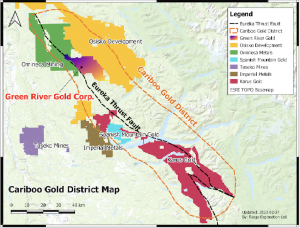

In an era defined by environmental consciousness and the urgent need for sustainable solutions, Green River Gold emerges as a beacon of hope in the resource sector. With a strategic focus on responsible mining practices and a portfolio of high-potential projects, Green River Gold is poised to lead the charge in powering the green revolution. Here’s why the company is a compelling investment opportunity and one to watch in 2024.

Commitment to Sustainability

At the core of Green River Gold’s ethos lies a steadfast commitment to sustainability. Unlike traditional mining operations that prioritize profit over environmental impact, Green River Gold integrates cutting-edge technologies and best practices to minimize its carbon footprint and mitigate ecological harm. By prioritizing reclamation efforts, reducing waste, and embracing renewable energy sources, the company sets a new standard for environmentally responsible mining.

Strategic Portfolio

Green River Gold boasts a diverse portfolio of projects strategically positioned to capitalize on emerging market trends. From precious metals like gold and silver to critical battery metals like nickel and magnesium, the company’s assets span a spectrum of commodities essential for the transition to clean energy technologies.

Projects like the Quesnel Nickel Project and Fontaine Gold demonstrate Green River Gold’s foresight in identifying and developing high-potential resources. Additionally, the company’s proximity to existing infrastructure further enhances its competitive advantage, streamlining project development and reducing operational costs.

Innovative Exploration Techniques

Green River Gold’s success is underpinned by its innovative approach to exploration. By employing rigorous geological surveys and state-of-the-art exploration techniques, the company maximizes the efficiency and accuracy of its exploration efforts. Through meticulous analysis of geological data and targeted drilling campaigns, Green River Gold identifies promising mineral deposits with unprecedented precision, reducing exploration costs and accelerating project development timelines.

Strong Leadership and Expertise

Behind Green River Gold’s success is a team of seasoned professionals with decades of experience in the resource sector. Led by CEO Perry Little, a visionary leader with a proven track record of success, the company’s management team combines technical expertise with strategic vision to drive growth and innovation. With a deep understanding of industry dynamics and a commitment to excellence, Green River Gold’s leadership ensures the company remains at the forefront of the green revolution.

Powering the Green Revolution

As the world shifts towards renewable energy sources and electric vehicles, the demand for critical battery metals like nickel and magnesium is poised to soar. Green River Gold’s strategic focus on these essential commodities positions the company as a key player in the green revolution. By supplying the raw materials needed to manufacture clean energy technologies, Green River Gold plays a vital role in accelerating the transition to a sustainable future.

Conclusion

In conclusion, Green River Gold’s commitment to sustainability, strategic portfolio, innovative exploration techniques, and strong leadership make it a company to watch in 2024 and beyond. As the world grapples with the challenges of climate change and environmental degradation, Green River Gold stands as a shining example of how responsible mining practices can drive positive change.

With its unwavering dedication to sustainability, close proximity to infrastructure, and role in powering the green revolution, Green River Gold is poised to shape the future of the resource sector and contribute to a cleaner, greener world.

YOUR NEXT STEPS

Visit $CCR HUB On AGORACOM: https://agoracom.com/ir/GreenRiverGoldCorp

Visit $CCR 5 Minute Research Profile On AGORACOM:https://agoracom.com/ir/GreenRiverGoldCorp/profile

Visit $CCR Official Verified Discussion Forum On AGORACOM:

https://agoracom.com/ir/GreenRiverGoldCorp/forums/discussion

Watch $CCR Videos On AGORACOM YouTube Channel:

https://youtube.com/playlist?list=PLfL457LW0vdLJgdyN9gnd7VKr4xMKBpQ7&si=DumfF-sMw_Uat7Ce

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.