Posts Tagged ‘otc’

Fabled Silver Gold $FCO $FBSGF Spins Out 20+ Copper Occurrences & 3 Classified Deposits Into Fabled Copper Co. $CMMC $NDM $CS $GMBXF

VIDEO – Fabled Silver Gold $FCO $FBSGF Increases Drill Program for Blue Sky Potential with 2nd Drill & Consolidates Copper Assets $RDU.ca $KTN.ca $GMBXF $EDR.ca

Fabled has been very busy positioning the company for future growth as an expanded drill program at the 100% controlled Santa Maria Project in Mexico was just announced, as well as consolidating its Northern B.C. copper assets in order to coordinate a 2021 exploration program.

The mining friendly jurisdiction of Parral has produced over 250M oz silver. Moreover, multiple major operators are in the vicinity (Grupo Mexico borders the property), and three toll mills are within a 20 km distance.

This is where Fabled’s project comes into play. Santa Maria is a high grade underground mine with a rich mining history and a Silver Equivalent 43-101 with 3.2million ounces Indicated and 1.1m inferred.

Surprisingly, Santa Maria has never been systematically explored with modern methods, until now. Armed with recent drill success from the first holes ( 10 Ounces of Silver over 6m ) Fabled is increasing their program from 8000 to a minimum of 9200m to drill from underground to firm up the known resource, and for “Blue Sky drilling” to explore the numerous anomalies unexplored on the property capable of demonstrating discovery potential.

CEO Peter Hawley, Fabled’s CEO breaks down the multiple events impacting shareholders.

Fabled $FCO $FBSGF Increases Drill Program to 9,200 meters and Adds Second Drill $RDU.ca $KTN.ca $GMBXF $EDR.ca

Fabled Silver Gold Corp. (“Fabled” or the “Company”) (TSXV:FCO)(OTCQB:FBSGF)(FSE:7NQ) is pleased to announce that it has increased the on-going 8,000 meter drill program to a minimum of 9,200 meters.at the “Santa Maria” Property in Parral, Mexico.

The extra 1,200 meter drill program has been awarded to Maza Drilling who is currently performing the surface drilling and has underground diamond drilling machines capable of drilling HQ size, (2.5 inches) drill core.

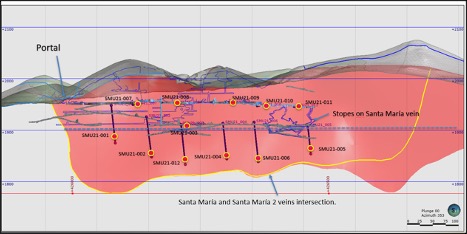

This program will be focused underground to delineate the Santa Maria Central Structure with multi underground drill stations being prepared, see Figure 1.

Peter J. Hawley, CEO and President, states, “As we advance the surface drill program and compile these findings into our data base and remodel the mineralized bodies with respect to orientation of structure, width, grade and predictability we are now ready to start at the same time to delineate the central sector of the Santa Maria structure. This cost-effective measure allows us, from underground, to drill with a second machine and determine the true width to the hanging wall and foot wall of the structure and also begin to infill drill the resource area to increase the confidence level of the various resource categories.”

Figure 1: Longitudinal Section of Central Santa Maria Structure

The Company has completed drill holes SM20-01 – 12 for a total of approximately 3,000 meters of the now increase 9,200 meter drill program completed to date. Holes SM20-8B, (resampled) and SM20-10, 11 have been sampled and submitted to ALS Chihuahua Laboratory for analysis. Hole SM20-12 has been completed and is in the process of being sampled, Hole SM20-13 is currently in progress.

Fabled $FCO $FBSGF Drill Hole Ends in 1.1 meters grading 75.9 g/t Ag and to be Extended Blue Sky Drilling In Progress $RDU.ca $KTN.ca $GMBXF $EDR.ca

Fabled Silver Gold Corp. (“Fabled” or the “Company”) (TSXV:FCO)(OTCQB:FBSGF) and (FSE:7NQ) is pleased to announce updates of diamond drill holes SM20-08B from the on-going 8,000 meter drill program on the “Santa Maria” Property in Parral, Mexico.

As previously mentioned in our news release of March 31, 2021, drill hole SM20-08 was collared approximately 225 meters east of the drill station for holes SM20-4, 5, and 6. See drill plan below as designed to drill thru the interpreted main north – south structure at an oblique angle and hit the Santa Maria structure.

The hole was drilled with NQ size core, 1 7/8th inches at -50 degrees for a premature total depth of 64.18 meters where the hole was terminated by major faulting and could not be advanced further.

Drill hole SM20-08B was a re-entry into hole SM20-08 with larger PQ size drill core, 3.36 inches in diameter, to compensate for the massive broken structure, which allowed the hole to be drilled to a final depth of 234 meters and was successful in reaching its target.

Drill results just received show the last sampled interval was from 226.5 – 227.6 meters grading 75.9 g/t silver in a north – south silicified structure, mineral bearing and black in color, this unit continues to the end of the hole at 234 meters, an extra 6.4 meters.

Peter J. Hawley, CEO and President, states, “The rest of this hole is now being sampled on a rush/priority. In addition, once the drill machine completes hole SM20-13 it will return to this drill station, re-enter the hole and continue from the depth of 234 meters onwards until the structure has been clearly exited.”

Drill hole SM20-09 was drilled with PQ size core from the collar, in anticipation of bad ground conditions, at -60 degrees for a targeted depth of -250 meters to hit the Santa Maria structure, as encountered in hole 8B and was terminated prematurely at 231 meters where not only did the hole collapse due to the fault but jammed the drill rods and a section of the drill string and bit was left in the hole.

BLUE SKY DRILL TARGET UPDATE

Peter J. Hawley, CEO and President, remarks, “As I mentioned previously, we are exploring areas never explored before, with new ideas to test our structure-on-structure theory over the Property.

New roads and drill pads have been completed to test IP Geophysics anomaly IPSM-04 located in the central north section of the Santa Maria Property and extends over 700 meters in an east – west trend.

Geophysical interpretation describes the anomaly as follows; ” IPSM-04 is +700 meters trending east to west over calcite / silica veins trending north to south. Both targets are considered to be shallow seated wide body targets which could represent disseminated to sulphide mineralization associated with quartz carbonate veins and imprinted over the East – west anomaly.”

Drill hole SM20-12 has been designed to intersect the eastern extension of the anomaly at a vertical depth of -150 meters, while SM20-13 is being planned to intercept the western sector of the anomaly at a vertical depth of -275 meters.

A major C1 regional north – south fault in the center of the property displaces the anomaly approximately 30-40 meters to the south. This is the same structure tested by holes SM20-8-11. See Plan View of Drill Station Locations over IP Anomalies below.

In the area of the intersection of the North – South Structure and anomaly IPSM-04 a surface alteration zone with micro lineaments NorthSouth that corresponds at the emplacement of a dike which has been totally replaced by quartz and pervasive silicification in stockwork form (“STW”) and halo’s with STW of quartz in the limestone unit.

Peter Hawley continues, “We are systematically taking what was previously thought of as simple E-W high grade structure and re-evaluating, with numerous successes to date, in order to develop our new concept which is seen below in the “Plan View of Drill Station Locations over IP Anomalies”.

Over the next few drill holes to test the blue sky potential in the north of the Property should add to the new data base as we start to dial in the focus of the remaining drill program. With the Company well funded we will continue to explore all targets as they present themselves.”

The Company has completed drill holes SM20-01 – 11 for a total of approximately 2,600 meters of the ongoing 8,000 meter drill program completed to date. Holes SM20-8B and SM20-10, 11 have been sampled and submitted to ALS Chihuahua Laboratory for analysis. Hole SM20-12 is currently in progress.

Fabled Silver Gold $FCO.ca $FBSGF Amends and Restates Copper Option Agreements and Acquires Additional Claims $RDU.ca $KTN.ca $GMBXF $EDR.ca

Fabled Silver Gold Corp. (“Fabled” or the “Company“) (TSXV:FCO)(OTCQB:FBSGF)(FSE:7NQ) is pleased to announce that it has entered into an amended and restated option agreement (the “Amended Agreement“) with respect to certain of the Company’s copper properties, being Neil Property and the Toro Property, located in the Liard Mining Division in northern British Columbia.

Pursuant to the Amended Agreement,Fabled also now has the right to acquire additional claims covering an additional 3,842 hectares located in the same mineral belt (together with the Neil Property and the Toro Property, the “Muskwa Property“) from High Range Exploration Ltd. (the “Optionor“).

Under the existing option agreements, the Company was required to pay to the Optionor $5,000,000 in cash or shares by August 17, 2021, and a further $5,000,000 in cash or shares by March 3, 2022 to acquire an additional 50% of Neil Property and Toro Property not already owned by Fabled. In addition, Fabled was required to pay an additional $200,000 per annum to the Vendor in advance royalty payments, and pay a 2% NSR on the commencement of commercial production. Prior to entering into the Amended Agreement, past and unpaid advance royalty payments of $750,000 were to become due on March 31, 2021. Such amounts are not due under the Amended Agreement.

Pursuant to the Amended Agreement, in consideration for the right to acquire the whole and expanded Muskwa Property Fabled has agreed pay to the Optionor, in cash:

(i) $200,000 on the closing date;

(ii) $500,000 on the date that is twelve months after the closing date;

(iii) $750,000 on the date that is twenty-four months after the closing date;

(iv) $1,000,000 on the date that is thirty-six months after the closing date; and

(v) $2,000,000 on the date that is forty-eight months after the closing date.

The Muskwa Property will be subject to a 2% NSR payable to the Optionor but no advance royalty payments will now be due.

The additional claims included in the Muskwa Property (which include the Bronson deposit and additional claims contiguous and to the north of the Neil Property and ChurchKey Property) increase the Company’s land package within the same mineral belt which is believed to be 6 miles wide and 40 miles long and that trends north 35 degrees west and contains the Davis-Keays Eagle Vein, the past-producing Churchill Copper Mine Magnum Vein, the Neil Vein, the Toro/Churchill, and Bronson deposits, each of which are now under option to Fabled.

Fabled Silver Gold $FCO.ca $FBSGF Reports on Drill Holes SM20-07 – 11 $RDU.ca $KTN.ca $GMBXF $EDR.ca

Fabled Silver Gold Corp. (“Fabled” or the “Company”) (TSXV:FCO)(OTCQB:FBSGF)(FSE:7NQ) is pleased to announce updates of diamond drill holes SM20-07 – 11 from the on-going 8,000 meter drill program on the “Santa Maria” Property in Parral, Mexico.

Peter J. Hawley, CEO and President, remarks, “We are heading into areas never explored before, with new ideas to test our structure-on-structure theory over the Property. Hole SM20-07 intercepted two broad zones of northwest trending, never seen before, semi-massive marcasite, (pyrite) in hornfels, and to the east 225 meters, we tried to cross the major C1 regional north – south fault in the center of the Property.”

Hole SM20-07 was drilled at -50 degrees and 246.0 meters in length from same drill station as hole SM20-03 at an angle of 210 degree azimuth and designed to test the tail end of two northwest trending IP anomalies labeled IPSM-08. Northwest trending anomalies or structures have not been seen previously on the Property.

Drill results clearly demonstrate the cause of the two conductive zones, with a 19.90 meter intersection from 145.50 – 165.30 meters and a second 78 meter interval from 167 – 245 meters of greenish hornfels, (a metamorphic rock formed by the contact between a mudstone / shale (clay rich rock) and a hot igneous body, usually at shallow depths), with strong chlorite / sericite alteration with 25-30% marcasite, (white iron pyrite, FeS2). See Plan View of Drill Hole Locations below.

Drill hole SM20-08 was collared approximately 225 meters east of the drill station for holes SM20-4, 5, and 6. See drill plan below as designed to drill thru the interpreted main north – south structure at an oblique angle and hit the Santa Maria structure.

The hole was drilled with NQ size core, 1 7/8th inches at -50 degrees for a premature total depth of 64.18 meters where the hole was terminated by major faulting and could not be advanced further.

Drill hole SM20-08B was a re-entry into hole SM20-08 with larger PQ size drill core, 3.36 inches in diameter, to compensate for the massive broken structure, which allowed the hole to be drilled to a final depth of 234 meters and was successful in reaching its target. Currently all sampled drill core of interest is being tested. See Cross Section View below.

Drill hole SM20-09 was drilled with PQ size core from the collar, in anticipation of bad ground conditions, at -60 degrees for a targeted depth of -250 meters to hit the Santa Maria structure, as encountered in hole 8B and was terminated prematurely at 231 meters where not only did the hole collapse due to the fault but jammed the drill rods and a section of the drill string and bit was left in the hole.

Drill hole SM20-10 was designed to follow up on the hole SM20-8B targeted intercept but also to replace the loss of hole SM20-09.

HoleSM20-10 was drilled with PQ size core from the collar, in anticipation of bad ground conditions as seen previously, at -70 degrees for a targeted depth of -220 meters to hit the Santa Maria structure, as encountered in hole SM20-08B. The hole was successful in its objective and as such stopped at a total depth of 227.5 meters. Currently all sampled drill core of interest is being tested. See Cross Section View below.

Drill hole SM20-11 is located approximately 125 meters northeast of drill hole station 4 for holes SM20-08, 8B, 9, and 10. See Plan View of Drill Stations below.

The hole was drilled due west, 270 degrees, at -60 degrees targeting the intercept of the major north – south C1 regional structure at the right angle, 90 degree. The hole was successfully completed and drilled to a total depth of 258 meters.

New roads and drill pads have been completed and the drill is currently being moved to drill station 6 for hole SM20-12. See Plan View of Drill Stations below.

Peter Hawley continues, “We are systematically taking what was previously thought of as simple E-W high grade structure and re-evaluating, with numerous successes to date, in order to develop our new concept which is seen below in the “Plan View of Drill Station Locations over IP Anomalies”. Over the next few drill holes to test blue sky potential in the north of the Property should add to the new data base as we start to dial in the focus of the remaining drill program. With the Company well funded we will continue to explore all targets as they present themselves.”

AGORACOM Small Cap 60: Fabled Silver Gold’s Big Picture $FCO.ca $FBSGF $RDU.ca $KTN.ca $GMBXF $EDR.ca

Peak Fintech Group $PKK.ca $PKKFF Engages MZ Group to Lead Strategic Investor Relations and Shareholder Communication Program $MOS.ca $MOGO.ca CTZ.ca $TRAD.ca

- Engaged international investor relations specialists MZ Group (MZ) to lead a comprehensive strategic investor relations and financial communications program across all key markets.

- MZ Group will work closely with Peak management to develop and implement a comprehensive capital markets strategy designed to increase the Company’s visibility throughout the investment community ahead of Peak’s anticipated listing on the Nasdaq Stock Market and thereafter.

Montreal, Quebec–(March 26, 2021) – Peak Fintech Group Inc. (CSE: PKK) (OTCQX: PKKFF) (“Peak” or the “Company”), an innovative Fintech service provider to the Chinese commercial lending sector, has engaged international investor relations specialists MZ Group (MZ) to lead a comprehensive strategic investor relations and financial communications program across all key markets.

MZ Group will work closely with Peak management to develop and implement a comprehensive capital markets strategy designed to increase the Company’s visibility throughout the investment community ahead of Peak’s anticipated listing on the Nasdaq Stock Market and thereafter. The campaign will highlight how Peak is leveraging the Cubeler Lending Hub platform in China to automate the commercial lending process as well as how Peak plans to deploy the Lending Hub ecosystem concept in North America by the end of 2021. Powered by an analytics and artificial intelligence platform, the Cubeler Lending Hub is a nation-wide ecosystem that brings together lenders, borrowers and other participants in the commercial lending space to conduct lending and credit transactions rapidly, efficiently and with the utmost transparency.

MZ has developed a distinguished reputation as a premier resource for institutional investors, brokers, analysts and private investors. Mark Schwalenberg, CFA, Director at MZ North America, will advise Peak in all facets of corporate and financial communications, including the coordination of roadshows and investment conferences across key cities, as well as building brand awareness with financial and social media outlets.

Ted Haberfield, Chairman & President of MZ Group North America, commented: “Peak’s innovative ecosystem provides access to all data on small businesses that would be required by any lender to qualify the business for credit, including from their accounting software and bank statements. Leveraging artificial intelligence to analyze lending criteria allows Peak to match small businesses with multiple lending institutions, and therefore, increase the likelihood of funding while also minimizing risk for lenders by providing pre-qualified leads. The Company has seen wide adoption of its platform in China, and we look forward to sharing Peak’s solid position and aggressive expansion plan with our wide network of institutional investors and family offices.”

“2021 is an important inflection point for Peak, as we focus on executing our development roadmap over the coming year and prepare for an eventual Nasdaq listing,” said Johnson Joseph, President and CEO of Peak Fintech Group. “We look forward to working with Mark and the entire team at MZ Group to communicate with and introduce the Company to a whole new audience who may not yet be familiar with Peak as we continue to build long-term value for our shareholders,” concluded Johnson.

The agreement is for a term of twelve (12) months with a review after six (6) months. As compensation for the services provided, MZ Group will receive a monthly fee of US$10,000 and options to purchase 110,000 common shares of Peak. The options will have an exercise price of $2.75 CAD and will expire five (5) years from the date of their issuance.

For more information on Peak, please visit the Company’s investor relations website at http://peakfintechgroup.com/investors/. To schedule a conference call with management, please email your request to [email protected] or call Mark Schwalenberg at 312-261-6430.

About MZ Group

MZ North America (www.mzgroup.us) is the US division of MZ Group, a global leader in investor relations and corporate communications. MZ North America was founded in 1996 and provides full scale Investor Relations to both private and public companies across all industries. Supported by our exclusive one‐stop‐shop approach, MZ works with top management to support the clients’ business strategy in six integrated product and service categories: 1) IR Consulting & Outreach – full service investor relations and roadshow services; 2) ESG iQ & Advisory – reporting technology platform and audit and reporting guidance; 3) SPAC Alpha IR+ & IPO Advisory – providing critical and timely guidance through business combinations and IPOs; 4) Financial & Social Media – lead generation and social media relations; 5) Market Intelligence – real time ownership monitoring; 6) Technology Solutions – webhosting, webcasting, conference calls, distribution services and board portals. MZ North America has a global footprint with offices located in New York, Chicago, San Diego, Aliso Viejo, Austin, Minneapolis, Taipei and São Paulo.

About Peak Fintech Group Inc.

Peak Fintech Group Inc. is the parent company of a group of innovative financial technology (Fintech) subsidiaries operating in China’s commercial lending industry. Peak’s subsidiaries use technology, analytics and artificial intelligence to create an ecosystem of lenders, borrowers and other participants in China’s commercial lending space where lending operations are conducted rapidly, safely, efficiently and with the utmost transparency. For more information: www.peakfintechgroup.com.

Video – HealthSpace Data Systems $HS.ca $HDSLF Empowers Governments & Businesses to Greater Efficiency via Enterprise and Mobile Solutions $RHT.ca $RQHTF $VMD $AND $WELL

If there’s one thing we know about governments at every level – whether local, state or federal – it’s that they can be hugely inefficient and can struggle to communicate.

Enter HealthSpace Data Systems (CSE: HS) (OTCQB: HDSLF) (Frankfurt: 38H). The company’s “empowering government efficiency” solution has empowered them to become an industry leading tech pioneer, providing both enterprise- and mobile internet-based applications to more than 500 state and local government organizations in North America. Including in:

- Sonoma County, California

- Jackson County, Missouri

- Illinois

- Wisconsin

- Ontario, Canada

HealthSpace currently offers the only integrated product suite to incorporate inspection, administration and analytics across all platforms in North America.

- A cloud-based and mobile platform helps revolutionize every aspect of government regulatory work

- including licensing and inspections, accounting, even disease surveillance.

It has now entered into the FinTech space with a payment platform that streamlines the intake of government revenue for the agencies it serves. Furthermore, it has begun delivering its government-grade tech to private businesses, enabling them to add visibility and predictability into their own organizational structures.

And underpinning its innovation is a robust business model:

- Scalable with Strong Pipeline of Organic Growth

- Fully funded and built to execute on all-time high sales pipeline of >$18m and growing

- Sticky and Diversified Customer Base: Over 98% client retention year-over-year

- Predictable Recurring Revenues, targeting $10m (Over 100% from YE2020) in Annual Recurring Revenue within 12 to 18 months

We sat down with HealthSpace CEO Silas Garrison for a deeper dive:

Fabled Silver Gold $FCO.ca $FBSGF Announces Commencement of Trading on the OTCQB $RDU.ca $KTN.ca $GMBXF $EDR.ca

- Graduated from the OTC Pink Sheets (“OTCPK”)

- Commenced trading on the OTCQB Venture Marketplace under the symbol “FBSGF”.

Fabled Silver Gold Corp. (TSXV: FCO) (OTCQB: FBSGF) (FSE: 7NQ) (“Fabled” or the “Company”) is pleased to announce that effective March 22, 2021, it has graduated from the OTC Pink Sheets (“OTCPK”) and commenced trading on the OTCQB Venture Marketplace (“OTCQB”) under the symbol “FBSGF”.

Peter Hawley, CEO and President, commented, “Trading on the OTCQB will make the Company accessible to a much broader range of U.S. investors and assist in our goal of increasing liquidity and visibility in the U.S. We look forward to introducing our Parral, Chihuahua, Mexico project, to this new group of investors.”

The Santa Maria project is located in the mining friendly jurisdiction of Parral, Mexico; situated in the centre of the Mexican epithermal silver-gold belt, which has produced more silver than any other area in the world.

The OTCQB Venture Market is the premiere marketplace for early stage and developing U.S. and international companies. Participating companies must be current in their reporting and undergo an annual verification and management certification process.