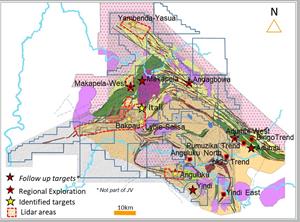

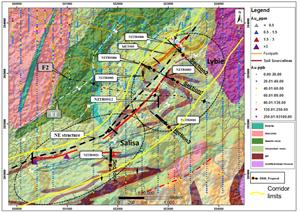

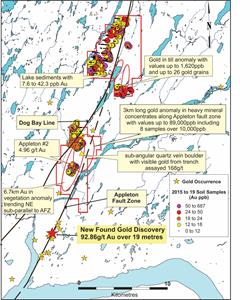

SPONSOR: Labrador Gold – Two successful gold explorers lead the way in the Labrador gold rush targeting the under-explored gold potential of the province. Exploration has already outlined district scale gold on two projects, including a 40km strike length of the Florence Lake greenstone belt, one of two greenstone belts covered by the Hopedale Project. Recently acquired 14km of the potential extension of the new discovery by New Found Gold’s Queensway project to the south. Click Here for More Info

(Kitco News) – Gold futures are behaving like a restless person taking a nap – with the market not moving much in either direction lately but yet tossing and turning a lot.

The metal has been in a narrowing range for nearly a month now, but sometimes making violent moves within that trading band. However, the pattern is forming a so-called wedge formation that should lead to a breakout in the not-too-distant future, some observers said.

“Something big is coming here,” said Sean Lusk, co-director of commercial hedging with Walsh Trading.

The formation is setting up for either an extension to the upside or a correction to the downside, he continued.

“I don’t see this being range-bound for much longer. The next couple of weeks should be tell-tale.â€

The metal sold off in mid-March with other asset classes as investors had to generate cash when stocks were falling. The June futures bottomed at $1,453 an ounce in mid-March. The contract then climbed as high as $1,788.80 an ounce on April 14, then backed off to a low of $1,666.20 on April 21.

Since, the range has been narrowing, confined to a $1,676-$1,1735.50 band so far this month. The range narrowed even further to $1,692.10-$1,713.80 this week. So far on Tuesday, the metal is having an “inside day†on the charts in which the high and low are within the prior day’s trading range. The contract was up $12.80 to $1,710.80 an ounce as of 10:23 a.m. EDT.

“We leapt, then we’ve been basically in a pretty violent trading range, fighting to hang onto $1,700 an ounce with people looking for record highs in the future,†said Phil Flynn, senior market analyst with Price Futures Group. “We’ve seen a lull.â€

Flynn described the underlying fundamental backdrop as still solid for gold, with governments undertaking massive fiscal stimulus and central bankers ultra-loose monetary policy. However, gold is being held back for the moment by a strong stock market and U.S. dollar, traders said.

“We are seeing a run back toward stocks and away from gold as a safe-haven play,†Flynn said. “So it’s been struggling a little bit.â€

Lusk characterized the stock-market recovery as “outstanding†since the sell-off to the March lows that occurred on worries about the economic impact of the coronavirus pandemic.

“If the Dow Jones makes a run for 25,000, or perhaps 26,000, it seems ridiculous considering what’s going on with the economy shutting down,†Lusk said. “But those are things that will probably drive some money out of gold.â€

Should stocks remain strong, gold conceivably could get “whacked†another $100, he said. Further, Lusk added, recent highs in the U.S. dollar have probably prompted some selling in gold.

But for now, the range has been narrowing, with buying on price dips.

“There’s a lack of conviction on both sides,†Lusk said. “You see a little bit of profit-taking. Then when we break below $1,700, we see some bargain buying come back into the market. That tells me it’s not over yet.â€

There is still much uncertainty in the world, Lusk said. If economies open up, will they have to shut down again due to another wave of the cornonavirus? Markets are also watching to see whether a trade war between the U.S. and China heats up again.

“I think we’re pausing here and waiting for the next shoe to drop,†Lusk said. “The market is looking for a new catalyst one way or another.â€

Longer-term structural issues in the economy are not likely to be resolved quickly, even if a vaccine for the virus is found, Lusk said. He also suggested there could be a stalemate between lawmakers in an election year.

Flynn commented that the underlying fundamentals for gold are still “very bullish†because of actions taken by the Federal Reserve.

“We know that low interest rates are supportive for gold,†Flynn said. “We know that quantitative easing is bullish for gold.â€

Further, with markets hopeful that economies will start to reopen, physical demand for gold jewelry should start to improve, Flynn added.

On top of this, Lusk pointed out that lawmakers in Washington D.C. are talking about another round of massive fiscal stimulus of perhaps $3 trillion on top of what has already occurred. That could eventually weigh on the U.S. dollar.

Yet, Lusk continued, that doesn’t mean gold can’t correct lower again, especially since late spring and early summer tend to be seasonally weak periods for physical demand. In the current environment, Indian and Chinese demand has been soft, in particular.

Lusk commented that the market could fall to just below $1,600 an ounce or alternatively take off to $1,827.

“It’s kind of frustrating,†he said about the uncertainty facing traders art the moment. “I look for a more pronounced move in the next couple of weeks for sure.â€

SOURCE: https://www.kitco.com/news/2020-05-12/-Something-big-is-coming-Gold-s-narrowing-range-to-lead-to-a-major-price-move-analysts.html