Lomiko Metals Inc. (“Lomikoâ€) (TSX-V: LMR, OTC: LMRMF, FSE: DH8C) and Quebec Precious Metals (“QPMâ€) (TSX.V: CJC) announces that further to the Company’s press release dated December 31, 2018, the Company wishes to update shareholders regarding its option to earn a 100% of the La Loutre Flake and Lac des ÃŽles Flake Graphite Properties, Quebec (the “Propertiesâ€). The Company has completed its initial option and has earned its 80% interest in the Properties.

Pursuant to an agreement dated December 22, 2018, the Company and Quebec Precious Metals Inc. (“QPMâ€) (previously known as Canada Strategic Metals Inc.) agreed to extend two options agreements relating to the Properties which allow the Company to earn a 100% ownership. Pursuant to an amendment dated May 13, 2016, in order to earn a further 20% interest for a total of 100%, the Company was to issue an aggregate of 5,000,000 shares (pre-consolidation) (2,500,000 on or before July 31, 2017 and 2,500,000 on or before December 31, 2018) and fund exploration expenditures of an aggregate of $1,125,000 ($250,000 by December 31, 2016; $375,000 by December 31, 2017 and $500,000 by December 31, 2018). The parties agreed to extend the deadline date for the Company to fund exploration work of $1,125,000 to December 31, 2019 and the Company shall forthwith, upon regulatory approval, issue 500,000 common shares (5,000,000 pre-consolidation) shares. In order to close the transaction, the Company must have adequate funds available and the transaction is subject to the approval of the TSX Venture Exchange. The transaction is arm’s length.

Further to the press release dated August 20, 2019, announcing the engagement of Leede Jones Gable Inc. (the “Agent”) as lead agent on a commercially reasonable agency basis to undertake a brokered private placement (the “Offeringâ€) of a combination of Units (as hereinafter defined) and FT Shares (as hereinafter defined) for gross proceeds of up to $2,750,000, the Company discloses that it will be relying on certain prospectus exemptions including but not limited to, the Existing Security Holder Exemption and BC Instrument 45-536 Exemption from prospectus requirement for certain distributions through an investment dealer. An exemption where the purchaser has obtained advice regarding suitability from a person registered as an investment dealer.

Subject to applicable securities laws, the Company will permit each person or company who, as of September 13, 2019 (being the record date set by the Company pursuant to Multilateral CSA Notice 45-313 – Prospectus Exemption for Distributions to Existing Security Holders) (“CSA 45-313â€), who hold common shares as of that date (a “Current Shareholderâ€) to subscribe for the Units and FS Shares that will be distributed pursuant to the Offering, provided that the Existing Security Holder Exemption is available to such person or company.

Pursuant to CSA 45-313, each subscriber relying on the Existing Security Holder Exemption may subscribe for a maximum of 300,000 Units or 300,000 FS Shares, being such amount of Units and FS Shares that results in an acquisition cost of less than or equal to $15,000 for such subscribers, unless a subscriber is resident in a jurisdiction of Canada and has obtained advice regarding the suitability of the investment from a registered investment dealer (in which case such maximum subscription amount will not apply). In the event that aggregate subscriptions for Units or FT Shares under the Offering exceed the maximum number of securities to be distributed, then Units will be sold to qualifying subscribers on a pro rata basis based on the number of Units or FT Shares subscribed for. In addition to conducting the Offering pursuant to the Existing Security Holder Exemption, the Company will also accept subscriptions for Units or FT Shares where other prospectus exemptions are available. Any Current Shareholder subscribing for Units or FT Shares pursuant to a prospectus exemption other than the Existing Security Holder Exemption will not be limited to a maximum of 300,000 Units or 300,000 FT Shares.

The Company also advises that the insiders of the Company may also participate in the financing, which will be completed pursuant to available related party exemptions under Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions.

Up to 20,000,000 units (the “Unitsâ€) of the Company will be offered at $0.05 per Unit to raise gross proceeds of up to $1,000,000. Each Unit will consist of one (1) common share and one half of one (1/2) common share purchase warrant (“Warrantâ€). Each full Warrant shall entitle the holder to acquire one (1) common share at $0.07 per share for a period of 24 months following closing. Up to 35,000,000 flow through shares (the “FT Sharesâ€) will be offered at $0.05 per FT Share for gross proceeds of up to $1,750,000.

The gross proceeds from the issuance of the FT Shares will be used for Canadian exploration expenses and will qualify as flow-through mining expenditures, as defined in Subsection 127(9) of the Income Tax Act (Canada), which will be renounced to the subscribers with an effective date no later than Dec. 31, 2019, to the initial purchasers of the offered securities in an aggregate amount not less than the gross proceeds raised from the issue of the flow-through shares, as applicable, and, if the qualifying expenditures are reduced by the Canada Revenue Agency, the company will indemnify each FT subscriber for any additional taxes payable by such subscriber as a result of the company’s failure to renounce the qualifying expenditures as agreed.

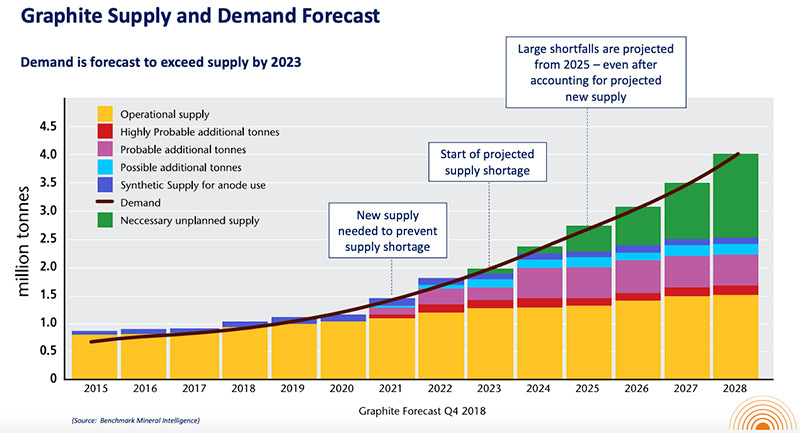

The net proceeds from the Offering of the Units and the gross proceeds from the Offering of FT Shares will be primarily used for: (1) approximately $50,000 for a new Resource Estimate prepared in accordance NI #43-101 regulations which will include recent drill results from the Refractory Zone; (2) approximately $700,000 for completion of work required for a Preliminary Economic Assessment (PEA), including but not limited to, metallurgical/engineering testing and drilling, community relations, testing for conversion to spherical graphite for use in graphite anodes, environmental assessment and extraction and processing cost studies; (3) fund exploration work of $1,125,000 to December 31, 2019, $425,000 on exploration in 2020; and (4) approximately $150,000 to pursue potential off-take partners, fees and for general working capital. While the Company intends to spend the net proceeds from the Offering as stated above, there may be circumstances where, for sound business reasons, funds may be reallocated at the discretion of the Board.

The closing of the Offering is expected to occur on or about October 30, 2019. Closing is subject to a number of prescribed conditions, including, without limitations, approval of the TSX Venture Exchange. All the securities issued under the Offering are subject to resale restrictions under applicable securities legislation.

Offering Jurisdictions

The Offering will take place by way of a brokered private placement to qualified investors in such provinces of Canada as the Agent may designate, and otherwise in those jurisdictions where the Offering can lawfully be made under applicable exemptions.

Agent’s Compensation

On the Closing of the Offering, the Company has agreed to pay to the Agent, subject to certain exclusions, a commission equal to 8% of the gross proceeds arising from the Offering. At the closing of the Offering, the Company will also issue to the Agent non-transferable warrants exercisable at any time up to 24 months from closing, to acquire common shares from treasury in an amount equal to 8% of the aggregate number of units and FT shares issued pursuant to the Offering.

The Company discloses that there are no material facts or material changes about the Company that has not been generally disclosed.

The Corporation does not expect to provide any offering materials to subscribers in connection with the Offering.

For more information on the Company, review the website at www.lomiko.com, contact A. Paul Gill at 604-729-5312 or email: [email protected].

On Behalf of the Board,

LOMIKO METALS INC.

A. Paul Gill,

Chief Executive Officer