- Palladium and platinum are irreplaceable as auto catalysts

- Palladium is essential in catalytic converters for gasoline-powered engines

- Platinum is necessary for production of catalytic converters for diesel engines

Platinum group metals (PGM’s) fly under the radar of investors in the world of mining. The evidence is all around us.

Like gold and silver, these are precious metals: 28% of platinum demand is specifically for jewelry and investment purposes, and 17% of palladium demand is for jewelry/investment. Yet when investors think “precious metalsâ€, typically all they consider are gold and silver.

Palladium and platinum are also vital for industry. Indeed, these are arguably the first two green metals. When investors think “greenâ€, they immediately look to the electric vehicle market, and the lithium-ion batteries that power these vehicles. However, before the EV came to market, it was palladium and platinum that have played crucial roles in mitigating harm to the environment.

Palladium and platinum are irreplaceable as auto catalysts, used in the manufacturing of the catalytic converters that have dramatically reduced toxic emissions from internal combustion engines. Palladium is essential in catalytic converters for gasoline-powered engines (more popular in North America). Platinum is necessary for the production of catalytic converters for diesel engines (more popular in Europe).

image: http://www.stockhouse.com/getattachment/84b58a2c-8be5-4db3-b9cd-822628d5c9ae/NewAgeMetals_Pd_Pt_demand.jpg

image: http://www.stockhouse.com/getattachment/aec2ed11-af8e-44d8-9d0b-b698b28ccbc7/NewAge_catatytic-(2).gif?width=450&height=338

A leading company looking to bring new supply of these metals to market is New Age Metals Inc. (TSX. V.NAM, OTCQB: PAWEF, Forum). NAM is currently advancing North America’s largest undeveloped resource of PGM’s. In a conference call with Stockhouse Editorial, management pointed to the lack of familiarity with these metals.

In terms of price, what has been the best-performing metal over the past ten years? Very few mining investors could answer this question. It’s palladium.

image: http://www.stockhouse.com/getattachment/8df15a5c-5157-45a5-a858-5060b98ce023/NewAgeMetals_pd_10yr.gif

Typically, when demand heats up for a particular metal, prices spike – stimulating additional supply as new mines come online. The increased supply turns into a glut and a bull market becomes a bear market. This hasn’t happened with palladium because the price has never risen high enough to spur such an increase in supply.

This is reinforced when we look closer at the sources for palladium. Russia and South Africa dominate the supply of these metals, with Canada a distant third. However, South Africa’s mining industry has become notorious for declining mine reserves and labour strife. Almost certainly, palladium production there is already at peak levels.

Meanwhile, Russia has been supporting the palladium market for years, selling roughly 15 tonnes per year from state stockpiles. Without these sales, the palladium market could not have remained fully supplied. In 2015, however, Russia’s government announced that it “may significantly reduce exports†of several strategic metals – including palladium.

With the sector in a continuing supply deficit and demand in the auto industry continuing to climb, the price has hit a 17-year high, and has actually exceeded the price of platinum for the first time since 2001. Rising emissions standards require better catalytic converters, implying further increases in demand. An article from December 2017 explains why metals analysts expect continued strength in this market.

The 2015 Volkswagen (ETR:VOW3) emissions-rigging scandal involving diesel-powered vehicles has also led drivers in Europe to gravitate towards gasoline-powered vehicles.

Johann Wiebe, lead analyst at Thomson Reuters’ GFMS Supply Chain & Commodities Research division, said, “diesel vehicles will still be around for awhile, but their share in Europe, the largest market, is estimated to decline from around 45 percent at present to as little as 35 percent in 2025.â€

Meanwhile, George Gero, managing director of RBC Wealth Management, recently told Reuters that palladium, “cannot be reclaimed as easily or as often from junked automobiles as platinum.â€

Clearly, the world needs additional sources of palladium. Even the current price of $1,000+ per ounce has been insufficient to bring this market into equilibrium. This puts the importance of New Age Metal’s multi-million ounce deposit into context. But while palladium prices have been merely insufficient, platinum prices have been truly depressed.

image: http://www.stockhouse.com/getattachment/58a5519d-ba40-45bd-8a27-830881daf1b2/NewAgeMetals_8yrPt.gif

Historically, platinum has always been priced at a significant premium to gold. Yet today, the price of platinum is lower than gold. Putting this fact into proper context, the price of gold is also depressed – so depressed that mine supply of the yellow metal is now falling. Today’s platinum price represents an historic trough for this metal.

The price of platinum must rise dramatically to restore sustainability to this market. The same is true with palladium. Russia’s 2015 announcement means that its stockpiles are no longer an assured source of supply. Given that these stockpiles are a “state secretâ€, they could even be near exhaustion.

New Age Metals is ideally positioned to take advantage of these supply/demand dynamics with its 100%-owned River Valley PGM Project, situated in the Sudbury’s famed mining district. Management has been patiently advancing this project for more than a decade. However, with current market conditions so favorable, the Company is now looking to step on the accelerator pedal.

The River Valley PGM Project

The first question that investors new to this Company will want answered is: how large is the River Valley deposit already?

image: http://www.stockhouse.com/getattachment/29d1798c-307b-4c91-97ea-88a58b5afdfd/NewAgeMetals_PGMresource.jpg?width=450&height=240

Total precious metals approach 2.5 million ounces. Expressed as a palladium resource, this equates to nearly 4 million ounces Pd equivalent (including base metals credits). Expressed as a gold resource, it equates to roughly 2.8 million ounces Au equivalent.

This robust resource is about to get bigger. A new resource estimate is due for release imminently.

Part of the reason why NAM has previously been patient in its development of River Valley was a matter of necessity. An important puzzle-piece was missing from this land package. On August 4, 2016; the Company announced the acquisition of what it has dubbed the “River Valley Extensionâ€: six mining claims previously held by Mustang Minerals Corp.

Harry Barr, the Chairman and CEO of New Age Metals explains why he has coveted these mining claims, and for how long NAM has been seeking to acquire them.

For more than 10 years, management has had its eye on the acquisition of the River Valley Extension. This new acquisition allows our shareholders to control 100% or 16 kilometers of a new PGM mining district.

Solidifying the land package still further, the Company did extensive staking around the boundaries of these claims until management was satisfied they had assembled the whole “puzzleâ€. Since that time, there have been three focal points in development of River Valley:

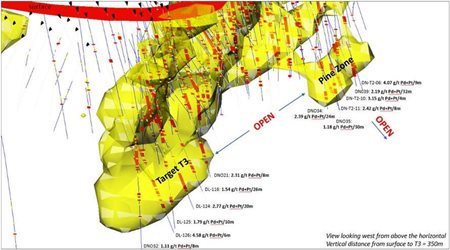

-  Developing NAM’s new Pine Zone and T3 discoveries (to the east of the original deposit).

- Continuing the development of the footwall discovery from T3 to T9.

- Demonstrating that the River Valley Extension can significantly enhance the overall resource

In 2015; New Age Metals reported a “new discoveryâ€: the Pine Zone. This mineralization was located in the footwall areas, east of the main deposit. Not only does this represent additional mineralization at River Valley, the Company has been encountering some higher grade intercepts, as well as significant levels of copper mineralization.

A total of seven drillholes were completed during 2015 and 2016. Highlights include:

- 16 meters @ 2.054 g/t Pd+Pt, 0.091 g/t Au, and 0.179% Cu

- 9 meters @ 4.065 g/t Pd+Pt, 0.176 g/t Au, and 0.280% Cu

image: http://www.stockhouse.com/getattachment/48d89daf-c116-4586-90e2-cfa01cc34a94/NewAgeMetals_newdiscovery.jpg?width=450&height=250

Investors looking to project ahead to the potential of River Valley don’t even need to leave Ontario. Approximately 90 km north of Thunder Bay is the Lac des Iles Mine of North American Palladium, a company that bills itself as (at present) “the only pure play palladium producer in the worldâ€.

Lac des Iles has been in operation for more than 20 years. It is a 6,000+ tonnes per day underground mining operation, with a 15,000 tpd mill. Similar grades to River Valley, very similar geology.

What is different between the two companies? Location. North American Palladium ships its concentrate roughly 1,000 kilometers to Sudbury, the nearest refining facility. New Age Metals is only 100 kilometers from Sudbury, representing 1/10th of the transportation costs.

NAM’s updated resource estimate for River Valley will be a stepping-stone in mine development, providing the first estimate of a resource for both the (new) Pine Zone and the recently added River Valley Extension. Slightly further along the horizon, management is planning to produce the first Preliminary Economic Assessment (PEA) for River Valley.

To further expedite development of the Project, in March 2017 the Company elevated Trevor Richardson from his role as VP Business Development to President and Chief Operating Officer (COO). Talk to Richardson about the exploration potential at River Valley, and you will quickly hear about “footwall mineralizationâ€.

To date, approximately 40 million dollars has been expended on our combined River Valley and River Valley Extension project. The current substantial resource which has been defined, but is a long way from being drilled out, is in the contact mineralization. The contact extends throughout our 16 kilometers. We are most excited about the newly defined footwall mineralization, which we have only completed 3,000 meters of geophysics on, and have already identified the Pine and T3 Zones discoveries.

The plan is to take this geophysics and drilling program from North to South over our entire project. Our ultimate goal is to mine a series of open pits throughout our 16 kilometers, concentrate on site, and ship the concentrates to the long-established Sudbury Metallurgical Complex.

image: http://www.stockhouse.com/getattachment/0333f53b-241d-482c-851e-5df18d5bbb7d/NewAge_newFootwall.png?width=450&height=291

For many investors, the River Valley Project alone would be reason enough to look to add NAM to their portfolio. However, this Company became “New Age Metals†in 2016, when management changed the corporate name to reflect the addition of a new lithium division.

While palladium and (especially) platinum have yet to hit their stride in terms of pricing, the lithium sector is already hot. NAM has acquired five prospective lithium properties, situated in the Winnipeg River Pegmatite Field in southeast Manitoba.

image: http://www.stockhouse.com/getattachment/164a4bdc-44a4-40ba-9aea-a009e8d48e7e/NewAgeMetals_lithiumproperties-(1).jpg?width=450&height=210

This is hard-rock lithium geology, meaning that any future mining would be via conventional mining operations, not the “lithium brine†mining with which most investors are now more familiar. Lithium brine extraction is environmentally and logistically challenging.

Commonly, Lithium brine operations require hyper-arid climates in order to be able to efficiently conduct the large-scale evaporation required to concentrate lithium. The problem is that this form of lithium concentration also requires vast quantities of water. This can result in environmental issues and friction with other water-users in these arid climates.

NAM recently completed a joint venture with Azincourt Energy, a comprehensive agreement covering all five properties. The exploration plan is to spend $500,000 in 2018 to advance three of the five projects.

Many mining and tech analysts would argue that the 21st century represents “a new age†for metals markets: producing large quantities of many metals, for industrial applications that didn’t even exist prior to this century. Many mining investors will see New Age Metals as a strong investment vehicle to help meet this new demand.

Appendix:Â