Sponsor: Affinity Metals Corp. (TSX-V: AFF) is a Canadian mineral exploration company building a strong portfolio of mineral projects in North America. The Corporation’s flagship property is the drill ready Regal Property near Revelstoke, BC where Affinity Metals is making preparations for a spring drill program to test two large Z-TEM anomalies. Click Here for More Info

As a general rule, the most successful man in life is the man who has the best information Richard (Rick) Mills, Ahead of the Herd

April 27, 2020 (Investorideas.com Newswire) Silver prices will test $19 an ounce later this year on the back of heavy investment demand, as the coronavirus continues to depress markets and push investors in the direction of safe havens like precious metals.

That is the conclusion of The Silver Institute’s annual World Silver Survey, compiled by research firm Metals Focus and released in April.

Silver prices are driven by mine supply/ recycling and demand from both retail/ institutional investors and industry.

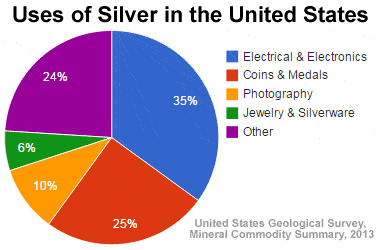

Over half of silver demand comes from industrial uses like solar panels, electronics and automotive parts. (Around 20 grams of silver are required to build a solar panel)

While most of the world’s mined gold is still around, either cast as jewelry, or smelted into bullion and stored for investment purposes, the same cannot be said for silver. It’s estimated around 60% of silver is utilized in industrial applications, leaving only 40% for investing. Of the 60% used for industrial applications almost 80% ends up in landfills.

The drop in demand for most goods and services owing to covid-19 doesn’t exempt silver – industrial fabrication is seen falling by 7%, along with jewelry and silverware offtake – but the report projects these declines will be offset by a 16% increase in silver bar and coin demand. There is also expected to be strong inflows into silver-backed ETFs as well as net buying by institutional investors on both the futures and OTC markets.

And while the white metal, sometimes called “poor man’s gold”, is expected to be in surplus again this year, the Silver Institute says the glut will be limited (to 14.7 million ounces, 53% smaller than in 2019), by a number of government shutdowns in top producers Mexico and Peru. As of April 3rd silver mine closures had restricted 40% of global production.

The Silver Institute therefore expects silver prices, currently trading around $15 an ounce, to hit $19/oz before year-end, possibly even outperforming gold on the back of its historically low relative value. If that happens, it would be a repeat of silver’s pattern last year.

Catching gold’s wave

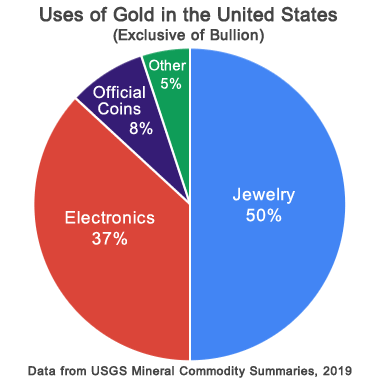

In analyzing silver we also need to look at gold. The precious metals often follow each other’s price movements and they are frequently found together in mineral deposits.

Silver and gold both spiked last summer after the US Federal Reserve began cutting interest rates to deal with slowing global growth and signs of a worsening US economy. In July the Fed lowered rates three times before freezing the federal funds rate at a range of 1.5 – 1.75%. (they have subsequently been cut to near 0%)

Rate cuts, along with similarly dovish policies among other central banks, a record $17-trillion of negative-yielding sovereign debt, and safe-haven demand due to tensions with Iran, to name a key issue, powered the precious metals to new heights.

Silver prices rose 15% in 2019, helped by a 12% increase in silver investment demand – the highest annual growth since 2015.Â

The onset of the coronavirus, first appearing as an epidemic in China, then spreading to Iran and South Korea, before becoming a full-blown pandemic in mid-March, has meant high volatility for gold and silver.

The onset of the coronavirus, first appearing as an epidemic in China, then spreading to Iran and South Korea, before becoming a full-blown pandemic in mid-March, has meant high volatility for gold and silver.

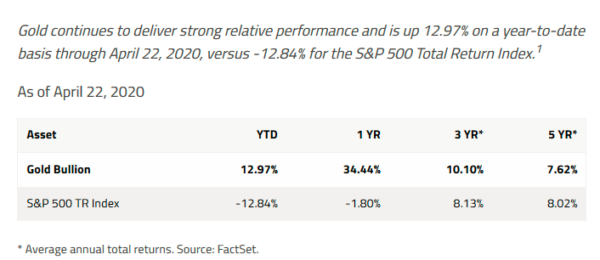

We’ve seen gold spike on safe-haven demand, as investors piled into gold ETFs, US Treasuries and the US dollar, only to fall sharply mid-March, as traders sold their gold holdings to cover losses in other assets

Since the beginning of April gold has surged, reclaiming $1,700/oz on the back of a record $2.2 trillion spending package announced by the US government, to combat the economic fallout from covid-19.

Other central banks have launched huge stimulus measures to head off, or more likely dampen, the effects of a global recession or even depression.

On April 14 Comex gold futures for June delivery vaulted to $1,785 an ounce, the highest since October 2012. Although gold prices have slipped back a bit, currently trading around $1,720/oz, some analysts see the potential for another leg up. Bloomberg quoted Hans Goetti, founder and chief executive officer of HG Research, saying:

“What’s happening here is that the Fed is expanding its balance sheet and every other central bank in the world is doing the same,” he told Bloomberg TV. “What you’re looking at is massive currency debasement in the long term. That’s the major reason why gold is higher, and I would think that over the next few weeks or months, we’re probably going to retest the high that we saw in 2011” (when gold passed an all-time high of $1,900/oz).

Another factor in gold’s favor is negative real interest rates.

Many countries including the United States have seen bond yields approach or even go below 0%. When real rates (yield minus rate of inflation) turn negative, investors tend to rotate from bonds into gold.

And while securities analysts quoted by Bloomberg expect the Federal Reserve’s renewed quantitative easing, combined with large fiscal stimulus (spending), could see long-end rate rise during the recovery phase of coronavirus, they don’t see that happening without inflation, “which should keep real rates suppressed.”

This week, Bank of America released a forecast predicting gold will rocket as high as $3,000 an ounce within 18 months.

According to Marketwatch, BofA Global Research raised its 18-month price target from an earlier $2,000, citing the prospects of endless monetary expansion from central banks, including the Federal Reserve, to limit the economic damage from the COVID-19 pandemic.

“The rather lofty upside gold price forecast from Bank of America continues to echo in the marketplace with the widely publicized quote ‘the Fed can’t print gold’ a very strong point for the bull camp,” analysts at Zaner Metals wrote in a daily update.

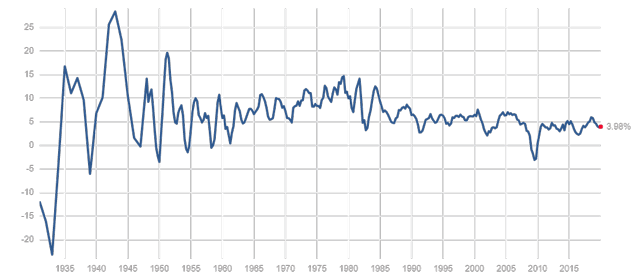

As we showed in a previous article, there is a close relationship between gold and debt-to-GDP ratios.

Undervalued silver

Gold and silver prices are often compared, to get a sense of which direction each are headed. The gold-silver ratio is the amount of silver one can buy with an ounce of gold. Simply divide the current gold price by the price of silver, to find the ratio.

When gold is over-valued compared to silver, investors take advantage of the arbitrage opportunity, by selling some of their gold holdings to buy silver. The opposite occurs when silver is over-valued compared to gold. In that situation, precious metals investors sell silver to buy gold.

The higher the number, the more undervalued is silver.

The current gold-silver ratio, 113:1, is double the historical ratio of 50-60 ounces of silver to one ounce of gold, meaning that silver is highly undervalued compared to gold. It means an investor with an ounce of gold could sell his gold for 113 ounces of silver.

All the bullish factors for gold are in place: a “black swan” event that has created huge fear and uncertainty, imploding global stocks and sending traders/ investors flocking to the safety of havens like the US dollar, US Treasuries and precious metals. The demand for Treasuries has pushed up their prices, causing their yields to fall to new lows. Negative real yields (yields minus inflation) are bullish for gold, and we expect real yields to remain negative for some time.

Remember, gold rises proportionally to debt. As long as governments are wrangling the coronavirus, we fully expect national debt piles to keep growing. Indeed the political pressure on governments to help the most vulnerable in society, for fear not only of losing power, but in some countries, extreme social unrest, is bound to keep the stimulus taps gushing.

While demand for silver, like for most industrial metals, will fall during this period of virus-related uncertainty, after the pandemic is beaten, we expect it to come roaring back, and the extremely out-of-whack gold-silver ratio to correct, in silver’s favor.

Silver mines, ranked

Silver supply is sensitive to mine production cuts – as we have seen recently with coronavirus-related stoppages. However, silver is also vulnerable to supply slippage, more so than gold, because there are relatively few pure-play silver mines.

Only around 30% of annual supply comes from primary silver mines while more than a third is produced at lead/zinc operations and a further 20% is from copper mines. Over two-thirds of the world’s silver resources are sourced from polymetallic ore deposits.

That makes silver quite a bit different from gold, in that primary gold deposits, with relatively few other minerals, are common. Large deposits of gold are also found in copper-gold porphyries.

Not so for silver, which most often has to be coaxed out of lead and zinc ores, followed by mines specializing in copper and gold, in that order.  Only twenty eight percent of global silver production is sourced from primary silver mines. Last year’s World Silver Survey delineated the world’s largest primary silver mines. Topping the list was Fresnillo’s Saucito mine in Mexico, which in 2018 produced 19.9 million ounces. Second spot went to Polymetal’s Dukat mine in Russia (16.5Moz), followed by Buenaventura Mines’ Uchucchacua mine in Peru, producing 15.4Moz.

Only twenty eight percent of global silver production is sourced from primary silver mines. Last year’s World Silver Survey delineated the world’s largest primary silver mines. Topping the list was Fresnillo’s Saucito mine in Mexico, which in 2018 produced 19.9 million ounces. Second spot went to Polymetal’s Dukat mine in Russia (16.5Moz), followed by Buenaventura Mines’ Uchucchacua mine in Peru, producing 15.4Moz.  According to the US Geological Survey, Mexico is by far the largest producer, outputting 6,300 tonnes in 2019, followed by Peru and China, at a respective 3,600t and 3,800t. Next on the list are Russia, Poland and Australia. Global silver production in 2019 totaled 27,000 tonnes, or 868 million ounces.

According to the US Geological Survey, Mexico is by far the largest producer, outputting 6,300 tonnes in 2019, followed by Peru and China, at a respective 3,600t and 3,800t. Next on the list are Russia, Poland and Australia. Global silver production in 2019 totaled 27,000 tonnes, or 868 million ounces.

Where are the world’s largest silver mines, including mines that produce silver as a by-product of other metals?

The 2020 Silver Survey has KGHM Polska Miedz’s three copper-silver mines in Poland – Lubin, Rudna and Polkowice-Sieroszowice – leading by a long shot, at 40.2Moz in 2019.

That is almost twice the production of number 2 Penasquito (22.7Moz) and over double Dukat’s 19.3Moz. Saucito, ranked highest last year in primary silver mine production in 2020, is the fourth-largest mine in the world containing silver and other metals.

Poland’s Kupferschiefer silver

State-run Polska Miedź (KGHM) is the second largest silver producer in the world, behind only Fresnillo, and the sixth biggest copper miner.Â

Why is so much silver produced from one company, KGHM Polska Miedz, versus Mexico and Peru, which are more closely associated with silver mining?

To know the answer, we must first understand Poland’s giant “Kupfershiefer” copper-silver deposits, of which the Lubin, Rudna and Polkowice-Sieroszowice mines, containing 1.4 billion ounces of silver reserves, are a significant part.

Sedimentary-hosted stratiform copper deposits are among the two most important copper sources in the world, the other being copper porphyries. They typically range from 1.6 million to 170 million tonnes copper ore, grading between 0.7% and 4.2%, with a median of 14 million tonnes at an average grade of 1.6% Cu, according to a 2019 academic paper, ‘The Kupferschiefer Deposits and Prospects in SW Poland: Past, Present and Future’.

Sedimentary copper deposits are formed in ocean basins, where copper and other minerals travel up through porous lithologies such as sandstone and become trapped in the upper sequence of sandstone and overlaying it black shale and limestone.

Red-bed deposits, so named due to oxidation resulting from exposure to the atmosphere, are divided into volcanic and sedimentary.

Kupferschiefer deposits are similar to red-beds but larger, even regionally extensive. They typically form in a marine setting, after land is gradually submerged into a shallow sea, then overlain by sedimentary rocks – which formed from the gradual deposition of the carcasses of dead sea creatures, onto the ocean floor.

A classic “Kupferschiefer” consists of three main layers – sandstone, bituminous shale and limestone overlain by evaporates often containing oil and gas. Copper-containing fluids migrate up through the sandstone and get trapped by the carbon-rich copper shale. This is where most of the mineralization is concentrated, although it can also be found in the sandstone, limestone, or a combination of all three layers.

The Kupferschiefer copper belt that underlies Germany and Poland is among only three giant sediment-hosted copper deposits in the world. It is also within an elite 1% of deposits that contain over 60 million tonnes of copper.

Orebodies can range in thickness from 0.3 m, contained largely within the black shale of the Kupferschiefer sensu stricto, up to more than 50 m, where sublevel stoping, backfilling, and pillar mining reflect the pervasive mineralization, states a research paper.

According to the Polish Geological Institute, Poland holds the largest economic copper resources in Europe, about 36 million tonnes, and the most anticipated economic silver resources on the continent, about 3.4 billion troy ounces.

Other metals recovered from copper ores at Poland’s Kupferschiefer deposits include gold, platinum, palladium and rhenium.

Despite being a small country, about the size of New Mexico, Poland produced 54.6 million ounces of silver in 2019, up 18% from 2018, mainly as a product of copper mining.

The richest silver deposits are located in the Lower and Upper Silesia regions, where the first shallow mines pre-date the Roman Empire, going back as far as 1136 AD.

According to the US Geological Survey, the massive volume of metal in Poland’s Kupferschiefer deposits is due to continuous mineralization that extends down dip and laterally for kilometers.

Identified resources within the giant Lubin-Sieroszowice deposit, are 1.6 billion tonnes of ore containing 30.3 million tonnes of copper and 2.7 billion ounces of silver, at average grades of 1.63% Cu and 57 g/t Ag. Reserves are 23.7 million tonnes copper and 1.4 billion ounces silver.

The strongest copper sulfide mineralization occurs in the black clay shales, including chalcocite, bornite, covelline and chalcopyrite, accompanied by minerals associated with silver, native silver, lead, zinc, cobalt and nickel.

A comparison at this point is interesting. #1 primary silver mine Saucito contains 130.3Moz in reserves, at an average silver grade of 272 g/t Ag. #2 is Dukat, with 93.4 Moz in reserves averaging 4.1 g/t Ag. The third largest primary silver mine, Uchucchacua, has 98.5Moz at 294.2 g/t.

Lubin-Sieroszowice dwarfs all three, at 10 times the reserves of Saucito, 15 times those of Dukat, and 14 times Uchucchacua’s. (Saucito and Uchucchacua are admittedly much higher-grade)

Minerals from three underground mines – Lubin, Polkowice-Sieroszowice and Rudna – are extracted using the room and pillar method at depths of between 600 and 1,250 meters. Expected minelife is 50 to 60 years, producing at a rate of 30 million tonnes a year. Consider that three of the four original mines have been producing since the late 1960s. They’ve already been going for 50+ years, yet they have another 50-60 more years to go and mineralization is open down dip.

The earliest exploration dates back to 1914, when German geologists conducted studies of the Zlotoryja region, and later, Grodziec. The first mine, Lena, started in 1936 but production was halted due to the onset of World War Two.

In 1959, 24 drill holes outlined the Lubin-Sieroszowice deposit, found at depths of between 400 and 1,000 meters. A resource estimate tallied indicated resources of 1.364 billion tonnes of ore grading 1.42%, containing 19.34 million tonnes of copper and about 1.157 billion ounces of silver.

Copper mining began in 1968 with the commissioning of two mines, Lubin and Polkowice.

According to KGHM’s 2019 results, the Lubin, Polkowice-Sieroszowice and Rudna mines produced 1,400 tonnes of silver last year, or 45 million ounces, at an average 48.7 g/t Ag.

In 2014, a project called “Deep Glogow” began mining from below the 1,200m level, using infrastructure from Rudna and Polkowice-Sieroszowice. The project contains 265.5 million tonnes grading 1.6% copper and 54 g/t silver, and has a minelife of 40 years.

There are also three undeveloped deposits to the north with identified resources (2018) of 139,535 million tonnes of ore including 2.2 million tonnes of copper and 356.3 million ounces of silver. And this year, 2020, Zielona Góra Copper (a Canadian company) documented a new Cu-Ag deposit “Nowa Sól” located northwest from the Lubin area. This new deposit has an estimated resource of 848 MT of copper and 0.036 MT of silver.

CESAR copper+silver project

The reason we have spent so much time writing about Poland’s Kupferschiefer is because of Max Resources (TSX.V:MXR).

Since November, Max’s geological teams have been identifying copper and silver targets within a 120 km x 20 km area, at their CESAR copper+silver project in northeastern Colombia.

Max field crew has been mapping copper-silver bearing stratabound horizons, rock chip channel sampling across mineralized beds and wall rock and following continuity of identified horizons along strike, to determine potential size prior to drilling.

The Vancouver-based company sees similarity of mineralization at the CESAR project to Kupferschiefer as a new giant sediment-hosted copper–silver mineralized system.

In a Feb. 27 news release, Max notes that its recent AM North and AM South discoveries are hosted in well-bedded sandstone-siltstone similar to KGHM’s monster “Kupferschiefer” mines in Poland.

In an earlier interview with AOTH, Max’s head geologist, Piotr Lutynski, said Colombia’s stratigraphy is similar to his homeland, Poland, and its cluster of Kupferschiefer sediment-hosted copper-silver deposits.

The last news release from CESAR concerns the AM South discovery – which features a stratabound copper-silver horizon, with mineralized structures totaling over 5 km of strike length. Earlier this year, sampling from 0.1 to 25-meter intervals returned highlight values of 5.4% copper and 63 g/t silver.

Having recently discovered a 10-meter by 2-meter panel which returned copper and silver grades of 3.5% Cu + 26 g/t Ag, the 1.4-km stratabound copper-silver horizon has been extended 1,000m, to 2,400m. (2.4 km).

Max also reported a new discovery, AM-2, located 500 meters south of AM-1. The new zone extends for 1,000 meters, and is open along strike and dip. The fact that it is parallel to AM-2 strongly suggests stacked horizons.

Assays at AM-2 are pending.

The CESAR project and its potential to be a Kupfershiefer analogue has grabbed the attention of one of the most important research centers in the world for the study of these sedimentary-hosted stratiform copper deposits which are also large repositories of silver.

In the press release below, Max says it has sent surface rock samples extracted from CESAR’s stratabound copper-silver mineralization horizons to the University of Science and Technology’s Department of Economic Geology, located in Krakow, Poland. Researchers at the university, which has worked extensively with KGHM in Poland, will conduct mineralogical and geochemical studies on the samples; also, a Masters-level student is planning on writing a thesis paper on the results.

Vancouver B.C., April 21, 2020 – MAX RESOURCE CORP. (“Max” or the “Company”) (TSX.V: MXR; OTC: MXROF; Frankfurt: M1D2) is pleased to report the involvement of the University of Science and Technology (“AGH-UST”), Faculty of Geology, Geophysics and Environmental Protection, Department of Economic Geology (“AGH”), Krakow, Poland in a study of the sediment-hosted copper-silver mineralization of the CESAR project, located 420-km north of Bogota, in NE Colombia.

Max has dispatched surface rock samples extracted from the CESAR stratabound copper-silver mineralized horizons to AGH. From these samples, AGH will conduct various mineralogical and geochemical studies.

AGH Professors and teaching staff have a long history of cooperation with KGHM Polska Miedz (“KGHM”), the largest copper producer in Europe and the worlds largest silver producer. AGH will leverage their extensive knowledge of KGHM’s world renowned Kupferschiefer sediment-hosted copper-silver deposits in Poland, on the academic study of CESAR.

Max and AGH agreed that results from the study on CESAR may be used for public presentations and scientific papers. In addition, discussion have commenced with respect to an AGH M.Sc. student focusing their thesis on selected material sent from the CESAR project.

AGH-UST in Krakow, Poland has a distinguished history and a deep understanding of sediment-hosted copper-silver deposits, due to their extensive work with Kupferschiefer, established in Poland as a world-class producer of copper and silver since 1968, also producing, gold, palladium, platinum and rhenium as by-products.

“We anticipate the scientific team from the Department of Economic Geology will play a significant role in identifying the similarities with Kupferschiefer and unlocking the ultimate potential of CESAR,” Max CEO, Brett Matich, commented.

“Max’s CESAR project in Colombia provides for significant exposure to both copper and silver, and notably silver has increased from a low of $11.74 per ounce in March to a high of $16.06 in April,” Mr. Matich concluded.

Max cautions investors that mineralization at Kupferschiefer is not necessarily indicative of similar mineralization at CESAR.

Conclusion

Investment demand for silver looks solid, with no end in sight to the low-interest-rate/ loose monetary policy direction of central banks, combined with record-breaking stimulus packages being passed by governments, as the coronavirus crisis rages on.

Adding higher demand due to shrinking silver supply, lower grades, and less by-product credits from falling lead and zinc mine production, we see a floor forming under silver prices.

The 113:1 gold-silver ratio is very high by historical standards. This is a warning to investors that at any time, the ratio could correct, either meaning a move up in silver prices or a move down in gold prices. Trust me, gold is not going down anytime soon, meaning silver prices must eventually correct.

The coronavirus has lit a fire under gold prices, which have burned past $1,720 an ounce. Historically, silver rides the wave started by gold.

As long as governments are wrangling the coronavirus, we fully expect national debt piles to keep growing. Gold prices rise proportionally to debt.

Consider what a $10 trillion Fed balance sheet will do to the debt-to-GDP ratio. Consider what it will do for gold and silver!

Despite broad-based market volatility, now is an unbelievably good time to be investing in precious metals. Buying physical gold and silver won’t hurt you, but high prices do not make an attractive entry point and we don’t see a significant pullback happening anytime soon.

Historically, and especially so today, the greatest leverage to rising precious metals prices has been owning the shares of junior resource companies focused on acquiring, discovering and developing precious metals deposits.

Identifying who owns the most attractive silver, in the ground, that can be bought at historically low valuations would seem to me a very prudent investing strategy at the moment.

For the last several months I’ve been following Max Resource Corp. as it develops CESAR. Max’s goal is to bring in a major as a partner, that can help finance a drill program at CESAR and bring it to a resource, then, fingers crossed, complete the rest of the steps (PEA, prefeasibility study, feasibility study, permits, etc.) required to build a mine.

We are also encouraged to see interest expressed by AGH-UST university in Poland, where some of the people most familiar with Kupfershiefer-type deposits, other than KGHM, will study samples from Max’s CESAR to see if there is a correlation. That’s exciting.

Could Max be sitting on another Kupfershiefer? Time will, as always, tell. But by the time we get a definitive answer I would expect the share price to have already runaway.

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Source:https://aheadoftheherd.com/Newsletter/2020/The-Fed-cant-print-silver.htm

The onset of the

The onset of the  Only twenty eight percent of global silver production is sourced from primary silver mines. Last year’s World Silver Survey delineated the world’s largest primary silver mines. Topping the list was Fresnillo’s Saucito mine in Mexico, which in 2018 produced 19.9 million ounces. Second spot went to Polymetal’s Dukat mine in Russia (16.5Moz), followed by Buenaventura Mines’ Uchucchacua mine in Peru, producing 15.4Moz.

Only twenty eight percent of global silver production is sourced from primary silver mines. Last year’s World Silver Survey delineated the world’s largest primary silver mines. Topping the list was Fresnillo’s Saucito mine in Mexico, which in 2018 produced 19.9 million ounces. Second spot went to Polymetal’s Dukat mine in Russia (16.5Moz), followed by Buenaventura Mines’ Uchucchacua mine in Peru, producing 15.4Moz.  According to the US Geological Survey, Mexico is by far the largest producer, outputting 6,300 tonnes in 2019, followed by Peru and China, at a respective 3,600t and 3,800t. Next on the list are Russia, Poland and Australia. Global silver production in 2019 totaled 27,000 tonnes, or 868 million ounces.

According to the US Geological Survey, Mexico is by far the largest producer, outputting 6,300 tonnes in 2019, followed by Peru and China, at a respective 3,600t and 3,800t. Next on the list are Russia, Poland and Australia. Global silver production in 2019 totaled 27,000 tonnes, or 868 million ounces.

Source: Bloomberg. Data as of 3/31/2020.

Source: Bloomberg. Data as of 3/31/2020. Data as of 3/31/2020. Source: Bloomberg. 12/23/1983 represents the inception of the XAU.

Data as of 3/31/2020. Source: Bloomberg. 12/23/1983 represents the inception of the XAU.

Source: Bloomberg. Data as of 4/20/2020.

Source: Bloomberg. Data as of 4/20/2020.