As the global gold market continues its bullish run, companies like Lake Winn Resources are uniquely positioned to benefit from this unprecedented growth. With gold prices recently reaching new all-time highs, driven by economic uncertainty and rising demand from central banks, the stage is set for gold exploration and mining firms to see increased profitability and investor interest.

Industry Outlook and Lake Winn Resources’ Trajectory

Gold’s current bull market has been fueled by significant factors such as the U.S. Federal Reserve’s interest rate cuts, ongoing geopolitical instability, and heightened inflation concerns. According to the World Gold Council, global gold demand has surged to its highest second-quarter level on record, with an 18% year-on-year increase in gold prices to an average of $2,338 per ounce. Central banks and investors alike are turning to gold as a hedge against economic uncertainty, and this strong demand is likely to persist throughout the remainder of 2024.

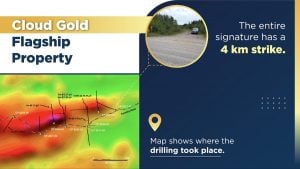

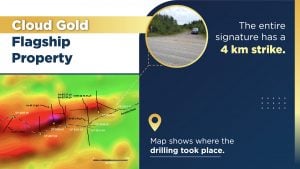

Lake Winn Resources, with its focus on gold exploration projects in Canada, is well-positioned to ride this wave of growing demand. Their gold-focused projects, including the Cloud and Quartz properties, align perfectly with current market conditions, offering the potential for new discoveries and significant resource development as gold prices remain at historic highs.

Voices of Authority

Industry experts are projecting continued growth for the gold market. Louise Street, Senior Markets Analyst at the World Gold Council, stated, “The rising and record-breaking gold price has made headlines as strong demand from central banks and the OTC market supported prices, which has been a consistent trend throughout the year.” These sentiments reflect an overall optimism that gold will remain a cornerstone investment for both institutional and retail investors seeking stability.

Lake Winn Resources Highlights

Lake Winn Resources has strategically positioned itself in this bullish environment with key projects designed to take advantage of the growing demand for gold. The company’s focus on the Cloud and Quartz projects in Manitoba represents a significant opportunity. Historical drilling on these properties revealed high-grade gold intercepts, with the Quartz Project showing grades of up to 19.9 g/t Au. As gold prices continue to climb, these results take on new importance, offering the potential for high-margin discoveries.

Moreover, Lake Winn’s strategic initiative to spin out its gold assets into a separate entity, Gold Winn Resources Corp., provides a streamlined focus on gold exploration, which will help the company capitalize on the sector’s growing momentum. This move positions Lake Winn to further benefit from the anticipated mergers and acquisitions activity in the gold sector.

Real-World Relevance

For the average investor, gold has long been a safe haven in times of market volatility. Now, with interest rates falling and inflation concerns rising, the current surge in gold prices offers a tangible opportunity for those looking to diversify their portfolios. Lake Winn Resources’ projects offer exposure to the gold market without the need for direct investment in physical bullion, providing an entry point into the gold sector through equity ownership in a promising exploration company.

As Lake Winn continues to explore high-potential areas like the Cloud and Quartz projects, their ability to generate new resources becomes increasingly valuable. The company’s operations in Manitoba, a region known for its mining-friendly policies and existing infrastructure, only add to its appeal as a growth-focused exploration firm.

Looking Ahead with Lake Winn Resources

With gold continuing its record-breaking run, the future looks bright for Lake Winn Resources. The company’s ongoing exploration efforts, combined with a favorable market environment, set the stage for potential resource discoveries and increased investor interest. As global demand for gold remains strong, Lake Winn’s ability to unlock value from its key assets will likely position it as a compelling opportunity in the junior gold exploration space. With the global gold market set to remain a key player in the financial landscape, Lake Winn’s strategic initiatives could prove rewarding for those seeking exposure to this growing industry.

Conclusion

Lake Winn Resources stands at the intersection of a bullish gold market and a well-timed exploration strategy. With gold prices breaking records and global demand continuing to rise, the company is poised to benefit from both its existing projects and its strategic plans for the future. Lake Winn represents a unique opportunity to gain exposure to the gold sector’s upward momentum while backing a company with a clear focus on exploration success.

Source: https://www.mining.com/global-gold-demand-reaches-q2-record-report/

YOUR NEXT STEPS

Visit $LWR HUB On AGORACOM: https://agoracom.com/ir/LakeWinnResources

Visit $LWR 5 Minute Research Profile On AGORACOM: https://agoracom.com/ir/LakeWinnResources/profile

Visit $LWR Official Verified Discussion Forum On AGORACOM:

https://agoracom.com/ir/LakeWinnResources/forums/discussion

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients.

In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.