expected rates of inflation. Meanwhile Treasury inflation-protected securities or TIPS, a type of Treasury bond that is designed specifically to protect your money against any rise in consumer prices, now offer inflation-adjusted yields that are actually slightly negative. In other words, you’re almost guaranteed to lose a small amount of purchasing power over the life of the bond.

In these circumstances, gold ceases to look quite so crazy as portfolio insurance. There is genuine debate about whether gold offers a “long term hedge†against inflation. And no one actually knows what gold is “really†worth, if it is “really†worth anything. Intelligent, sane financial experts can make plausible cases for a range of values from a few hundred dollars an ounce to many thousands.

But gold makes more sense when viewed, not as an investment, but as a type of currency. It doesn’t produce anything, but it can be used as a medium of exchange. And history strongly suggests that it has a low correlation with other assets. In other words, it tends to “zig†when everything else zags.

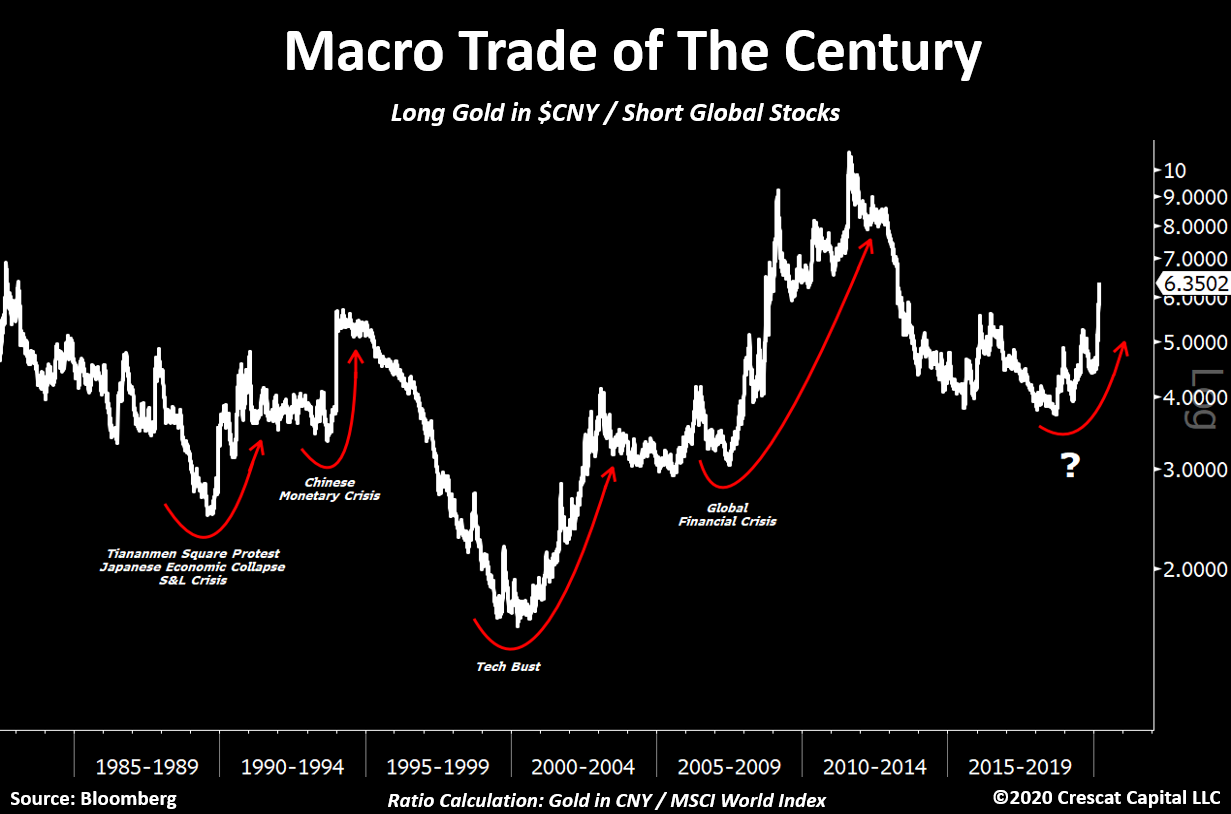

It’s certainly done that under the current administration. Gold has risen by 38% since Donald Trump’s inauguration. Meanwhile the S&P 500 SPX, +3.85% index of large U.S. companies is up 13%, and the Russell 2000 RUT, +4.32% index of small U.S. companies is down 8%.

“The case for gold is simple,†says Strauss. “You want to own gold in times of financial dislocation and or inflation. And that’s been the case since time immemorial. And gold behaves well in those cases. In those cases stocks behave poorly. It’s a great portfolio hedge. Gold does poorly when you’ve got strong economic growth and low inflation. Tell me when that’s going to happen. Gold held its value during 2008 and after all that money printing it tripled over the next three years.â€

Strauss recommends Sprott Physical Gold, PHYS, +1.41% an exchange-traded fund where shares are matched to actual bullion in a vault. He says he holds 25% of his personal wealth in gold. For those who are agnostics? “I think it’s criminal to go below 10%,†he joked, “but start with 5%.â€