SPONSOR: Labrador Gold – Two successful gold explorers lead the way in the Labrador gold rush targeting the under-explored gold potential of the province. Exploration has already outlined district scale gold on two projects, including a 40km strike length of the Florence Lake greenstone belt, one of two greenstone belts covered by the Hopedale Project. Recently acquired 14km of the potential extension of the new discovery by New Found Gold’s Queensway project to the south. Click Here for More Info

- Gold is known as the safe-haven asset, and whenever we see a meltdown in the equity markets or prospects of loose monetary policy, its price begins to explode to the upside.

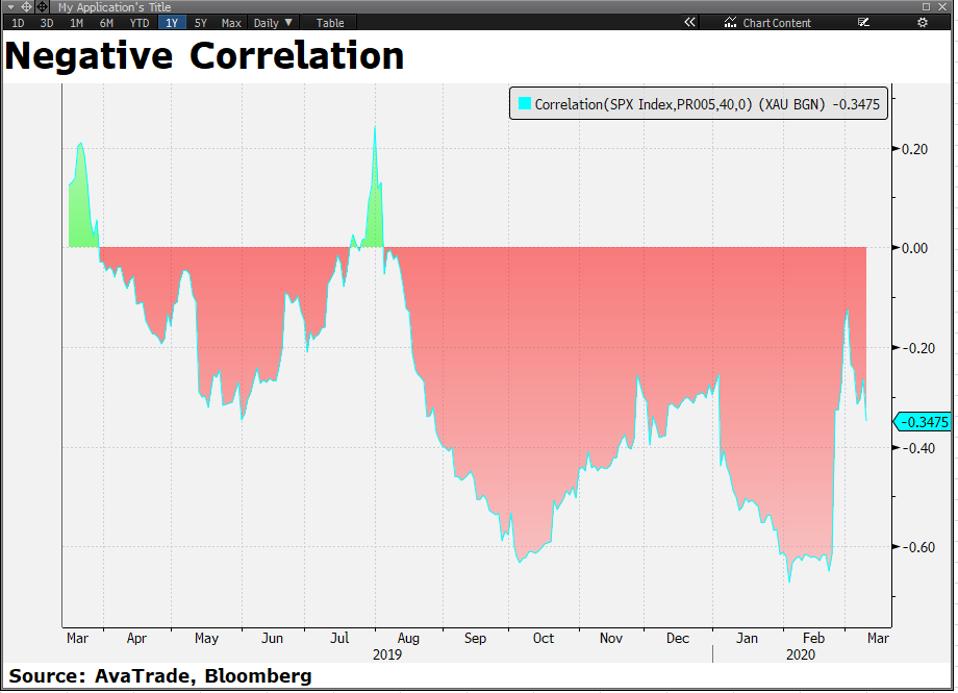

- Currently, the gold price has a strong negative correlation with the equity markets meaning when the equity markets fall; investors pour money into gold and vice versa.

The fact is that the current sell-off in the global equity markets is only a start because there is a lot more to come. After all, the economic weakness isn’t fully baked into economic data, let alone in earnings. Thus, there is no better time to buy gold.

Why?

First, the equity markets are in major turmoil as a 1000 point move for the Dow Jones index has become the norm. Secondly, the Coronavirus has pushed the Federal Reserve into a corner, and it’s being forced to keep its monetary policy on the dovish side. The Fed cut the interest rate by 50 basis points only a couple of weeks ago, and yet the market expects further cuts.

Gold which is up nearly 10% year-to-date is likely to score serious gain in the coming weeks. The reason is that we have a situation where monetary policy itself isn’t enough to calm the markets; however, governments are trying to provide support on the fiscal front as well. For instance, Donald Trump has pitched the idea of no payroll tax for this year to soften the blow of Coronavirus. So far, we have not seen a green flag which is why investors are still nervous. Donald Trump may achieve some of his goals, but it won’t be enough, the economic damage is too considerable, and the Coronavirus is still nowhere close to coming under control.

Going back to the monetary policy action and why there is serious potential for the gold price to increase; at present, traders and Wall Street are expecting further interest rate cuts from the Fed during their meeting next week. An interest rate cut of 50 basis points is the minimum that investors expect, and according to bigger banks like Goldman Sachs and JP Morgan, we can expect 75 basis points and a full percentage point.

Regarding the price action, an interest rate cut isn’t priced in at all, if it had been, the price would have been trading much higher. Currently, it’s trading near $1,661.

The Play

If the Fed cuts the interest rate by 50 basis points, this could push the gold price above 1700 again. Anything more than 50 basis points, especially a whole percentage point, could pump the price to 1750 or higher.

The Flow

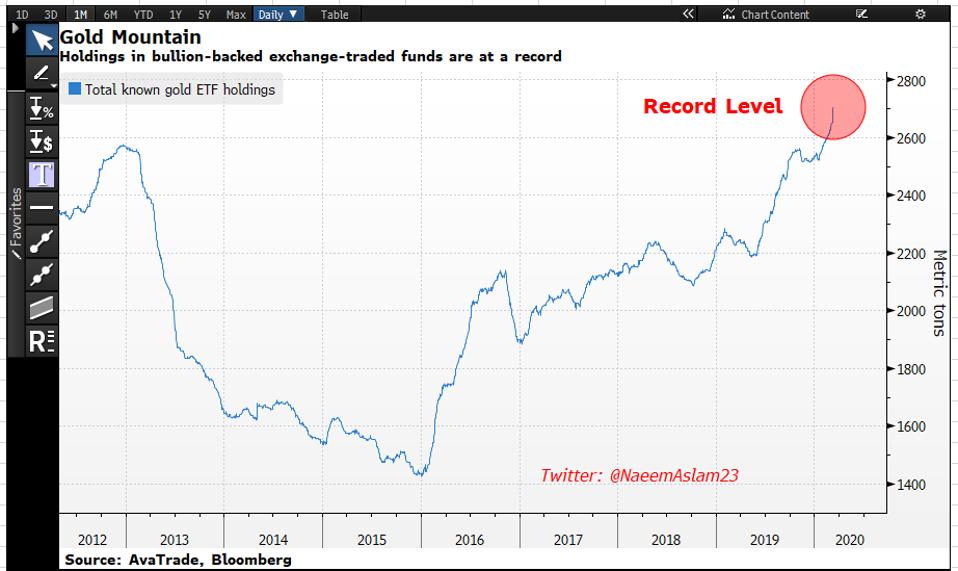

If we look at the total gold ETF holding data, it supports our thesis that the gold price is likely to increase because the total holding in ETFs is sitting at a record level, and the inflow continues to rise. It appears that investors are discounting this current price weakness and using this opportunity to buy more.

The Bottom Line

The current retracement in the gold price is an enormous opportunity for traders to get back in the game or add to their position, similar to the institutions. If for some reason, the Fed doesn’t cut the interest rates during the meeting, it will create more panic in the equity markets, which would be a positive sign for the gold price.

SOURCE: https://www.forbes.com/sites/naeemaslam/2020/03/11/why-you-should-buy-gold-now/#7d3d34446828