- Received highly encouraging assay results from its reconnaissance program at its 100%-owned Dianna Lake Silver Prospect in northern Saskatchewan

- high-grade silver and copper anomalies which assayed up to 457.0 g/t Ag and 0.72% Cu over 0.30 m in channel samples taken from the main zone of historical workings, and up to 2.06% Cu in grab samples

Vancouver, BC / September 6, 2016 – Durango Resources Inc. (TSX.V-DGO), (the “Company” or “Durango”) announces that further to its news release of July 26, 2016, Durango has received highly encouraging assay results from its reconnaissance program at its 100%-owned Dianna Lake Silver Prospect in northern Saskatchewan.

Durango’s team was successful in locating and mapping nearly all historical drill holes, pits, and trenches. In addition, several new silver, copper, and gold-bearing showings were discovered during the reconnaissance program.

The reconnaissance program encountered high-grade silver and copper anomalies which assayed up to 457.0 g/t Ag and 0.72% Cu over 0.30 m in channel samples taken from the main zone of historical workings, and up to 2.06% Cu in grab samples. The highest-grade copper values were returned from a historical trench 270 meters to the northeast of the main zone of historical workings. *

* Please see Table 1 and Table 2 for full summary and ranges of anomalous results.

A single grab sample taken from a newly-identified, gold-bearing showing returned 0.37g/t Au. This showing is located approximately 300 metres to the southwest of the main zone of historical workings, adjacent to an under-explored IP anomaly. Gold mineralization was also found to be associated with historically documented silver mineralization in one historical pit in the main zone, assaying 0.17g/t Au in a grab sample.

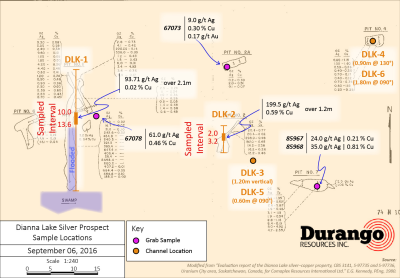

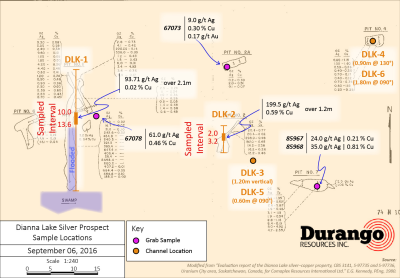

Historical Pit #1 was found to be mostly flooded with water up to 2 metres deep in places, as the adjacent swamp breached the edge of the pit. Based on the locations shown in the historical documentation, the highest grade material from the historical pits is likely submerged in the areas that were impossible to sample in the current program. However, the Company intends to dewater and fully sample the pit in the next exploration campaign. See Figure 1.

Channel Sampling Results

Six channels, designated as DLK-1 through DLK-6, were cut across separate outcrops, with continuous samples taken over 0.30-metre intervals. The first two channels (DLK-1 and DLK-2) were cut along historical Pit #1 and Pit #2 and returned high values of 379.0 g/t Ag and 457.0 g/t Ag, respectively. The remaining four channels were cut across various other outcrops. The locations of channels are illustrated in Figure 1.

Channel DLK-1 is located within, and parallel to the orientation of Pit #1, which yielded a historical sample of 2,458 oz/t Ag (1) (see section About Dianna Lake at the end of this release for full range of values). DLK-1 was sampled continuously at surface from 10.0 to 13.6 metres at 0.30 metre intervals, until reaching the edge of the water in the flooded area of the pit. Based on the locations shown in the historical documentation, the highest-grade material from this pit is likely submerged in the areas that were impossible to sample in the current program.

Of 16 continuous channel samples taken within DLK-1 and DLK-2, 9 samples assayed higher than 28 g/t Ag. In total, 31 channel samples were taken at 0.30 metre intervals within DLK-1 through DLK-6. Channels DLK-3 through DLK-6 did not return anomalous values above 5.0 g/t Ag and 0.1% Cu.

Channel sampling results are summarized in Table 1, below.

Table 1: Channel Sampling Highlights

| Channel |

Orientation |

Historical Pit |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Ag (g/t) |

Cu (%) |

| DLK-1 |

090? (South) |

Pit #1 |

11.2 |

13.3 |

2.1 |

0.0 |

93.7 |

0.02 |

|

|

including |

13.0 |

13.3 |

0.3 |

0.0 |

379.0 |

0.01 |

|

|

|

|

|

|

|

|

|

| DLK-2 |

090? (South) |

Pit #2 |

2.0 |

3.2 |

1.2 |

0.0 |

199.5 |

0.59 |

|

|

including |

2.6 |

2.9 |

0.3 |

0.0 |

457.0 |

0.72 |

|

|

|

|

|

|

|

|

|

Grab Sampling Results

Out of a total of 20 grab samples taken in the survey, 11 samples returned anomalous silver, copper and/or gold values (shown below in Table 2). Grab sampling successfully identified several new showings at the Dianna Lake Prospect.

Newly-identified showings include outcrops at Sample 67080, located 90 metres to the northeast of the main zone, and Sample 67056, located 400 metres southwest of the main zone. Of particular interest was a grab sample taken from a historical trench located 270 metres to the north-northeast of the main zone, which assayed 43.0 g/t Ag and 2.06% Cu.

These results are summarized in Table 2, below. Sampling from the main zone of historical workings is highlighted in Figure 1.

Table 2: Grab Sampling Highlights

| Sample |

Easting |

Northing |

Ag (g/t) |

Cu (%) |

Au (g/t) |

Comment |

| 67053 |

6617178 |

619626 |

9.0 |

0.41 |

0.00 |

Historical trench 270 metres north-northeast of main zone |

| 67054 |

6617186 |

619645 |

43.0 |

2.06 |

0.00 |

Historical trench 270 metres north-northeast of main zone |

| 67056 |

6617001 |

619545 |

33.0 |

1.00 |

0.00 |

New showing 400 metres southwest of main zone |

| 67060 |

6616930 |

619370 |

13.0 |

0.00 |

0.00 |

100 metres west of main zone |

| 67073 |

6616954 |

619484 |

9.0 |

0.30 |

0.17 |

Grab from Pit #2A |

| 67078 |

6616944 |

619463 |

61.0 |

0.46 |

0.00 |

Pit #1 waste pile |

| 67080 |

6616794 |

619075 |

54.0 |

0.57 |

0.00 |

90 metres northeast of main zone |

| 85966 |

6616936 |

619516 |

6.0 |

0.11 |

0.00 |

10 metres north of Pit #7 |

| 85967 |

6616927 |

619514 |

24.0 |

0.21 |

0.00 |

Pit #7 (southeast main zone) |

| 85968 |

6616927 |

619514 |

35.0 |

0.81 |

0.00 |

Pit #7 (southeast main zone) |

| 85969 |

6616734 |

619279 |

0.00 |

0.00 |

0.37 |

New showing 300 metres southwest of main zone |

* All coordinates are NAD83 UTM Zone 12N

Cautionary statement: Readers are cautioned that grab samples are selective by nature and are not necessarily representative of mineralization hosted on the property.

Figure 1: Sampling Locations Within Historical Pit Area (Highlights)

Click Image To View Full Size

Larger image available at: http://www.durangoresourcesinc.com/dianna-lake-silver-saskatchewan/

New Anomalous Gold Showings Identified

Two outcrop areas returned anomalous gold values which were not previously documented, indicating that silver mineralization at Dianna Lake is associated with some degree of gold mineralization.

One new showing, designated as “Deadshot”, is located 300 metres to the southwest of the historical workings and assayed 0.37g/t Au from a grab sample taken from a white to reddish biotite gneiss unit. This gold showing is located adjacent to an under-explored IP conductor.

Sample 67073 assayed 0.17 g/t Au and was taken from historical Pit #2A, within the main zone of historical workings. The sample exhibited strong malachite mineralization and iron oxide staining, as well as pervasive calcite veining.

These newly-discovered gold anomalies will warrant further exploration.

Marcy Kiesman, CEO of Durango, comments, “Our team is excited to receive anomalous assays returned from previously undocumented areas. The Dianna Lake Prospect was previously explored by Comaplex Resources which had a vast stable of high quality prospects – several which have been developed into projects such as Northquest’s (TSX.V-NQ) Pistol Bay Project. The impressive results from locations both within and outside of previously documented showings, pits, and trenches is compelling and anomalous gold values from the gneiss unit is particularly encouraging. These results may indicate the project’s potential to be greater than originally thought. We intend to follow up on these favourable results with a more detailed and extensive exploration program in the near future, including dewatering of historical trenches and pits.”

The Company’s geological team is presently constructing a model of the project data, including historical drill holes, which were not sampled in this reconnaissance program, as well as current results. Durango will provide more details as they become available.

Assays were performed at Activation Laboratories located in Thunder Bay, Ontario using package 1A3 Au/Ag fire assay gravimetric and package 1F2 total digestion ICP.

Durango would also like to announce that final acceptance was received from the TSX Venture Exchange for its non-brokered private placement of $266,000 as announced on June 22, 2016. All of the 2.63 million units issued are subject to a four-month hold period ending October 30 and 31, 2016, and December 10, 2016. No further tranches will close.

About Dianna Lake Silver, Saskatchewan

Durango’s Dianna Lake silver prospect covers an historical area in which, from 1968 to 1969, two-high grade, primarily native silver-bearing exploration targets of between 30,000 tonnes and 50,000 tonnes grading five to ten ounces per ton silver, approximately 600 meters apart, were determined by trench grab sample assays, according to an historical evaluation report composed for Comaplex Resources in 1980 (1)*.

* Potential quantities and grades are conceptual in nature. There has been insufficient exploration to define a mineral resource, and it is uncertain if further exploration will result in the target being delineated as a mineral resource.

Additionally, the main silver-bearing zone is spatially associated with a large zone of low-grade, disseminated copper-silver mineralization in which drilling of two IP (induced polarization) anomalies indicated approximately five million tonnes averaging 0.4 ounce per ton silver and 0.4 per cent copper (undefined category historical resource estimate), according to the same report (1)**.

** A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves, and the issuer is not treating the historical estimate as current mineral resources or reserves. Further work must be carried out to verify all historical information before a resource estimate is possible. Fourteen additional IP anomalies in the historical exploration area surrounding Dianna Lake and the nearby Doug Lake remain yet undrilled, according to the Comaplex Resources report (1), four of which occur within the property boundary of Durango’s Dianna Lake silver project.

Previous work on the claims was reported in 1969, 1980 and 1998 and included diamond drill holes, trenches and pits primarily across two zones where mineralization was identified at or near surface. One zone was reported to have five trenches exposing silver-copper mineralization over approximately 80 meters. Historical grab samples from pit No. 1 of this zone included ounce-per-ton silver values of 2,458.4, 684.4, 647.4, 600.2, 464.2 and 454.8 ounces per ton silver. Out of 18 grab samples, 13 samples assayed between 185 ounces per ton silver and 2,458.4 ounces per ton silver. Pit No. 2 grab samples returned reported highs of 298 ounces per ton silver and 197 ounces per ton silver (out of seven samples ranging from 12.2 ounces per ton silver to 298 ounces per ton silver) (1). (The company cautions that grab samples are selective and may not be representative of the mineralization on the property.)

The technical contents of this release were approved by Case Lewis, P.Geo., a consultant to the Company and a qualified person as defined by National Instrument 43-101. The Dianna Lake Property has not been the subject of an NI 43-101 report.

References

(1) “Evaluation report of the Dianna Lake silver-copper property, CBS 3141, S-97735 and S-97736, Uranium City area, Saskatchewan, Canada, for Comaplex Resources International Ltd.,” E.G. Kennedy, P.Eng., 1980.

About Durango

Durango is a natural resources company engaged in the acquisition and exploration of mineral properties. The Company has a 100% interest in the Mayner’s Fortune and Smith Island limestone properties in northwest British Columbia, the Decouverte and Trove gold properties in the Abitibi Region of Quebec, and certain lithium properties near the Whabouchi project, the Buckshot graphite property near the Miller Mine in Quebec, the Dianna Lake silver project in northern Saskatchewan, the Whitney Northwest property near the Lake Shore Gold and Goldcorp joint venture in Ontario, as well as three sets of claims in the Labrador nickel corridor.

For further information on Durango, please refer to its SEDAR profile at www.sedar.com.

Marcy Kiesman, Chief Executive Officer

Telephone: 604.428.2900 or 604.339.2243

Facsimile: 888.266.3983

Email: [email protected]

Website: www.durangoresourcesinc.com

Forward-Looking Statements

This document may contain or refer to forward-looking information based on current expectations, including commencement and completion of future exploration or project development programs and the impact on the Company of these events. Forward-looking information is subject to significant risks and uncertainties, as actual results may differ materially from forecasted results. Forward-looking information is provided as of the date hereof and we assume no responsibility to update or revise them to reflect new events or circumstances. For a detailed list of risks and uncertainties relating to Durango, please refer to the Company’s prospectus filed on its SEDAR profile at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.