Industry Outlook and Green River Gold Trajectory

As the world accelerates towards sustainable energy solutions, the Biden administration’s recent $1.7 billion investment in EV production highlights the booming market for critical minerals. Green River Gold Corp. (CSE: CCR) (OTC Pink: CCRRF) stands at the forefront of this green revolution, strategically positioned to meet the increasing demand for nickel, cobalt, magnesium, and chromium—all essential for powering the EV revolution.

Voices of Authority

Energy Secretary Jennifer Granholm emphasizes the importance of bringing manufacturing jobs back to America, aligning perfectly with Green River Gold’s mission. Perry Little, President and CEO of Green River Gold, underscores this by stating, “Our strategic initiatives are geared towards supporting the critical minerals market, essential for EV technologies.”

Green River Gold Highlights

- Strategic Operations: Initiated placer gold mining on the Wabi claim, providing immediate cash flow.

- 50/50 Success: Achieved a 50/50 hit rate for nickel, cobalt, magnesium, and chromium at the Quesnel Nickel Project.

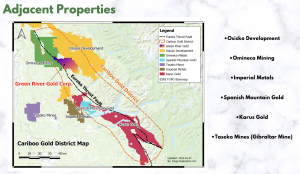

- Diverse Portfolio: Advancing the Quesnel Nickel Project, Fontaine Gold Project, and Kymar Silver Project.

Real-world Relevance

Green River Gold’s contributions to the industry are tangible and significant. The company’s focus on critical minerals not only supports the green energy transition but also bolsters the economy by creating jobs and reducing dependency on foreign resources.

Looking Ahead with Green River Gold

With a forward-looking strategy, Green River Gold aims to capitalize on the growing demand for critical minerals. Their ongoing projects and strategic planning ensure a robust presence in the market, aligning with the optimistic industry forecast. As the global push for sustainable energy intensifies, Green River Gold is well-positioned to drive future growth and innovation in the mining sector.

Conclusion

Green River Gold Corp. is a compelling participant in the sustainable energy landscape. Their strategic initiatives, diverse portfolio, and successful operations position them as a key player in the industry’s growth narrative. With a clear vision for the future, Green River Gold invites stakeholders to explore the promising opportunities ahead, further solidifying their role in the green revolution.

YOUR NEXT STEPS

Visit $CCR HUB On AGORACOM: https://agoracom.com/ir/GreenRiverGoldCorp

Visit $CCR 5 Minute Research Profile On AGORACOM:https://agoracom.com/ir/GreenRiverGoldCorp/profile

Visit $CCR Official Verified Discussion Forum On AGORACOM:

https://agoracom.com/ir/GreenRiverGoldCorp/forums/discussion

Watch $CCR Videos On AGORACOM YouTube Channel:

https://youtube.com/playlist?list=PLfL457LW0vdLJgdyN9gnd7VKr4xMKBpQ7&si=DumfF-sMw_Uat7Ce

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.