- Entered into a binding agreement with Iceland Resources ehf to acquire all its outstanding shares

- Iceland Resources owns multiple polymetallic exploration & development projects in Iceland and has direct or indirect access to all active mineral tenure, claims and mineral leases in Iceland

Montreal, Quebec / November 22, 2016 – St-Georges Platinum and Base Metals Ltd. (CSE: SX)(OTC: SXOOF) (FSE: 85G1) is pleased to announce that it has entered into a binding agreement with Iceland Resources ehf to acquire all its outstanding shares. Iceland Resources owns multiple polymetallic exploration & development projects in Iceland and has direct or indirect access to all active mineral tenure, claims and mineral leases in Iceland.

The Opportunity

Iceland Resources ehf is a privately-owned Icelandic corporation with gold/silver/copper/cobalt/zinc projects in Iceland.

Iceland is an important producer and developer of geothermal energy. St-Georges management has been active over the last few years in Iceland with the goal of securing access to geothermal operations to test the development of technologies allowing the extraction of lithium and light minerals from the brines being pumped from the geothermal wells and for the extraction of a large variety of precious and base metals found in the mud rejected from the same operations.

Enrico Di Cesare, Director of St-Georges commented: “(…) With St-Georges focused on innovative extraction technologies and working on strategic alliances with several providers, this opportunity is exciting; it is an excellent platform to apply new technologies, monetize tailings and demonstrate our solutions which also address environmental issues. The focus is to economically recover precious and base metals and to provide an avenue for positive environmental remediation of the by-products. St-Georges is also looking at niche and value added products that this opportunity lends itself to.”

Terms of Acquisition

St-Georges will create a subsidiary that will become the owner of Iceland Resources. 40% of this subsidiary will be owned by the Iceland Resources shareholders and the remaining 60% will be owned by St-Georges. Additionally, St-Georges makes the following commitments:

-Issuing 6,000,000 common shares of St-Georges to Iceland shareholders with a 12-month escrow release schedule;

-Issuing a $350,000 debenture, bearing a 6% annual interest (cash or shares), maturing in November 2026 to be distributed to Iceland shareholders and some creditors; and

-$1,000,000 of expenditure on the Iceland assets over the next 24 months, including mineral exploration expenses and metallurgical process research & development.

Iceland Resources Projects

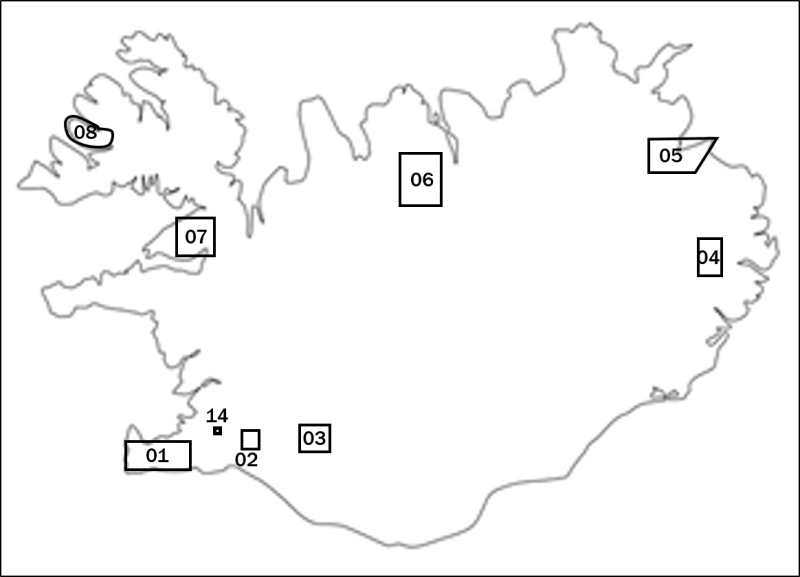

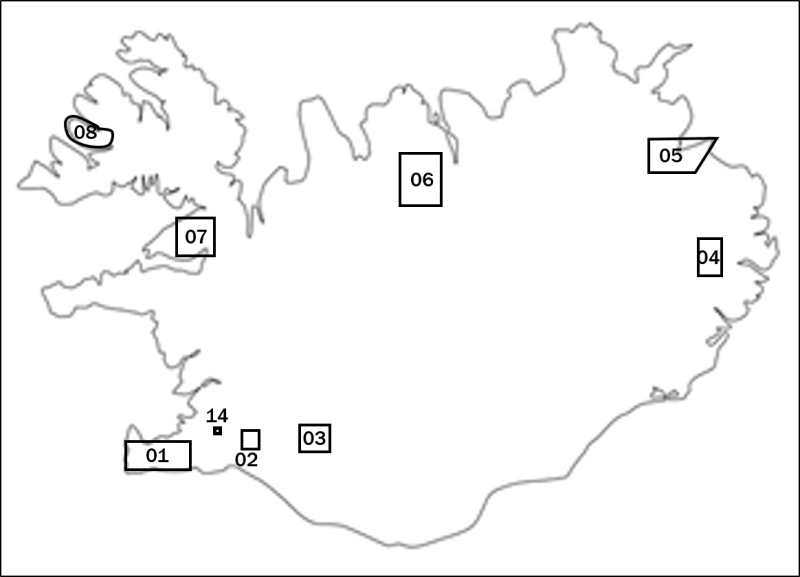

Iceland Resources currently has 9 defined mineral exploration and development projects in Iceland (8 licenses or license applications held directly and one within a Joint-Venture). Other opportunities are being sought after with the collaboration of St-Georges (with the possibility to deploy St-Georges technologies result from its R&D initiatives).

St-Georges intends to direct most of its efforts in the next 24 months to 3 priority projects:

Reykjanes Project (EL 01) (Au-Ag-Cu-Zn)

The 897.5 km2Reykjanes licence area is in close proximity to the capital Reykjavik and the international airport in the town of Keflavik and is supported by good transport infrastructure with main highways running through it. The project is prospective for gold, silver, copper, zinc and cobalt. The Company also plans to apply for licenses to evaluate the lithium potential of the geothermal brines present on the property.

Figure 1. The Reykjanes Project

The Thormodsdalur Project (EL-14) (Au-Ag-Cu)

Thormodsdalur is located about 20km east of the city centre of Reykjavik and south-east of the lake Hafravatn. The project was discovered in 1908. The property produced mineral concentrate from 1911 to 1925 when over 300 meters of tunnels where dug alongside surface excavations. The ore recovered was transported to Germany and historic sources reported values ranging between 11g/t and 315g/t Au. Note: All information pertaining to mineral resources, grades or operational results herewith presented are historical in nature and while relevant, the information was obtained from sources that cannot be independently verified and that are not compliant with National Instrument 43-101 reporting standards.

More recently, visible gold was seen in cores from geothermal wells located on the project. This new discovery compelled the Icelandic government to create a mining entity for gold exploration in Iceland called Malmis.

Studies between 2005 and 2013 identified the project mineralization as a low sulphidation system containing banded chalcedony and ginguro. Petrographic analysis of the vein material identified gold occurring in its free form and as part of an assemblage with pyrite and chalcopyrite. Petrographic and XRD studies show an evolution of the vein system from the zeolite assemblage to quartz adularia and lastly to minor calcite. In the area, 32 holes have been drilled for a total of 2439 meters.Gold values vary from less than 0.5 ppm to the maximum of 415 ppm. (These values were obtained from selected random intervals and cannot be construed to be representative of the any particular thickness or overall length).

Iceland Resources entered in to a Joint Venture agreement with Melmi ehf, Malmis hf (majority government owned) and Gold Island Limited. Melmi is the owner of the Thormodsdalur license that was first granted in October 2004. Melmi is owned by Malmis (51%) and Gold Island (49%).

Figure 2. The Thormodsdalur Project

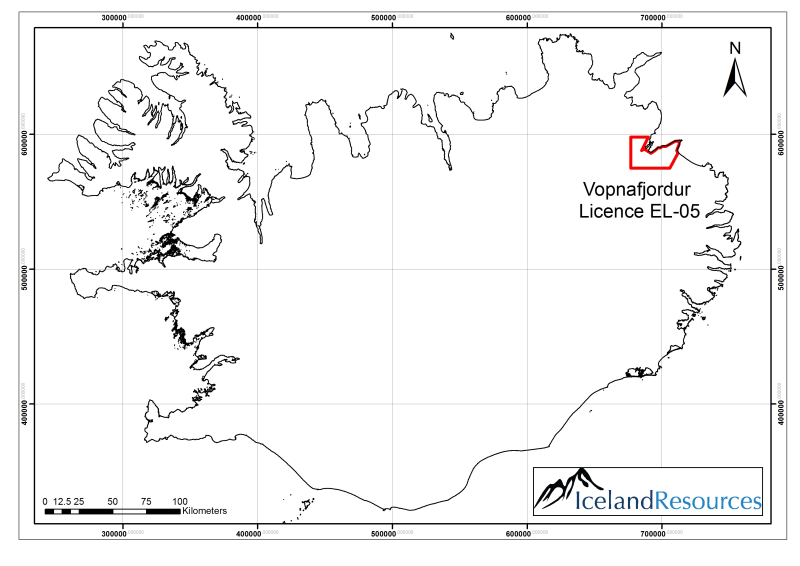

The Vopnafjordur Project (EL-05) (Au-Ag-Te) (Bi-Co-Sb-Se-Zn)

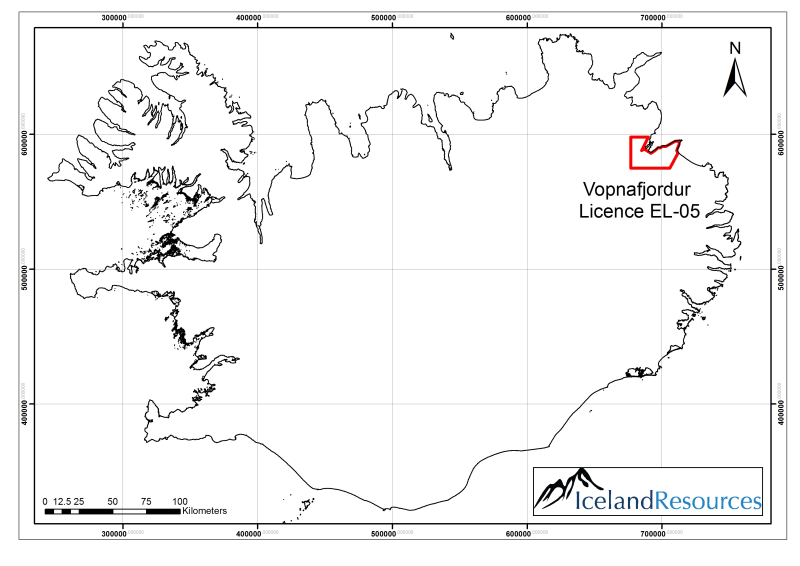

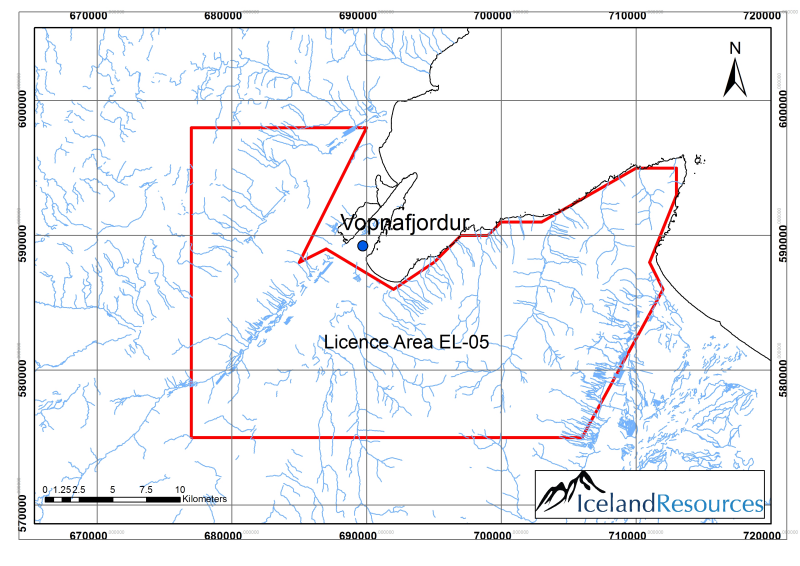

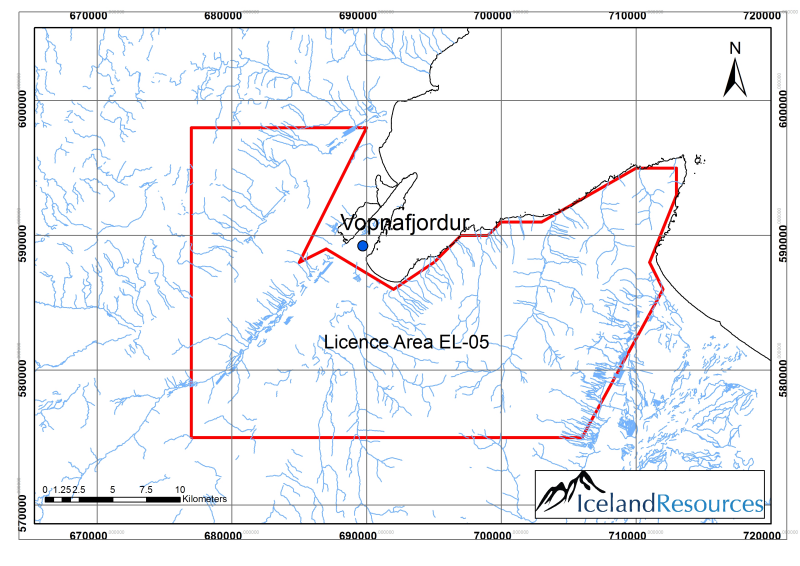

The Vopnafjordur licence covers 598.5 km2(Maps, fig. 3 & 4) and is valid until July 2021. Exploration in Vopnafjordur was carried out by Malmis between 1991 and 1993 in the form of BLEG surveys and vein sampling. Follow-up work was carried out by Melmi in 1997, which carried out stream sediment and helicopter-assisted rock chip sampling in the Vopnafjordur area. The rock chip sampling programme focused on areas of strong alteration, known quartz-carbonate-pyrite veining and in selected structural settings. The sampling programme indicated anomalous antimony, selenium and tellurium values in the northern rhyolitic centre and further identified anomalous gold, antimony, bismuth and zinc in an acid intrusion in the central southern part of the licence.

Recently, a comprehensive review of the BLEG and rock chip sampling programme was undertaken alongside satellite interpretation of the whole of the Vopnafjordur licence and a short exploration program in August 2016. In addition to the two volcanic centres identified in the 1990s, a number of regional fault zones associated with elevated levels of key pathfinder elements and occasionally gold was identified. The geological team is expecting assay results shortly.

These areas will be investigated further by the Company’s geological team in 2017, which will carry out close-spaced traverse mapping and grab sampling of key fault structures identified by previous exploration.

Click Image To View Full Size

Figure 3. Vopnafjordur licence EL-05 is situated in the Nord Austurland region of NE Iceland

Click Image To View Full Size

Figure 4. Extent of Vopnafjordur licence boundaries. Map scale 1:200,000

Click Image To View Full Size

Figure 5. World map showing Iceland

Click Image To View Full Size

Figure 6. Map of Iceland with location of the projects

Icelandic Geology is unique and considered relatively young in geology term. Iceland lies in the divergent boundaries of the Mid Atlantic Ridge. The buoyancy of the Iceland plume leads to dynamic uplift of the Iceland plateau, and high volcanic productivity over the plume has developed an anomalous volume of volcanic material and magma chambers at depth.

Iceland has not been thoroughly mapped and geological exploration has been limited when compared to other jurisdictions. St-Georges now have the unencumbered opportunity to explore Iceland’s potential starting with its most known prospective target sites with data generated from existing geological work and geothermal operations around the country. Furthermore, St-Georges technologies should enable the team of Iceland Resources to unlock the potential for prospective lithium brines and mud tailings that were not considered in the past.

Vilhjalmur Thor Vilhjalmsson, director of Iceland Resources, commented: “The opportunity to combine the resources of both companies, our extensive knowledge of Iceland and its geology and the addition of St-Georges team’s expertise in metallurgical processing and eco-mining environmental friendly solutions, provides a unique offering to the market and stakeholders of both companies (…) St-Georges brings a portfolio of R&D initiatives aimed at reducing the environmental impact of mining activities and improving producers’ financial bottom line. Iceland like the Scandinavian countries is a place of certainty in regulations and mining law with reliable and accessible data available from government bodies thus opening possibilities to get additional licenses with historical data available similar to work previously done in Iceland as well as in Greenland (…) we believe that we found a good home for our shareholders in St-Georges and we are excited at the prospect of the proposed 2017 exploration and development campaigns.”

General Disclaimer: The current press release contains references to mineral sampling results that are provided by Iceland Resources or were sourced in the geological literature published by the Icelandic government or its departments. St-Georges has not sampled and analysed these samples. Readers should exercise caution as real width, depth or length of the mineralisation encounter is not defined. No resource estimate that is compliant with the standard of the National Instrument 43-101 is currently available.

The technical information in this release has been reviewed and approved by Mr. Herb Duerr, P. Geo. a ‘qualified person’ as defined by National Instrument 43-101Standards of Disclosure for Mineral Projects.

ON BEHALF OF THE BOARD OF DIRECTORS

“Frank Dumas’

FRANK DUMAS, PRESIDENT & CEO

About St-Georges

St-Georges is developing new technologies to solve the biggest environmental problems in the mining industry. If thesenew technologiesare successful, they should improve the financial bottom line of current mining producers. The potential success of these technologies would also involve upgrading certain current known metal resources to economic status while addressing the environmental and social acceptability issues. The Company also explores for Nickel on the Julie Nickel Project & for industrial minerals on the Quebec’s North Shore and for Lithium and rare metals in Northern Quebec and in the Abitibi area.Headquartered in Montreal, St-Georges’ stock is listed on the CSE under the symbol SX, on the US OTC under the Symbol SXOOF and on the Frankfurt Stock Exchange under the symbol 85G1. For additional information, please visit our website at www.stgeorgesplatinum.com

About Iceland Resources EHF

Iceland Resources ehf is a junior mineral exploration company with a focus on the Scandinavian region. The company has one licence in the Vopnafjordur area in Iceland and further seven areas pending issue totalling over 4,000km2. The company also has an earn-in agreement with Melmi ehf and Gold Island Ltd to earn into the well-known Thormodsdalur licence where gold grades up to 415 g/t have been identified and the partners are working towards a NI 43-101 compliant resource.http://www.icelandresources.is

The Canadian Securities Exchange (CSE) has not reviewed and does not accept responsibility for the adequacy or the accuracy of the contents of this release.