Sponsor: Affinity Metals Corp. (TSX-V: AFF) is a Canadian mineral exploration company building a strong portfolio of mineral projects in North America. The Corporation’s flagship property is the drill ready Regal Property near Revelstoke, BC where Affinity Metals is making preparations for a spring drill program to test two large Z-TEM anomalies. Click Here for More Info

COVID-19: The Pin that Punctured the Credit Balloon

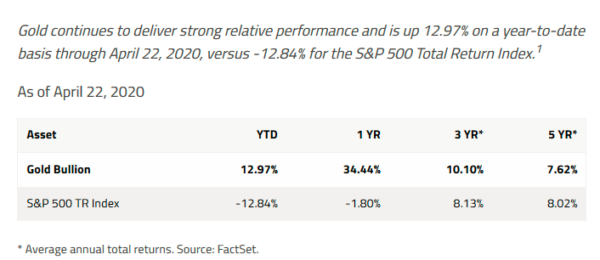

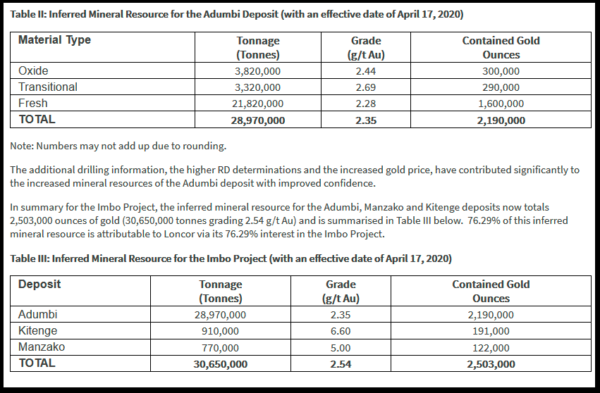

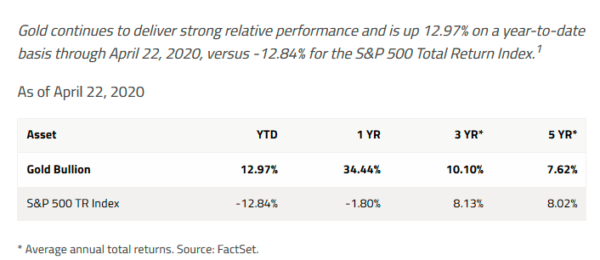

Gold is on the cusp of breaking out to all-time highs in U.S. dollars and has already done so in virtually every other currency. Gold mining stocks continue to lag the metal and, in our opinion, represent a compelling investment opportunity at this moment. The COVID-19 pandemic panic was merely the black swan that punctured a financial market asset bubble that took almost a decade to inflate.

Think of the pandemic as the pin that punctured the credit balloon. In a few months, the pandemic will ease (hopefully) with the formulation of a COVID-19 vaccine, widespread testing and other responses that will surely come from the healthcare industry. However, the fiscal and monetary policy damage committed by all governments to save the world has created a debt hangover that will linger for years. Economic growth will rebound but only to subpar levels once extreme health-related restrictions are lifted and “stimulus†kicks in.

The requisites for robust economic growth most likely to misfire are investment confidence and bank lending. Both have been severely compromised. Whether this landscape evolves into a long stretch of deflation or combusts into untamed inflation remains to be seen. What seems quite apparent is that traditional Keynesian stimulus measures are in their endgame. They will most likely deliver only steadily diminishing returns. Starkly opposite economic outcomes are possible from this policy morass; both would be positive for gold but negative for real returns on fixed income or equities.

Q1 Marks a Pivotal Turning Point for All Asset Classes

As of this writing, gold is trading about 10% less than its all-time high of US$1,900 attained nine years ago (September 2011). In effect, it has gone nowhere for a decade despite a tectonic shift in the investment and economic outlook. A lengthy correction lasting until 2016 and subsequent churning resulted in the establishment of a powerful multi-year basing structure. From this base and with strong macroeconomic tailwinds, we believe new highs well above $1,900 can be achieved over the next four years.

Despite enthusiastic advocacy and much chatter from investment luminaries, including Ray Dalio, Jeff Gundlach, Seth Klarman and others, gold remains severely and inappropriately underrepresented in the portfolios of fiduciaries, endowments and family offices. Flows into channels such as gold-backed exchange traded funds (“ETFsâ€) have been strong relative to previous low levels, but must still be considered a trickle in terms of what could still come.

Figure 1. Gold-Backed ETFs Reach Record Levels

Global gold-backed ETFs added 298 tonnes and net inflows of US$23 billion in Q1 2020 — the highest quarterly amount ever in absolute U.S. dollar terms and the largest tonnage additions since 2016.

Source: World Gold Council. Data as of 3/31/2020.

In our opinion, the first quarter of 2020 will mark a pivotal, secular turning point for all major asset classes including equities, bonds, gold and currencies. A return to the pre-2020 financial market normalcy and investment complacency is unlikely. In our view, consensus hopes remain high that the credit smash is only a temporary repercussion of the health scare. We disagree and suggest the effects will be long lasting.

Despite the solid price gains achieved by gold in the past two years, there is much more upside to come as investors gradually give up on repeated equity market bottom fishing and the hope of a return to financial market normalcy. A full reversal to the previous complacency cannot take place following a brief crash. The mood change will more likely become pervasive after grueling stretches of disappointing returns from previously successful investment strategies.

Unprecedented Central Bank Monetary Expansion

In our view, the decade preceding 2020 was characterized by the systematic stifling of price discovery for interest rates and the appropriate dependent valuations for financial assets. Such distortion was made possible only by unprecedented central bank balance sheet expansion that encouraged, abetted and rewarded risk taking in the form of ever greater leverage.

The prolonged somnolence of gold was among the most egregious price distortions of the previous decade and this suppressed interest in the metal as a risk mitigator and portfolio diversifier. Disinterest was fed in large part by the nearly universal expectation that the past would always be prologue and that highly leveraged financial and economic structures would perpetually result in outsized returns. In our view, the greatest change stemming from the credit bust will be a mood shift or paradigm change in the opposite direction.

At gold’s previous peak in 2011, the combined balance sheets of the U.S. Federal Reserve (“U.S. Fedâ€) and the European Central Bank (“ECBâ€) totaled approximately US$5.5 trillion. Today, that number is more than $11.4 trillion and rapidly moving higher. The USD gold price is still lower than nine years ago. In our view, gold price is still well below where it should be and will likely trade higher in the new macro landscape.

Figure 2. Pandemic Policy Response Pushes Global Balance Sheets to Record Levels Source: Bloomberg. Data as of 3/31/2020.

Source: Bloomberg. Data as of 3/31/2020.

Gold Mining Stocks are Inexpensive

If gold is not correctly priced for what has transpired and what lies ahead, gold mining stocks are even more inappropriately priced. Based on current metal prices, most companies are generating positive earnings and cash flow and in many cases, free cash flow that can be applied to higher dividend payouts. Compared to other sectors of the economy, the gold mining industry stands almost alone in looking forward to strong 2020 earnings and a positive outlook for 2021.

2020 free cash flow yields for large-cap producers range from 3%-7% and 6%-25% for intermediate producers based on conventional sell-side research. The stats are similar or better for 2021 based on spot gold prices. As Figure 3. shows, mining stocks are inexpensive in absolute terms and have never been so cheap relative to the gold price.

Figure 3. Gold Equities Are Undervalued Relative to Bullion

Ratio of XAU Index to Spot Gold (12/23/1983-3/31/2020)

Since 2008, the relative valuation of gold equities to gold bullion has fallen 75% from the prior 25-year average. The ratio of the XAU Index to spot gold averaged 0.2497x for a quarter century through 2008. As of 3/31/2020, the ratio was 0.0501x.

It is undoubtedly true that the industry will suffer health-related mine shutdowns and other shortfalls this year. Much of the disruption potential has already been broadcast and priced into the market. Some downside news may still have yet to surface. However, most miners are not financially levered and should be able to survive a few quarters of lower or no production. Unlike the airline, leisure, retail and manufacturing sectors, gold not produced today should grow in value and be produced at higher prices and lower costs next year and those beyond. It is not the same story for many other sectors of the economy. Based on fundamentals, gold stocks are inexpensive. By contrast, several other sectors of the economy could face long stretches of poor earnings, bad news flow and financial woes.

The gold mining sector registered a decline of approximately 20% in Q1 (as measured by GDX2) as shares did get battered by indiscriminate liquidations during March. However, as of this writing, two weeks after the close of the quarter, most shares trade near to where they stood at the beginning of the year, and have certainly registered outstanding performance in relative terms. It is remarkable that the largest sector ETF, GDX, suffered outflows of $381 million3 during the quarter at what could be the threshold of an upside breakout. In a favorable cycle for the gold price, mining stocks have historically delivered outperformance 3 to 5 times that of the metal itself.

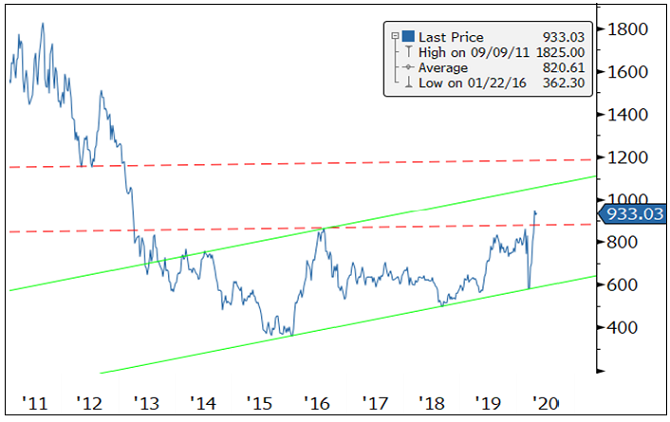

Gold mining shares continue to be viewed by investors with deep skepticism as reflected by valuation and flows. When we scan Figure 4, it appears to us that the sector is on the verge of an upside breakout from a multi-year base should our assessment of the macroeconomic environment prove correct.

Figure 4. NYSE Arca Gold BUGS Index (HUI4)

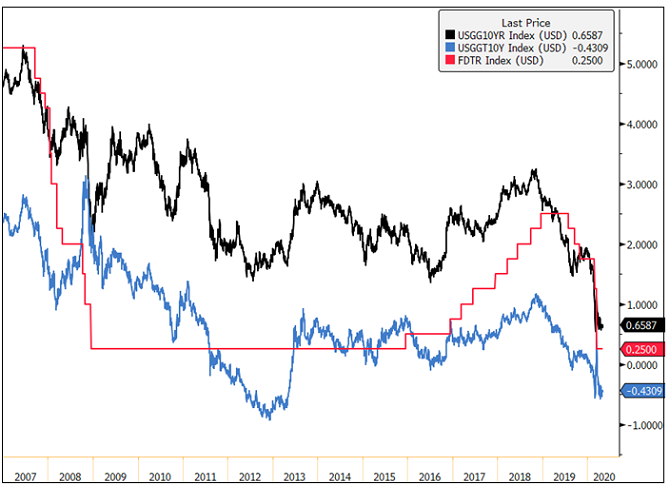

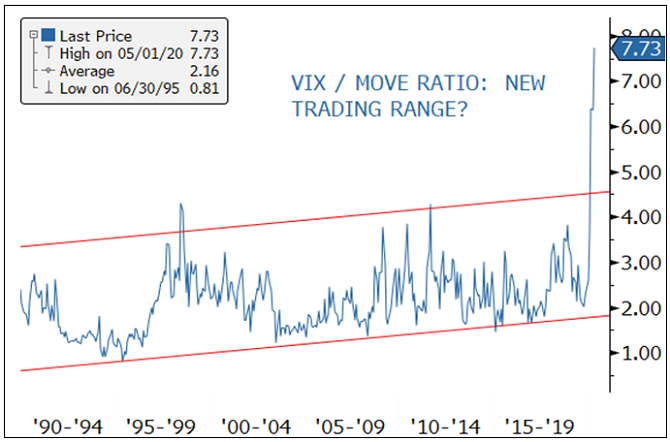

Monetary and Fiscal Policy Going Ballistic

There is no need to belabor the obvious. However, the consequences of these actions have yet to be priced into the financial markets or gold. The risk parity trade has fallen short, partly because bonds were caught up in the indiscriminate liquidations of Q1. Looking forward, bonds may no longer be able to play the safe haven role they traditionally filled to balance equity risk. The vacuum could be filled in part by increased gold exposure for all classes of investors. Sovereign credit liquidity injections are likely to remain significant and permanent. The bond market has become socialized. Owning Treasury bonds of any duration could become akin to parking Treasury bills, with little upside and considerable risk of impairment through inflation. Gold is the antidote to the fixed-income investor’s dilemma.

Gold is extremely under-owned, under-represented, and poorly thought of in the circles of conventional investment thinking. It is still considered to be a fringe asset. Just ask Goldman Sachs which recently advised its clients:

“We concluded then (2010) that gold does not have a role as a strategic asset class in clients’ already well-diversified portfolios. We have updated the research and the evidence is even more compelling today than it was then.” (4/5/2020; Goldman Sachs Investment Strategy Group)

We remind the reader that Goldman is the same firm that in December 2019 declared the U.S. economy to be “recession proof†and then in March 2020 cautioned that stocks had substantial further downside:

“Overall, the changes underlying the Great Moderation appear intact, and we see the economy as structurally less recession prone today.†(12/31/2019; Goldman economists Jan Hatzius and David Mericle)

“Goldman Sachs on Friday dramatically cut its U.S. economic forecast, saying it now expects GDP to decline by 25% in the second quarter of 2020 because of the coronavirus panic.†(3/20/2020; Business Insider)

“What is your estimate for the S&P 500 by yearend 2020? David Kostin, “3400.†(1/2020; GS Podcast, David Kostin Goldman, U.S. chief equity strategist and Jake Siewert)

“Kostin thinks the market goes lower. ‘In the near term, we expect the S&P 500 will fall towards a low of 2000.’†(3/22/2020; Yahoo Finance)

Goldman’s commentary is, in our opinion, a reasonable proxy for conventional wisdom. One could easily find other embarrassing examples of mainstream thinking ignorant of the best-performing asset class (by far) versus equities and bonds since 2000.

Contrarians and value investors, take note! The secular gold bull that began in 2000 and corrected for a few years has returned to life with renewed vigor. Pullbacks — price declines during this uptrend — should be bought. The setup for gold and gold mining shares ticks every box for highly rewarding investment returns.

Figure 5. Gold Has Outperformed Stocks, Bonds and USD over the Past 20 Years

Returns for Period from 12/31/1999-4/13/2020

Source: Bloomberg. Period from 12/31/1999-4/20/2020. Gold is measured by GOLDS Comdty; US Agg Bond Index is measured by the Bloomberg Barclays US Agg Total Return Value Unhedged USD (LBUSTRUU Index); S&P 500 TR is measured by the SPX; and the U.S. Dollar is measured by DXY Curncy. Past performance is no guarantee of future results.

Figure 6. Gold Provides Portfolio Diversification

Gold provides diversification in a portfolio, and has low correlation with other asset classes. The period measured is April 1, 2015 to April 1, 2020.

* Source: World Gold Council. Period from April 1, 2015 to April 1, 2020, based on monthly returns. Gold is measured by the LBMA Gold Price; stocks by the S&P 500 Index; commodities by the Bloomberg Commodity Index;Â Bonds by the BarCap Treasuries and Corporates.

| 1 | The S&P 500 or Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. You cannot invest directly in an index. TR, “Total Return”, represents the index with dividend income reinvested. |

| 2 | VanEck Vectors Gold Miners ETF (GDX) seeks to replicate the NYSE Arca Gold Miners Index (GDMNTR), which is intended to track the overall performance of companies involved in the gold mining industry. |

| 3 | Source: ETFtrends.com. |

| 4 | The NYSE Arca Gold BUGS Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. |

SOURCE: https://sprott.com/insights/sprott-gold-report-secular-gold-bull-resumes-with-force/#

The onset of the

The onset of the  Only twenty eight percent of global silver production is sourced from primary silver mines. Last year’s World Silver Survey delineated the world’s largest primary silver mines. Topping the list was Fresnillo’s Saucito mine in Mexico, which in 2018 produced 19.9 million ounces. Second spot went to Polymetal’s Dukat mine in Russia (16.5Moz), followed by Buenaventura Mines’ Uchucchacua mine in Peru, producing 15.4Moz.

Only twenty eight percent of global silver production is sourced from primary silver mines. Last year’s World Silver Survey delineated the world’s largest primary silver mines. Topping the list was Fresnillo’s Saucito mine in Mexico, which in 2018 produced 19.9 million ounces. Second spot went to Polymetal’s Dukat mine in Russia (16.5Moz), followed by Buenaventura Mines’ Uchucchacua mine in Peru, producing 15.4Moz.  According to the US Geological Survey, Mexico is by far the largest producer, outputting 6,300 tonnes in 2019, followed by Peru and China, at a respective 3,600t and 3,800t. Next on the list are Russia, Poland and Australia. Global silver production in 2019 totaled 27,000 tonnes, or 868 million ounces.

According to the US Geological Survey, Mexico is by far the largest producer, outputting 6,300 tonnes in 2019, followed by Peru and China, at a respective 3,600t and 3,800t. Next on the list are Russia, Poland and Australia. Global silver production in 2019 totaled 27,000 tonnes, or 868 million ounces.