TRADING ALERT!!!

Â

Â

Last: $0.68 Up: $0.15

Percentage: 28% Volume: 11M Shares

VANCOUVER, British Columbia, Nov. 23, 2017 (GLOBE NEWSWIRE) — Glacier Lake Resources Inc. (TSX-V:GLI) (“Glacier†or the “Companyâ€) is pleased to announce it has signed a definitive agreement with an arm’s-length vendor to acquire 2,549 hectares of prospective mining claims located in north-central British Columbia, approximately 45 kilometres south of Houston.

The new property lies approximately 6,000 metres to the south of the New Nadina claim block and contiguous to the east with the Poplar block recently acquired by Tasca Resources Ltd. The underlying geology of the claim block is Cretaceous Kasalka group andesitic volcanics and Eocene Ootsa Lake Group felsic volcanics. Several regional scale faults have been mapped throughout the area. The southern boundary of the Cretaceous Bulkley intrusions lies one kilometres to the northwest.

In connection with the acquisition, Glacier Lake intends to research the BC Ministry of Energy and Mines assessment report database to determine if any historical exploration work has been completed on the new claim block to help in designing a preliminary exploration program to explore them.

In consideration for the claim block, Glacier Lake will complete a cash payment of $10,000 and issue 2,000,000 common shares. Completion of the acquisition is subject to the approval of the TSX Venture Exchange. All common shares issued will be subject to a four-month-and-one-day statutory hold period.

“We have been following developments throughout central British Columbia, looking for assets to complement our Silver Vista Project located 130 kilometres to the north,†stated Saf Dhillon, Glacier Lake’s President and Chief Executive Officer. “We were impressed with core photographs of the recently intersected mineralization on the New Nadina website and feel the geology of the region may support additional new discoveries with diligent exploration efforts.”

The technical content of this news release has been reviewed and approved by R. Tim Henneberry, P.Geo., a member of the Glacier Lake Advisory Board and a qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Contact information:

Satvir Dhillon, President & CEO

Glacier Lake Resources Inc.

Ph: 604-688-2922

Email:Â [email protected]

Following the November 9th announcement of a Lock-Up Agreement for 32% of the company’s shares, Augusta has surprised the market announcing a NCIB whereas up to 17,340,061 common shares representing up to 10% of the Company’s public float will be purchased through an Agent and subsequently cancelled. Once again AAO is demonstrating its commitment to create shareholder value through the process of reducing the available shares on the open market.

Allen Lone, President and CEO of Augusta stated:

“The Company believes that the purchase of the Shares will increase the proportionate interest of, and be advantageous to, all remaining security holders.â€

Not only is this excellent news for existing shareholders, it could potentially lead a surge in price if recent examples of NCIB’s in the market are any indicator; especially considering the following are peers of AAO.v:

Spartan Energy (TSX SPE)

Announced NCIB buy back August 22nd when price was $5.11. It went as high as $7.37.                                        Spartan’s NCIB buy back was based on 5% of 175m outstanding or 8.7 million shares

Genworth MI Canada Inc  (TSX MIC)

Announced their NCIB buy back May 2nd when price was $34.45. Genworth went as high

as $44.81. Their NCIB buy back was based on 5% of 90.9m outstanding, equivalent to 4.59 million shares

Augusta Announces Normal Course Issuer Bid

Augusta Industries November 14th NCIB announcement for up to 17,340,061 common shares separates itself from its peers.  Not only is Augusta consuming for closure another 10% of the Company’s public float, it is sending a clear message to its current and prospective shareholders; the company is preparing itself for the market to take notice. Augusta is removing more shares on a percentage basis at 10% than the 5% & 5% that Spartan & Genworth each removed through their respective NCIB.

The AGM is December 29th

For more information about Augusta and the proposed Spin-Off, watch this interview with Allen Lone on AGORACOM.

Opinions expressed by Forbes Contributors are their own.

The potential for blockchain technology to bring about widespread change has been predicted since 2011 and the emergence of Bitcoin. But it was this year when the concept really started to capture people’s attention.

Perhaps spurred on by the meteoric rise in price of Bitcoin – the first tangible example of a blockchain technology – hype grew around encrypted, distributed ledgers in the financial sector.

Shutterstock

Blockchain-focused financial services startups raised $240 million in venture funding during the first half of the year. However, its potential was beginning to be recognized across other sectors and industries.

2018 is likely to see a continuation of this trend of innovation and disruption. Here are the five key ways this is likely to happen.

While it’s implications for the financial sector might seem most apparent, any industry or organization in which recording and oversight of transactions is necessary could benefit. In healthcare, IDC Health Insights predicts that 20% of organizations will have moved beyond pilot projects and will have operationalized blockchain by 2020, so 2018 should see significant progress in that direction.

In recruitment and HR, blockchain CVs have been developed which will streamline the selection process by verifying candidates’ qualifications and relevant experience.

Legal work which involves tracking transfer of ownership – for example intellectual property law, or rea estate deeds – will also be made more efficient through implementation of distributed ledgers. Next year we should expect to see inroads by innovators in the legal field making this a reality.

Meanwhile in manufacturing and industry, the Blockchain Research Institute, the founders of which include IBM, Pepsi Co and FedEx, say it expects blockchain to become the “second generation†of the digital revolution following the development of the internet. It has highlighted work by electronics manufacturer Foxconn to use blockchain to track transactions in its supply chain.

Though this sounds like a clash of the buzzwords, serious thinking is going into how these technologies could be made to work together to improve business processes, and day-to-day life.

Security is one reason they are a good fit – blockchain’s encrypted and trustless nature makes it a viable option when it comes to keeping the ever-growing number of connected devices in our homes and offices safe. Research envisages that blockchain compute power that is used to “mine†Bitcoin could be put to use safeguarding our smart homes from a new generation of cyber-burglars looking to break in and steal our data.

Another proposed use is that the cryptocurrencies built on blockchains would prove ideal for automated micro-transactions made between machines. As well as recording machine activity on the ledger for record-keeping and analytical purposes, machines could effectively “pay†each other when smart machines operated by one organization interact and transact with those owned by others. This is likely to be further down the road, but it is likely we will see research and breakthroughs in this area in 2018.

READ MORE: https://www.forbes.com/sites/bernardmarr/2017/11/22/5-essential-blockchain-predictions-that-will-define-2018/#17b415a37c93

By: Matthew Leising

The program, managed by blockchain startup Axoni, kept track of the swaps contracts after they were executed, recording things like amendments or termination of the deals, stock splits and dividends, and achieved a “100 percent success rate,†Axoni said in a statement Monday. Other participants include the Canada Pension Plan Investment Board, Citigroup Inc., BNP Paribas SA and Credit Suisse Group AG.

“We’re on a path to take this forward,†Axoni Chief Executive Officer Greg Schvey said in an interview. “We know the thing works now.â€

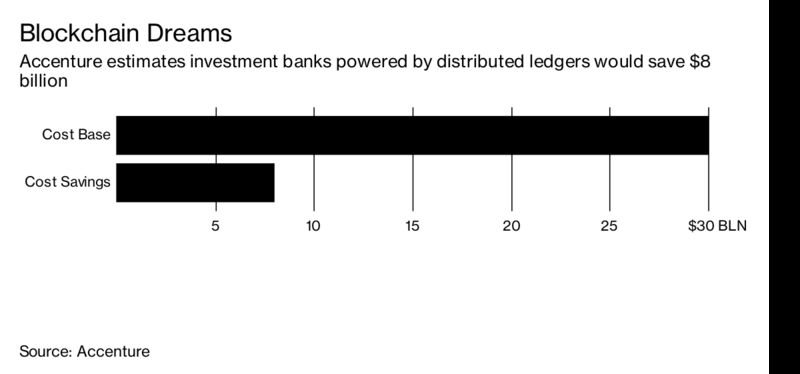

Blockchain software has captivated Wall Street because it could vastly reduce the cost of back-office operations and speed up trade clearing and settlement times. Banks have to set aside capital while they wait for transactions to be settled, so billions of dollars could be freed up for other uses if trade times go down to minutes from days or even weeks.

Axoni is far from alone in offering banks the ability to experiment with blockchain. Its competitors include Digital Asset Holdings, Symbiont, R3 and Chain.

Read More: All About Bitcoin, Blockchain and Their Crypto World

A blockchain system for equity swaps works to speed transaction times because the banks and asset managers all become members of a network that shares a so-called distributed ledger. Each member has an up-to-date copy of the ledger, so when payments need to go from one participant to another they can be processed almost in real time.

“Fewer valuation disputes, less reconciliation and real-time access to data would benefit all of the industry,†Adam Herrmann, global head of prime finance at Citigroup, said in the statement.

The program was all done in a test environment with no real trades being processed by Axoni’s AxCore blockchain software. No money changed hands either; the plan is that current systems like Fedwire or Swift will be used if the program goes live, Schvey said. He declined to say when blockchain for the equity swaps market will be done for real.

A similar test to move parts of the credit-default swap market onto a blockchain for post-trade processing uses the same system as in the equity-swaps model, Schvey said. AxCore uses smart contracts, the heart of the ethereum blockchain network, with a few tweaks.

“It looks and feels a lot like ethereum, but with a lot of differences,†such as changes to enhance scalability, privacy and security, Schvey said.

Source: https://www.bloomberg.com/news/articles/2017-11-20/blockchain-gets-a-wall-street-win-we-know-the-thing-works-now