Kamloops,

British Columbia–(Newsfile Corp. – November 6, 2019) – Advance Gold

Corp. (TSXV: AAX) (“Advance Gold” or “the Company”) is pleased to

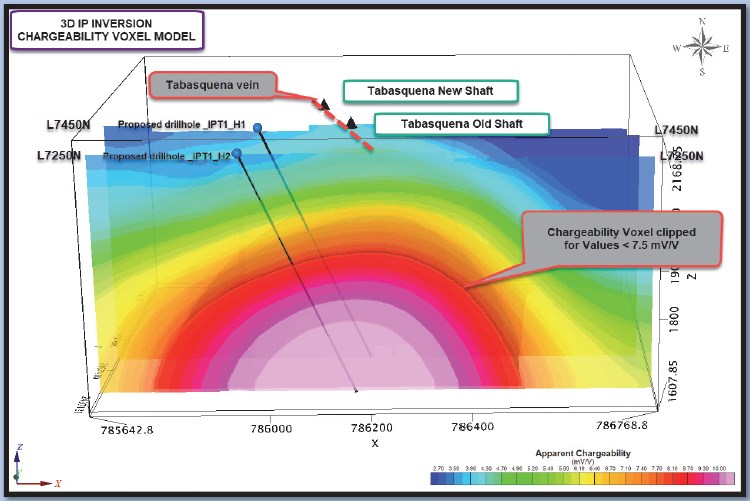

announce that the recently completed second phase of 3D Induced

Polarization (IP) geophysical survey on its Tabasquena project in

Zacatecas, Mexico, has significantly increased the size of its

continuous chargeability anomaly. This anomaly now has an east-west

width of approximately 400 to 500 metres and an apparent strike length

of over 1000 metres. The anomaly remains open to the north and to the

south and at depth.

Images

below are east-west cross sections representing key portions of the

overall anomaly where upcoming drilling will test this continuous

chargeability anomaly.

Line 7350N

To view an enhanced version of Line 7350N, please visit:

https://orders.newsfilecorp.com/files/5492/49483_ee273a13f4482b50_001full.jpg

Line 7150N

To view an enhanced version of Line 7150N, please visit:

https://orders.newsfilecorp.com/files/5492/49483_ee273a13f4482b50_002full.jpg

Allan Barry Laboucan, President and CEO of Advance Gold Corp. commented: “After

our first phase of geophysics, we identified a large chargeability

anomaly with the highest chargeability at the southern end of the grid

and still wide open. In that southerly direction we have elevation

relief and it was also where the anomaly appeared to be closest to

surface. Prior to drilling this anomaly, we decided to carry out a

second phase of geophysics to see if the anomaly continued to the south.

The second phase of geophysics has revealed that the anomaly actually

has a much longer strike length and appears to be somewhat wider. This

chargeability anomaly is now at least 1000 metres from north to south

and approximately 400 to 500 metres from east to west. It sits below a

network of veins with widespread gold and silver mineralization that

ranges from anomalous to high-grade gold. There are three shafts on the

property that go down around 100 metres that were used in the historical

mining of the oxide zone of the Tabasquena vein. The geophysical

anomaly is primarily right below those shafts, starting at approximately

200 metres below the underground workings. It is fair to say that we

have identified a major target. Our next step will be to drill this

target, we expect to start this shortly and will put out a news release

once it has started.”

Gennen McDowall, Geophysical Advisor to Advance Gold Corp. commented:

“This southerly extension to the original IP grid has shown that the

large chargeability anomaly first detected in August is actually much

bigger than originally thought and appears to strike right across the

claim group and shows little evidence of ending either to the north or

to the south and its depth extent is as of yet unknown. The

chargeability anomaly is visible on every east-west IP line. The

observed near surface mineralisation may be an expression of a much

larger mineralised body underlying the entire Tabasquena project.”

Details of Geophysical Survey

The

first 3D Induced Polarization survey was carried out by GEOFISICA TMC

SA de CV, between August 3rd and August 14th, 2019. Approximately 9.6

kms of IP data was collected over the central portion of the company’s

claims. This was followed up by a second phase of geophysics consisting

of 5 east-west lines. The southerly extent of the second survey reached

just beyond the Tesorito shaft. An off-set pole dipole array was used.

Data

processing and inversion of the data was carried out using RES3DINV

software. The inversion model was extended to approximately 550 metres

below surface. 3D Voxel images together with a series of depth slices

were generated (all available on the company’s website).

The

main purpose of the IP survey was to map, laterally and at depth the

evolution of the known gold and silver veins and to identify any new

mineralised structures. The survey was designed in such a way to allow

approximately 500 to 550 metres of vertical depth investigation.

The

IP survey area encompassed the historic and new shafts that are located

to the east of the Tabasquena and Nina veins that define a mineralised

system that outcrops at surface for 2.0 km. From past exploration work,

the Tabasquena vein was recognized over approximately 70 m along strike

near the shafts but only at shallow depth (< 100 m).

The

fourteen (14) vertical sections that were extracted from the 3D IP

inversion voxels suggest the presence of (4) four main stratigraphic

horizons (lithological units) mainly characterized by their resistivity

signatures.

The

IP data also clearly shows that the large polarisable body/target is

apparently quickly deepening northward and getting closer to surface

southward. The IP anomaly starts at around 100 metres below the past

drill hole intersections that contained widespread gold and silver

mineralization in epithermal veins.

Chargeability

and resistivity anomalies are indicated on the IP sections (see report

on company’s website) and are graded as per their relative strength.

Those chargeability anomalies that are deemed to be caused by the same

anomalous target are grouped together in what is called a polarisable

axis. Only one main axis was delineated following the review of the IP

data, which was labelled IPT-1 (Map C351-3 & Figure 11, report on

company website). This axis is a single large amplitude continuous

chargeability anomaly running north-south, coincident with the two

shafts at Tabasquena, the Tesorito shaft and the surface projection of

the mineralised veins. This anomaly has been categorized as having a

high chargeability and is conductive. The anomaly has an average depth

of approximately 250 to 300 meters. It should also be mentioned that

this anomaly is visible on every line, albeit less intense on the most

northerly line, as the target is becoming deeper to the north.

In conclusion

This

geophysical work has now identified a large consistent chargeability

anomaly that can be seen on all lines, implying a strike extent of at

least 1000 metres and an apparent width of 400 to 500 metres. This

observed IP anomaly could define a much wider mineralised system at

depth.

The

main recommendation of the original geophysical report was that prior

to drilling the anomaly the 3D IP survey should be extended to the

southeast for at least 1 km in the direction of the Tesorito shaft. This

has now been completed and this new work has established that the main

anomaly does in fact continue past the Tesorito shaft and is somewhat

wider. A number of boreholes are now planned to intersect this anomaly.

Julio

Pinto Linares is a QP, Doctor in Geological Sciences with specialty in

Economic Geology and Qualified Professional No. 01365 by MMSA., and QP

for Advance Gold and is the qualified person as defined by National

Instrument 43-101 and he has read and approved the accuracy of technical

information contained in this news release.

About Advance Gold Corp. (TSXV: AAX)

Advance

Gold is a TSX-V listed junior exploration company focused on acquiring

and exploring mineral properties containing precious metals. The Company

acquired a 100% interest in the Tabasquena Silver Mine in Zacatecas,

Mexico in 2017, and the Venaditas project, also in Zacatecas state, in

April, 2018.

The

Tabasquena project is located near the Milagros silver mine near the

city of Ojocaliente, Mexico. Benefits at Tabasquena include road access

to the claims, power to the claims, a 100-metre underground shaft and

underground workings, plus it is a fully permitted mine.

Venaditas

is well located adjacent to Teck’s San Nicolas mine, a VMS deposit, and

it is approximately 11km to the east of the Tabasquena project, along a

paved road.

In

addition, Advance Gold holds a 13.23% interest on strategic claims in

the Liranda Corridor in Kenya, East Africa. The remaining 86.77% of the

Kakamega project is held by Barrick Gold Corporation.

For further information, please contact:

Allan Barry Laboucan,

President and CEO

Phone: (604) 505-4753

Email: [email protected]