Posts Tagged ‘$TSXV’

INTERVIEW: Meet the Namaste Team! $N.ca

Monarques Gold intersects 17.1 g/t Au over 5.9 metres (19.4 feet) on Gold Bug (Croinor Gold) $MQR.ca

- Hole CR-17-532 intersected 6.96 g/t Au over 15 metres

- including 17.1 g/t Au over 5.9 metres

- Drilling confirms that the shear corridor is mineralized over a width of 15 metres, to a vertical depth of at least 115 metres

MONTREAL, April 4, 2017

Drilling confirms that the shear corridor is mineralized over a width of 15 metres, to a vertical depth of at least 115 metres

MONTREAL, April 4, 2017 – MONARQUES GOLD CORPORATION (“Monarques” or the “Corporation”) (TSX-V: MQR) (FRANKFURT: MR7) is pleased to announce the results of drilling in the Gold Bug area, which lies less than 500 metres from the Croinor Gold deposit.

The 2017 drilling program on Gold Bug was aimed at testing the gold-bearing potential of the zone discovered by the Corporation in January, when Hole CR-16-521 returned an intersection of 8.41 g/t Au over 25 metres (see press release dated January 24, 2017).

Drilling has confirmed that the shear corridor contains anomalous to economic gold grades over a width of about 15 metres, to a vertical depth of at least 115 metres. Hole CR-17-532 intersected 6.96 g/t Au over 15 metres (see plan view), including 17.1 g/t Au over 5.9 metres. That intersection, as well as those from Holes CR-17-526 and CR-17-533, confirms that the shear corridor intersected near surface in Hole CR-16-521 is about 15 metres wide. In addition, Holes CR-17-527 and CR-17-528 returned 0.27 g/t Au over 8.6 metres (from 101.1 to 109.7 metres) and 0.97 g/t Au over 6.7 metres (from 158.1 to 164.8 metres), respectively, demonstrating that the shear corridor extends to a vertical depth of approximately 115 metres. The shear corridor remains open along strike and at depth.

“The results for Gold Bug show increasingly attractive economic gold potential due to the width and depth of the gold-bearing structure discovered in January,” said Jean-Marc Lacoste, President and Chief Executive Officer of Monarques. “We believe that this area could eventually add to the resource for the Croinor Gold project. A key advantage at Gold Bug is that the structure lies close to surface, and could therefore be mined more easily, at a lower cost. This area will remain a high-priority drill target, with further testing of the structure along strike and at depth.”

The following table shows the results for the 2017 drilling program on Gold Bug:

|

Hole |

From (m) |

To (m) |

Length (m) |

Au (g/t) |

|

CR-17-526 Â Â Including |

35.8 41.0 |

51.2 44.2 |

15.4 3.2 |

0.69 2.49 |

|

CR-17-527 Â Â Including |

101.1 101.1 |

109.7 104.8 |

8.6 3.7 |

0.27 0.45 |

|

CR-17-528 Â Â Including |

158.1 159.5 |

164.8 161.9 |

6.7 2.4 |

0.97 1.73 |

|

CR-17-529 |

166.3 |

168.3 |

2.0 |

0.10 |

|

CR-17-530 |

106.7 |

107.7 |

1.0 |

0.37 |

|

CR-17-531 Â Â Including |

43.9 49.3 |

49.8 49.8 |

5.9 0.5 |

0.29 2.22 |

|

CR-17-532 Â Â Including |

21.0 21.0 |

36.0 26.9 |

15.0 5.9 |

6.96 17.07 |

|

CR-17-533 Â Â Including |

43.3 46.3 |

61.9 49.5 |

18.6 3.2 |

0.63 2.04 |

The widths shown are core lengths; true width cannot be estimated. High grades were cut to 70 g/t, which is the cutoff grade used to calculate the resource estimate for the Croinor Gold deposit.

The technical and scientific content of this press release has been reviewed and approved by Donald Trudel, P.Geo., B.Sc., the Corporation’s Qualified Person under National Instrument 43-101.

Sampling normally consisted of sawing the core into two equal halves along its main axis and shipping one of the halves to the ALS Minerals laboratory in Val-d’Or for assaying. The samples are crushed, pulverized and assayed by fire assay with atomic absorption finish. Results exceeding 3.0 g/t are re-assayed using the gravity method, and samples containing gold grains are assayed using the metallic sieve method. Monarques has established a full QA/QC protocol, including the insertion of standards, blanks and duplicates.

ABOUT MONARQUES GOLD CORPORATION

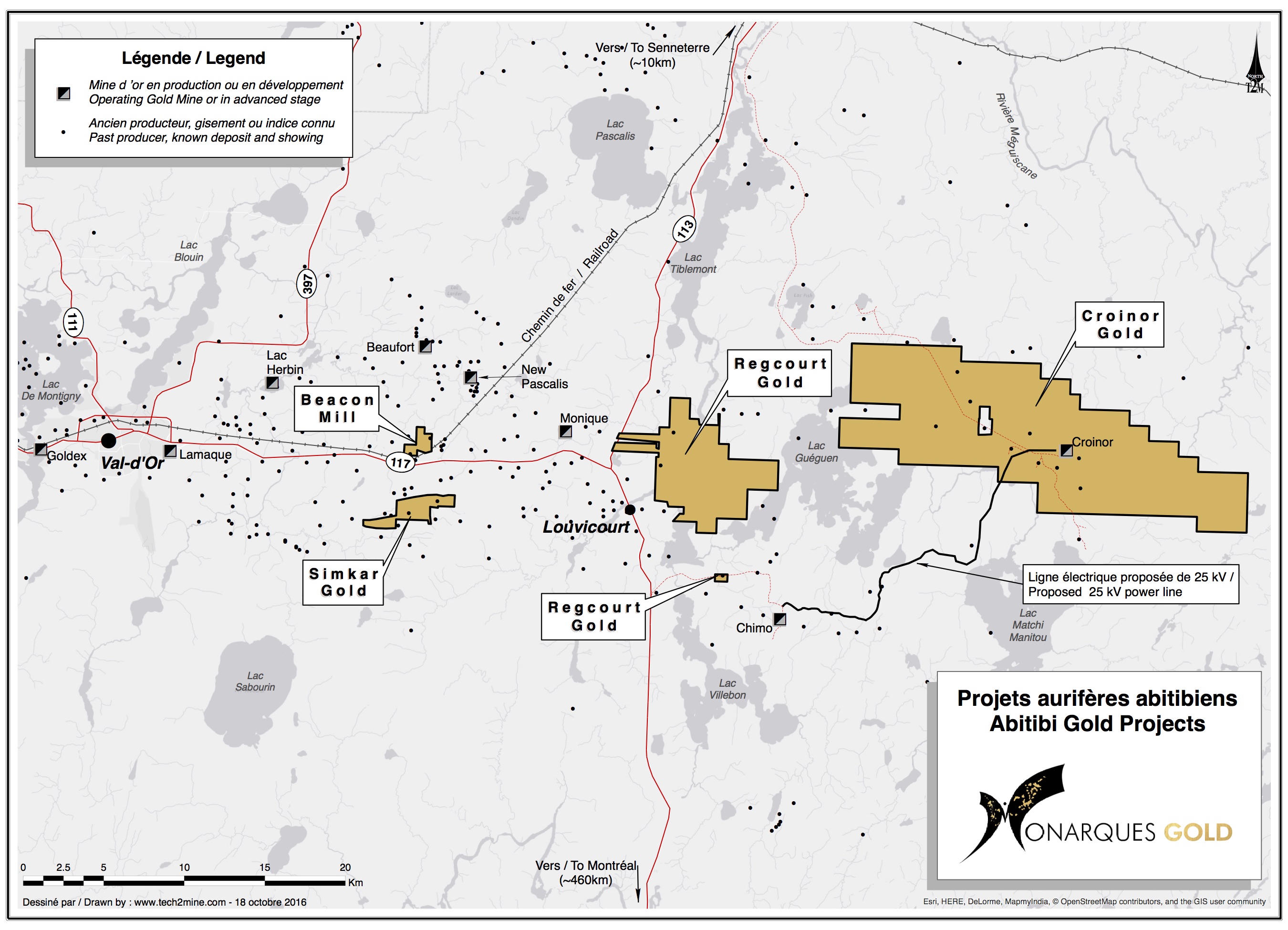

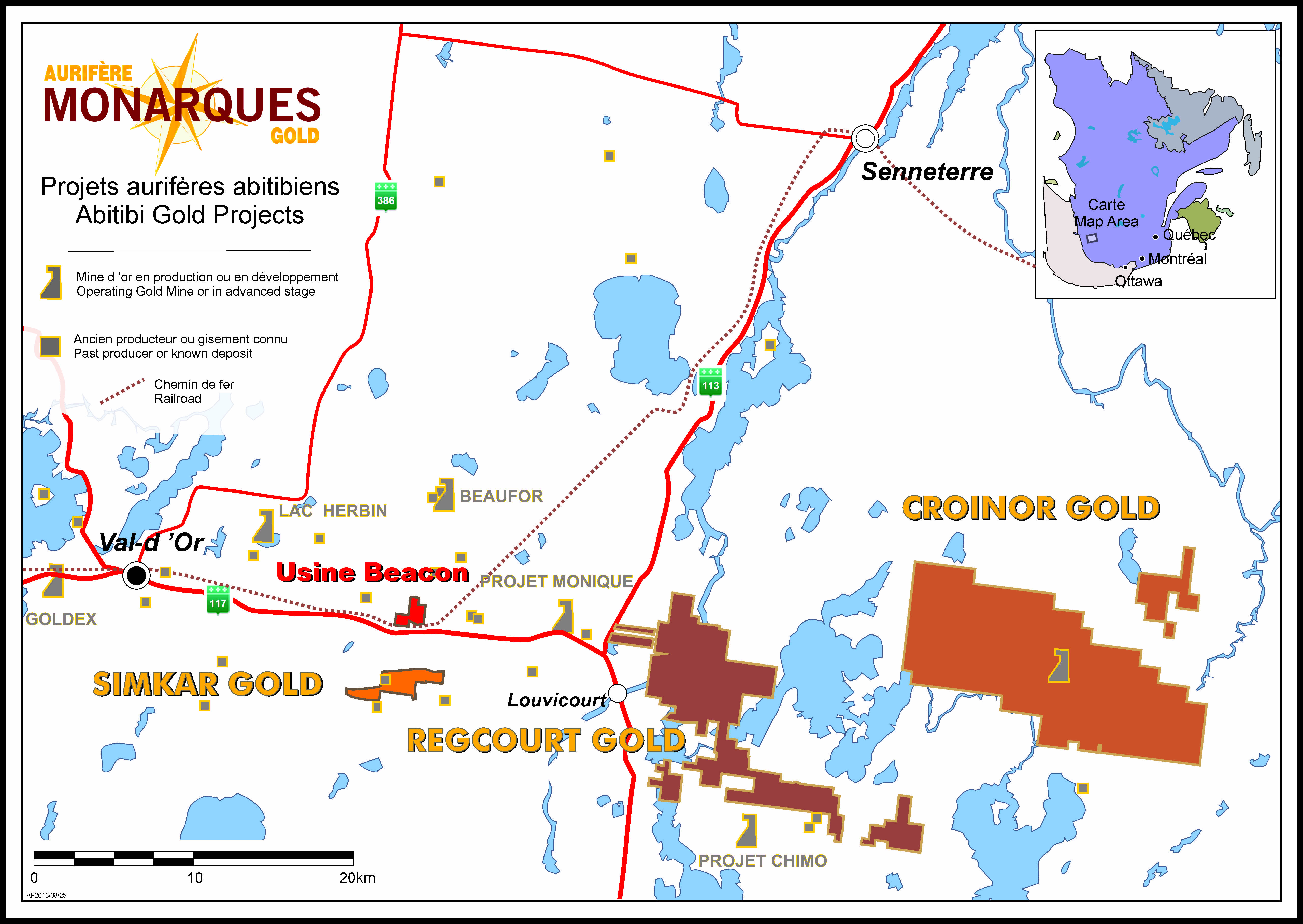

Monarques Gold is a growing junior gold company focused on becoming the leading explorer and developer of gold properties in the Val-d’Or/Abitibi gold camp in Quebec, Canada. The Corporation currently has approximately 200 km² of gold exploration properties (see map) along the Cadillac Break, as well as its main asset, the Croinor Gold mine, which has great potential to become a producing mine. Monarques Gold is well financed and has close to $9 million in credits from Quebec’s Ministry of Energy and Natural Resources.

(Watch our latest Corporate Video)

Forward-Looking Statements

The forward-looking statements in this press release involve known and unknown risks, uncertainties and other factors that may cause Monarques’ actual results, performance and achievements to be materially different from the results, performance or achievements expressed or implied therein. Neither TSX Venture Exchange nor its Regulation Services. Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

SOURCE Monarques Gold Corporation

To view the original version on PR Newswire, visit: http://www.newswire.ca/en/releases/archive/April2017/04/c5950.html

Jean-Marc Lacoste, President and CEO, 1-888-994-4465 x 201, [email protected], www.monarquesgold.comCopyright CNW Group 2017

MCOA Finalizes Joint Venture Agreement With Bougainville Ventures in Washington State $MCOA.us

- Finalized the joint venture agreement with Bougainville Ventures, Inc. in Washington State

- MCOA will invest $1 million in cash in a newly formed entity

- Bougainville Ventures, Inc. will contribute its expertise in the construction and management of a 30,000 sq. ft. greenhouse facility

BONSALL, CA–(Apr 4, 2017) – MARIJUANA COMPANY OF AMERICA (“MCOA” or the “Company”) (OTC PINK: MCOA), an innovative cannabis and hemp marketing and distribution Company, is pleased to announce that it has finalized the joint venture agreement with Bougainville Ventures, Inc. (“BV”) in Washington State.

MCOA will invest $1 million in cash in a newly formed entity. Bougainville Ventures, Inc. will contribute its expertise in the construction and management of a 30,000 sq. ft. greenhouse facility, which will accommodate a Tier-3 production and processing I-502 tenant that has decades of experience and a proven track record of consistency and quality. MCOA and BV will split equity and profits equally, 50/50.

As turnkey landlords, MCOA and BV will provide our I-502 tenant with a state-of-the-art facility that creates an ideal cultivation environment that they can move into and be fully operational on day one. This enables our tenants to focus on what they do best, producing top quality products and not worrying about maintaining their infrastructure.

Donald Steinberg, MCOA President and CEO, said, “This project will help to expand our operations as an ancillary business into the Washington State market. Achieving this milestone of closing this deal, as well as completing our PCAOB audit at the end of the first quarter are two more pillars of the strong foundation we are building for our shareholders.”

The execution of the agreement is the final step in formalizing the Letter of Intent that was publicly announced on February 15, 2017. This joint venture partnership is formed for the purpose of greenhouse construction, management and commercial leasing to I-502 licensed producers within Washington State only and not beyond its borders.

ABOUT BOUGAINILLE VENTURES, INC.

Bougainville Venture Inc. is in the core business of converting irrigated farmland that was traditionally used to grow marginally profitable feed crops, to greenhouse-equipped farmland used to grow luxury crops with a primary focus on high-density and high-yielding crops. Bougainville is an agricultural services company that focuses on providing growers with state-of-the-art computer controlled greenhouses and processing facilities. Bougainville offers fully built out turnkey solutions to tenant-growers and provides growing infrastructure, as well as landlord services for licensed I-502 producers and processors in the state of Washington.

SAFE HARBOR STATEMENT

This release contains forward-looking statements that are based upon current expectations or beliefs, as well as a number of assumptions about future events. Although we believe that the expectations reflected in the forward-looking statements and the assumptions upon which they are based are reasonable, we can give no assurance or guarantee that such expectations and assumptions will prove to have been correct. Forward-looking statements are generally identifiable by the use of words like “may,” “will,” “should,” “could,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. The reader is cautioned not to put undue reliance on these forward-looking statements, as these statements are subject to numerous factors and uncertainties, including but not limited to: adverse economic conditions, competition, adverse federal, state and local government regulation, international governmental regulation, inadequate capital, inability to carry out research, development and commercialization plans, loss or retirement of key executives and other specific risks. To the extent that statements in this press release are not strictly historical, including statements as to revenue projections, business strategy, outlook, objectives, future milestones, plans, intentions, goals, future financial conditions, events conditioned on stockholder or other approval, or otherwise as to future events, such statements are forward-looking, and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements contained in this release are subject to certain risks and uncertainties that could cause actual results to differ materially from the statements made.

For more information, please visit the Company’s websites at:

MarijuanaCompanyofAmerica.com

hempSMART.com

agoracom.com/ir/MarijuanaCompanyofAmerica

Marijuana Company of America

Investor Relations

1+(888)-777-4362

[email protected]

Tetra Bio-Pharma and IntelGenx Announce the Signing of a Definitive Agreement for the Development and Commercialization of a Dronabinol XL Tablet $TBP.ca

- Signed definitive agreement for the development and commercialization of a drug product containing the cannabinoid Dronabinol

- for the management of anorexia and cancer chemotherapy-related pain

- U.S. cancer pain market is expected to reach $5 billion in 2018

OTTAWA, ONTARIO–(April 3, 2017) – Tetra Bio-Pharma Inc. (“Tetra“) (CSE:TBP)(OTC PINK:GRPOF) and IntelGenx Corp. (“IntelGenx”) (TSX VENTURE:IGX)(OTCQX:IGXT), today announced the signing of a definitive agreement for the development and commercialization of a drug product containing the cannabinoid Dronabinol (the “Product”) for the management of anorexia and cancer chemotherapy-related pain. The U.S. cancer pain market is expected to reach $5 billion in 2018. This definitive agreement follows the binding term sheet between the two companies that was announced on February 9, 2017.

Pursuant to the definitive agreement, Tetra has exclusive rights to sell the Product in North America, with a right of first negotiation for territories outside of the United States and Canada. Tetra will make an upfront payment to IntelGenx, in addition to set future milestone and royalty payments, based on the completion of an efficacy study, approvals from the U.S. Food and Drug Association (“FDA”) and Health Canada, and the commercial launch of the Product. IntelGenx will be responsible for the research and development of the Product, including clinical studies, and will develop the product as an oral mucoadhesive tablet based on its proprietary AdVersa® controlled-release technology. Tetra will be responsible for funding the product development, and will own and control all regulatory approvals, including the related applications, and any other marketing authorizations. Tetra will also be responsible for all aspects of commercializing the Product.

“We are pleased to announce the closing of the definitive agreement with IntelGenx and look forward to working very hard with them to bring this much-needed product to patients suffering from cancer pain,” said Andre Rancourt, CEO of Tetra Bio-Pharma Inc. “The execution of this agreement is just the beginning for Tetra as we look forward to aggressively concluding future agreements as we build a leading bio-pharmaceutical organization focused on developing medicinal cannabis as pharmaceutical drugs.”

“The U.S. cancer pain market is expected to reach $5 billion in 2018, and the quick growing medical cannabis industry is poised to capture a signature portion of that opportunity,” said Dr. Horst G. Zerbe, President and CEO of IntelGenx. “We are pleased to be working with Tetra to bring this much-needed cannabinoid product to North American patients suffering from anorexia and cancer chemotherapy-related pain.”

Background Information:Â

There are many clinical problems associated with the use of currently available form of Dronabinol in patients with anorexia and cancer chemotherapy-related pain. It has been demonstrated that psychoactive drugs exert their euphoria, and other psychoactive effects, when the blood levels of the drug rapidly increase. The pharmacokinetic profile of tetrahydrocannabinol (“THC”) and its metabolite increases the abuse potential of cannabinoids like Dronabinol. The significant advantage of an oral mucoadhesive tablet based on IntelGenx’ proprietary AdVersa® controlled-release technology is that it can be adjusted to achieve a predetermined drug release pattern by increasing the residence time, promoting intimate contact with the mucosal tissue and increasing the bioadhesive properties of the dosage form. It is believed that, by deploying this technology in the controlled-release of THC, a longer time release of the drug will be achieved and, thereby, a rapid increase in the blood will be avoided. There will also potentially be improved bioavailability and reduced gastro-intestinal side effects, making a sustained-release THC product a promising alternative in the battle for the reduction of opioids in patients with chronic pain.

About IntelGenx:

IntelGenx is a leading oral drug delivery company primarily focused on the development and manufacturing of innovative pharmaceutical oral films based on its proprietary VersaFilm™ technology platform. Established in 2003, the Montreal-based company is listed on the TSX-V and OTC-QX.

IntelGenx highly skilled team provides comprehensive pharmaceuticals services to pharmaceutical partners, including R&D, analytical method development, clinical monitoring, IP and regulatory services. IntelGenx state-of-the art manufacturing facility, established for the VersaFilm™ technology platform, supports lab-scale to pilot and commercial-scale production, offering full service capabilities to our clients. More information is available about the company at: www.intelgenx.com.

About Tetra Bio Pharma:Â

Tetra Bio Pharma is a multi subsidiary publicly traded company (CSE:TBP) (OTC PINK:GRPOF) engaged in the development of Bio Pharmaceuticals and Natural Health Products containing Cannabis and other medicinal plant based elements.

Tetra Bio Pharma is focused on combining the traditional methods of medicinal cannabis use with the supporting scientific validation and safety data required for inclusion into the existing bio pharma industry by regulators physicians and insurance companies. More information is available about the company at: www.tetrabiopharma.com.

The Canadian Securities Exchange (“CSE”) has not reviewed this news release and does not accept responsibility for its adequacy or accuracy.

Forward-looking statements

Some statements in this release may contain forward-looking information. All statements, other than of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding potential acquisitions and financings) are forward-looking statements. Forward-looking statements are generally identifiable by use of the words “may”, “will”, “should”, “continue”, “expect”, “anticipate”, “estimate”, “believe”, “intend”, “plan” or “project” or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company’s ability to control or predict, that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements. Factors that could cause actual results or events to differ materially from current expectations include, among other things, without limitation, the inability of the Company, through its wholly-owned subsidiary, GrowPros MMP Inc., to obtain a licence for the production of medical marijuana; failure to obtain sufficient financing to execute the Company’s business plan; competition; regulation and anticipated and unanticipated costs and delays, and other risks disclosed in the Company’s public disclosure record on file with the relevant securities regulatory authorities. Although the Company has attempted to identify important factors that could cause actual results or events to differ materially from those described in forward-looking statements, there may be other factors that cause results or events not to be as anticipated, estimated or intended. Readers should not place undue reliance on forward-looking statements. The forward-looking statements included in this news release are made as of the date of this news release and the Company does not undertake an obligation to publicly update such forward-looking statements to reflect new information, subsequent events or otherwise unless required by applicable securities legislation.

Tetra Bio-Pharma Inc.

Edward Miller

Vice President, IR & Corporate Communications

[email protected]

(343) 689-0714

www.tetrabiopharma.com

Explor closes a first tranche of a maximum of $1 million private placement in flow-through shares $EXS.ca

- Announced the closing of a first tranche of a non-brokered private placement of a maximum of 11,764,705 flow-through common shares at a price of $0.085 each, for total gross proceeds of up to CDN $1,000,000

- The first tranche of the Private Placement closed on March 30, 2017 consists in the sale of 5,294,000 flow-through shares for an aggregate subscription of $449,990

ROUYN-NORANDA, QUEBEC–(March 31, 2017) – Explor Resources Inc. (TSX VENTURE:EXS) (OTCQB: EXSFF) (FRANFURT:E1H1) (BERLIN:E1H1) (“Explor” or the “Corporation“) announces the closing of a first tranche of a non-brokered private placement of a maximum of 11,764,705 flow-through common shares at a price of $0.085 each, for total gross proceeds of up to CDN $1,000,000 (the “Private Placement“). The first tranche of the Private Placement closed on March 30, 2017 consists in the sale of 5,294,000 flow-through shares for an aggregate subscription of $449,990.

The net proceeds from the Private Placement will be incurred by the Corporation in exploration expenditures on mining properties located in the province of Québec.

In connection with the Private Placement, the Corporation will pay to an arm’s length finder, finder’s fees representing a cash amount equal to 8% of the subscribed amount through the finder, and non-transferrable finder’s warrants entitling to purchase such number of common shares of the Corporation equal to 8% of the aggregate number of shares subscribed through the finder. These finder’s warrants will be exercisable at a price of $0.085 per common share, up to 24 months from the closing date.

The securities issued pursuant to the first closing of the Private Placement are subject to a hold period of four months and a day ending July 31, 2017. The Private Placement is subject to the final approval of the TSX Venture Exchange.

Explor Resources Inc. is a publicly listed company trading on the TSX Venture (EXS), on the OTCQB (EXSFF) and on the Frankfurt and Berlin Stock Exchanges (E1H1).

This press release was prepared by Explor. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the Policies of the TSX Venture Exchange) has reviewed or accepts responsibility for the adequacy or accuracy of this release.

About Explor Resources Inc.

Explor Resources Inc. is a Canadian-based natural resources company with mineral holdings in Ontario, Québec, Saskatchewan and New Brunswick. Explor is currently focused on exploration in the Abitibi Greenstone Belt. The belt is found in both provinces of Ontario and Québec with approximately 33% in Ontario and 67% in Québec. The Belt has produced in excess of 180,000,000 ounces of gold and 450,000,000 tonnes of cu-zn ore over the last 100 years. The Corporation was continued under the laws of Alberta in 1986 and has had its main office in Québec since 2006.

Explor Resources Flagship project is the Timmins Porcupine West (TPW) Project located in the Porcupine mining camp, in the Province of Ontario. Teck Resources Ltd. is currently conducting an exploration program as part of an earn-in on the TPW property. The TPW mineral resource (Press Release dated August 27, 2013) includes the following:

Open Pit Mineral Resources at a 0.30 g/t Au cut-off grade are as follows:

- Indicated:Â 213,000 oz (4,283,000 tonnes at 1.55 g/t Au)

- Inferred:Â 77,000 oz (1,140,000 tonnes at 2.09 g/t Au)

Underground Mineral Resources at a 1.70 g/t Au cut-off grade are as follows:

- Indicated:Â 396,000 oz (4,420,000 tonnes at 2.79 g/t Au)

- Inferred:Â 393,000 oz (5,185,000 tonnes at 2.36 g/t Au)

This document may contain forward-looking statements relating to Explor’s operations or to the environment in which it operates. Such statements are based on operations, estimates, forecasts and projections. They are not guarantees of future performance and involve risks and uncertainties that are difficult to predict and may be beyond Explor’s control. A number of important factors could cause actual outcomes and results to differ materially from those expressed in forward-looking statements, including those set forth in other public filling. In addition, such statements relate to the date on which they are made. Consequently, undue reliance should not be placed on such forward-looking statements. Explor disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, save and except as may be required by applicable securities laws.

Christian Dupont, President

888-997-4630 or 819-797-4630

Fax: 819-797-1870

Website: www.explorresources.com

Email: [email protected]

Joe Montana talks of esports: ‘We believe in the space’ $GMBL.ca

Joe Montana said he doesn’t take losing well, and after getting beaten by his kids in video games he lost interest in playing. But investing in esports, however, is a whole different ballgame for the NFL Hall of Famer. Thearon W. Henderson/Getty Images

The Cloud9 organization and its co-founder and CEO Jack Etienne are no strangers to winning, having won the North American LCS in its inaugural season in the summer of 2013.

Former San Francisco 49ers quarterback and Hall of Famer Joe Montana is also no stranger to victory, just on a different playing field. He was named Super Bowl MVP three times in his career and lifted the Vince Lombardi Trophy on four occasions in the 1980s and early ’90s.

Together, they both hope to continue their winning ways. Montana and his seed stage fund Liquid 2 Ventures invested in Cloud9 over the past week, along with other notable athletes such as Hunter Pence of the San Francisco Giants and Andrew Bogut of the Cleveland Cavaliers.

For Montana, one of the winningest players in NFL history, the rapid growth of esports was an opportunity that he and his partners couldn’t pass up, even if his children continually beat him down in the world of video games.

“[My background] in video games has been very limited,” Montana said. “[It’s] because I hate to lose.”

Montana’s four children, in their mid-20s and early 30s, passed up the MVP quarterback when it came to video games, and made him a less-than-active participant. As an observer, however, Montana has already made moves to enter the video-game scene, helping create Montana 17, a mobile virtual reality football game for VR systems like the Samsung Gear.

On the opposite end of the spectrum, Etienne has been in the esports scene for five years now, first a manager for Team SoloMid before co-founding Cloud9. Even during his days while working at Crunchyroll, the leading streaming anime service, the C9 CEO knew one day esports had the potential to be as big as it’s getting now.

“I did believe we were heading in this direction” Etienne said of his team’s growth over the past few years. Starting as just a League of Legends club, the organization has expanded across the esports landscape, having players and teams in such large competitive titles as Overwatch, Dota 2 and Counter-Strike: Global Offensive.

With the added funding, Cloud9 is always on the search for the next big esport, and for Etienne, it’s the fans, not the game publisher or title itself, that interests the organization in terms of expanding.

“Twitch is a fantastic tool to find what people are watching,” Etienne said. “There is a lot of research you can do on Twitch. H1Z1 and games [in the same genre] are getting a lot of attention.”

In the day and age where every game publisher with a new multiplayer title wants to become an esport, Cloud9 believes in trusting what the fans support instead of simply backing the video game with the most marketing behind it. If the fans flock to a video game on Twitch, C9 takes notice.

With that being said, though, Etienne says that although the organization is looking to expand, the added investment will also be a boon toward its already established teams, giving them more funds to help them improve.

“We believe in the team. We believe in the space.”

Joe Montana

In the whirlwind of traditional sport owners and stars investing in esports over the past year, the NFL has seemingly lagged behind the competition. The NBA has had the biggest impact in competitive gaming, with stars and former stars like Rick Fox, Magic Johnson, and Shaquille O’Neal becoming faces for various organizations. Montana, the biggest NFL name to attach himself to esports, says he believes there are a few factors for that.

“Part of it is the NFL, part of is coincidence,” Montana said. “On average, until recently at least, NBA players made more than players in the NFL. Also, NBA players are traveling all the time, and are on the road three-to-five days a week.”

In the NFL, players can have more of a stable home life. They play on the road only eight times a season, not counting the playoffs, and when you’re a family man, being able to play games is a luxury. NBA players, especially younger ones, bring their favorite consoles along for long road trips, playing with their teammates in the hotel to kill time while away from their families. Additionally, the NBA has fewer traditional owners compared to the NFL, so it’s not surprising why it’s now that the NFL and its representatives are discovering the potential of esports.

A similarity Montana found between esports and NFL is the newfound training regimens. When asked how he felt about esports moving away from the old stereotype of players sitting in a room guzzling Mountain Dew and devouring Doritos, Montana said, “Anything you do, you’re better when you’re healthier. That [stereotype] is what linemen used to be.”

As esports advances to match traditional sports in mental and health training, it also appears to be heading toward a franchising system. Blizzard, for example, announced the upcoming Overwatch League in North America would be built around geolocation and owners bidding where they would want their team to play.

Etienne sees this as the inevitable future of competitive gaming if it wants to reach its full potential. “I think for esports to evolve, these franchises need to happen,” he said. “Franchise models are critical.”

On the topic of fan support and the difference between esports fans primarily following teams because of personalities over any sort of allegiance with a city, Montana isn’t deterred. He cites a story about meeting a die-hard 49ers fan in the heart of Miami Dolphins country, so he says he believes fans can come in all different shapes. “To [esports] fans, it’s the same as a [traditional] sport to them. They’re crazy. It can survive the way it is.”

Montana knows that profits won’t come easy or right away. He and his group, especially when coming into a space so early, are aware of the risks and are confident that their investment in Cloud9, and esports in general, will bear fruit sooner rather than later.

“We believe in the team,” Montana said. “We believe in the space.”

Source: http://www.espn.co.uk/esports/story/_/id/19027086/joe-montana-esports-believe-space

HPQ Silicon Resources Provides Update on Spin out of Beauce Gold Project, Listing and Distribution to Shareholders $HPQ.ca

- Patrick Levasseur, President and COO of HPQ Silicon stated, “The spin out of our gold assets into Beauce Gold Fields is nearing completion and will prove to be worth the wait for our shareholders and everyone who will benefit from it. The recent signing of our MOU with Golden Hope Mines regarding the Bellechasse-Timmins Gold Deposit allows us to now focus our efforts to spin out Beauce Gold Fields. The TSX-V has received documentation therefore we are now waiting for a positive response of this documentation. We are eager for Beauce Gold Fields to be an independently trading entity that unlocks the true value of our gold assets.”

MONTREAL, QUEBEC–(March 31, 2017) – HPQ-Silicon Resources Inc. (TSX VENTURE:HPQ) (FRANKFURT:UGE) (OTC PINK:URAGF) wishes to provide to its shareholders an update regarding the spin out of its Beauce Gold Project into Beauce Gold Fields Inc. (“BGF”) and its application for listing on the Canadian Securities Exchange (“CSE”).

Patrick Levasseur, President and COO of HPQ Silicon stated, “The spin out of our gold assets into Beauce Gold Fields is nearing completion and will prove to be worth the wait for our shareholders and everyone who will benefit from it. The recent signing of our MOU with Golden Hope Mines regarding the Bellechasse-Timmins Gold Deposit allows us to now focus our efforts to spin out Beauce Gold Fields. The TSX-V has received documentation therefore we are now waiting for a positive response of this documentation. We are eager for Beauce Gold Fields to be an independently trading entity that unlocks the true value of our gold assets.”

PROPOSED DISTRIBUTION OF BEAUCE GOLD FIELDS SHARES TO HPQ SILICON SHAREHOLDERS

Once HPQ receives notice of the acceptance of its documents by the TSX-V, we will complete the final documentation for our CSE listing. At that point, we will announce the proposed distribution of BGFI shares, the record date on which HPQ shareholders will qualify to receive such shares and the proposed listing date of BGFI. BGFI would issue 25.1 million shares of its share capital to HPQ in consideration of the sale of the Beauce-Placer-Fancamp claims, the Beauce Placer claims and the exploration and extraction rights for precious and base metals on the Roncevaux property. The per share value currently being considered for BGFI is $0.10. The proposed distribution of the shares will be done under a three year escrow. 10% of the shares should be releaseded upon listing, and 15% should then be released every 6 months afterwards, effectively shareholders should receive 40% of their BGFI shares during the first year.

ADDITIONAL SPIN OUT MATTERS

The following actions have been completed in relation to the spin out:

- HPQ has entered into an agreement to grant to BGF the Gold, Precious metals and base metals exploration and extraction rights on the Roncevaux property in exchange for a 5% NSR on such production and the issuance of 100,000 shares.

- HPQ has entered into an agreement selling the Beauce-Placer-Fancamp claims and the Beauce Placer claims, the Beauce Gold Project, and the Real Estate lots relating thereto, in exchange for 25 million shares

- The Corporation has received and filed on SEDAR both the updated National Instrument 43-101-compliant report on the Beauce Placer Project, as well as, a NI 43-101-compliant report on the Roncevaux property.

- The Board of Directors of Beauce Gold Fields Inc has been nominated and is composed of:

- Dr.Vivian Stuart-Williams, M. Sc. Geo. SACNASPS

- Mr. Michael Flanagan, P. Geo (Québec)

- Mr. Marc-André Drapeau, ing.

- Mr. Bernard Tourillon

- Mr. Patrick Levasseur

- The Officers of BGFI have nominated and will be composed of:

- Mr. Bernard Tourillon, Chairman and CEO

- Mr. Patrick Levasseur, President and COO

- Mr. François Rivard, Chief Financial Officer

- The Corporation has filed with the TSX-Venture Exchange the necessary documents regarding the various claims sales, the real estate lots and exploration and extraction rights Agreements..

CAPITAL RAISE

Concurrently with the listing process on CSE Exchange, BGF is in the process of raising in excess of $400,000 to qualify for listing. This will enable the Corporation to meet its working capital obligations as well as most of its first year exploration needs.

About HPQ Silicon

HPQ Silicon Resources Inc is a TSX-V listed junior exploration company planning to become a vertically integrated and diversified High Value Silicon Metal (99.9+% Si), and Solar Grade Silicon Metal (99.999+% Si) producer.

Our business model is focused on developing a one step High Purity and Solar Grade Silicon Metal manufacturing process (patent pending) and becoming a vertically – integrated Solar Grade Silicon producer that can generate high yield returns and significant free cash flow within a relatively short time line.

About Beauce Gold Fields

Beauce Gold Fields (BGF) is a wholly own subsidiary of HPQ Silicon. HPQ is in the process of “Spinning Out” Beauce Gold Fields into a new publicly trading junior gold company. The Beauce Gold property will become the property of merit of BGF.

The Beauce Gold project is a unique, historically prolific gold field located in the municipality of Saint-Simon-les-Mines in the Beauce region of Southern Quebec. Comprising of a block of claims 100 per cent owned by HPQ, the project area hosts a six-kilometre-long unconsolidated gold-bearing sedimentary unit (a lower saprolite and an upper brown diamictite) holding the largest historical placer gold deposit in eastern North America. The gold in saprolite indicates a close proximity to a bedrock source of gold, providing significant potential for further exploration discoveries.

Property highlights

- Certificate of authorizations (CA) allowing the start of first phase mining activities on the Rang Chaussegros sector of the Beauce gold project;

- Polygonally calculated gold exploration target for the entire historical placer channel ranging between 61,000 ounces (2.2 million cubic metres at 0.87 gram of gold per cubic metre) and 366,000 ounces (2.2 million cubic metres at 5.22 grams of gold per cubic metre);

- Significant potential for further exploration discoveries; geology suggest a proximate bedrock source of gold;

- 176 acres of real estate 100 per cent owned by HPQ;

- The property once held four historical gold mining operations;

- The property produced the largest gold nuggets in Canadian mining history (St-Onge nugget, 43 ounces; McDonald nugget, 45 ounces; Kilgour nugget, 51 ounces).

Disclaimers:

This press release contains certain forward-looking statements, including, without limitation, statements containing the words “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “in the process” and other similar expressions which constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking statements reflect the Company’s current expectation and assumptions, and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. These forward-looking statements involve risks and uncertainties including, but not limited to, our expectations regarding the acceptance of our products by the market, our strategy to develop new products and enhance the capabilities of existing products, our strategy with respect to research and development, the impact of competitive products and pricing, new product development, and uncertainties related to the regulatory approval process. Such statements reflect the current views of the Company with respect to future events and are subject to certain risks and uncertainties and other risks detailed from time-to-time in the Company’s on-going filings with the securities regulatory authorities, which filings can be found at www.sedar.com. Actual results, events, and performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements either as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Shares outstanding: 168 387 616

Patrick Levasseur

President and COO

(514) 262-9239

www.HPQSilicon.com

Tartisan Resources Corp. Acquires the Don Pancho Polymetallic Zinc-Lead-Silver-Man… Property in Huaral, Peru $TTC.ca

- Acquired 100% of the Don Pancho polymetallic zinc-lead-silver-manganese project located in the Province of Huaral, in the Department of Lima Peru

- located in a prolific polymetallic mineral belt in central Peru with several operating mines in the area including the world class Iscaycruz and Yauliyacu polymetallic mines operated by Glencore-Xtrata Plc located 50 kilometers to the north-northwest

Toronto, Ontario – Tartisan Resources Corp. (CSE: TTC) (“Tartisanâ€, or the “Companyâ€) is pleased to announce the closing of the acquisition of the Don Pancho |polymetallic zinc-lead-silver-manganese project in Peru.

Tartisan Resources Corp. has now acquired 100% of the Don Pancho polymetallic zinc-lead-silver-manganese project located in the Province of Huaral, in the Department of Lima Peru, 105 kilometers north-northeast of Lima, comprising one concession of 600 hectares and located approximately between 3,660 meters and 4,487 meters above sea level. A Technical Report on the Don Pancho Polymetallic Project (Zn,Pb,Ag,Mn) NI 43-101 has been filed on SEDAR (2014).

The Don Pancho Project is located in a prolific polymetallic mineral belt in central Peru with several operating mines in the area including the world class Iscaycruz and Yauliyacu polymetallic mines operated by Glencore-Xtrata Plc located 50 kilometers to the north-northwest. Additionally, Trevali Mining Corporation’s Santander silver-lead- zinc mine is located 9 kilometers to the east and Buenaventura’s silver-lead-zinc Uchucchacua mine is located 63 kilometers to the north, (10 million ounces of silver produced in 2011). Infrastructure is considered excellent with ready access and a power line crossing the property en route to the Santander mine.

Don Pancho Project

Previous exploration on the property included an extensive surface mapping and sampling program, geophysics and a 2021 metre diamond drilling program of 6 holes conducted by a private Peruvian company.

Mapping and sampling shows an extensive NNW-SSE trending breccia zone measuring over 800 metres in length and 150 to 200 metres in width. There are numerous old workings and underground drifts located within this zone. The 2014 diamond drilling program shows large intersections of polymetallic mineralization, including 40 metres of 0.88% Zn, 0.40% Pb and 7.7 g/t Ag, 22.65 metres of 1.00% Zn, 0.26% Pb and 6.85 g/t Ag and 1.15 metres of 4.38% Zn, 3.25% Pb and 61.1 g/t Ag, (see Duran’s Press Release September 2, 2014). Surface sampling from the previous operator has revealed very interesting values, including 13.9 metres of 28.1 g/t Ag, 2.43% Pb, and 2.42% Zn, 2.8 metres of 28.1g/t Ag, 1.06% Pb, and 9.07% Zn and 13 metres of 8.38g/t Ag, 0.39% Pb, and 2.22% Zn. Sampling of underground workings in Yanapallaca area before the previous operators retuned 106 g/t Ag, 3.26% Pb and 17.56% Zn over 2.00 metres. (see 43-101 Technical Report on Don Pancho filed December 30th, 2014 on Sedar). Please note that the true width of the mineralization both on the surface and underground workings cannot yet be determined as the controls of the mineralization is yet to be fully understood.

A “Stage 1 Program†of geophysics, diamond drilling and potentially underground drifting is envisioned to commence in 2017. Structural analysis on the geology suggests previous drilling did not properly test the potential of the property. Tartisan has acquired the core and data.

In summary under the terms found in the Defineative Agreement Tartisan has acquired a 100% undivided interest in the property by paying $50,000 and issuing 500,000 common shares. Upon completion of 5,000 metres of drilling and/or underground development a further 150,000 shares are payable, and if a NI 43-101 compliant resource is published, a further 150,000 shares are payable and if the Company loses control of the project either by sale or joint-venture, a further 200,000 shares are payable. Duran Ventures will retain a 2% net smelter return royalty, of which half (1%) can be purchased by Tartisan for US$500,000.

Tartisan Resources Corp. common shares are listed on the Canadian Securities Exchange (CSE:TTC). Currently, there are 64,564,345 shares outstanding (84,913,414 fully diluted)..|Tartisan additionally owns a 20% + equity stake in Eloro Resources Ltd . as well as holding a 2% NSR in the La Victoria Project in North-Central Peru.

For further information on Tartisan, please contact Mr. D. Mark Appleby, President & CEO and a Director of the Company, at 416-804-0280 ([email protected]). Additional information about Tartisan can be found at the Company’s website at www.tartisanresources.com or on SEDAR at www.sedar.com. For further information on Duran, please contact Jeff Reeder at 647-302-3290 ([email protected]) or www.duranventuresinc.com

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this press release)

Jeff Reeder P.Geo. a qualified person in the context of NI 43-101 has reviewed and approved the technical content of this News Release

Durango Enters Into Option Agreement With Bonterra Resources For Trove Windfall Lake Property $DGO.ca

- Entered into an option agreement under which BonTerra can earn a 100% interest in Durango’s Trove Windfall Lake Property located in the Windfall-Urban Gold Camp district of northern Quebec

- Direct extension of the south west mineralized trend that BonTerra is currently exploring on its Gladiator Gold Deposit and Coliseum Gold Property

- BonTerra technical team is experienced and very familiar with the type of geology hosted by the Trove Property

Vancouver, BC / March 30, 2017 – BonTerra Resources Inc. (TSX.V-BTR, US: BONXF, FSE: 9BR1) (“BonTerra”) and Durango Resources Inc. (TSX.V-DGO, OTC: ATOXF, FSE:86A1), (“Durango”) are pleased to announce that they have entered into an option agreement (the “Agreement”) under which BonTerra can earn a 100% interest in Durango’s Trove Windfall Lake Property located in the Windfall-Urban Gold Camp district of northern Quebec (the “Trove Property”).

The Trove Property, surrounded by properties held by Osisko Mining Inc. (TSX: OSK) (“Osisko”) and Beaufield Resources Inc. (TSXV: BFD) (“Beaufield”), is a direct extension of the south west mineralized trend that BonTerra is currently exploring on its Gladiator Gold Deposit and Coliseum Gold Property. The BonTerra technical team is experienced and very familiar with the type of geology hosted by the Trove Property.

Pursuant to the Agreement, BonTerra may earn a 100% interest in the Trove Property from Durango in exchange for making the following payments and undertaking the following exploration work on the Trove Property:

- -BonTerra must pay Durango CDN$150,000 in cash and issue Durango 1,500,000 BonTerra common shares within 2 business days of the date the TSX-V approves of the transaction (the “Closing Date”);-on or before the first anniversary of the Closing Date, BonTerra must pay Durango a further CDN$150,000 in cash and issue Durango an additional 1,500,000 common shares;

-on or before the second anniversary of the Closing Date, BonTerra must pay Durango $200,000 and complete a minimum of CDN$1,000,000 in exploration expenditures, upon which BonTerra will have exercised its option and full title of the Property will be transferred from Durango to BonTerra;

-BonTerra will issue an additional 2,000,000 common shares to Durango as a discovery bonus if, and when, BonTerra produces a technical report compliant with National Instrument 43-101 showing a minimum 500,000 ounces inferred resource of gold; and

-Durango will retain a 2% net smelter return royalty in respect of the Trove Property. BonTerra may purchase 50% of this royalty at any time for $1,000,000.

Marcy Kiesman, CEO of Durango, stated “The next exploration stage of the Trove Property requires immediate expenditures for drilling, which Durango’s management is unwilling to finance at current share prices due to the dilution which would result for our shareholders. Entering into this transaction with BonTerra provides Durango with cash flow and allows Durango to share in BonTerra’s potential success in working the Trove Property as a shareholder of BonTerra. BonTerra brings a strong management team and a talented exploration team for future exploration on the Trove, having made a significant gold discovery in the Windfall Lake area on the eastern section, making this partnership an exciting opportunity for Durango. Durango recently acquired additional strategically located ground in the Windfall Lake area adjacent to Osisko and within a few kilometres of the Trove Property boundary, and plans to advance this newly-acquired property in the same manner as the Trove Property was advanced. If Bonterra has success exploring the Trove Property, Durango may be better positioned finance large exploration drilling programs on its other projects. We are very excited about this transaction and the year ahead.”

The Agreement is subject to TSX Venture Exchange approval and will be filed on SEDAR under the profiles of each of Durango and BonTerra at www.sedar.com.

About Durango

Durango is a natural resources company engaged in the acquisition and exploration of mineral properties. The Company has a 100% interest in the Mayner’s Fortune and Smith Island limestone properties in northwest British Columbia, the Decouverte and Trove gold properties in the Abitibi Region of Quebec, and certain lithium properties near the Whabouchi mine, the Buckshot graphite property near the Miller Mine in Quebec, the Dianna Lake silver project in northern Saskatchewan, and the Whitney Northwest property near the Lake Shore Gold and Goldcorp joint venture in Ontario.

For further information on Durango, please refer to its SEDAR profile at www.sedar.com.

Marcy Kiesman, Chief Executive Officer

Telephone: 604.428.2900 or 604.339.2243

Facsimile: 888.266.3983

Email: [email protected]

Website: www.durangoresourcesinc.com

Forward-Looking Statements

This document may contain or refer to forward-looking information based on current expectations, including, but not limited to the acquisition of additional ground, the option of the Trove Property or any other properties held by Durango, the entering into of any transaction with any third parties, exploration results on the Trove Property or the New Windfall Property and the impact on the Company of these events. Forward-looking information is subject to significant risks and uncertainties, as actual results may differ materially from forecasted results. Forward-looking information is provided as of the date hereof and we assume no responsibility to update or revise them to reflect new events or circumstances. For a detailed list of risks and uncertainties relating to Durango, please refer to the Company’s prospectus filed on its SEDAR profile at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

AGORACOM Welcomes Monarques Gold (MQR: TSX-V) With NI 43-101 High-Grade Gold Reserves and Resources $MQR.ca

Why Monarques Gold?

- NI 43-101 high-grade gold reserves and resources

- Excellent discovery potential along strike and at depth

- Ongoing 10,000 drilling program (results are pending)

- Acquisition of the 750 ton-per-day Beacon mill

Croinor Gold Property

Flagship project at the prefeasibility stage

- 100% interest in the Croinor Gold property, a gold mine project that is currently at the prefeasibility stage

- Property consists of one mining lease and two non-contiguous blocks of claims for a total of 335 claims over a 151 km² area. A 1.5% NSR is applicable on the mining lease and only 44 claims.

- Drilling program will test a diorite-hosted gold-bearing zone that returned grades of up to 38.7 g/t Au over 3.8 metres in historical drilling (see release)

Check Out Croinor Gold

Prefeasability Study

Simkar Gold Property

NI 43-101 Gold Resource 20 km from Val-d’Or

- 100% interest in the Simkar Gold property

- located 20 kilometres east of Val-d’Or, in the heart of the Abitibi Greenstone Belt.

- Comprised of two mining concessions and 15 claims covering an area of 5 km², and is subject to a 1.5% NSR.

- NI 43-101 (click here)

The Simkar Gold property is the result of a merger of the Simkar and Texsol properties. The transaction was announced by way of press release on June 26, 2014.

Regcourt Gold Property – Val d’Or

- 100% interest in the Regcourt Gold property

- Property is located at the eastern end of the Val-d’Or gold mining camp, some 30 km east of Val-d’Or, and is easily accessible via Route 117.

- Consists of 94 claims covering an area of 38 km2 near the centre of the western border of Vauquelin Township

- Property is subject to a 1.5% and 2.5 % NSR.

12 Month Stock Chart

Log in to Agoracom