Posts Tagged ‘#smallcapstocks’

VIDEO: Stephen Banham Talks Vie #Esports from #gamescom $GMBL

Are you an investor in Yorbeau Resources $YRB.A? Check Out Opawica $OPW.ca

WHY OPAWICA?

- 7km’s of gold vault strike between 3 gold producers

- In one of the largest gold producing regions in Canada

- Adjoining to Ridgemont, Granada and Kinross Gold Producing Mines in Rouyn-Noranda Quebec

- Bazooka properties cover 7 kilometres of the prolific CLLB

- Cadilac-lardner lake fault system has produced Over 200M oz of GOLD

FEATURE: Legendary Financier Sheldon Inwentash is Back, Check Out $IDK.ca #Stocks #Investing

“The Dot Com Crash Was The Catharsis That Forced The Entire Tech Ecosystem To Forget Fast Money And Focus On Building Disruptive Companies….Â

The Canadian Small Cap Ecosystem Just Completed Its’ Catharsis â€

Sheldon Inwentash, CEO   ThreeD Capital

WHO IS SHELDON IWENTASH?

Proven Track Record

Creating a Dominant Merchant Bank In Canada

Extending Beyond Resouces Into Disruptive Technologies

A Formidable Network To Create Formidable Returns

Why Merchant Banking?

Interested In ThreeD Capital? Check Out Their Group of Companies

Marijuana Company of America $MCOA.us Retained The Brand Law Firm, P.A., And, Craig A. Brand, Esq. #MMJ

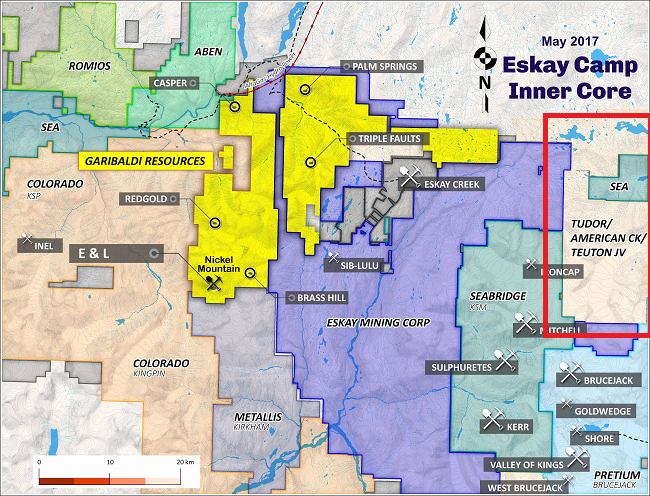

Are you an Investor in #Garibaldi Resources $GGI.ca You should also discover American Creek $AMK.ca #Gold #Eskay

Why American Creek Resources?

- Located in Eskay Mining Camp – Neighbouring Seabridge Gold, Eskay Mining Corp. Garbibaldi Resources and Pretium Resources

- Additional gold discovery of 5.1m of 9.57 g/t gold from 249.35m to 254.45m Read More

- Tudor Has Discovered a New Gold Zone at Treaty Creek: 110 M of 0.909 g/t Gold, Upper 316 M of Hole Yet to Be Assayed

- Specimens from the Electrum property average 27,092 gm/tonne silver and 248 gm/tonne gold. Read More

- Tudor has now completed the previously announced Magnetotelluric survey and has commenced drilling Read More