Kamloops, British Columbia–(Newsfile Corp. – November 27, 2019) – Advance Gold Corp. (TSXV: AAX) (“Advance Gold” or “the Company”) is pleased to announce drilling has started to test the large chargeability anomaly identified in recent 3D Induced Polarization (IP) geophysical surveys on its Tabasquena project in Zacatecas, Mexico. Two phases of IP surveys identified a 1000 metres by 500 metres continuous chargeability anomaly. The anomaly remains open to the north and to the south and at depth.

Allan Barry Laboucan, President and CEO of Advance Gold Corp. commented: “We are very excited to drill this large chargeability anomaly as these kinds of targets are not easily found, especially in regions well known for big mines. What makes it particularly stand out is that the high chargeability is consistent from east to west on each survey line, and from line to line over the entire grid. One always has to be aware of possible false positives, such as the possibility of disseminated magnetite causing the chargeability anomaly. However, in this case there has been no magnetite found in the area and an historical magnetic geophysical survey by the Geological Survey of Mexico showed no magnetic anomaly. There are a few potential explanations for the anomaly of this size from mines in Zacatecas. At the Real de Angeles mine and the mine at Fresnillo there were large stockwork vein systems. Previous drilling at Tabasquena has found a near surface network of epithermal veins with widespread gold and silver mineralization, although the IP survey did not pick up that network of drilled veins. Another possibility is a porphyry intrusion that are known to be below epithermal vein systems. Finally, volcanogenic massive sulphide deposits (VMS) are known to occur in clusters, so far, there is only one found in the area, Teck’s San Nicolas VMS deposit. The San Nicolas discovery was found with the first drill hole into a large IP chargeability anomaly. For a small company like Advance Gold to have such a significant anomaly, in a prolific region for mines is exceptional, now we are drilling to better understand what we have at the Tabasquena project.”

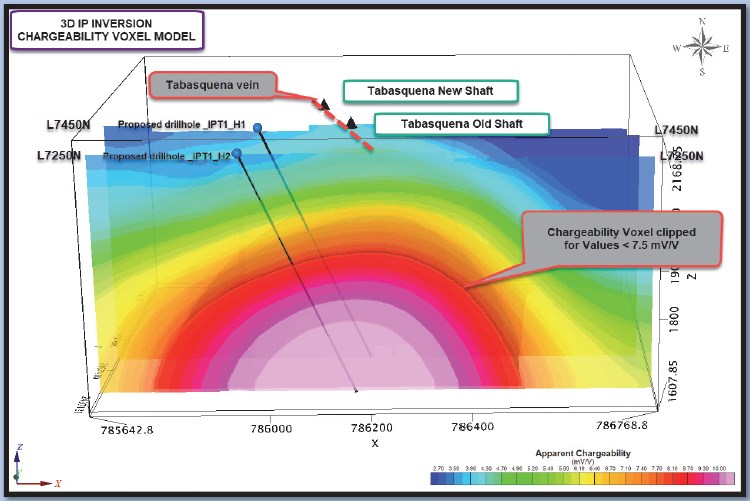

The

first drill hole to test the chargeability anomaly will be

approximately in the middle of the anomaly. It will be drilled at a 65

degree angle, from west to east. The first image below shows the collar

location and direction of the hole. In the north part of the image, you

can see the Tabasquena shaft area, where historical mining was done in

the oxide zone of the Tabasquena vein, and just off the image to the

south is the Tesorito shaft also used historically to mine the

Tabasquena vein in the oxides.

Drill Hole 1

To view an enhanced version of Drill Hole 1, please visit:

https://orders.newsfilecorp.com/files/5492/50185_7f3793d874883847_001full.jpg

The image below is a plan view, with past drill holes outside the purple area which is the projected chargeability anomaly to surface. Those drill holes intersected a series of veins, with widespread gold and silver mineralization. None of the holes reached the chargeability anomaly.

Plan view showing previous drill holes

To view an enhanced version of the plan view, please visit:

https://orders.newsfilecorp.com/files/5492/50185_7f3793d874883847_002full.jpg

The final image below, is a cross section of the new drill hole, which has been designed to cover approximately 100 metres from west to east, plus go down to 500 metres and hit the middle of the chargeability anomaly. The anomaly remains open at depth beyond the planned 500 metres and a decision will be made during drilling to extend it.

Cross section of new drill hole

To view an enhanced version of the cross section, please visit:

https://orders.newsfilecorp.com/files/5492/50185_7f3793d874883847_003full.jpg

Julio Pinto Linares is a QP, Doctor in Geological Sciences with specialty in Economic Geology and Qualified Professional No. 01365 by MMSA., and QP for Advance Gold and is the qualified person as defined by National Instrument 43-101 and he has read and approved the accuracy of technical information contained in this news release.

About Advance Gold Corp. (TSXV: AAX)

Advance Gold is a TSX-V listed junior exploration company focused on acquiring and exploring mineral properties containing precious metals. The Company acquired a 100% interest in the Tabasquena Silver Mine in Zacatecas, Mexico in 2017, and the Venaditas project, also in Zacatecas state, in April, 2018.

The Tabasquena project is located near the Milagros silver mine near the city of Ojocaliente, Mexico. Benefits at Tabasquena include road access to the claims, power to the claims, a 100-metre underground shaft and underground workings, plus it is a fully permitted mine.

Venaditas is well located adjacent to Teck’s San Nicolas mine, a VMS deposit, and it is approximately 11km to the east of the Tabasquena project, along a paved road.

In addition, Advance Gold holds a 13.23% interest on strategic claims in the Liranda Corridor in Kenya, East Africa. The remaining 86.77% of the Kakamega project is held by Barrick Gold Corporation.

For further information, please contact:

Allan Barry Laboucan,

President and CEO

Phone: (604) 505-4753

Email: [email protected]Reply