Agoracom Blog Home

Posts Tagged ‘gold’

Golden Hope Mines (TSX VENTURE: GNH)( Pink Sheets: GOLHF)

Golden Hope Mines Limited recently announced further significant results from its 2011 drill campaign in southeastern, Quebec. The company is pleased to present the following highlights from holes BD2011-174, 175, 176 and 177.

| Hole Number |

From |

To |

Length (m) |

Au (g/t) |

| BD2011-174 |

23 |

25 |

2 |

2.24 |

| BD2011-174 |

106 |

107 |

1 |

2.97 |

| BD2011-174 |

221 |

253 |

32 |

2.01 |

| Including |

233 |

238 |

5 |

10.18 |

| Including |

249 |

253 |

4 |

1.93 |

| BD2011-174 |

266 |

267 |

1 |

2.33 |

| BD2011-174 |

406 |

431 |

25 |

3.08 |

“The results continue to confirm significant widespread mineralization at Bellechasse-Timmins. We are pleased with the amount of important information that we continue to accumulate as we move closer to our initial goal of a resource estimate at Bellechasse-Timmins” states Frank Candido, President, Golden Hope Mines Limited.

Investment Highlights

- New discovery resulting in 20km mineralized gold belt

- 10,000+meter drill program currently in progress

- Recent Drilling Intersects 6140 g/t Au (197.4 oz/t Au) of Gold Over 1 Metre

- Target Potential for multiple multi-million ounce deposits

- Positive Preliminary Metallurgical Testing – recovery ranged from 97% to more than 99%

- Dominant land position in the most recent North American stalking rush

The Bellechasse Gold Belt

Location

- Site of the first gold rush in North-America in 1828

- Strategic land position comprising 80% of mineralized belt

- 554 mining claims spanning 24,436 hectares

- Excellent infrastructure nearby

Geology

Gold mineralization in the Bellechasse area occurs in quartz/carbonate veins in albite diorite and related intrusive rocks, and also in minor amount in the veins within the volcanoclastic rocks that host the diorite.

The area in which mineralization is known measures approximately 875 metres along 045° and approximately 650 metres across the regional strike. Gold-bearing zones consist in quartz-filled structures which locally exhibit stockwerk pattern and may be brecciated. They are known to develop in plug-like protrusions of diorite emplaced in the country rock (T1 Zone) and in larger diorite masses (T2 Zone).

Click to enlarge

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate Website / Golden Hope Hub

|

Tags: #mining, #smallcapstocks, $TSXV, gold, gold stock, small cap stock

Posted in Golden Hope Mines | Comments Off on Golden Hope Intersects 3.08 g/t Au Over 25 Metres and 2.01 g/t Au Over 32 Metres at Bellechasse-Timmins, Quebec

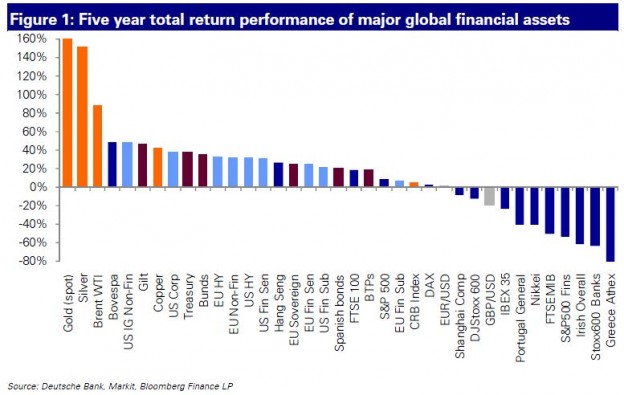

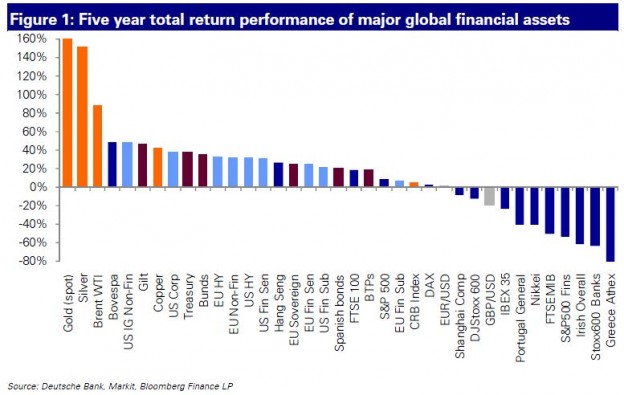

A chart is worth a thousand words…….

Tags: #copper, #DAX, #DOW, #hardassets, #realmoney, #silver, #SP500, $CL_F, $GC_F, $GLD, $SI_F, $SLV, $SPY, $XLF, gold

Posted in All Recent Posts | Comments Off on Five Year Total Return of Major Financial Assets

The $TSXV had another strong week. I was definitely looking for a correction, but that has yet to materialize – we may just rock ‘n’ roll into PDAC. I remain confident that the good issuers will prevail and the cream will rise in addition to certain hot sectors like Graphite and precious metals that will bring volume in. I am also keeping a close eye on Uranium and some interesting biotech issues.

There are a few points that I noticed this week that stood out:

- Market Internals: Long side momentum players and the “Jitney Magic Men”(broker code 99 that takes out those key levels in the blink of an eye) are all over issues with good news and price levels to be taken out.

- Risk Appetite: There is a sense that the worst is behind us and money is flowing into the speculative issues. There is money available to fiance projects of merit. Retail can follow this via http://canadianfinancing.com/

- The CRB Index: The CRB index is crossing it’s 200EMA and is trending very nicely.

Here is where the $STXV stands going into Monday morning:

I’d like to see some larger trading ranges and divergence added to the MACD but I will take the levitation. I want to see that ADX continue to rise and would love to see more volume in this market.

By the way has anyone else been hearing about Zinc? Is it just me or it starting to make noise again?

Tags: #99, #copper, #CRB, #Jitney, #mining, #moneyflow, #silver, #smallcapstocks, #zinc, $CDNX, $CIB, $TSXV, gold

Posted in All Recent Posts | Comments Off on $TSXV Week in Review

I though we were going to see  sell off into the end of the week as per my risk off post, but it looks like the equity markets are going to push higher and the $TSXV is going to challenge that 1,673 high – caveat: beware of a double top here and that November high. That being said, I remain relatively hesitant to take new speculative long positions but will re-enter into names I know, those that I believe offer a good value proposition. The overall volume on the $TSXV is in decline but we did start this rally on less. Again, ultimately I think 2012 will be a great year, but I would like to see a correction from the  post Xmas rally we have been seeing.

Here is where the $TSXV stands on the daily:

Here is the weekly view…. We need more volume flowing into this market to keep marching forward but this looks very promising for the rest of the year.

Tags: #mining, #oil, #silver, #smallcapstocks, $CDNX, $TSXV, gold

Posted in All Recent Posts | Comments Off on $TSXV Week in Review

I’m very proud to announce the following Q1 2009 financial results from AGORACOM client, La Mancha whose profits surged as their Australian Mine turned cash flow positive.

Highlights from the press release include:

Key Points:

- Cash flow from operating activities of $11.0 million

- Revenues of $24.7 million

- Net earnings of $3.5 million

- Cash and short term investments of $20.1 million

- 18,515 ounces of gold produced at an average cash cost of US $451 per ounce

- Trading at 1.5x cash flow multiple, there considered to be significantly undervalued

La Mancha IR Hub

La Mancha Profile

Tags: gold, gold stock, resource stock, small cap stock

Posted in AGORACOM Clients (New), All Recent Posts | 1 Comment »