- A steady roll-out of wireless products, such as power tools, vacuums, phones and computers over the past decade has driven increased demand for the metals that go into lithium batteries

- Franklin Equity Group’s Steve Land explains why the growing adoption of electric vehicles (EVs) is one particular development that is arousing investor interest in those resources

A Bit of Background

For decades, lithium and its compounds have been used in a variety of ways, including in pharmaceuticals and chemical manufacturing. However, lithium’s popularity in recent years can be tied to the demand for lithium-ion batteries that power EVs, as well as smartphones, laptops and other products.

Although they are called lithium-ion batteries, they also contain significant amounts of cobalt, copper, nickel and sometimes manganese or aluminum. Battery technology continues to evolve, as companies look to reduce their reliance on harder to source materials. However, a need to produce a safe battery capable of delivering the high-performance characteristic needed for an EV makes this a slow process. Given the potentially rapid growth in EVs, battery suppliers are worried about shortages of critical elements in the years ahead.

The World Embraces Electric Vehicles

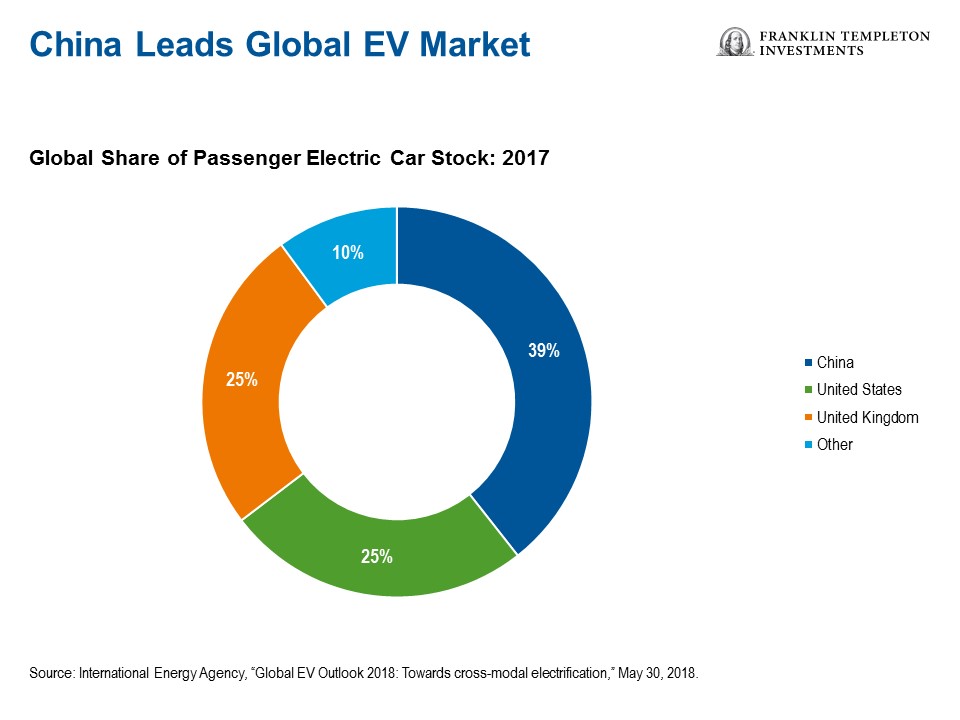

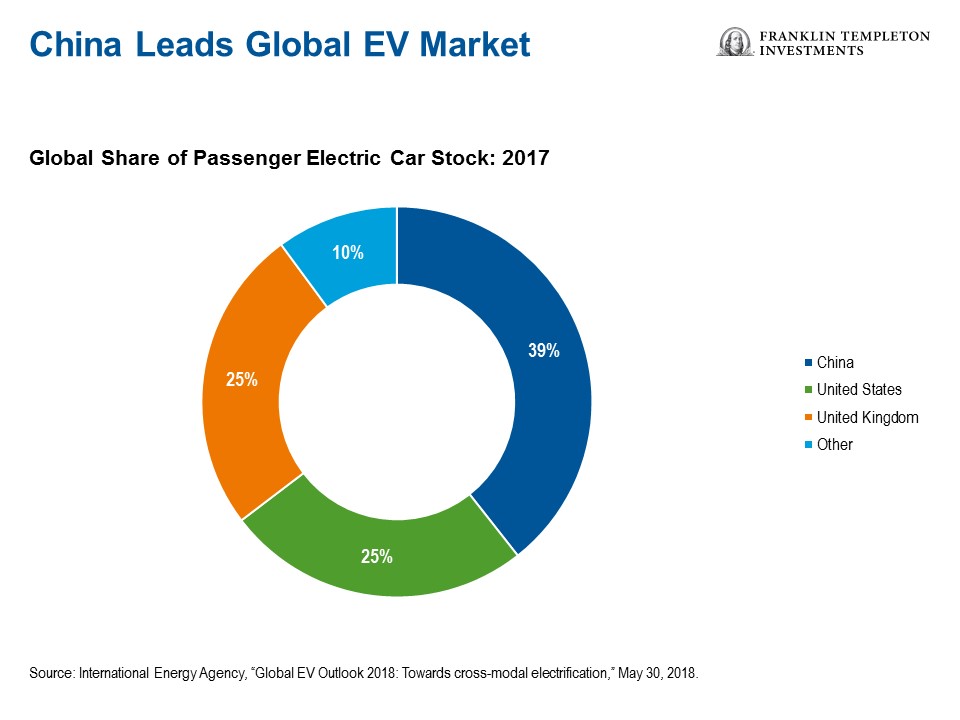

According to the International Energy Agency (IEA), by the end of 2017, there were more than three million EVs globally.1Â As the chart below shows, China has the largest stock of these vehicles, with more than 1.2 million EVs.

China has the longest-running national program to build up its EV volumes, including financial incentives to manufacture and buy the vehicles, as well as build out the country’s EV-charging station infrastructure. However, major world economies, including France, India, the United Kingdom and Norway, have set strict target dates by which they want to have specific percentages of EVs on the road.

Based on these new policies, the IEA projects there could be as many as 125 million EVs on the world’s roads by 2030.2 Under its high-adoption scenario, where EVs comprise 30% of the global auto market by 2030, the agency projects up to 220 million electric cars could be on the road by then.3

Demand for EV Batteries Rises

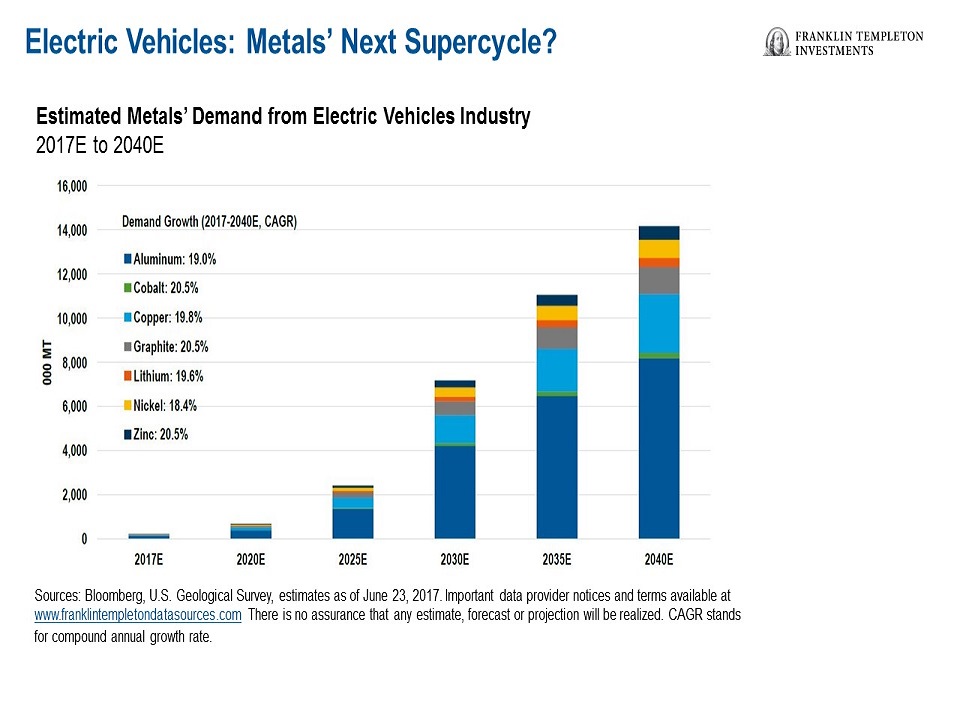

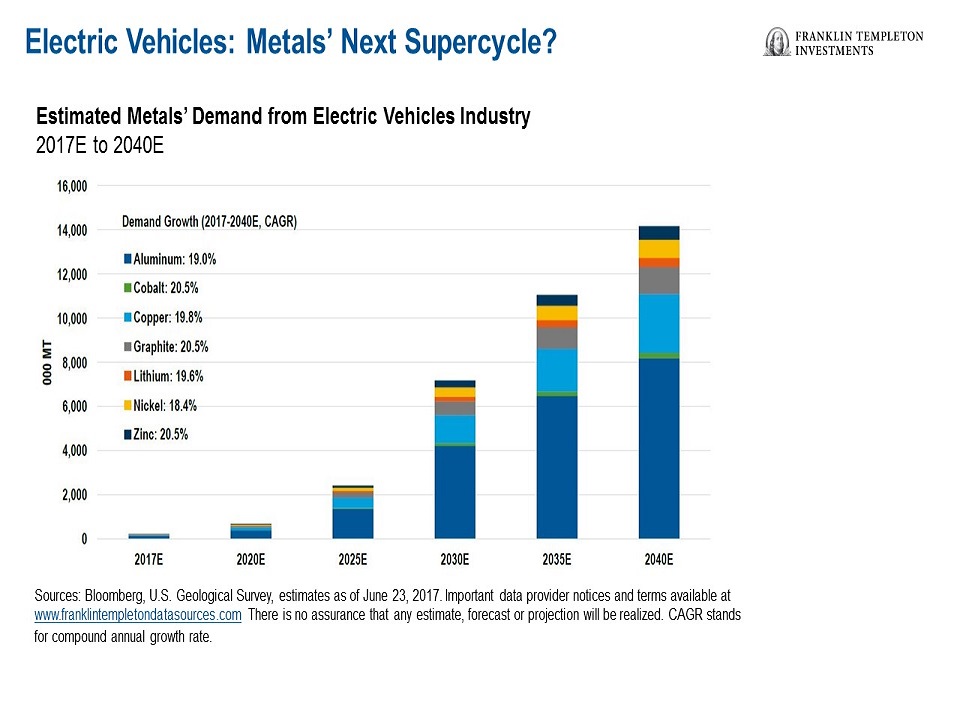

In our view, the demand for lithium-ion batteries from technology firms and vehicle manufacturers is likely to grow exponentially, with automakers already scrambling to secure supplies as more customers switch their gas-guzzling vehicles for an electric alternative with significantly lower maintenance and operating costs. As the chart below shows, Bloomberg projects demand for both lithium and cobalt from the EV industry to increase at a compound annual growth rate of about 20% through 2040.4

The growing adoption of EVs has already led lithium and cobalt prices to rise dramatically over the past two years. In 2017 alone, the prices for lithium and cobalt rose 29% and 129% respectively, and many producers’ share prices also increased sharply.5

The Road Ahead for Lithium Battery Production

Lithium is a relatively common element, so many market observers believe there should be enough lithium in the ground to meet the needs of an electric-car future. However, we’ve already seen periods of market disruption amid concerns that heightened demand for lithium-ion batteries for EVs, laptops, drones and smartphones could prompt shortages.

Although common, developing naturally occurring lithium into a form and purity level suitable for modern battery usage can be a challenging process. Producers are building new, more efficient processing centers in response to the expected demand spike but it can still take several years for a new plant to reach the required specifications for EV battery-grade lithium.

With cobalt, virtually all (99%) of the world’s supply comes as by-products, where a small amount of cobalt is recovered from certain large copper and nickel mines around the world, making it difficult to grow supply. Although the nickel and copper markets are already much larger with diverse areas of demand, EV growth can still be a significant demand driver, especially when combined with the limited current investment in new mines.

Investment Implications

Despite the IEA’s rosy outlook for EV adoption, its trajectory is likely to remain a hotly debated topic for the next decade. On the one hand, it seems clear that with tightening government emission standards and a growing consumer desire for low-pollution vehicles, EVs are going to be a critical part of the transportation mix going forward.

On the other hand, we do see some possible production issues for the metals that comprise EV batteries in the near term. The mining industry is still recovering from explosive Chinese-led demand growth in the early 2000s, a boom that resulted in the development of many of the world’s known ore bodies. What is left either requires higher-than-average costs or exists in more challenging mining jurisdictions such as central Africa.

Also, it typically takes about 15 years from first discovery to production for new mines. Mining companies need this lead time for exploration, engineering studies and proper environmental work before they can even consider beginning construction on new mines.

At this time, there are relatively few new copper and nickel projects in the development pipeline. Instead, major mining companies are focused on repairing balance sheets and returning cash to shareholders, coming off of a period of rapid expansion and cost blowouts.

The Democratic Republic of Congo (DRC) accounts for about 63% of the world’s cobalt production,6 and many of the world’s undeveloped, low-cost copper and cobalt deposits are located in the DRC. That presents many unique operating and regulatory challenges as well as a concentration of supply risk to the EV industry.

Battery manufacturers are looking for ways to reduce the amount of cobalt in lithium batteries. However, it remains a critical safety and performance component for several of the leading battery chemistries.

The market for lithium outside of the battery industry is limited, so EV adoption will require the market to grow multiple times its current size. There are a number of lithium projects moving forward, but there are relatively few examples in recent history where raw materials companies have tried to deliver such a large increase in production in such a relatively short timeframe. Based on our experience, the only thing for certain is that all of the projects won’t be on time and under budget.

On paper, the amount of mined lithium seems to be tracking ahead of current demand scenarios, leading to a number of bearish forecasts from several analysts. The real challenge with lithium is less with the mining and more with the industry’s ability to process and upgrade the material to a high-quality, battery-grade product. As a result, we believe the companies that are best positioned to benefit from EV demand growth are those with existing lithium capacity capable of delivering reliable, high-quality, battery-grade supply.

Mass adoption of EVs also has significant implications beyond the battery. Major infrastructure improvements will be required to create charging networks capable of high-speed charging. New power sources will have to be developed to provide the energy, and significant power distribution upgrades will have to take place to accommodate high voltage at-home charging in many parts of the world. These improvements are favorable for the copper and aluminum demand outlook.

Overall, we see a positive backdrop developing over the next decade for metals tied to the global roll-out of EVs, and thus we see opportunity in natural resource companies with exposure to the key building blocks of an electrified future.

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any industry, security or investment.

This information is intended for US residents only.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

To get insights from Franklin Templeton Investments delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_US and on LinkedIn.

What are the Risks?

Franklin Natural Resources Fund

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors or general market conditions. Investing in a fund concentrating in the natural resources sector involves special risks, including increased susceptibility to adverse economic and regulatory developments affecting the sector. Growth stock prices may fall dramatically if the company fails to meet projections of earnings or revenue; their prices may be more volatile than other securities, particularly over the short term. Smaller companies can be particularly sensitive to changes in economic conditions and have less certain growth prospects than larger, more established companies and can be volatile, especially over the short term. The fund may also invest in foreign companies, which involve special risks, including currency fluctuations and political uncertainty. These and other risks are described more fully in the fund’s prospectus.

Investors should carefully consider a fund’s investment goals, risks, sales charges and expenses before investing. Download a prospectus, which contains this and other information. Please carefully read a prospectus before you invest or send money.

__________________________________

1. Source: International Energy Agency, “Global EV Outlook 2018: Towards cross-modal electrification,†May 30, 2018. The report refers to an electric car as either a battery electric vehicle (BEV) or a plug-in hybrid electric vehicle (PHEV) in the passenger light-duty vehicle (PLDV) segment. It does not include hybrid electric vehicles (HEVs) without a plug.

2. Source: International Energy Agency, “Global EV Outlook 2018: Towards cross-modal electrification,†May 30, 2018.

3. Ibid.

4. Sources: Bloomberg, U.S. Geological Survey, estimates as of June 23, 2017. Important data provider notices and terms available at www.franklintempletondatasources.com.

5. Source: Bloomberg New Energy Finance, “The Force Is With Clean Energy: 10 Predictions for 2018,†January 16, 2018. Important data provider notices and terms available at www.franklintempletondatasources.com.

6. Source: Bloomberg, “We’ll All Be Relying on Congo to Power Our Electric Cars,†October 27, 2017. Important data provider notices and terms available at www.franklintempletondatasources.com.

The Global X Lithium ETF (LIT) closed at $32.43 on Tuesday, up $0.07 (+0.22%). Year-to-date, LIT has declined -16.33%, versus a 1.92% rise in the benchmark S&P 500 index during the same period.

Source: https://etfdailynews.com/2018/07/04/lithium-demand-continues-to-soar-lit/