Agoracom Blog Home

Posts Tagged ‘#silver’

After the breakout in precious metals this week,  everyone and their grandmother has come out and said that the $TSXV is going for a ride, I would like to do a little selfless promotion and say I told you so in this post on August 15th.

Now that we have some confirmation and a little more confidence in this turn around, I think we could be looking for the 1400 mark or a ~17% gain from today’s close at 1245.82, as the first target. This may take the next 3-5 months to play out but I am confident it will.

I am also certain that some names will do better than others and I have my own picks that I will most certinly share with everyone in the coming days as well as a cardinal rule to this volatile market.

….. Everyone loves a picture… note MACD crossing zero line and ADX turning up: Bullish!

Tags: #copper, #exploration, #gas, #mining, #oil, #silver, $CDNX, $TSXV, gold

Posted in All Recent Posts | Comments Off on $TSXV rally underway… right on schedule

A variety of market commentators have come out in the last week or so with opinions that the $TSXV is about to enter it’s regular seasonal bull run which traditionally occurs from September to February. The best empirical data I have seen so far is this piece from Canaccord ( cropped file here: JMW_08142012crop).

When I look at the daily chart, it certainly see selling pressure has waned, but I would like to see a close above the 1211 mark on volume. The weekly chart is also looking to get out of over-sold territory. What will the catalyst be to begin the run?

Tags: #copper, #exploration, #mining, #natgas, #oil, #silver, $CDNX, $TSXV, gold

Posted in All Recent Posts | Comments Off on Seasonal run in the $TSXV coming?

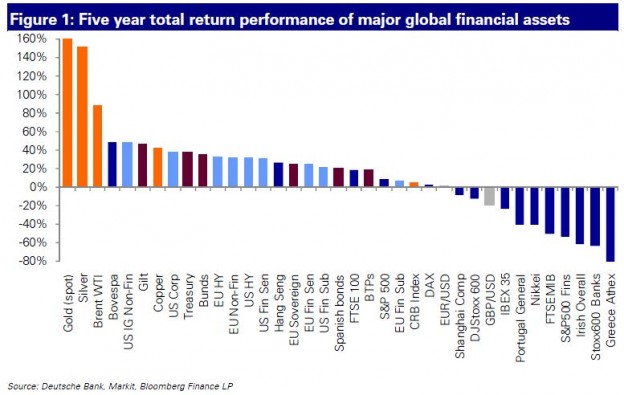

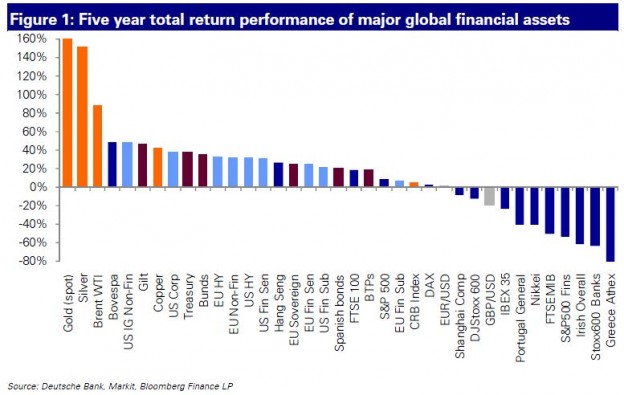

A chart is worth a thousand words…….

Tags: #copper, #DAX, #DOW, #hardassets, #realmoney, #silver, #SP500, $CL_F, $GC_F, $GLD, $SI_F, $SLV, $SPY, $XLF, gold

Posted in All Recent Posts | Comments Off on Five Year Total Return of Major Financial Assets

The $TSXV had another strong week. I was definitely looking for a correction, but that has yet to materialize – we may just rock ‘n’ roll into PDAC. I remain confident that the good issuers will prevail and the cream will rise in addition to certain hot sectors like Graphite and precious metals that will bring volume in. I am also keeping a close eye on Uranium and some interesting biotech issues.

There are a few points that I noticed this week that stood out:

- Market Internals: Long side momentum players and the “Jitney Magic Men”(broker code 99 that takes out those key levels in the blink of an eye) are all over issues with good news and price levels to be taken out.

- Risk Appetite: There is a sense that the worst is behind us and money is flowing into the speculative issues. There is money available to fiance projects of merit. Retail can follow this via http://canadianfinancing.com/

- The CRB Index: The CRB index is crossing it’s 200EMA and is trending very nicely.

Here is where the $STXV stands going into Monday morning:

I’d like to see some larger trading ranges and divergence added to the MACD but I will take the levitation. I want to see that ADX continue to rise and would love to see more volume in this market.

By the way has anyone else been hearing about Zinc? Is it just me or it starting to make noise again?

Tags: #99, #copper, #CRB, #Jitney, #mining, #moneyflow, #silver, #smallcapstocks, #zinc, $CDNX, $CIB, $TSXV, gold

Posted in All Recent Posts | Comments Off on $TSXV Week in Review

I though we were going to see  sell off into the end of the week as per my risk off post, but it looks like the equity markets are going to push higher and the $TSXV is going to challenge that 1,673 high – caveat: beware of a double top here and that November high. That being said, I remain relatively hesitant to take new speculative long positions but will re-enter into names I know, those that I believe offer a good value proposition. The overall volume on the $TSXV is in decline but we did start this rally on less. Again, ultimately I think 2012 will be a great year, but I would like to see a correction from the  post Xmas rally we have been seeing.

Here is where the $TSXV stands on the daily:

Here is the weekly view…. We need more volume flowing into this market to keep marching forward but this looks very promising for the rest of the year.

Tags: #mining, #oil, #silver, #smallcapstocks, $CDNX, $TSXV, gold

Posted in All Recent Posts | Comments Off on $TSXV Week in Review