In an electrifying development, GameOn Entertainment Technologies (CSE: GET) (OTCQB: GMETF), a trailblazing mobile-first fantasy sports gaming company, has set the stage for a monumental launch. The eagerly awaited $GAME token, a testament to GameOn’s commitment to revolutionize the fantasy sports landscape, is poised to debut on major exchanges on June 3.

Unlocking the Potential of Fantasy Sports

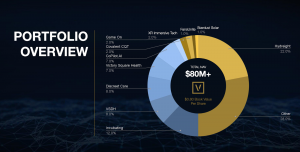

Since its inception in 2018, GameOn has been at the forefront of innovation, pioneering cutting-edge solutions to enhance player engagement and asset ownership. With a firm focus on integrating Web3 technology, GameOn has forged strategic partnerships with premier sports leagues such as LALIGA, PFL, and Karate Combat, elevating the fantasy sports experience to unprecedented heights.

A Collaborative Endeavor with Sportsology

The $GAME token represents a significant milestone in GameOn’s journey, marking the culmination of extensive collaboration with Sportsology. This innovative fantasy sports infrastructure is designed to provide unified experiences and rewards across GameOn’s ecosystem of fantasy sports products.

Leveraging blockchain solutions from Arbitrum, GameOn is poised to deliver a rich, interactive gaming experience that transcends traditional boundaries. Notably, GameOn received a grant of 59,000,000 $GAME tokens from Sportsology, further solidifying its position as a leader in the fantasy sports arena.

$GAME Week: A Festive Celebration

To celebrate the impending launch of the $GAME token, GameOn has kicked off ‘$GAME Week’ with a bang. This week-long extravaganza is brimming with excitement, featuring a diverse array of events supported by sports leagues, web3 partners, and crypto influencers. From X Spaces and AMAs to live streams and special appearances by industry luminaries like Javi Martinez and Mario Nawfal, $GAME Week promises to be an unforgettable experience for sports fans and fantasy gamers alike.

Empowering Fans Globally

At its core, the $GAME token is designed to empower fans globally, offering them unprecedented opportunities to compete, engage, and win rewards based on actual sports results. With GameOn leading the charge, millions of sports enthusiasts will have the chance to connect with their favorite players, teams, and leagues like never before. As CEO Matt Bailey aptly puts it, “It’s time to change the way we play.”

Join the Conversation

As anticipation reaches a fever pitch, GameOn CEO Matt Bailey invites you to join him for live commentary and Q&A on GameOn’s shareholder Telegram channel. Don’t miss this opportunity to be part of a historic moment in the evolution of fantasy gaming.

Conclusion

With the imminent launch of the $GAME token, GameOn is poised to redefine the fantasy sports landscape and set new standards for player engagement and asset ownership. As the countdown to June 3 begins, the excitement is palpable, and the possibilities are endless. Get ready to embark on an exhilarating journey with GameOn, where fantasy sports meets the future.

Visit $GET 5 Minute Research Profile On AGORACOM: https://agoracom.com/ir/GameOn/profile

Visit $GET Official Verified Discussion Forum On AGORACOM: https://agoracom.com/ir/GameOn/forums/discussion

Watch $GET Videos On AGORACOM YouTube Channel:

https://youtube.com/playlist?list=PLfL457LW0vdJdz244fLf3Nmrzh6OUWrHl&si=Wy4F0yteUrs6hGVt

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.

From time to time, reference may be made in our marketing materials to prior Records we have published. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously published information and data may not be current and should not be relied upon.

NO INVESTMENT ADVICE

This record, and any record we publish by or on behalf of our clients, should not be construed as an offer or solicitation to buy or sell products or securities.

You understand and agree that no content in this record or published by AGORACOM constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable or advisable for any specific person and that no such content is tailored to any specific person’s needs. We will never advise you personally concerning the nature, potential, advisability, value or suitability of any particular security, portfolio of securities, transaction, investment strategy, or other matter.

Neither the writer of this record nor AGORACOM is an investment advisor. Both are neither licensed to provide nor are making any buy or sell recommendations. For more information about this or any other company, please review their public documents to conduct your own due diligence.

If you have any questions, please direct them to [email protected]

For our full website disclaimer, please visit https://agoracom.com/terms-and-conditions