As the world transitions towards sustainable energy and advanced technologies, the demand for certain metals has skyrocketed. Among them, lithium and palladium stand out as crucial elements driving progress in electric vehicles, renewable energy storage, and various industries. This article explores the future prospects of these metals and showcases New Age Metals (NAM: TSXV).

The Lithium Revolution

Lithium has emerged as the backbone of the clean energy revolution, thanks to its pivotal role in lithium-ion batteries. With the rapid expansion of the electric vehicle (EV) market, the demand for lithium is expected to soar. By learning about New Age Metals’ lithium division, people are not only supporting the transition to green transportation but also positioning themselves at the forefront of a burgeoning industry.

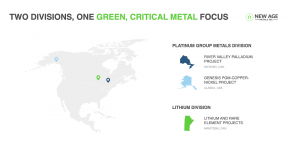

New Age Metals boasts a portfolio of 14 ongoing exploration and drilling projects within its lithium division. A standout feature is their partnership with Mineral Resources Ltd (MinRes), the fifth-largest lithium producer globally. This partnership covers all exploration, drilling, and development costs associated with the South Eastern Projects. The collaboration is strategic, providing financial benefits and access to some of the best lithium experts in the world, working alongside the New Age Metals team.

Palladium: Powering the Automotive Industry

Palladium plays a vital role in reducing harmful emissions from internal combustion engines through catalytic converters. As environmental regulations become more stringent worldwide, the demand for palladium continues to rise. New Age Metals’ palladium division is anchored by the 100% owned River Valley Palladium Project, located just outside Sudbury, Ontario. This project is one of North America’s largest primary palladium deposits, with approximately 70% of the mineral resource being palladium.

The River Valley Palladium Project, backed by a positive 2023 Preliminary Economic Assessment (PEA), offers a unique North American palladium opportunity. Exploring in this division means supporting a product that will enable cleaner air and a more sustainable future. Hybrid cars, which are becoming increasingly popular, require more palladium and platinum in their catalytic converters than traditional vehicles. Currently, the majority of palladium and platinum is mined in Russia and South Africa, making New Age Metals’ North American project even more significant.

Synergies Between Lithium and Palladium

The convergence of lithium and palladium presents an intriguing opportunity. Lithium-ion batteries are essential for powering hybrid vehicles, which are progressively adopting palladium-intensive catalytic converters.

Embracing the Green Economy Opportunity

The future for lithium and palladium looks exceptionally promising. As governments worldwide commit to reducing carbon emissions and accelerating the transition towards clean energy, the demand for these metals will continue to surge. New Age Metals is well-positioned to capitalize on this trend, with a robust exploration budget of $7.3 million for 2023/24 and strong partnerships with industry leaders like Mineral Resources Ltd.

New Age Metals Highlights:

- Developing North America’s Largest Primary Palladium Project: The River Valley Palladium Project is a key asset with significant growth potential.

- Strategic Partnerships: Collaboration with Mineral Resources Ltd ensures financial and technical support, enhancing the company’s capabilities.

- Diversified Portfolio: With two divisions focusing on Platinum Group Metals and Lithium, New Age Metals maintains a balanced and resilient portfolio.

- Experienced Leadership: The company’s leadership team comprises seasoned explorers, geologists, and developers driving innovation and growth.

- Positive Economic Assessments: The River Valley Project’s 2023 PEA highlights its strong economic potential.

Looking Ahead with New Age Metals

New Age Metals stands as a compelling participant in the evolving precious metals market, with a strategic focus on platinum and palladium advancements. Their achievements and ongoing projects underscore their potential to drive significant industry growth. For people seeking to align with a forward-thinking and innovative company, New Age Metals presents a promising opportunity. As the green revolution gains momentum, New Age Metals is set to play a pivotal role in shaping the future of sustainable energy and transportation.

Conclusion

New Age Metals is poised to be a key player in the green revolution, with significant investments and strategic partnerships in lithium and palladium. Their comprehensive approach and diversified portfolio make them an attractive prospect for people looking to capitalize on the growing demand for these essential metals.

YOUR NEXT STEPS

Visit $NAM HUB On AGORACOM: https://agoracom.com/ir/NewAgeMetals

Visit $NAM 5 Minute Research Profile On AGORACOM: https://agoracom.com/ir/NewAgeMetals/profile

Visit $NAM Official Verified Discussion Forum On AGORACOM:

https://agoracom.com/ir/NewAgeMetals/forums/discussion

Watch $NAM Videos On AGORACOM YouTube Channel:

https://www.youtube.com/playlist?list=PLfL457LW0vdLbNGQy7XX-5_B8l0kYTajA

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.