Introduction

As global economic uncertainty persists, central banks worldwide are increasing their gold reserves, signaling a robust future for gold investments. According to Kitco News, 29% of central banks plan to buy more gold in 2024. This trend underscores the enduring value of gold as a safe-haven asset. Amidst this optimistic landscape, Green River Gold Corp. stands out with its strategic initiatives and diversified portfolio, aligning perfectly with the rising demand for gold and critical minerals.

Industry Outlook and Green River Gold’s Trajectory

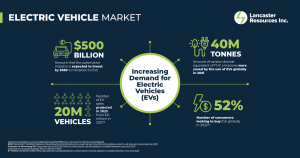

The surge in gold purchases by central banks highlights a significant trend in the precious metals market. Green River Gold Corp. is strategically positioned to capitalize on this trend. The company’s diverse portfolio includes critical minerals essential for the electric vehicle (EV) industry and extensive gold projects. As the global focus shifts towards sustainable energy, Green River Gold’s dual emphasis on precious metals and critical minerals places it at a strategic advantage.

Voices of Authority

Experts highlight the importance of gold in maintaining economic stability. According to the Kitco News article, “Central banks are diversifying their reserves away from currencies amid ongoing geopolitical tensions.” This sentiment is echoed by Perry Little, CEO of Green River Gold, who states, “Our strategic focus on gold and critical minerals ensures that we are well-positioned to meet the growing demand driven by global economic trends.”

Green River Gold’s FLASH Highlights

Green River Gold Corp. has several key achievements that underscore its potential:

- Fontaine Gold Project: Spanning 200 square kilometers, this project is adjacent to Osisko Development Corp.’s Cariboo Gold Project.

- Placer Gold Mining: Set to commence on the Wabi Claim on the Swift River in Summer 2024, expected to generate immediate cash flow.

- Kymar Silver Project: Covering 16 square kilometers, this project diversifies the company’s precious metals portfolio.

- Quesnel Nickel Project: Successfully hitting 50 for 50 in drilling, uncovering significant nickel, magnesium, cobalt, and chromium deposits.

These milestones highlight Green River Gold’s robust exploration and development strategy, positioning it as a leader in the resource sector.

Real-world Relevance

Green River Gold’s contributions extend beyond the mining sector. The company’s critical minerals, such as nickel and cobalt, are essential for the burgeoning EV market. For instance, nickel is crucial for EV battery performance, longevity, and energy density. By developing these resources, Green River Gold supports the global shift towards sustainable energy and reduced carbon emissions.

Looking Ahead with Green River Gold

Green River Gold’s forward-looking goals are aligned with the industry’s optimistic forecast. The company aims to expand its resource base and enhance its production capabilities. With gold prices expected to remain strong and the demand for critical minerals surging, Green River Gold is well-positioned to achieve significant growth.

Conclusion

Green River Gold Corp. is a compelling participant in the resource industry’s growth narrative. Its strategic focus on gold and critical minerals, combined with significant achievements and a promising project pipeline, makes it an attractive investment opportunity. As central banks continue to bolster their gold reserves and the EV market drives demand for critical minerals, Green River Gold stands ready to deliver substantial value.

YOUR NEXT STEPS

Visit $CCR HUB On AGORACOM: https://agoracom.com/ir/GreenRiverGoldCorp

Visit $CCR 5 Minute Research Profile On AGORACOM:https://agoracom.com/ir/GreenRiverGoldCorp/profile

Visit $CCR Official Verified Discussion Forum On AGORACOM:

https://agoracom.com/ir/GreenRiverGoldCorp/forums/discussion

Watch $CCR Videos On AGORACOM YouTube Channel:

https://youtube.com/playlist?list=PLfL457LW0vdLJgdyN9gnd7VKr4xMKBpQ7&si=DumfF-sMw_Uat7Ce

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.