WHY ROYAL HELIUM?

Worldwide usable Helium is in short supply as demand is increasing, making it a high-priced commodity

- Royal Helium has aims to deliver a minimum of 1 trillion cubic feet (Tcf) of total inert gas into the market

- Via exploration and development drilling of Helium resources in southern Saskatchewan.

Highlights:

Strategy of full-cycle inert gas capture, refining and liquefaction

Commenced 3 Well Drill Program at Climax:

- Production testing of 70m of potential helium bearing intervals for CLIMAX-1

- Production testing of 68m of intervals for CLIMAX-2

- Currently drilling CLIMAX-3

Royal Helium will be producing: helium, nitrogen and some CO2

Saskatchewan is one of the only places on earth with current and past production of primary Helium

Helium:

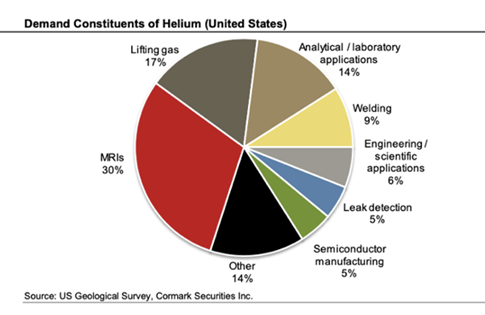

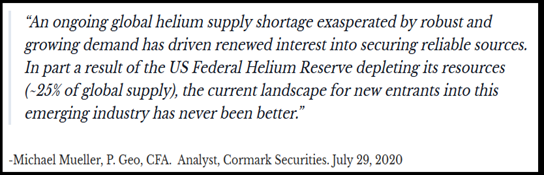

- Scarce: Dwindling supply combined with growing demand

- Helium prices have been rising due to a shortage of supply

Technical Partners:

- Saskatchewan Research Council (“SRC”): Conducting engineering and scoping study for a large-scale industrial gas polygeneration facility located in Saskatchewan with RHC

- AXIOM Group: Specialize in Energy Services, Geomatics, Exploration, Environment

- SPROULE Associates Ltd: consulting on the completions and testing programs and to prepare an independent evaluation of the prospective helium resource from the first three wells at Climax, in accordance with the classification, definitions and guidelines of NI 51-101.

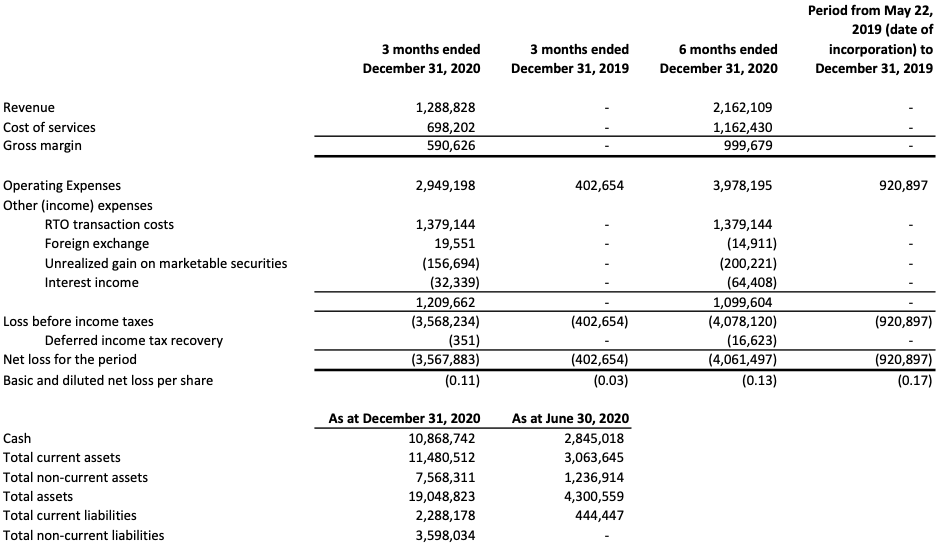

Helium Uses:

Helium

Helium is a non-substitutable and non-renewable commodity needed in many high-tech and health care industries, with specific applications in rocket engines, semiconductors, electronics, and health care.

- As these sectors continue to expand, the demand for helium expands in concert.

- High value and increasing Helium price

- Large and growing demand

Decreasing supply - Non-substitutable

Royal Helium

- Strategy of full-cycle inert gas capture, refining and liquefaction

Commenced 3 Well Drill Program at Climax:

- Production testing of 70m for CLIMAX-1

- Production testing of 68m for CLIMAX-2

- Drill rig mobilizing to drill CLIMAX-3

Mobile, membrane separation facilities: First stage of production

2nd Stage: permanent membrane separation facility

3rd Stage: Permanent poly-generation facility that makes products from the CO2 and the N2 gases

3rd or 4th stage: liquefaction facilities allowing full downstream transportation and worldwide export.

- Sell products both direct to customer and wholesale to re-sellers

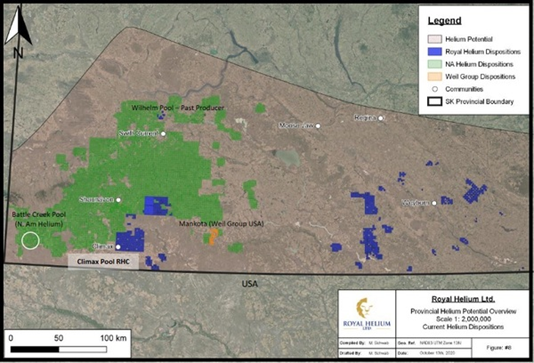

Largest Helium Lease Holders in N. America

- 4,000 square km of prospective helium lands across southern Saskatchewan

- 572 sections of land in Saskatchewan

Southern Saskatchewan

Saskatchewan has a history of current and historic primary helium production. It is one of the few places on the planet where helium is produced with nitrogen rather than hydrocarbons. Saskatchewan has the potential to replace supply that is leaving the market

▪High helium concentrations

▪Stable regulatory environment

▪Geopolitically favorable especially associated with production and export of critical commodities

▪Existing infrastructure, information and personnel from a long history of oil and gas exploration and production

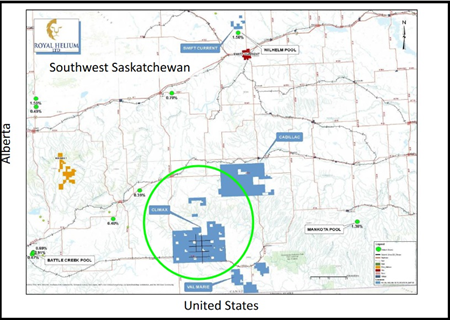

CLIMAX & BENGOUGH HELIUM PROJECTS

Royal Helium’s initial focus begins in two areas, Climax and Bengough, identified using a combination of seismic data, well logs and aeromagnetic surveys that narrowed down prospective areas to locate the source rocks for the helium enrichment (where the helium could be trapped and accumulated)

Royal Helium’s goal is to prove-up to 30 structures, targeting between 1.0 to 2.0 Tcf (Trillion cubic feet) of raw inert gas grading at least 1% Helium

- Single well costs around CAD$1.5 million with pay back in less than 1 year

Exploration Parcel #1 – CLIMAX

Royal Helium Ltd.’s Climax-1 helium exploration well drilled to target depth of 2,600m

Royal Helium Ltd. has successfully drilled Climax-2 to a total depth of 2,611m

- Selected target completion intervals for both the Climax-1 and Climax-2 helium exploration wells. (potential helium-bearing zones)

- The Climax-3 drilling nearing target depth

Completion and testing of Climax-1 and Climax-2 involves the sequential perforation and production testing of approximately 70 metres of potential helium-bearing zones at Climax-1 and approximately 68 metres of potential helium-bearing zones at Climax-2, both spanning multiple structural zones.

Consistent with Climax-1, the Climax-2 well was drilled into the Precambrian basement at the base of the Deadwood formation. The Deadwood is a sand and shale sequence that is known to produce helium in Saskatchewan. These first three wells are targeting different parts of the same large structural trap identified on the central portion of the Climax land block.

The seven drill targets at Climax were identified in late 2019 after the company first reprocessed 77.6 km of 2D seismic in conjunction with historic well logs and delineated a basement structure of ~3,094 hectares of four-way structural closure.

Another 17,676 hectares of helium permits (100% crown) located immediately west of its Climax property were then granted in November 2019.

To further define the possible inert gas/helium bearing formations and refine company target wells, a deep, detailed aeromagnetic survey was flown over the Climax central structure in May.

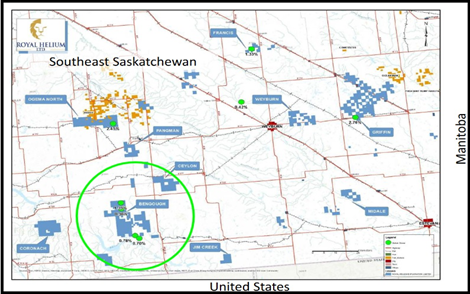

Exploration parcel #2: Bengough

- South-Central Saskatchewan with Five Target Wells

Comprise roughly 50% of the total land holding

Royal has reprocessed 50.36 square km of 3-D seismic, which was acquired in 2017. The re-interpretation was completed to gain an understanding of regional basement structures and to identify potential drill targets. The 3D seismic shows a large regional feature with multiple closures.

- Five (5) of these closures have been identified as initial drill targets and will be subject to further detailed investigation, including an airborne magnetometer survey.

Royal believes that the Bengough basement structure is part of a larger regional basement structural trend extending at least 60 miles north from the US border and passing through three of Royal’s Focus Areas.

- Along this trend, historic helium tests have ranged from 0.70% to 0.78% at Minton, 1.39% to 1.41% at Bengough, and 0.48% to 2.45% at Ogema/Ogema North.

Royals southeast Saskatchewan lands, which comprise roughly 50% of the total land holding, show the potential for robust helium occurrences. With the strategy of full-cycle inert gas capture, refining and liquefaction, it is crucial to develop a large number of derisked drill targets throughout the Company’s significant land package.

- The initial five targets identified at Bengough is an exciting first step in the southeast, growing the initial target inventory to 12 when combined with the seven targets on the Climax project in southwestern Saskatchewan.

Saskatchewan Research Council

The SRC is Canada’s second-largest research and technology organization. With more than 290 employees, $91-million in annual revenue and nearly 75 years of experience, SRC provides services and products to its 1,500 clients in 27 countries around the world.

- Commenced Engineering Study for a Helium Polygeneration Facility in Saskatchewan

- The results of this initial engineering and economic study due Dec. 2020

Royal Helium Ltd. has initiated the engineering and scoping study for a large-scale industrial gas polygeneration facility located in Saskatchewan, which will be conducted by the Saskatchewan Research Council

- The study is Royal’s first step in determining the economic potential of a large-scale facility for the separation and monetization of the gas streams associated with helium production wells in Saskatchewan.

Royal is reviewing whether there is an opportunity to monetize the complete gas stream. Current economic analysis does not include credits for other potentially commercial gases produced and processed. While the economics of helium production are significant on their own, the impact of the commercialization of other gases could substantially add to net cash flow.