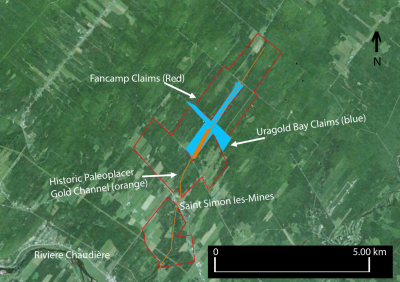

Montreal, Quebec / September 15 2014 / Uragold Bay Resources Inc. (“Uragold”) (TSX Venture: UBR) is pleased to announce that it’s wholly owned subsidiary, Quebec Quartz, has successfully finish the sampling programs over the historical quartz and quartzite showings on the Montpetit Quarry, and the Martinville and Malvina Silica properties. A map of the properties can be viewed here: http://www.uragold.com/Quebec-Quartz.php.

The Montpetit Property is located in the Monteregie Region of Quebec, some 40 km south of Montreal and 7 km south of Saint-Clotilde-de-Chateauguay. The Quebec-New-York border is 10 km from the property. The property is located on NTS map sheets 31H/04 (1:50,000 scale). Farms fields and forest, owned by private landowners, mostly cover the region.

A review of the historical work indicates that the quarry operated for one (1) year and that the deposit is composed of consolidated beach sand that was highly purified by segregation, sorting and leaching. Through natural Diagenesis, overtime the sand was transformed into a quartzite.

In 1956, six thousand (6,000) tons was mined from a 100 m long by 30 m large and 2 m deep tranche. The quartzite material mined was shipped to Electro-Metallurgical, where it averaged a SiO2 purity of 99.27% and was used to produce ferrosilicon.

The Quebec Quartz field crew, consisting of a geologist and a technician, performed the sampling program over the historical quartzite showing on the claims. The historical quarry is 100 m long by 35 m large and is inside a tabular orthoquartzite. This sandstone (Cairnside sandstone) is well spread all around the area. In order to have a good sampling spread, 5 samples were taken at different zone of the quartzite. Each quartzite layer along the stratigraphy has been sampled.

Click Image To View Full Size

Figure 1. This is a picture of Cairnside sandstone from the Montpetit Property.

The Martinville Property is located 180 km east of Montreal and 30 km south of Sherbrooke. The property is located on NTS map sheets 21E/05 (1:50,000 scale). Private forests and small farms mostly cover the region.

A review of the historical work indicates that Constelar Geosciences carried an extensive survey of the Property in 1995. This geophysics survey associated with excavation and rock sampling work done then enabled the estimation of a (non NI 43-101 compliant) quartzite resource of 1 million tons. 70% of the quartzite samples tested over 90% Si02. The quartz is found in large hydrothermal veins that were followed for 100 m.

The Quebec Quartz field team performed a sampling program over the historical the quartzite body. Three production holes have been found and many blocks had been removed from the veins. Samples were taken on different zones of the diggings. A total of 8 samples were collected in order to have representative’s samples for the area.

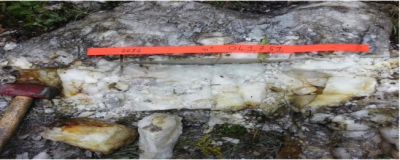

Click Image To View Full Size

Figure 2. This is picture of Quartz Vein samples taken from the Martinville Property.

The Malvina Property is located in the Eastern Township, some 200 km east of Montreal and 5 km from the Quebec-New-Hampshire border. The property is located on NTS map sheets 21E/03 (1:50,000 scale). Private forests and small farms mostly cover the region.

A review of the historical work indicates that the Malvina showing hosted a producing quarry in the past. At the time the quartz was mined for its whiteness.

The Malvina showing was reviewed in 1995 and the exploration campaign revealed that the mineralization appears to take place in a 15 m by 6 m lens. Samples taken indicate that high purity quartz (99.74% SiO2) is present. The mineralization seems to be linked with a post orogenic event that created several shear zone filled with hydrothermal quartz.

The Quebec Quartz field crew was successful in finding the historic quartz vein. The outcrop is a 12 m by 6 m quartz vein. The quartzite body on the Property was assayed, 3 channel samples were taken. Another quartz showing was identified to the field crew by the landowner and corresponds to an old exploitation gallery following a quartz vein. A grab sample was taken from the gallery.

Click Image To View Full Size

Figure 3. This is picture of a Quartz Vein taken on the Malvina Property

Source: Resources Naturelles du Quebec, Sigeom 2014, Work Reports GM54343, GM53695, GM03695. All information such as resources estimates and grades herewith presented is historical in nature and while relevant, the information was obtained before the implementation of National Instrument 43-101 and as such does not meet National Instrument 43-101 reporting standards. The historical estimate should not be relied upon until the Company can confirm them.

All the samples and the duplicates are blocs that range in sizes between 10cm3 to drill core size to allow thermal testing. The Company has sent all the samples collected to the INRS (Institut National de la Recherche Scientifique) laboratory in Quebec City. The INRS will prepare the samples to remove mineral contaminants caused by the sampling tools, handling and weathering. Various tests will be performed such as chemistry analysis, thermal shock, particle shape, size and distribution.

Patrick Levasseur, President and COO of Uragold stated, “we are extremely pleased that the field crew was able to find the historical quartz showings, extract samples and confirm that there still remains significant quantity of material present.” Mr. Levasseur then added, “The accessibility to the properties was exceptional and we express our gratitude to all land owners for their help and collaboration.”

To fully comply with high purity quartz industry standards, several constant parameters must be met including: 1) Chemistry; 2) Particle shape, size and distribution; 3) Hydroxyl level and; 4) Carbon content. These four characteristics are fundamental for the successful production of high purity quartz to a commercially acceptable product standard. Samples will be sent to an independent lab, silicon metal producers and specialized labs that supply high purity quartz to high tech companies.

Mr. Robert Gagnon, P. Geo, is a Qualified Person as defined by National Instrument 43-101, supervised the preparation of the information in this news release. All information such as resources estimates and grades herewith presented is historical in nature and while relevant, the information was obtained before the implementation of National Instrument 43-101 and as such does not meet National Instrument 43-101 reporting standards. The historical estimate should not be relied upon until the Company can confirm them.

About Quebec Quartz

Uragold acquired some of the most prospective historical High Purity Quartz deposits with High Purity Silica (+99.5% SiO2) (HPS) values in Quebec during Q2 2014. Quebec Quartz is a 100% own subsidiary of Uragold Bay Resources, a junior exploration company listed on the TSX Venture under the symbol UBR. Quebec Quartz holds a strategic portfolio of high purity silica (+99.5% SiO2) deposits and closed silicon metal mines in Quebec.

About Silica

Quartz is one of the most abundant minerals. It occurs in many different settings throughout the geological record. High Purity Quartz deposits with low impurities are rare. However, only very few deposits are suitable in volume, quality and amenability to tailored refining methods for specialty high purity applications.

High Purity Silica (HPS) and Silicon Metal which is used in large part in the aluminum industry has become one of today’s key strategic minerals with applications in high-tech industries that include semiconductors, LCD displays, fused quartz tubing, microelectronics, solar silicon applications and recently, Silicon Anode Lithium Batteries

About Uragold Bay Resources Inc.

Uragold Bay Resources is a TSX-V listed Gold and High Purity Quartz exploration junior focused on generating free cash flow from mining operations. Our business model is centered on developing mining projects suited for smaller-scale start-up, (Capex < C$10M), that will generate high yield returns (IRR > 50%). Uragold will reach these goals by developing Quebec’s first placer mine in 50 years, the Beauce Placer Project developing and, in partnership with Golden Hope Mines, the Bellechasse-Timmins Gold Deposit.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information contact

Bernard J. Tourillon, Chairman and CEO

Patrick Levasseur, President and COO

Tel: (514) 846-3271

www.uragold.com