VIDEO – Allan Barry Discusses The #Gamestop $GME Short Squeeze, Its Implications For #Gold & #Silver, Plus Advanced Gold $AAX.ca

Novamind $NM.ca Weekly Roundup $RVV.ca $MMED $PSYC.ca $FTRP.ca $CMPS $NUMI.ca

A weekly summary of Novamind news and media

The Wall Street Reporter Interviewed Novamind’s CEO, Yaron Conforti

MULTIMEDIA January 27, 2021

Psychedelics and Eating Disorders

OPINION January 23, 2021

Novamind looks to scale mental health clinics and clinical sites with shift in psychedelics policies

MULTIMEDIA January 21, 2021

January 29, 2021

Novamind Reaches Major Milestones for Ketamine and Spravato™ Treatments

January 28, 2021

Novamind Announces Marketing Services Agreements

January 26, 2021

Novamind to Present at Inaugural KCSA Psychedelics Investor Conference

January 25, 2021

Former LifeLabs COO Joins Novamind Leadership Team

January 19, 2021

Novamind Expands Psychedelic Medicine Access in Utah

January 13, 2021

Novamind is a leading mental health company enabling safe access to psychedelic medicine through a network of clinics, retreats, and clinical research sites. Novamind provides ketamine-assisted psychotherapy and other novel treatments through its network of Cedar Psychiatry clinics and operates Cedar Clinical Research, a contract research organization specialized in clinical trials and evidence-based research for psychedelic medicine. Both Cedar Psychiatry and Cedar Clinical Research are wholly-owned subsidiaries of Novamind. For more information on how Novamind is enhancing mental wellness and guiding people through their entire healing journey, visit www.novamind.ca

Predictmedix Inc. $PMED.ca $PMEDF Announces Results of its Annual and Special Meeting of Shareholders

- Sheldon Kales, Rahul Kushwah, Tomas Sipos and Ajit Kumar re-elected as directors of the company.

TORONTO, ON / ACCESSWIRE / January 29, 2021 / Predictmedix Inc. (CSE:PMED) (OTCQB:PMEDF) (“Predictmedix” or the”Company“) is pleased to announce the results of its Annual General and Special Meeting of Shareholders held on January 28, 2021 at 10:00 a.m. (the “Meeting“). The requisite approval of shareholders for the following items, all as more particularly described in the information circular of the Company dated December 21, 2020 (the “Circular“), was received at the Meeting:

1. setting the number of directors of the Company at four;

2. the re-election of Sheldon Kales, Rahul Kushwah, Tomas Sipos and Ajit Kumar as directors of the Company for the ensuing year;

3. the re-appointment of Harbourside CPA LLP (previously Buckley Dodds LLP) as the Company’s auditors; and

4. the authorization of the Company to make an application to the Supreme Court of British Columbia pursuant to Section 229 of Business Corporations Act (British Columbia) (“Section 229 Application“).

The only omissions, defects, errors or irregularities the Company sought to rectify through the Section 229 Application was the Company’s failure to hold an annual general meeting during the 2019 calendar year and distribute interim and annual financial statements. There were no other undisclosed omissions, defects, errors or irregularities that Predictmedix needed to cure.

Peak $PKK.ca $PKKFF Appoints Banking Executive Dana Ades-Landy to Its Board of Directors $MOS.ca $MOGO.ca CTZ.ca $TRAD.ca

- Added former banking executive, Dana Ades-Landy to its Board of Directors

- Over 25 years of experience in strategic development, governance and advocacy in the banking and financial services sector.

- Experience includes: Senior positions at National Bank, KPMG, Laurentian Bank

Montreal, Quebec–(January 29, 2021) – Peak Fintech Group Inc. (CSE: PKK) (OTCQX: PKKFF) (“Peak” or the “Company”), an innovative Fintech service provider to the Chinese commercial lending sector, today announced that it has added former banking executive, Dana Ades-Landy to its Board of Directors.

Ms. Ades-Landy has over 25 years of experience in strategic development, governance and advocacy in the banking and financial services sector. She is currently in her second tour of duty with the National Bank of Canada where she works with the bank’s special loans group, managing a diverse portfolio of commercial and corporate clients while providing coaching and mentoring to the group’s less seasoned members. She first worked at the National Bank of Canada from 1993 to 2004 occupying various management and executive positions, culminating with the position of Vice-President, Credit Risk and Specialized Products.

Ms. Ades-Landy spent 3 years at KPMG as a Senior Vice-President and Associate providing the firm’s corporate clients with advice in the fields of insolvency, restructuring, turnaround, and business revitalization. She left KPMG in 2006 and went on to spend the following 10 years holding Senior Vice-President and Vice-President positions at the Laurentian Bank of Canada and Scotia Bank, respectively, before serving as CEO of the Quebec chapter of the Heart and Stroke Foundation of Canada from 2016 to August 2020.

Read More: https://agoracom.com/ir/PeakFintechGroup/forums/discussion/topics/754200-peak-appoints-banking-executive-dana-ades-landy-to-its-board-of-directors/messages/2300968#message

Tartisan Nickel Corp. $TN.ca Announces Webinar on Thursday February 11, 2021 at 12 Noon EST $RNX.ca $TSLA $NOB.ca $SHL.ca $ELO $CNC.ca $FPC.ca $NICO.ca

Tartisan Nickel Corp. (CSE:TN)(OTC PINK:TTSRF)(FSE:A2D) (“Tartisan”, or the “Company”) announces that the Company will conduct a webinar at 12 noon EST on Thursday, February 11th, 2021.

The Company invites investors to join President & CEO Mark Appleby for an update on Tartisan Nickel Corp. and plans for the Company’s flagship Kenbridge Nickel project.

LIVE WEBINAR

The Tartisan Nickel Corp. webinar will take place on Thursday, February 11th, 2021 at 12 noon local time, Toronto.

The following link provides online registration details to join the webinar:

https://us02web.zoom.us/webinar/register/WN_4BcYSGmDQN2eeQwffUiFfA

After registering, you will receive a confirmation email containing information about joining the webinar.

The event is being facilitated by PBA (Paul Benwell & Associates).

About Tartisan Nickel Corp.

Tartisan Nickel Corp. is a Canadian based mineral exploration and development company which owns; the Kenbridge Nickel Project in northwestern Ontario; the Sill Lake Silver Property in Sault Ste. Marie, Ontario as well as the Don Pancho Manganese-Zinc-Lead-Silver Project in Peru.

The Company has an equity stake in; Eloro Resources Limited, Class 1 Nickel and Technologies Limited and Peruvian Metals Corp.Tartisan Nickel Corp.

For further information, please contact Mark Appleby, President & CEO and a Director of the Company, at 416-804-0280 ([email protected]).UnfollowRecommend

#Novamind $NM.ca to Present at Canaccord Genuity Conference: “New Paradigms & Treatment Approaches in #MentalHealth” $RVV.ca $MMED $PSYC.ca $FTRP.ca $CMPS $NUMI.ca

Conference highlights industry leaders and innovators in the psychedelic therapy space and features Michael Pollan, author of New York Times bestseller, “How to Change Your Mind”

- Will present at Canaccord Genuity’s “New Paradigms & Treatment Approaches in Mental Health” conference on February 3rd and 4th, 2021.

- Two-day virtual conference will explore the science, intellectual property, and legality of psychedelic compounds, which are at the forefront of breakthrough medical science.

- Novamind’s CEO and Director, Yaron Conforti will present on Wednesday February 3rd from 1:30-1:55 PM.

TORONTO, ON / January 29, 2021 / Novamind Inc. (CSE:NM) (“Novamind”), a mental health company specialized in psychedelic medicine, today announced that it will present at Canaccord Genuity’s “New Paradigms & Treatment Approaches in Mental Health” conference on February 3rd and 4th, 2021.

The two-day virtual conference will explore the science, intellectual property, and legality of psychedelic compounds, which are at the forefront of breakthrough medical science. Novamind’s CEO and Director, Yaron Conforti will present on Wednesday February 3rd from 1:30-1:55 PM.

Novamind, which has administered over 5,000 ketamine therapy treatments since 2016 and hosted over 20,000 client visits to its clinics in 2020 alone, will share its vision for scaling access to psychedelic medicine and advancing clinical research.

The conference will also feature keynote speaker Michael Pollan, author of the #1 New York Times bestseller “How to Change Your Mind: What the New Science of Psychedelics Teaches Us About Consciousness, Dying, Addiction, Depression, and Transcendence.”

For more information about the conference, please click here.

Read More: https://agoracom.com/ir/Novamind/forums/discussion/topics/754196-novamind-to-present-at-canaccord-genuity-conference-new-paradigms-treatment-approaches-in-mental-health/messages/2300955#message

Industry Bulletin: Eloro Resources Hits the Silver Jackpot SPONSOR Tartisan Resources $ TN.ca $ELO $CFE.ca $NICO.ca

- Tartisan owns approximately 4 million shares of Eloro Resources

- Eloro could amount to between 500 million tonnes to 1 billion tonnes at four to eight ounces silver eq grade

- Discovery Hole of 129.6 grams silver equivalent over 257.5 meters

- “Eloro is going to be bought out in short order” Bob Moriarty

Potosi in Bolivia is sometimes referred to as the GOAT of silver mining. That is, the Greatest Of All Time for silver. Discovered in 1545, Cerro Rico produced just over 2 billion ounces of silver at a cost of 8 million lives of slaves. If you held two and a half 100 ounce silver bars that came from Potosi, that would have cost the life of one slave, either Indian or Negro. The silver from Potosi funded the Spanish Empire for two and a half centuries. The silver went to Manila before being traded to China for tea, Chinaware and silk. The opium wars weren’t really about opium; they were about the silver riches from Potosi. Spain mined it and traded to China. China had it. Britain wanted it.

It appears Eloro is on track to pushing Potosi aside as the silver GOAT. At least if you are willing to consider silver equivalent ounces. Quinton Hennigh has done several interviews and believes Eloro could amount to between 500 million tonnes to 1 billion tonnes at four to eight ounces silver eq grade. Well, yesterday Eloro came out with brilliant assays that support Quinton’s belief and actually suggests he may have underestimated the potential. Now it seems to imply over 1 billion tonnes. If the four ounces held, Eloro would be the biggest silver story in history. Certainly the biggest silver story in the last fifty years.

Eloro has one of the strongest mining and geology teams in Peru or Bolivia. Dr. Osvaldo Acre runs the Bolivian operation. He is the world’s leading expert on Potosi type systems and literally has written the book about them. Dr. Bill Pearson who I first met when he was leading the geological team at Desert Sun fifteen years ago is the senior technical advisor. Tom Larsen is the CEO and drives the company. Quinton Hennigh also serves as a technical and business advisor.

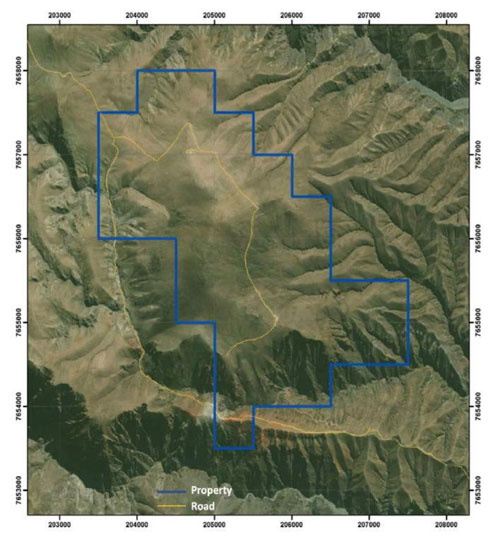

Eloro has an option on 99% of the Iska Iska property in the very southern bit of Bolivia near Potosi. They are paying the owner 500,000 shares and $10 million USD at some point in the next four years. There is no NSR. The owner retains a 1% interest in the project.

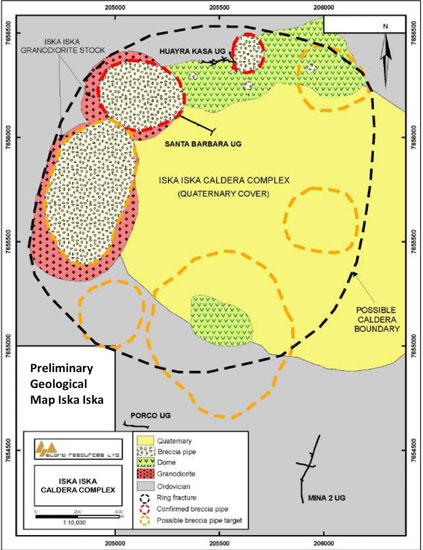

If you look at the center of the concession outlined in blue, clearly there is a caldera. While the geological team has been focused on identifying and drilling breccia pipes with great success, they have also identified a series of more potential pipes to the east and south.

I have never seen any company move a project forward and prove their theory so quickly. In the results released on January 26th one hole measured 129.6 grams silver equivalent over 257.5 meters from the newly discovered Santa Barbara breccia pipe. The Santa Barbara pipe was discovered and announced in the November press release. Through surface mapping and Aster satellite data located yet another breccia pipe, this one named the Central Breccia Pipe measuring 700 meters by 400 meters. This latest set of assays discusses drilling into both the Santa Barbara pipe and the Central Breccis pipe. Those results have not been released yet. Those include hole DHK-02 intercepting 475 meters below surface in the Central Breccia pipe.

This is an interesting system because it has a variety of minerals of economic value including almost an ounce of silver, some gold, lead, zinc, tin, bismuth, indium and cadmium. Quinton Hennigh did up a spreadsheet with the values from the 257-meter hole and it showed a total in the ground value of $103 US per tonne. That would make 500 million tonnes worth somewhere in the $50 billion USD range.

Bill Person and Osvaldo are punching holes in the pipes they have identified so far. I suspect that if they stepped back a foot or so and just stared at the maps of the project I have showed above they would realize there appears to be a ring of different breccia pipes around the edge of the caldera. Osvaldo talks about the possibility of the Santa Barbara and Central Breccia pipes merging deeper in the system. You have a series of pipes, why not start drilling vertical holes right in the center of the caldera? I’m not sure knowing the exact dimension of any of the pipes is important. This is a BFD system and all the company needs to attract bidding from every major in the world is to show an obvious billion tonnes of $100 rock. Don’t drill for the pipes, drill for the feeders.

Eloro is going to be bought out in short order, I’m talking 6-12 months. They are fully financed for a planned 14,000 meters of drilling both from surface and from underground. Due to drill limits, the underground drilling is pretty much limited to 350 meters but they can drill 1.2 km holes from the surface.

Today’s price action gives the company about a $190 million CAD market cap. The price is going to be up and down like a bride’s nightie but in six months it’s going to be a hell of a lot higher.

The shares were as cheap as $2.10 a week ago and hit $4.11 on Wednesday the 27th for almost double in a week. While they were cheap a week ago, they got expensive in a hurry. There is a backdoor way to buy shares that have not yet exploded higher yet. Cartier Iron, a gold company run by Tom Larsen, CEO of ELO, happens to own 2.09 million shares of ELO. At today’s highest price for Eloro, the shares held by Cartier were worth more than their entire market cap. The shares were 25% higher ten days ago. That situation won’t last for long.

Eloro and Cartier are both advertisers. I have bought shares in the open market and participated in private placements for both companies. As always do your own due diligence.

SOURCE: http://www.321gold.com/editorials/moriarty/moriarty012821.html

Red Light Holland $TRIP.ca Announces Closing of $9.77 Million Bought Deal Financing $SHRM.ca $RVV.ca $MMED $PLNT.ca $HALO.ca $PSYC.ca

Red Light Holland Corp. (CSE: TRIP) (“Red Light Holland” or the “Company“), an Ontario-based corporation engaged in the production, growth and sale of a premium brand of magic truffles to the legal, recreational market within the Netherlands, is pleased to announce that it has closed its previously announced bought deal short form prospectus offering, including the exercise in full of the underwriter’s over-allotment option (the “Offering“). In connection with the Offering, the Company issued 38,334,100 units of the Company (the “Units“) at a price of $0.255 per Unit, for aggregate gross proceeds of $9,775,195. The Offering was conducted by Eight Capital (the “Underwriter“).

“To have Red Light Holland – The People’s Company, being supported by ‘The Suits’ alongside our new and existing shareholders truly strengthens our Psychedelic Movement and our growth. We are so grateful for all of our loyal supporters and we now have over $20 million[1] of capital available which is incredible! This funding will enable us to fully execute on our business plan and the Red Light Holland team will continue working hard towards our goal of developing a leading brand in this emerging industry. Our mission continues – providing legal and responsible adult access now,” said Todd Shapiro, CEO and Director of Red Light Holland.

VIDEO – AI/ML Innovations $AIML.ca $FIRZF Uses #AI & Machine Learning to Make Waves in The $245bn Global Digital Health Monitoring Market $ADK.ca $PFM.ca $DM.ca

Tim Daniels / Executive Chairman of AI/ML Innovations Inc. / (CSE:AIML / OTC:FIRZF) explains how the Toronto-based business is focusing on acquiring and furthering Artificial Intelligence and Machine Learning technologies that can address urgent societal needs.

The firm’s key subsidiary, Health Gauge, is a leading digital health solutions provider that’s poised to disrupt the traditional healthcare industry by providing A.I. innovations and services that improve health outcomes, while at the same time reducing costs and stresses on the overburdened healthcare infrastructure.

AI/ML Highlights:

- Recently showcased its proof-of-concept deployment in a study funded by The Bill and Melinda Gates Foundation

- Health Gauge aims to penetrate the $245bn global digital health monitoring market by partnering with leading channel partners, health benefits providers, and end-users

- Will do this via its proprietary combination of digital health monitoring devices, AI-based software, and cloud computing platform.

Take a seat and learn more about AI/ML and its ambitious vision for the future.

VIDEO – Molecule $MLCL.ca Is At The Forefront of The Cannabis Beverage Revolution, with Landmark Licensing Deal And Estimated Revenue Run Rate of $18.5m $WEED.ca $TPX.A.ca $ACB.ca

Phil Waddington / President and CEO of Molecule Holdings Inc. / (MLCL:CSE) discusses the craft-focused, cannabis beverage production company’s cutting-edge work in the nascent Canadian market.

Boasting a 200,000 square foot production facility based in Ontario, the company has just been given the green light to begin selling its unique line of cannabis-infused beverages throughout Canada, starting in Ontario and Québec.

The company’s recent partnership with Vortex Cannabis Inc. allows Molecule to bring its unique line of cannabis-infused beverage products to market this year, while completing its own sales amendment application.

Molecule Highlights:

- Molecule’s recent deal with Vortex Cannabis Inc. allows it to begin selling its unique line of cannabis-infused beverages throughout Canada this year.

- Vortex will sell products produced by Molecule to provincial retailers, starting with Ontario and Québec.

- Molecule has a 200,000 square foot production facility based in Ontario, offering huge capacity.

- The company forecasts 2021 Q1 revenue of $3.5m, 2021 Q2 revenue of $5.8m, and a 2021 Run Rate revenue of $18.5m

- An early leap of faith into this emerging industry in 2018 has positioned the company well ahead of the pack now.

- “We are excited to move into full scale production and sale,” says CEO Phil Waddington.