Sponsor: Loncor is a Canadian gold explorer that controls over 2,400,000 high grade ounces outside of a Barrick JV.. The Ngayu JV property is 200km southwest of the Kibali gold mine, operated by Barrick, which produced 800,000 ounces of gold in 2018. Barrick manages and funds exploration at the Ngayu project until the completion of a pre-feasibility study on any gold discovery meeting the investment criteria of Barrick. Newmont $NGT $NEM owns 7.8%, Resolute $RSG owns 27% Click Here for More Info

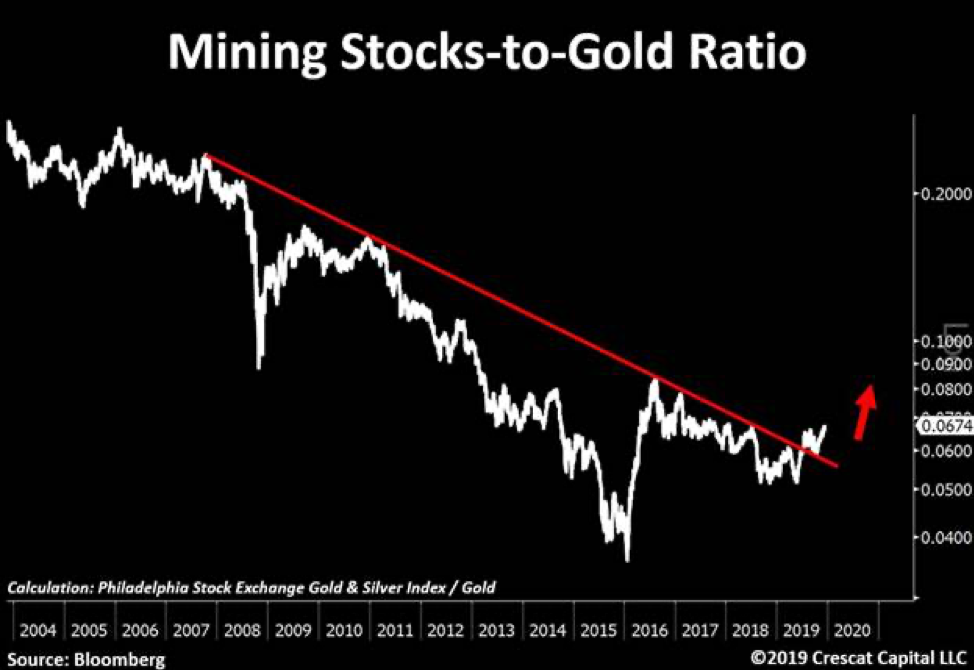

- We believe that there is a strong case to expect gold mining shares to outperform the metal in the years ahead…

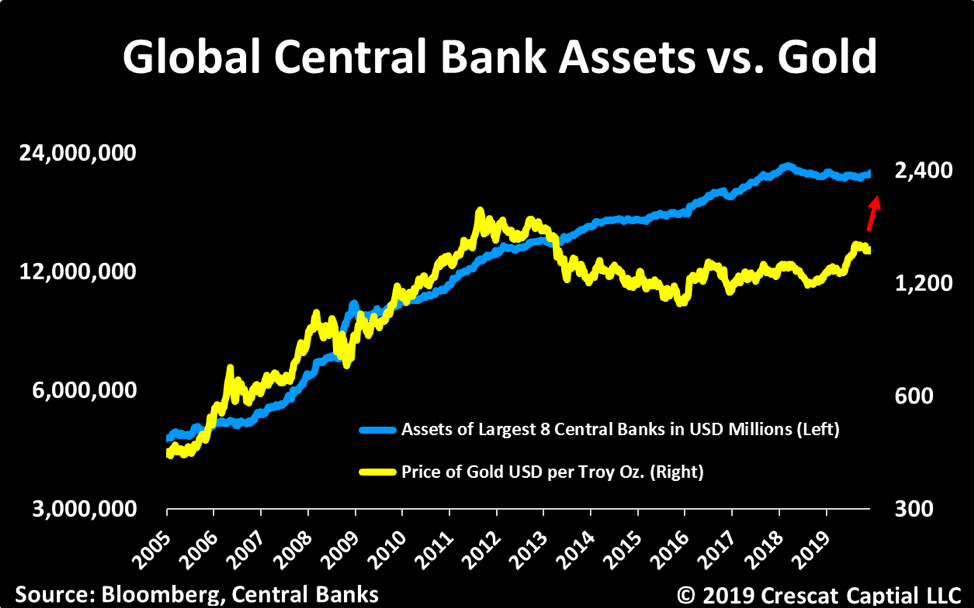

On September 17, 2019, overnight repo rates spiked 121 basis points, climbing from 2.19% to 3.40%, providing yet another crucial buttress for the bullish rationale for gold. The spike signaled that the U.S. Federal Reserve (“Fedâ€) had lost control of the price of money. Without subsequent massive injections of liquidity by the Fed into the repo market, out of control, short-term interest rates would have undermined the leverage that underpins record financial asset valuations. Going forward, unless the Fed continues to expand its balance sheet, it risks a meltdown in equity and bond prices that could exceed the damage of the 2008 global financial crisis. Despite consensus expectations, there appears no escape from this treadmill.

The Fed must monetize deficits because non-U.S. investors are no longer absorbing the growing supply of U.S. debt. Ultra-low, short-term interest rates do not compensate foreign investors for the cost of hedging potential foreign currency (FX) losses (see Figure 1). The U.S. fiscal deficit is too high and the issuance of new U.S. treasuries is too great for the market to absorb at such low interest rates. In a free market, interest rates would rise, the economy would stall and financial asset valuations would decline sharply.

Figure 1. Treasury Issuance Goes Up, Foreign Purchases Go Down (2010-2019)

Source: Bloomberg. Data as of 12/31/2019.

The predicament facing monetary policy explains why central banks are buying gold in record quantities, as shown in Figure 2. It also explains the fourth quarter “melt-up†in the equity market, even with Q4 earnings that are likely to be flat to down versus a year ago (marking the second quarter in a row for lackluster results) and the weakest macroeconomic landscape since 2009 (as shown by Figure 3).

Figure 2. Central Banks Purchases of Gold are 12% Higher than Last Year

Source: World Gold Council; Metals Focus; Refinitiv GFMS. Data as of 9/30/2019.

Figure 3. The U.S. ISM PMI Index Indicates Economic Contraction

The U.S. ISM Manufacturing Purchasing Managers Index (PMI)1 ended the year at 47.2, indicating that the U.S. economy is in contraction territory (a reading above 50 indicates expansion, while a reading below 50 indicates contraction).

Source: Bloomberg. Data as of 12/31/2019.

Liquidity injections will result in more debt, both public and private sector, but not necessarily enhanced economic growth:

“As these forms of easing (i.e., interest rate cuts and QE [quantitative easing]) cease to work well and the problem of there being too much debt and non-debt liabilities (e.g., pension and healthcare liabilities) remains, the other forms of easing (most obviously currency depreciations and fiscal deficits that are monetized) will become increasingly likely …. [this] will reduce the value of money and real returns for creditors and will test how far creditors will let central banks go in providing negative real returns before moving into other assets [including gold].â€

– Ray Dalio, Paradigm Shifts, Bridgewater Daily Observations, 7/15/2019

Gold Bullion and Miners Shine in 2019

Though overshadowed by the rip-roaring equity market, precious metals and related mining equities also had significant gains in 2019 (up 43.49%)2. Gold’s 18.31% rise last year was its strongest performance since 2016. More significantly, after two more years of range-bound trading, the metal closed out 2019 at its highest level since mid-2013, and within striking distance of $1,900/oz, the all-time high it reached in 2011.

The investment world has taken little notice. Despite gold’s strong performance, GDX3, the best ETF (exchange-traded fund) proxy for precious metals mining stocks, saw significant outflows over the year as shares outstanding declined from 502 million to 441 million (or 12%) over the twelve months, despite posting a 39.73% gain, well ahead of the 31.49% total return for the S&P 500 Total Return Index.4 We believe that there is a strong case to expect gold mining shares to outperform the metal in the years ahead…

It has been our long-held view that until mainstream investment strategies run aground, interest in precious metals will continue to simmer on low, notwithstanding the likelihood that 2020 may be another very good year for the precious metals complex. The many reasons why mainstream investment strategies could unravel are not difficult to imagine. They include the emergence of meaningful inflation, further slippage of the U.S. dollar’s nearly exclusive reserve currency status, and market-driven interest rate increases or a recession. Any or all of these could disrupt the continued expansion of the Fed’s balance sheet, triggering a rapid reversal in financial asset valuations. Each possibility deserves a more complete discussion than space here allows, but evidence strongly suggests that none can be ruled out. While timing the zenith in complacency is risky, we feel confident that a reversal of fortune for high financial asset valuations awaits unsuspecting investors sooner than they expect.

We are even more confident that a bear market will generate far broader investment interest in gold. Considering that institutional exposure to gold and related mining stocks hovers near multi-decade lows, the slightest uptick could easily drive the metal and related precious metals mining shares to historic highs. Today, the aggregate market capitalization of precious metals equity shares is $400 billion, an insignificant speck on the current market landscape.

Investors outflows from precious metals mining stocks in 2019, even as gold rose 18.31%, suggests skepticism that the current rally is sustainable — perhaps hardened by the wounds of years of middling performance. Contrarian analysis would regard such bearishness as grounds to be very bullish. In our opinion, investors have overlooked that the 2019 rise in gold prices has restored financial health to sector balance sheets, earnings and cash flow. Gold stocks offer both relative and absolute fundamental value and growth potential that compares very favorably to conventional investment strategies

We believe that there is a strong case to expect gold mining shares to outperform the metal in the years ahead by a substantially wider margin than they outperformed in 2019. With continued advances in precious metals prices, the return potential from these still unloved orphans and pariahs of the investment universe should prove to be very compelling.

SOURCE:https://www.sprott.com/insights/sprott-gold-report-no-way-out/

-637160977007144981.png)

-637160977627630029.png)