If you thought small cap social media investor relations was all about opening a Twitter and Facebook account, think again and let me know how you are going to handle all of these tools … or just give us a call.

Archive for the ‘Online Investor Relations’ Category

So You Think You Can Handle Small Cap Online Investor Relations On Your Own?

Posted in Online Investor Relations, Small-Cap CEO Lessons, Social Media Investor Relations | Comments Off on So You Think You Can Handle Small Cap Online Investor Relations On Your Own?

BREAKING: SEC Says “YES” To Social Media. AGORACOM Online IR Platform For Investor Relations & Disclosure

This is simply big – and long overdue – Â news out of the SEC last night. Â In 2008, the SEC allowed companies to use their websites to conduct investor relations and make disclosure. Â As of today, companies can now use social media sites to conduct investor relations, including the release of material news, data and information.

WHY IS THIS SO IMPORTANT FOR US SMALL CAP COMPANIES?

1.  Freedom To Communicate And Create Real Conversations With Investors – Until yesterday, small-cap CEO’s couldn’t say a thing about their businesses without consulting lawyers, their board and anybody else in the compliance process.  This made it extremely difficult – actually impossible – for small-cap companies to release any new information via anything but a press release, especially those small but important tidbits of information that didn’t warrant the expense of a press release.

For example, this specific decision arose from an incident that occurred last summer when NetFlix CEO, Reed Hastings, posted to Facebook that NetFlix had exceeded 1 billion hours in a month for the first time. Â It was an important milestone that Hastings wanted investors to know about – but not necessarily something that warranted a press release or SEC filing.

The SEC took exception and opened an investigation in whether or not this violated selective disclosure rules.

However, as a result of this decision, the SEC now agrees that release of such information via social media sites is sufficient. Â The only requirement is that all companies must make it clear to investors that they plan to use a particular social media site (i.e. AGORACOM).

In the case of AGORACOM, all clients issue press releases announcing the launch of their online IR community. Â Until yesterday, those IR communities were used to post press releases and then answer questions from shareholders. NOW, small-cap executives can make a major leap forward by actually posting helpful information and data to help investors better understand their company and progress.

For example, a small-cap executive at a trade show can now go back to their hotel room and post an overview of the day including the number of visitors to their booth, product feedback, etc. Moreover, small cap companies can now provide regular updates on previously announced or brand new initiatives. Â The possibilities are endless. Â The most important thing is such disclosure can now lead to real conversations with investors that extend well beyond big material news.

This is critical for small-cap companies that typically don’t have or can’t afford a plethora of press releases and want to fill the information gaps with shareholders.

2. Â Significant Savings – In the sentence above, I touched on the fact that most small-cap companies simply can’t afford a plethora of press releases. Â As such, they are forced to release only the biggest, most important news, which significantly limited their frequency of communication with investors. Â The only option was to issue more press releases and spend more $$. Â With this new SEC decision, this is no longer an issue.

Moreover, small cap companies were often forced to issue “kitchen sink” press releases because they would piggyback smaller tidbits of information and updates with material press releases. Â I don’t have to tell you how that causes expenses to skyrocket when you are being charged by the word.

3. Â Size Doesn’t Matter – It doesn’t matter if your online shareholder audience is 200,000 or 200. Â As long as you’ve clearly told investors where to look for your information, you’re good to go.

4.  Social Media vs Your Website – Investors simply don’t have time to navigate to every website of companies they’re either invested in, or interested in.  They overwhelmingly prefer financial communities such as AGORACOM, or even non-financial communities such as Twitter where all information is available under one roof.  Thanks to this decision, small-cap companies can now meet investors where they exist, rather than forcing them to visit stand alone websites that rarely change with the exception of new press releases.

CONCLUSION

This is a great day for small-cap companies and investors that want to truly engage in meaningful discussions without having to worry about disclosure rules and expenses. Â To be clear, you are still going to issue important, material press releases by press release.

However, much like the NetFlix example above, it is all those valuable morsels and tidbits of information that can now finally be set free to open the lines of communications with current and prospective investors.

“Great day” is actually an understatement. Â It is more accurate to say this day is monumental, even epic for small-cap investor relations.

To discuss this post and your next investor relations steps, contact me right now.

Regards,

George Tsiolis, Founder

AGOARCOM

Posted in Online Investor Relations, SEC, Small-Cap CEO Lessons, Small-Cap Investor Revolts, Social Media Investor Relations | Comments Off on BREAKING: SEC Says “YES” To Social Media. AGORACOM Online IR Platform For Investor Relations & Disclosure

Small-Cap CEO Lesson: You Are Not Berkshire Hathaway, So Write Better Headlines For Your Press Releases

I came across this press release today:

————

Canadian Overseas Petroleum Reports Second Quarter Results

CALGARY, Aug. 10, 2012 /CNW/ – Canadian Overseas Petroleum Limited (“COPL” or the “Company”) (XOP: TSX-V) announces its second quarter results for the three months and six months ended June 30, 2012. The Interim Financial Statements and Management’s Discussion and Analysis for the second quarter can be viewed on the company’s website at www.canoverseas.com or on SEDAR at www.sedar.com under the COPL listing.

————-

That was the entire press release, with the usual About and Contact information below it. Â Here are my comments:

1. Â I understand the trend towards notice and access press releases, which basically entails companies advising they have issued a press release and letting you know where you can read it. Â It has numerous advantages, especially the cost of having to distribute a long quarterly report. Â Companies across the entire cap-range are using this new technique to cut down costs, including the richest man on the planet.

(Side Note – What Is A Notice And Access Press Release? – Notice and Access press releases give companies the option to stop sending full-text news releases and instead use paid PR wires to advise investors that new information is available on companies’ websites and provide direct links to the information.) Via IR Web Report

2.  Canadian Overseas Petroleum, or any small cap for that matter, is not Berkshire Hathaway.  If you want new investors to read your press releases, you absolutely have to get more descriptive in your headline.  Tease us with some figures related to revenues, income, production, growth … anything to make investors want to pick your press release out of the pile and actually click through for more.

3. Â We now live in a social, interconnected world where your actual and prospective investors can “Like”, “Tweet”, “Retweet” and post compelling news with just one click. Â Give them a reason to get you and your news viral. Â I guarantee you that “Reports Second Quarter Results” doesn’t work for anybody with a market cap under $100 Million.

Press releases are an important component of investor relations for any small-cap company … make them count.

Regards,

George

Like this Small-Cap CEO Lesson? Â View all of my Small-Cap CEO Lessons here.

Posted in Online Investor Relations, Small-Cap CEO Lessons, Social Media Investor Relations | Comments Off on Small-Cap CEO Lesson: You Are Not Berkshire Hathaway, So Write Better Headlines For Your Press Releases

Small-Cap CEO Lesson: The 8 Best Investor Relations Practices During Market Turmoil

Much of my time this week has been spent flagging calls from small-cap CEO’s asking what they should be doing about Investor Relations in this market. Â Given the fact I can’t get on the phone with all of you, I’ve listed 8 effective things you should be doing right now to take control of your investor relations during this market turmoil.

GETTING INTO THE RIGHT MINDSET

Before even starting on my 8 best practices below, you are going to need to get into the right mindset.  Specifically, it is important to understand that during this kind of market environment, investor relations is not just about increasing your share price. Every company is getting hit, so to think you can buck that trend isn’t realistic.

Rather, your goals in this environment are:

- Short Term – To mitigate, even stop any further losses to your market capitalization.

- Longer Term – To take advantage of competitors with weak or non-existent strategies and attract new investors.

Both goals are heavily dependent on choosing the right philosophy. Â Specifically:

(+) Â If you listen to me and get proactive, a properly executed strategy will yield great short and long-term results.

(-) Â If, as some small cap CEO’s have told me, you choose to run for cover and fail to communicate, Â you are creating a guaranteed recipe for disaster.

THE 8 BEST INVESTOR RELATIONS PRACTICES DURING THIS MARKET TURMOIL

With all this in mind, here is the AGORACOM recipe for success during periods of market turmoil.

1]Â Â Silence Is Death -Â Have you ever had a friend or family member owe you money but suddenly become hard to get a hold of? How did you feel? Do not make your shareholders feel this way or they’ll write you off as a bad debt and wash their hands clean of you. This is no time to duck for cover if you believe in your business, your plan, your management team and your board.

2]  Provide Long-Term Vision – Investors are worried by these short-term market gyrations. It is your job to get shareholders to look beyond this gyration and remind them that you are building a long-term business that will survive and thrive far beyond 2012.

3]  Accentuate Your Strengths – Provide shareholders with a press released corporate update that discusses the strength of your product / services / project / technology. Be sure to also address the long-term viability and strength of your industry. Remind investors that there will always be demand for your products and you are one of the companies that will be benefiting from it.

4]  State Of The Union – Support your corporate update with a multi-media “state of the union”. Specifically, tape an audio or video address for your shareholders that conveys confidence. If your text based corporate update in step 2 provides the facts that assure investors, your multi-media address will provide your shareholders with confidence they are in the right hands. No matter what the context, people need to hear from their leaders.  Think Winston Churchill in WW II, or George Bush after 9/11.

5]  You’re Not Bullet Proof – Be honest about any negative impacts to your operations.  Shareholders don’t expect you to be bullet-proof, so openly telling them about the 1 or 2 items in your business that have been impacted demonstrates an honest and realistic management team.

6]Â Â Differentiate Yourself From The Pack -Â Though you should never specifically name a competitor, do to tell investors about any significant general problems with your competitors, some of whom will not make it through this period due to poor planning or business models. Differentiate yourself from the pack.

7]  Business As Usual - Do not hold back communications as part of a “market timing” strategy. Yes, be careful not to issue press releases on a specific morning where futures are showing significant weakness due to a macro event – but it is otherwise business as usual, so get on with your business and continue issuing press releases.

8]  Capitalize On New Blood - Never, ever stop looking for new investors. You are in a position to benefit from the following two ways:

First, we all know that a significant portion of small-cap and micro-cap stocks are unfortunately built upon unviable business models. That is the nature of the business. Shareholders in those companies will see the writing on the wall, take their tax losses and start looking for high-quality alternatives that can help them get back above water over the next 12-24 months. Be that alternative!

Second, investors that were smart enough to raise cash earlier in the year will be looking to come back into the markets over the next few months. They will be looking for good companies with good management teams executing a plan that will succeed over the next 2-3 years. Be there when they come knocking!

CONCLUSION

If you need any more proof about the validity of this plan, I ask you to once again follow the AGORACOM experience. Despite the fact markets are going through tough times, we have managed to maintain a status quo and actually grow while other investor relations firms suffer.

Why? We practice what we preach:

A] Â We openly communicate with and help our customers as much as ever during this turmoil. Â We don’t go silent.

B] Â We continue marketing ourselves via search engines, our blog and newsletters to attract new customers.

If you follow our plan, never lose site of the fact that you currently have great shareholders and remember there are millions of other shareholders looking for companies like yours, you will succeed in mitigating short-term losses while maximizing long-term success.

Regards,

George

Did You Find This Article Helpful? Â What To Do Next …

1]  Read George’s Small-Cap CEO Lessons For Free Powerful Advice On Great Investor Relations

2] Â Contact AGORACOM To Discuss Your Online Investor Relations Needs and Solutions

Posted in All Recent Posts, Online Investor Relations, Small-Cap CEO Lessons, Social Media Investor Relations | Comments Off on Small-Cap CEO Lesson: The 8 Best Investor Relations Practices During Market Turmoil

Small-Cap CEO Lesson – Why You MUST Issue Press Releases By 8:30 AM EST

Â

I first published this story in August of 2007 – but it is even more important today than ever before.

Now that AGORACOM Small Cap TV has cracked 400,000 views, one of the things we have noticed in our morning research is that small-cap companies continue to release news just at or before the open. This might have been a smart practice back in the day when only brokers could access press releases on their screens but it makes no sense whatsoever now that the web opens up your press releases to the entire world.

Why?

Folks, we are in a social media world (and never going back) in which investor communities are becoming invaluable sources of information for small-cap investors. As a result, small-cap and micro-cap information is being analyzed and discussed by and on AGORACOM, StockTwits, Twitter, Bloggers, Commentators, Podcasters, and Vloggers everyday.  Much of this collaboration takes place well before market open as online  investors prepare for their day.  The more time you give them to discover your news, the more time you give them to share it via their preferred networks …. for free!

THE LEAST THAT YOU COULD DO

Being the most recent news just prior to market open is no longer a smart strategy. Â It’s a dumb strategy. Â If you want your great news syndicated around the web by these incredible reporting sources, you have to give them a chance to see your news, digest it and report on it. That can’t happen at 9:15 because professional sources such as AGORACOM TV have a cut-off of 8:45 AM so that we can be published by 9:45. Â Individual investors also have the reality of a job that most begin by no later than 9:00 AM, which explains why most are doing their research between 7:30 – 8:30.

As such, if your press release is coming out at 9:30, you’ve robbed yourself of potential mass coverage by one or more sources that might have otherwise picked up your news and sent it right around the world.

Bottom line – put your news out by no later than 8:30 AM EST. In fact, somewhere between 8:00 and 8:30 AM EST makes the most sense …. unless shunning free coverage is actually part of your investor relations plan.

Best,

George

Posted in Online Investor Relations, Small-Cap CEO Lessons, Social Media Investor Relations | Comments Off on Small-Cap CEO Lesson – Why You MUST Issue Press Releases By 8:30 AM EST

Online Investor Relations Done Right – UC Resources Embraces Skype, Online Q&A, Video To Reach Shareholders

When Gary Monaghan was appointed CEO of UC Resources a few months ago, it was to usher in a new era for the company and its shareholders. Â Nonetheless, you hear that just about anytime a new coach takes over a team or a company, so some shareholders of UC Resources could have been forgiven if they didn’t hold their breath. Â Well, it’s time for them to exhale because Gary has done nothing less than exceed expectations by embracing online investor relations to create better communications and relationships with shareholders. Â Here are the highlights:

- On November 10th, UC Resources announced the sale of its interests in the highly promising McFaulds Lake (a.k.a. Ring Of Fire) region for $6,000,000 to Cliffs Natural Resources in order to focus on its Mexican production and exploration projects

- With some shareholders expressing concern over this shift away from the Ring Of Fire, Gary took to Skype just a couple of days later to communicate his specific reasons for the move and why it was in the best interests of shareholders. Â Shareholder response was overwhelmingly positive and appreciative of Gary’s proactive step to reach out and speak with them.

- On November 30th, UC issued a further press release to update shareholders on the status of the transaction AND the company’s plans upon successful close of the sale in January.

- On January 6, 2012, UC Resources announced closing of the $6,000,000 sale.

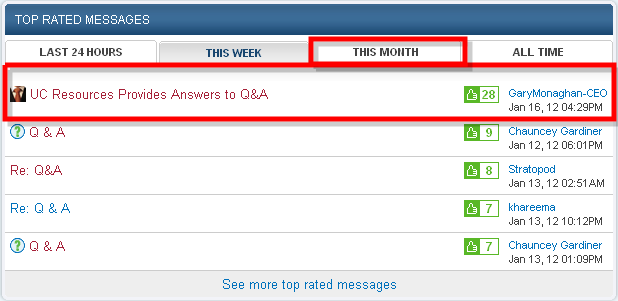

- On January 12, less than a week later, Gary announced an online Q&A in which shareholders were invited to ask questions about the company’s Mexican assets and future direction

- On January 16, Gary and the company provided answers to all of the questions asked by investors

- On January 17, Gary and UC Resources broadcast a video to update their shareholders on the sale, as well as, their Mexican Operations

Gary and UC Resources may be clients of AGORACOM – but that doesn’t take away from the fact that he simply gets online investor relations.  Specifically, though conferences and road shows are great places to meet your investors in person 3-4 times per year, online collaboration is the only way to truly collaborate with your shareholders anytime and anywhere.

This is especially important for small-cap companies that lack analyst and media coverage to fill the gaps.  As a result, shareholders heavily rely on management to go beyond press releases and actually communicate with them about the intricacies that potentially affect their investments.  Communications that are just one click away create greater confidence, turst and belief in the long-term vision of the company, leading to a greater number of shareholders becoming long-term investors and the company’s best ambassadors.

INVESTORS OVERWHELMINGLY APPROVE … Â INDUSTRY EXPERTS COVERING THE STORY

More than just lip service, look how Gary’s Q&A has shot to the top of the most favourite posts as voted by shareholders:

Moreover, his efforts are already starting to get recognized by industry experts:

Congratulations to Gary and the entire UC Resources team. We not only look forward to more of the same … we also hope this will serve as a great example for other small-cap companies to follow.

Contact AGORACOM to discuss your online investor relations program.

Regards,

George

Posted in Online Investor Relations, Small-Cap CEO Lessons, Social Media Investor Relations, UC Resources | Comments Off on Online Investor Relations Done Right – UC Resources Embraces Skype, Online Q&A, Video To Reach Shareholders

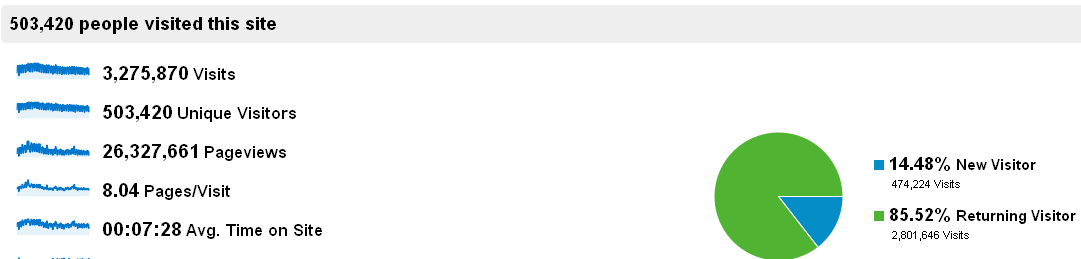

AGORACOM Surpasses 500,000 Visitors YTD 2011 … And Counting

As you all know very well by now, I love to share data pertaining to our accomplishments.  Why? Talk is cheap and data is the only way to differentiate who is actually getting the job done in the world of online investor relations.

Despite what all the “Johnny Come Lately IR Experts“ have been telling you as of late, AGORACOM has been proving to small-cap CEO’s for years that online investor relations is the key to attracting the widest possible audience of investors.

ONLINE INVESTOR RELATIONS PLATFORM IS BEST FOR SMALL-CAP INVESTOR RELATIONS

Moreover, we’ve been pounding the table on the fact that a unified small-cap investor relations platform such as AGORACOM is a cheaper, faster and easier way to achieve that goal.  We simply don’t agree that solo social media efforts are sufficient because individual small-cap companies simply don’t push out enough content and information to attract a meaningful audience and presence.

To this end, AGORACOM has been working hard at casting the widest net possible via our own site, sister sites, social media and small-cap videos.  That effort is paying big dividends in terms of driving traffic into our network.

THE PROOF IS IN THE PUDDING – 503,420 INVESTORS IN 2011 … AND COUNTING

Here is the irrefutable visitor data (independently tracked by Google Analytics), as well as, the list of Top 10 countries … and here is how you contact us to discuss your online investor relations needs.

To put this success into further perspective, this traffic does not include data from our social media sites (Twitter, YouTube and Facebook) which are enjoying their own success per our January 5, 2011 post. Â Look for an update on these in the coming week.

Regards,

George Tsiolis, Founder

Posted in AGORACOM News And Events, AGORACOM Traffic, All Recent Posts, Online Investor Relations | Comments Off on AGORACOM Surpasses 500,000 Visitors YTD 2011 … And Counting

The Rise Of Social Media Investor Relations “Experts” a.k.a. Pretenders – Part 2

Back In October of 2010, I posted the story The Rise of Social Media IR “Experts†a.k.a. Pretenders and I used the image below.  It was humorous poke at a very serious subject – Pretenders that are fleecing small-cap companies by promising they can tap into 700 Gazillion people on Facebook, Twitter and every where else (see full story at the end).

Courtesy of Briansolis.com

I used the concept for my keynote speech at IR Conference 2011 where I presented 500 Million Reasons Why Facebook IR Will Kill You (Watch Webcast) to small-cap resource companies – to their great satisfaction.

Well, it seems my good friends (and our fantastic web developers) at The Working Group are running into a similar problem in their industry and have also used humour to convey their caution to customers … so I just had to add it on to this post to drive the point home even further.

As you all know, I simply love online investor relations. I believe it is the ultimate equalizer for small-cap companies that need affordable and efficient ways to both communicate with current shareholders and find new prospective investors.

I’m proud to say that AGORACOM pioneered online investor relations for small-cap companies by creating a platform that ties both communications and marketing together into one great package. More than just lip service, AGORACOM ranked #57 in the Profit 100 of Canada’s fastest growing companies in 2009. This isn’t meant to show off our success but, rather, to demonstrate how big online investor relations has become – and how big it is going to be.

GREAT ONLINE IR COLLEAGUES

I’m also happy to say that we don’t own the online investor relations space. Otherwise how valuable could the services be if others didn’t find it worthy to participate in? For example, Q4 Websystems, Meet The Street and IR Web Report have done some great things in the space, keep me on my toes and teach me new tactics along the way.

I respect my colleagues for the work they do and for making the space better for everyone.

GREAT ONLINE IR PRETENDERS – A Twitter/Facebook/YouTube Account Is Not An Online IR Program

Unfortunately, we are now starting to see the rise of Online IR Pretenders. They claim to be “leaders” in social media and will set up a Twitter/Facebook/YouTube account to prove it.

If it were only that easy.

Setting up some social media accounts mean nothing unless they come with traffic and visibility. Any 16-year old kid can create flashy looking social media accounts for you in under an hour and bolt on some basic advertising to it.  This is why social media pretenders are so cheap. Unfortunately, social media pages do not make an online investor relations program, no matter how cheap the pitch.

Said another way, you’re better off saving the $10,000 you’d spend on a Yugo and putting it towards a $40,000 Maxima.

Without a real vehicle, all you have is a puttering online IR program.

A REAL AUDIENCE VS. A PRETENDERS AUDIENCE

Social Media IR Pretenders don’t have an audience – they simply talk about the blue sky audience. Hell, if a traditional IR firm pitched you by saying “there are 6 Billion people on this planet”, would you get excited and hire them? Think about it.

Here Is What A Pretender Audience Looks Like

- Facebook Has 500 Million Members

- Twitter Has 165 Million Users

- YouTube Has 1 Zillion people watching 10 Zillion videos every day

- Everybody in the world has a mobile phone

- …. etc., etc.

This may all be true – but it doesn’t mean any of them are going to run to your social media pages. Getting their attention is hard. Very hard. It takes time … years even …. to build credibility and content that drives a small fraction of these people to you.

Here Is What A Real Audience Looks Like:

- 1.1 Million Investors Hit AGORACOM Annually (Average 2008 – 2010)

- They Visit 7.4 Million Times Annually (Average 2008 – 2010)

- The Read 75 Million Pages Of Small Cap Information (Average 2008 – 2010)

- AGORACOM Reports 17,792 Investors From 77 Countries Participated In Online Gold and Commodities Conference

- Mobile Devices Drive 16,000 Small-Cap Visits To AGORACOM In August

- AGORACOM Videos Viewed Over 250,000 Times

- …. you get the idea

CONCLUSION

Next time a Social Media IR “Expert” comes knocking on your door – ask them how much traffic they’re actually pulling into their sites. If they start talking about blue sky, show them the door.

Posted in All Recent Posts, Online Investor Relations, Small-Cap CEO Lessons, Small-Cap Investor Revolts, Social Media Investor Relations | Comments Off on The Rise Of Social Media Investor Relations “Experts” a.k.a. Pretenders – Part 2

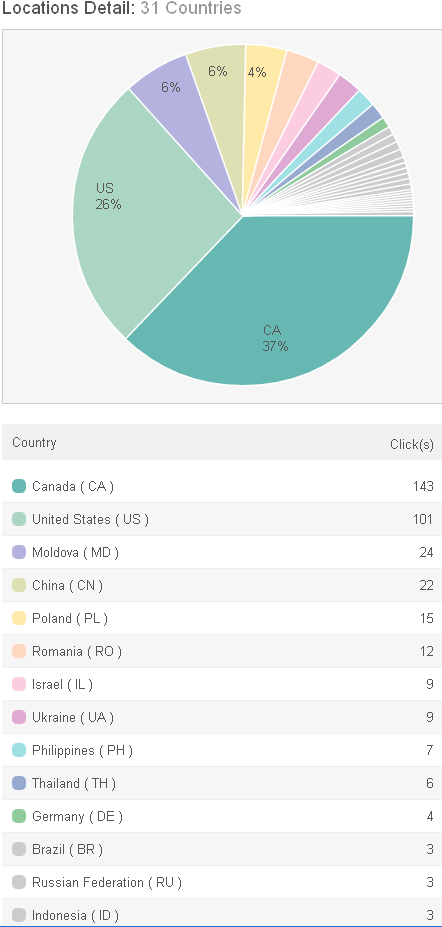

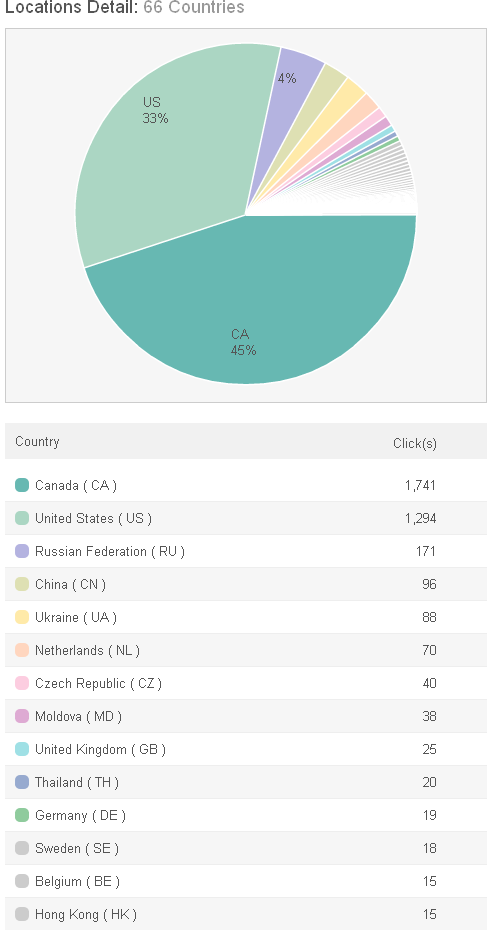

International Small-Cap Investors Account For 37% Of AGORACOM Story Clicks Today

1/2 DAY; 500 CLICKS; 31 COUNTRIES; 37% INTERNATIONAL – AS OF 3:30 PM EST

As you all know very well by now, I love to share data pertaining to our accomplishments.  Why? Talk is cheap and data is the only way to differentiate who is actually getting the job done in the world of online investor relations.

Despite what all the “Johnny Come Lately IR Experts“ have been telling you as of late, AGORACOM has been proving to small-cap CEO’s for years that online investor relations is the key to attracting the widest possible audience of investors.

Moreover, we’ve been pounding the table on the fact that a unified small-cap investor relations platform such as AGORACOM is a cheaper, faster and easier way to achieve that goal.  We simply don’t agree that solo social media efforts are sufficient because individual small-cap companies simply don’t push out enough content and information to attract a meaningful audience and presence.

To this end, AGORACOM has been working hard at casting the widest net possible via our own site, sister sites, social media and small-cap videos.  That effort is paying big dividends in terms of traffic to all of those sources – and today we present further evidence of that with 37% of our stories today being clicked on by international small-cap investors.

Here is the irrefutable click data and list of countries … and here is how you contact us to discuss your online investor relations needs.

Posted in AGORACOM News And Events, AGORACOM Traffic, All Recent Posts, Online Investor Relations, Social Media Investor Relations | Comments Off on International Small-Cap Investors Account For 37% Of AGORACOM Story Clicks Today

International Small-Cap Investors Account For 22% Of AGORACOM Clicks In July 2011

As you all know very well by now, I love to share data pertaining to our accomplishments. Â Why? Talk is cheap and data is the only way to differentiate who is actually getting the job done in the world of online investor relations.

Despite what all the “Johnny Come Lately IR Experts” have been telling you as of late, AGORACOM has been proving to small-cap CEO’s for years that online investor relations is the key to attracting the widest possible audience of investors.

Moreover, we’ve been pounding the table on the fact that a unified small-cap investor relations platform such as AGORACOM is a cheaper, faster and easier way to achieve that goal. Â We simply don’t agree that solo social media efforts are sufficient because individual small-cap companies simply don’t push out enough content and information to attract a meaningful audience and presence.

To this end, AGORACOM has been working hard at casting the widest net possible via our own site, sister sites, social media and small-cap videos. Â That effort is paying big dividends in terms of traffic to all of those sources – and today we present further evidence of that with 22% of our stories in July being clicked on by foreign small-cap investors.

Here is the irrefutable click data and list of countries … and here is how you contact us to discuss your online investor relations needs.

Posted in AGORACOM News And Events, AGORACOM Traffic, All Recent Posts, Online Investor Relations | Comments Off on International Small-Cap Investors Account For 22% Of AGORACOM Clicks In July 2011