Agoracom Blog Home

Posts Tagged ‘gold’

Liberty Star is an Arizona-based mineral exploration company engaged in the acquisition, exploration, and development of mineral properties in Arizona and the southwest USA. Currently, the Company controls properties which are located over what management considers some of North America’s richest mineralized regions for copper, gold, silver, molybdenum (moly), and uranium.

Hub On AGORACOM / Watch Interview

Tags: $TSXV, amex, copper, finance, gold, hay mountain, investing, investment, investor relations, liberty star, micro-cap stocks, nyse, otcbb, pink, pink sheet, pink sheets, pinksheet, pinksheets, small cap stocks, stock, stock market, stocks, tsx, tsx-v, uranium, venture

Posted in AGORACOM Via Satellite, Liberty Star Uranium and Metals | Comments Off on INTERVIEW: Liberty Star Discusses Use of Titan R-40 Drill Rig $LBSR.us

AMK: TSX-V, ACKRF: OTC Pink

- Announce that Tudor Gold Corp. (“Tudor”), American Creek’s new joint venture partner on both the Treaty Creek and Electrum projects is now trading on the TSX-V under the symbol “TUD”.

- Entered into two separate JV agreements with Tudor (as announced yesterday) and will receive shares of Tudor as consideration in both agreements.

CARDSTON, ALBERTA–(May 12, 2016) – American Creek Resources Ltd. (“American Creek“) (TSX VENTURE:AMK) is pleased to announce that Tudor Gold Corp. (“Tudor”), American Creek’s new joint venture partner on both the Treaty Creek and Electrum projects is now trading on the TSX-V under the symbol “TUD”.

American Creek entered into two separate JV agreements with Tudor (as announced yesterday) and will receive shares of Tudor as consideration in both agreements. The terms of the two agreements are summarized below:

Pursuant to the first agreement, American Creek will sell an undivided 60% interest in its Electrum property located in NW British Columbia in consideration for 1,000,000 Tudor shares and the payment of $500,000 cash on receipt of all regulatory approvals. Tudor has also agreed to invest $250,000 into American Creek pursuant to a private placement at a price of the greater of $0.08 per share or the discounted market price as defined by Exchange policy. A 60/40 joint venture will be formed and Tudor will be operator of the project.

Pursuant to the second agreement, American Creek will sell an undivided 31% interest in its Treaty Creek property to Tudor in consideration for 500,000 Tudor shares. Tudor has agreed to complete a minimum of $1,000,000 in exploration expenditures on the Treaty Creek property during 2016. A joint venture has been formed with Tudor holding a 60% interest and each of American Creek and Teuton Resources Corp. (“Teuton”) holding a 20% interest in the joint venture. However, both American Creek’s and Teuton’s 20% interests are fully carried during the exploration period until a production notice is given. Thereafter, each will be responsible for 20% of the costs under and subject to the terms of the joint venture.

American Creek wishes to further define and clarify the term “fully carried” as it pertains to the Treaty Creek Project JV Agreement. “Fully carried” means that American Creek will not have to expend exploration funds to advance the Treaty Creek project through the exploration phase up until the point that a production notice is given by the operator. This means that American Creek will not need to raise exploration capital for the project and therefore will not need to suffer further dilution related to the exploration advancement of the project.

Tudor is arm’s length to American Creek. These transactions are subject to TSX-V approval.

Darren Blaney, President & CEO, stated: “We are pleased that Tudor Gold Corp. has received regulatory approval to begin trading. With Walter Storm’s past track record of success, in particular with Osisko Mining Corp., we have the utmost confidence in both his ability and vision for the advancement of the Treaty Creek and Electrum properties. We are very much looking forward to working together.”

The Electrum property is located in the “Golden Triangle” of NW British Columbia and encompasses the historic past producing East Gold Mine. The property is road accessible and is only 45 km from recently upgraded concentrate shipping port facilities located in Stewart. The East Gold Mine produced extremely high grades of gold, silver and electrum in the past.

The Treaty Creek property is also located in the “Golden Triangle” immediately adjacent to Seabridge’s KSM project and near Pretivm’s Snowfield/Valley of the Kings deposits. The Treaty Creek property lies within the same broad hydrothermal system that generated the several deposits on the Seabridge and Pretivm properties that lie south of the Treaty Creek claims.

American Creek Resources Ltd. is a Canadian junior mineral exploration company focused on the acquisition, exploration and development of mineral deposits within the Province of British Columbia, Canada. Further information relating to American Creek is available on its website at www.americancreek.com.

Information related to the Corporation can also be found on the American Creek investor hub profile page at www.agoracom.com.

Darren Blaney, CEO & Director

This press release was prepared by management who takes full responsibility for its contents. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements

This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. Actual results could differ materially because of factors discussed in the Company’s management discussion and analysis filed with applicable Canadian securities regulators, which can be found under the Company’s profile on www.sedar.com. The Company does not assume any obligation to update any forward-looking statements.

American Creek Resources Ltd.

Kelvin Burton

403 752-4040

Tags: #mining, #smallcapstocks, $TSXV, gold, Seabridge Gold (SEA.T), Treaty Creek, Tudor Gold Corp.

Posted in All Recent Posts, American Creek Resources Ltd. | Comments Off on American Creek’s JV Partner Begins Trading on TSX Venture Exchange $AMK.ca $TUD.ca

- American Creek Resources is a precious metals exploration company with an impressive portfolio of high-potential gold and silver projects in British Columbia. Mineralization in the Treaty Creek claims area lies within the same broad hydrothermal system that generated the several deposits on the Seabridge Gold KSM and the Pretivm Brucejack properties that lie immediately southwest of the Treaty Creek claims

- So far over 130 million ounces of gold, 800 million ounces of silver and 20 billion pounds of copper (all categories included), representing one of the greatest concentrations of metal value on the planet, have been delineated within the geological system shared by KSM, Brucejack, and Treaty Creek.

Hub On AGORACOM / Watch Interview

Tags: $TSXV, American Creek Resources, amex, finance, gold, investing, investment, investor relations, micro-cap stocks, nyse, otcbb, pink, pink sheet, pink sheets, pinksheet, pinksheets, Seabridge Gold, small cap stocks, stock, stock market, stocks, tsx, tsx-v, Tudor Gold, venture

Posted in AGORACOM Via Satellite, American Creek Resources Ltd. | Comments Off on INTERVIEW: American Creek Discusses Joint Venture Agreement with Walter Storm’s Tudor Gold Corp. $AMK.ca

- Entered into two separate joint venture agreements with Tudor Gold Corp. (TSX VENTURE:TUD)

- Pursuant to the first agreement, American Creek will sell an undivided 60% interest in its Electrum property located in NW British Columbia in consideration for 1,000,000 Tudor shares and the payment of $500,000 cash on receipt of all regulatory approvals

- Second agreement, American Creek will sell an undivided 31% interest in its Treaty Creek property to Tudor in consideration for 500,000 Tudor shares. Tudor has agreed to complete a minimum of $1,000,000 in exploration expenditures on the Treaty Creek property during 2016

CARDSTON, ALBERTA–(May 11, 2016) – American Creek Resources Ltd. (TSX VENTURE:AMK) (“American Creek“) is pleased to announce that it has entered into two separate joint venture agreements with Tudor Gold Corp. (TSX VENTURE:TUD) (“Tudor“). Tudor is arm’s length to American Creek. These transactions are subject to TSXV approval.

Pursuant to the first agreement, American Creek will sell an undivided 60% interest in its Electrum property located in NW British Columbia in consideration for 1,000,000 Tudor shares and the payment of $500,000 cash on receipt of all regulatory approvals. Tudor has also agreed to invest $250,000 into American Creek pursuant to a private placement at a price of the greater of $0.08 per share or the discounted market price as defined by Exchange policy. A 60/40 joint venture will be formed and Tudor will be operator of the project.

Pursuant to the second agreement, American Creek will sell an undivided 31% interest in its Treaty Creek property to Tudor in consideration for 500,000 Tudor shares. Tudor has agreed to complete a minimum of $1,000,000 in exploration expenditures on the Treaty Creek property during 2016. A joint venture has been formed with Tudor holding a 60% interest and each of American Creek and Teuton Resources Corp. (TSX VENTURE:TUO) (“Teuton“) holding a 20% interest in the joint venture. However, both American Creek’s and Teuton’s 20% interests are fully carried during the exploration period until a production notice is given. Thereafter, each will be responsible for 20% of the costs under and subject to the terms of the joint venture.

In conjunction with the execution of the Treaty Creek joint venture agreement above, American Creek is also pleased to advise that a settlement has been reached between American Creek, Darren Blaney, Allan Burton, Robert Edwards and Kelvin Burton (the “Plaintiffs“) and Teuton, Dino Cremonese, Gary Assaly and Amanda Mullin (the “Defendants“) related to the litigation in Alberta, Court File No. 1201-07918 with respect to the conspiracy, defamation, economic interference and economic harm claim that American Creek filed in 2012 against the Defendants and others. Accordingly, the Summary Judgement hearing against the Defendants above and scheduled for June 29, 2016 has been adjourned. The settlement is conditional on TSXV approval of the Treaty Creek joint venture agreement. The terms of the settlement are confidential.

Darren Blaney, American Creek’s CEO, states: “We are very pleased to be joint venturing with Walter Storm and his new public company Tudor Gold Corp. We have the utmost respect for Walter and his associates, and their track record of success, and are very much looking forward to working with them to advance our Treaty Creek and Electrum projects. We believe this is a game changer for American Creek as it will bring these two projects the recognition they deserve.”

About American Creek

American Creek Resources Ltd. is a Canadian junior mineral exploration company focused on the acquisition, exploration and development of mineral deposits within the Province of British Columbia, Canada. Further information relating to American Creek is available on its website at www.americancreek.com.

Darren Blaney, CEO & Director

This press release was prepared by management who takes full responsibility for its contents. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements

This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. Actual results could differ materially because of factors discussed in the Company’s management discussion and analysis filed with applicable Canadian securities regulators, which can be found under the Company’s profile on www.sedar.com. The Company does not assume any obligation to update any forward-looking statements.

Contact Information

American Creek Resources Ltd.

Kelvin Burton

403 752-4040

[email protected]

www.americancreek.com

Tags: #mining, #smallcapstocks, $TSXV, gold, Seabridge Gold (SEA.T), Treaty Creek

Posted in American Creek Resources Ltd. | Comments Off on American Creek Enters Into Two Joint Ventures With Tudor Gold Corp. $AMK.ca

Why Explor Resources?

- Flagship Property Offers The Following:

- NI 43-101 Resource – 609,000 oz Indicated / 470,000 Inferred

- Teck Resources To Spend $12 MILLION To Earn 70%

- Property Is 2.5 KM From Lake Shore Gold Mine

- Property Is 13 KM From Downtown Timmins

- 2nd Project 43-101 Open Pit Resource

- 1.4 MILLION T Indicated @ 1.38% Copper

- 2.09 MILLION T Inferred @ 1.26% Copper

ONTARIO AND NEW BRUNSWICK PROPERTIES CURRENTLY UNDER EXPLORATION

Timmins Porcupine West (TPW) (4300 ha)

- NI 43-101 Resource: 609,000 oz Indicated

470,000 oz Inferred Gold

- 13 km from downtown Timmins

- Property is 2.5 km, NE of LSG West Timmins Mine

- Model: Hollinger McIntyre Gold System: 30,000,000 oz. Au

- Discovery Hole 10-30 : 9.22g/tonne over 11.0 meters

- Optioned to Teck Resources

- Teck to spend $12,000,000 to earn 70% interest

Chester Copper & VMS Project (3500ha)

- Mineral Target: Cu, Pb, Zn, Ag, & Au

- 70 km SW of Bathurst NB

- Structural Model Complete

- 300 m wide x 2000m long mineralized Corridor identified

- Ramp to ore zone (480 meter long (3m x 4m)

- Optioned to Brunswick Resources (BRU)

- Brunswick to spend $500,000 over 3 years

- Explore to receive $40,000 and 5,000,000 shares of BRU

- Open pit resource – NI 43-101 Resource: 1,400,000 Indicated t @ 1.38% Cu

2,089,000 Inferred t @ 1.26 % Cu

Kidd Creek Project (2466 ha)

- Mineral Target: Cu-Zn Ore

- Located 1.0 km west of Kidd Creek Mine

- Kidd Mine yielded 130M tonnes of Cu-Zn Ore since 1960

- Numerous Geophysical max/min and IP Targets

- Diamond Drilling winter 2015/2016

QUEBEC PROPERTIES CURRENTLY UNDER EXPLORATION

East Bay (3203 ha):

- Mineral Target: Gold

- Lies on Porcupine Destor Fault Zone, on strike with Beattie & Donchester mine

- Historical channel samples by Lacana Mining in 1982 including: 0.81 oz/ton over 5ft; 0.16 oz/ton over 6 ft; 0.10 oz/ton over 10 ft

- Wrap around Clifton Star

Nelligan (1198 ha):

- Mineral Target: Nickel

- Located in Val d’Or mining district of Quebec

- Historical grab samples of 10% Ni and 0.6% Cu obtained by INCO

- Discovered anomalous Nickel, Copper Zones

Launay (2250 ha):

- Mineral Target: Nickel

- Mineralized zones contained in mafic volcanic rocks

- Contiguous to Royal Nickel’s Dumont property (NW end)

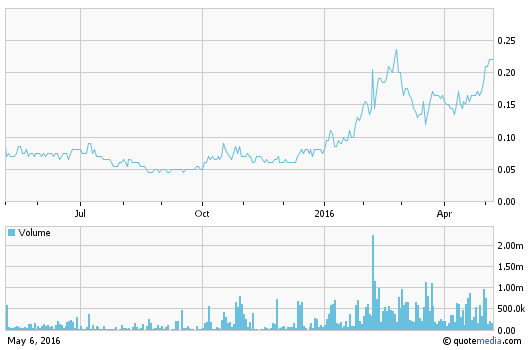

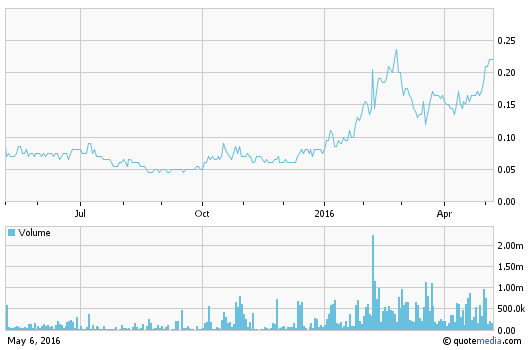

12 Month Stock Chart

Tags: #mining, #smallcapstocks, $TSXV, gold, Teck Resources (tck.b: tsx), Timmins Mining

Posted in AGORACOM Client Feature, All Recent Posts, Explor Resources Inc. | Comments Off on FEATURE: Explor Resources (EXS: TSX-V) 609K oz Indicated / 470K Inferred, Teck Resources To Spend $12 MILLION To Earn 70% $EXS.ca

- Acquired additional ground north west of Tahoe Resources Inc.’s, (NYSE-TAHO, TSX-THO) Whitney Gold project and adjacent to Durango’s Whitney NW project near Timmins, Ontario

- Ground was staked to extend the land position from the previously announced till sediment samples by Durango on March 2, 2016 and was acquired for staking costs.

Vancouver, BC / May 6, 2016 – Durango Resources Inc. (TSX.V-DGO), (the “Company” or “Durango”) announces that it has acquired additional ground north west of Tahoe Resources Inc.’s, (NYSE-TAHO, TSX-THO), Whitney Gold project and adjacent to Durango’s Whitney NW project near Timmins, Ontario. The ground was staked to extend the land position from the previously announced till sediment samples by Durango on March 2, 2016 and was acquired for staking costs.

About Durango

Durango is a natural resources company engaged in the acquisition and exploration of mineral properties. The Company has a 100% interest in the Mayner’s Fortune and Smith Island limestone properties in northwest British Columbia, the Decouverte and Trove gold properties in the Abitibi Region of Quebec, and certain lithium properties near the Whabouchi mine, the Buckshot graphite property near the Miller Mine in Quebec, the Dianna Lake silver project in northern Saskatchewan, the Whitney Northwest property near the Lake Shore Gold and Goldcorp joint venture in Ontario, as well as three sets of claims in the Labrador nickel corridor.

For further information on Durango, please refer to its SEDAR profile at www.sedar.com.

Marcy Kiesman, Chief Executive Officer

Telephone: 604.428.2900 or 604.339.2243

Facsimile: 888.266.3983

Email: [email protected]

Website: www.durangoresourcesinc.com

Forward-Looking Statements

This document may contain or refer to forward-looking information based on current expectations, including, but not limited to the development, commencement and completion of future exploration or project development programs and the impact on the Company of these events. Forward-looking information is subject to significant risks and uncertainties, as actual results may differ materially from forecasted results. Forward-looking information is provided as of the date hereof and we assume no responsibility to update or revise them to reflect new events or circumstances. For a detailed list of risks and uncertainties relating to Durango, please refer to the Company’s prospectus filed on its SEDAR profile at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Tags: #mining, #smallcapstocks, $TSXV, (NYSE-TAHO, gold, lithium, Tahoe Resources Inc.'s, TSX-THO)

Posted in Durango Resources | Comments Off on Durango Expands Whitney Northwest $DGO.ca

AMK: TSX-V, ACKRF: OTC Pink

WHY AMERICAN CREEK RESOURCES?

- Mineralization in the Treaty Creek claims area lies within the same broad hydrothermal system that generated the several deposits on the Seabridge Gold KSM and the Pretivm Brucejack properties that lie immediately southwest of the Treaty Creek claims

- So far over 130 million ounces of gold, 800 million ounces of silver and 20 billion pounds of copper (all categories included), representing one of the greatest concentrations of metal value on the planet, have been delineated within the geological system shared by KSM, Brucejack, and Treaty Creek.

RECENT HIGHLIGHTS

- Specimens from the structure averages 27,092 gm/tonne silver and 248 gm/tonne gold

- Results from outcrop specimens of high grade material collected on its Electrum property from the Shiny Cliff vein on the North Face Showing Read More

- TSX Venture Exchange approved the Amended and Restated Purchase Agreement regarding the Treaty Creek NSR that was previously announced April 13, 2016. Read Our Recent Blog

Exceptional Properties

Electrum Gold-Silver Property, British Columbia – 100% owned

The Electrum property has a rich history with some of the highest grade hand-mined ore mined in North America combined with excellent logistics. The property is located directly between two high-grad vein gold/silver mines; the past producing Silbak Premier mine and Pretiums high-grade Brucejack mine (production in 2017).All three lie within the Iskut mineral district (a particularly prolific part of the Canadian Cordillera) with numerous geological similarities between them.

The Electrum Property holds significant potential to attract mining companies when considering its high-grade nature combined with the exceptional logistics in place.

- Located in the prolific Golden Triangle of northwestern British Columbia, an area encompassing mineral rich belts that host more than 43 past producing mines including Eskay Creek, Silbak Premier, Granduc and Big Missouri.It is a hotbed of activity with one new mine having come online in 2015 (Imperial Mines Red Chris) and another scheduled for 2017 (Pretium Brucejack) and at least three more world-class mining projects headed toward production.

- Located in a particularly rich valley with 4 past producing commercial mines and a 5th in the adjacent valley.

- Includes the historic East Gold Mine that had intermittent small-scale production of approximately 46 tonnes of ore with grades averaging 1,661 grams of gold per tonne and 2,596 grams of silver per tone (roughly 50oz gold with 75oz silver).

- Mineralization is believed to be very similar to the silver-gold-base metal veins responsible for the precious metal mineralization found in the Silbak Premier Mine and the Big Missouri mines (located in same extended valley).

- Pretiums Brucejack Summary Report (for exploration) compares itself geologically to the Silbak Premier mine as well.

- Exceptional gold and silver assays including 440 g/t gold with 400 g/t silver over 0.52m, with numerous silver intervals of 583g/t, 501 g/t, 420 g/t, 384 g/t in core, and surface samples of 80.96 g/t gold with 80,818 g/t silver, 694 g/t gold with 550 g/t silver, 54.77 g/t gold with 14,903 g/t silver, 615 g/t gold with 616 g/t silver.

- A very successful program was run in 2015 wherein:

- A new approach focusing on high-grade was employed very successfully

- A new zone of gold / silver mineralization was discovered

- A better understanding of the property geology was obtained

- Surface samples from the structure averages 27,092 gm/tonne silver and 248 gm/tonne gold

- The program proved the Electrum Property has multiple high-grade gold-silver epithermal breccia vein systems and gave us a better understating of their sequencing.

- Excellent logistics including road access, power located 2 km away and a bulk tonnage shipping port and supportive mining town located just40 km away in a mining friendly jurisdiction.

The high-grade ELECTRUM PROPERTY recently had a program run on it. CLICK HERE for the Electrum presentation and HERE for the 2015 drill program presentation. The highly mineralized gossans on the Electrum are shown in the image at the top of this page.

2015 Drill Program Presentation

Treaty Creek Gold-Copper Property, British Columbia – 51% Joint Venture

Treaty Creek Property

Treaty Creek is located in British Columbia’s prolific Golden Triangle; one of the richest areas of mineralization in the world with one new mine having come online in 2015 (Imperial Mines Red Chris) and another scheduled for 2017 (Pretium Brucejack) and at least three more world-class mining projects headed toward production.

Mineralization in the Treaty Creek claims area lies within the same broad hydrothermal system that generated the several deposits on the Seabridge Gold KSM and the Pretivm Brucejack properties that lie immediately southwest of the Treaty Creek claims. So far over 130 million ounces of gold, 800 million ounces of silver and 20 billion pounds of copper (all categories included), representing one of the greatest concentrations of metal value on the planet, have been delineated within the geological system shared by KSM, Brucejack, and Treaty Creek.

Seabridge Gold’s KSM is the world’s largest undeveloped gold/silver project by reserves while Pretium’s Brucejack is the highest grading undeveloped large-scale gold project in the world.KSM has just past the environmental and permitting stage while the Brucejack is in construction phase.

Treaty Creek is part of the same large hydrothermal system as it’s neighbours, hosts the same bedrock geology as its neighbours, the same magneto-telluric (MT) anomalies that proved to be large deposits on the neighbours claims, the same major fault system (Sulphurets) that is responsible for KSM’s deposits, and initial exploration and drilling show similar results to initial drilling on KSM.

The Treaty Creek property is in a strategic location as it’s included in Seabridge’s plan for the KSM to go into production. Seabridge has proposed twin tunnels that would take the KSM ore through American Creek’s Treaty Creek property to a processing plant and tailings pond.

Tags: #mining, #smallcapstocks, $TSXV, gold, Pretium Resources (PVG.T), Seabridge Gold (SEA.T)

Posted in AGORACOM Client Feature, All Recent Posts, American Creek Resources Ltd. | Comments Off on CLIENT FEATURE: American Creek’s Treaty Creek Included In Seabridge Gold Plan To Take KSM Into Production $AMK.ca

- Placement consists of an amount of $800,000 in capital in unsecured convertible debentures

- Debentures bear interest at an annual rate of 8% and expire in one year from the closing of the Placement

- Explor Resources invites investors to visit our booth at the following conference:

- Booth #P28 (Pavilion) at the Big Event, Canadian Mining Expo in Timmins, Ontario, held at the McIntyre Community Centre from June 1 to June 2, 2016.

ROUYN-NORANDA, QUEBEC–(May 4, 2016) – Explor Resources Inc. (“Explor” or the “Corporation“) (TSX VENTURE:EXS)(OTCQX:EXSFF)(FRANKFURT:E1H1)(BERLIN:E1H1) announces that it has closed a non-brokered private placement of $800,000 (the “Placement”). The Placement consists of an amount of $800,000 in capital in unsecured convertible debentures (the “Debentures“). The Debentures bear interest at an annual rate of 8% and expire in one year from the closing of the Placement. Each holder of Debentures will be entitled to convert the principal amount of the Debentures in common shares of the Corporation, at a price of $0.15 per share. Therefore, the Corporation will reserve an aggregate number of 5,333,333 common shares of its capital stock in the event of the conversion of the full principal amount of the Debentures.

In connection with the Placement, a total of 426,667 non-transferrable warrants will be issued to two finders. Each warrant will be exercisable at $0.15 per common share of Explor for one (1) year from the closing date of the Placement.

The Debentures and any shares that may be issued on conversion of the Debentures, as well as any shares that would be issued on exercise of the finders’ warrants are subject to a hold period of four months and one day, expiring September 5, 2016.

The Placement is conditional to the final approval of the TSX Venture Exchange.

Explor Resources invites investors to visit our booth at the following conference:

Booth #P28 (Pavilion) at the Big Event, Canadian Mining Expo in Timmins, Ontario, held at the McIntyre Community Centre from June 1 to June 2, 2016.

The management team at Explor Resources Inc. looks forward to having you join us.

Explor Resources Inc. is a publicly listed company trading on the TSX Venture (EXS), on the OTCQX (EXSFF) and on the Frankfurt and Berlin Stock Exchanges (E1H1).

This Press Release was prepared by Explor. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the Policies of the TSX Venture Exchange) has reviewed or accepts responsibility for the adequacy or accuracy of this release.

About Explor Resources Inc.

Explor Resources Inc. is a Canadian-based natural resources company with mineral holdings in Ontario, Québec, Saskatchewan and New Brunswick. Explor is currently focused on exploration in the Abitibi Greenstone Belt. The belt is found in both provinces of Ontario and Québec with approximately 33% in Ontario and 67% in Québec. The Belt has produced in excess of 180,000,000 ounces of gold and 450,000,000 tonnes of cu-zn ore over the last 100 years. The Corporation was continued under the laws of Alberta in 1986 and has had its main office in Québec since 2006.

Explor Resources’ Flagship project is the Timmins Porcupine West (TPW) Project located in the Porcupine mining camp, in the Province of Ontario. Teck Resources Limited is currently conducting an exploration program as part of an earn-in on the TPW property. The TPW mineral resource (Press Release dated August 27, 2013) includes the following:

| Open Pit Mineral Resources at a 0.30 g/t Au cut-off grade are as follows: |

|

|

|

Indicated: 213,000 oz (4,283,000 tonnes at 1.55 g/t Au) |

|

Inferred: 77,000 oz (1,140,000 tonnes at 2.09 g/t Au) |

|

| Underground Mineral Resources at a 1.70 g/t Au cut-off grade are as follows: |

|

|

|

Indicated: 396,000 oz (4,420,000 tonnes at 2.79 g/t Au) |

|

Inferred: 393,000 oz (5,185,000 tonnes at 2.36 g/t Au) |

This document may contain forward-looking statements relating to Explor’s operations or to the environment in which it operates. Such statements are based on operations, estimates, forecasts and projections. They are not guarantees of future performance and involve risks and uncertainties that are difficult to predict and may be beyond Explor’s control. A number of important factors could cause actual outcomes and results to differ materially from those expressed in forward-looking statements, including those set forth in other public filling. In addition, such statements relate to the date on which they are made. Consequently, undue reliance should not be placed on such forward-looking statements. Explor disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, save and except as may be required by applicable securities laws.

Explor Resources Inc.

Christian Dupont

President

819-797-6050

888-997-4630 or 819-797-4630

[email protected]

www.explorresources.com

Tags: #mining, #smallcapstocks, $TSXV, Abitibi Greenstone Belt, Canadian Mining Expo, gold, Lake Shore Gold (LSG.T), Rogue Resources Inc. (TSX VENTURE: RRS), Teck Resources (tck.b: tsx), West Timmins Mining Inc. (TSX:WTM)

Posted in All Recent Posts, Explor Resources Inc. | Comments Off on Explor Closes a Private Placement of Unsecured Convertible Debentures $EXS.ca

TTC: CSE

- US $250,000 recommended work program

- Grab samples of note:

- 2.273 g Au/t

- 1,814 g Ag/t

- Gold and silver in Perú’s prolific North- Central Mineralized Belt

- “La Victoria” lies within this 300 km belt along the Andes which hosts 12 operating mines, 3 of which are world class producers.

- La Arena owned by Tahoe Resources, Lagunas Norte (Alto Chicama) owned by Barrick Gold Corporation (TSX:ABX) and Santa Rosa owned by Compañia Minera AurÃfera Santa Rosa (COMARSA).

- La Victoria has excellent potential to host high-grade oxide and sulphide epithermal Au, Ag vein systems as well as potential for a large, low-grade, disseminated Cu, Au and Ag (porphyry-type) deposit.

- Situated in the District of Huandoval, Province of Pallasca, Department of Ancash in the Republic of Peru on the continent of South America; approximately 425 kilometers (km) north-northwest of Lima. It is located within the Instituto Geografico Nacional (IGN) map sheet 17-h Pallasca.

- Claims are centered on Universal Transverse Mercator (“UTM”) coordinate system, Provisional South American Datum 1956 (“PSAD56″), zone 18L, 174202 meters (m) East and 9081240 meters North; or geographic coordinate system 77º 57′ 15″ of west Longitude and 8º 18′ 10” of south Latitude.

- Located in a remote area of Ancash on the western slopes of the Peruvian Andes at elevations that vary from 3000 m to 4200 m above sea level.

- Landscape includes rocky mountaintops emerging from wide grassy valleys carved by glacial activity (Figure 7.1a and 7.1b).

- Fertile land is abundant at lower altitudes. The vegetation at lower altitudes includes eucalyptus and pine trees, pasture and garden vegetables whereas the vegetation above 4000 m is restricted to grasses such as the ichu, cactus and some flower species.

- Temperature on the Property varies between -3 and 20 degrees celsius (“ºC”) with an annual average of approximately 13 ºC. There are only two seasons: the rainy season from November to March along with snowfall during this period, and the dry season from April to October which is also cold.

The Property is located about 10 hours away from Lima by truck with a travel distance of approximately 600 km. Exploration and mining activity can function year-round; however, it is expected that there will be down time during the rainy season because of the poor road conditions. Extreme caution is advised during this period. Figure 6.2 illustrates the route to the Property whereas the travel times, distances and road conditions are listed in Table 7.1.

| Route |

Distance (km) |

Time (hours) |

Condition |

| Lima – Chimbote |

440 |

5.75 |

Paved road |

| Chimbote – Santa |

11 |

0.25 |

Paved road |

| Santa – Estacion Chuquicara |

66 |

1 |

Paved road |

| Estación Chuquicara – La Galgada |

30 |

0.5 |

Paved road |

| La Galgada – Pallasca |

40 |

2 |

Maintained gravel road |

| Pallasca Property |

6 |

0.5 |

Maintained gravel road |

The nearest road to the San Markito and Victoria anomalies is approximately 3 km away, therefore, the Phase I exploration was performed using horses and donkeys as the main transport method. Water is not abundant within these areas but is available at higher elevations. Infrastructure improvements such as road, water reserve and electrical lines (if feasible) should be implemented before the Phase II exploration operations.

Hub On AGORACOM / Corporate Profile / Read Release

Tags: #mining, #silver, #smallcapstocks, $TSXV, Barrick Gold Corporation (TSX:ABX), copper, CSE, gold, Peru

Posted in AGORACOM Clients (New), Tartisan Resources | Comments Off on AGORACOM Welcomes Tartisan Resources (TTC: CSE) – Situated in the Andes which hosts 12 operating mines, 3 of which are world class producers $TTC.ca

Gold and Silver Go Boom. GREAT News For These Juniors!

EXS: TSX-V, OTCQX:EXSFF

- 609,000 Ozs Indicated / 470,000 Inferred

- Teck Resources To Spend $12 MILLION To Earn 70%

View Profile

—————————————

AMK: TSX-V, ACKRF: OTC Pink

- Included In Seabridge Gold Plan To Take KSM Into Production

- Recent samples average 27,092 gm/tonne silver and 248 gm/tonne gold

- Adjacent area host to Over 130M Ozs Gold, 800 million Ozs silver, 20 billion pounds copper

View Profile

—————————————-

UBR: TSX-V, URAGF: OTC

- Planned Dividend To Shareholders Via Gold Assets Spin Out

- Largest Historical Placer Gold Deposit In Eastern North America

- Past Gold Producer

- Word Renowned Geophysical Team

- Core Quartz Conversion To Solar Grade Silicon Metal Received $5,000,000 Funding + 20 Year Offtake Agreement For Asia

View Profile

Start Your Research And Discover Your Next Great Junior Resources Company

Tags: #silver, American Creek Resources, Explor Resources, gold, Small Cap Resource Stoks, Uragold Bay Resources

Posted in American Creek Resources Ltd., Explor Resources Inc., Uragold, URagold Bay Resources | Comments Off on With Gold And Silver On The Move, These 3 Juniors Are Set To Capitalize $EXS.ca $AMK.ca $UBR.ca