As you know, we like to report AGORACOM traffic results on a regular basis, especially our annual results. In the world of online investor relations, nothing speaks more about your ability to meet a client’s needs than the amount of traffic and overall engagement you are able to deliver. This is especially true in the small-cap space, which is full of investor relations pretenders that throw around all the right jargon but offer little to no substance.

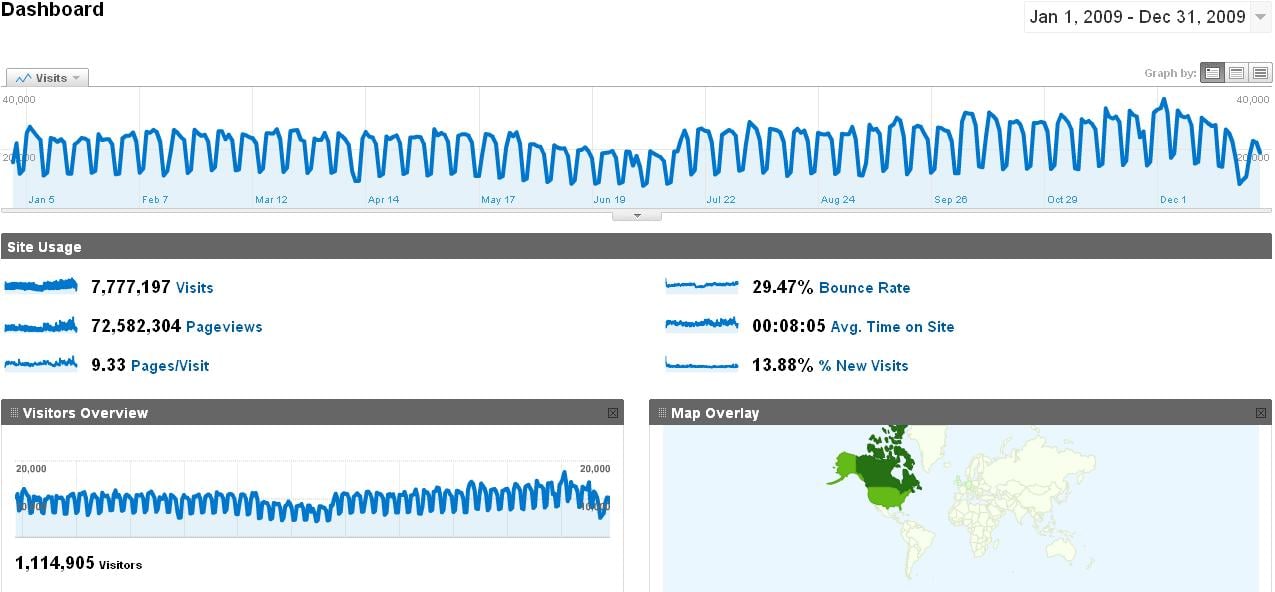

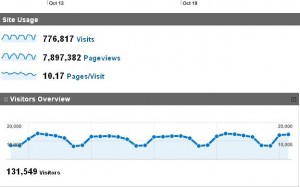

To this end, I am very happy to announce our traffic results for the full year 2009. If a picture is worth a thousand words, this snapshot from our Google analytics is worth several million

[PLEASE CLICK ON IMAGE FOR LARGE, CLEAR GRAPH]

THE TALE OF THE TAPE

(Figures for January 1, 2009 – December 31, 2009. All figures reported by Google Analytics)

- Unique Visitors 1,114,905

- Visits 7,777,197

- Page Views 72,582,304

- Pages Per Visit 9.33

- Avg Time On Site 8:05

- Number Of Countries/Territories 212

- Top 10 (Canada, USA, Germany, Netherlands, UK, Belgium, Australia, Sweden, Switzerland, Norway)

The numbers look even better when you consider

- We built our model on quality vs quantity. As such, this is pure discussion. No spam, flaming and bickering traffic.

- We are only focusing on small-cap and mid-cap stocks …for now.

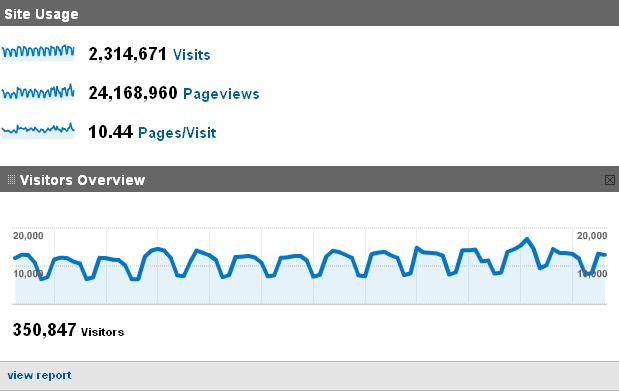

What is even more encouraging are the Q4 numbers which, if extrapolated out, point to rapidly accelerating traffic of close to 10M visits, 100M page views and 1.4M unique visitors.

Suffice it to say, we are once again ecstatic with the results. This is especially true given the state of the markets in H1 2009. We attribute much of this success to practicing what we preach. Specifically, when times are tough and your competitors are running for cover, crank up the marketing. AGORACOM did just that with the continuation of TV ads on Bloomberg, CNBC and BNN that we had begun in 2008.

In addition, 2009 was the year in which we continued upgrading site features – but we really increased time, energy and resources on extending our content far beyond AGORACOM. Specifically, we are now extremely active in terms of:

- Video (See: AGORACOM Launces YouTube + Multi-Site Video Distribution For Clients)

- Vlog (See: AGORACOM Small-Cap TV On YouTube)

- Twitter (See: What The @#$! Is Twitter?)

- Facebook (See: Facebook Fan Page)

Where are we going in 2010? Mobile, Mobile, Mobile baby. Look for good stuff to start coming out in the next 30 days or so.

CLIENTS AND MEMBERS THAT BELIEVED

I want to thank all of our great clients and members that believed in our model and breathed unbelievable life into this paradigm shifting platform. Without them, this would be one hell of an application with no users. A special thanks goes out to all HUB Leaders that abandoned their former communities at Stockhouse, Raging Bull, Yahoo Finance and others in hopes of a better experience. I’m glad our promises to you have been fulfilled. We know we’re not perfect – but together we’ve created a financial community that come as close to perfect as possible. Thank-You!

REPUTATION AND RANKING SYSTEM

When we created our community by combining UGC, Wiki and reputation based tools, we set out to destroy the stock discussion forum status quo that we have all come to hate over the past 10 years thanks to unrelenting spam, profanity, stock bashing, stock hyping and the unacceptable. Many thought it could not be done because we could neither change habits nor unseat the incumbents. We not only knew we could, we knew investors wanted us to. All they needed was a solution that focused on quality over quantity. By refusing to sacrifice quality for quantity, we will continue to attract great investing minds that have a lot to offer. Quality begets quality. As a result, we now have a massive community that both generates its own content and moderates itself to replace the status quo.

CONCLUSION

This is Wiki meets IGC (investor generated content), meets reputation based systems at their finest. There are bigger communities to be sure – but can you find another vertical in which the need for a drastically more efficient model is needed more? As I’ve stated since October 2007, Trillions of dollars are at stake. People’s futures are at stake. The implications of inefficient or imperfect information are severe. We now know it to be true.

Electronic shareholder forums are vital to the lives of so many people. With the advent of top-notch financial bloggers such as Kedrosky and Ritholtz and Grandich, as well as, the StockTwits financial micro-blog and online investor conferences, we are witnessing another paradigm shift in the way investors communicate and make decisions – and we plan to keep pushing that change for the foreseeable future. Stay tuned for more.

Regards,

George