In the dynamic world of mineral exploration, where risk meets opportunity, Power Nickel Inc. (PNPN:TSX-V) (PNPNF:OTCQB) has once again captured investor attention with its latest drilling results from the Lion Zone. With assays confirming exceptional grades of copper equivalent (CuEq), this Canadian junior exploration company is setting the stage for transformative growth. The announcement comes as the company continues to solidify its position in the high-stakes race to develop Canada’s next polymetallic mine.

Background and Context: Power Nickel’s Journey and Vision

Founded on the ambition to unlock Canada’s mineral wealth, Power Nickel has carved out a niche in the exploration and development of high-grade nickel-copper-platinum group metal (PGM) deposits. Its flagship Nisk Project—acquired in 2021—covers an extensive 20-kilometer land package in Quebec, rich with untapped potential.

The Lion Zone, a part of the Nisk Project, has been the focal point of Power Nickel’s recent exploration efforts. Located in a region with a strong mining legacy, the zone’s polymetallic deposits are promising not only for their grade but also for their economic feasibility, thanks to modern mining technologies and infrastructure in Quebec.

This latest update builds on Power Nickel’s history of strategic exploration success, highlighting its ability to deliver consistent, high-grade results.

Key Highlights and Advantages: A Roaring Discovery

Power Nickel’s recent assay results underline the Lion Zone’s remarkable potential. Among the highlights:

- Hole PN-24-072 delivered 19.6 meters of 3.82% CuEq, including:

- 4.5 meters of exceptionally high-grade mineralization at 6.4% CuEq.

- Hole PN-24-074 yielded 23.55 meters of 0.6% CuEq, featuring:

- 2.5 meters of 5.1% CuEq, demonstrating concentrated mineralization.

- Hole PN-24-075 recorded 19.2 meters of 1.04% CuEq, with intervals of:

- 3.4 meters containing 3.6 g/t palladium (Pd) and 3.38 g/t platinum (Pt).

These results not only confirm the zone’s polymetallic nature but also highlight its versatility with recoverable gold, silver, platinum, palladium, nickel, and copper.

The company’s utilization of downhole electromagnetic (EM) technology is enhancing its exploration efficiency, enabling larger step-outs and accelerating discovery.

Potential Impact: Shaping the Future of Polymetallic Mining

The Lion Zone discovery positions Power Nickel to play a pivotal role in Canada’s mining sector, addressing growing global demand for critical minerals. Key advantages include:

- Economic Potential: High-grade deposits like these reduce operational costs and improve project viability.

- Environmental Efficiency: Concentrated mineralization may allow for more efficient extraction, aligning with sustainable mining practices.

- Strategic Relevance: With demand for PGMs, nickel, and copper surging due to their role in electric vehicles and renewable energy systems, Power Nickel is well-placed to capitalize on global market trends.

Expert Insights: Confidence in the Lion Zone

Terry Lynch, CEO of Power Nickel, expressed enthusiasm about the findings:

“The summer of 2024 will be remembered as an epic one regarding the Lion Zone. As we push west, we’re refining our understanding of the zone, and the results are only getting better. Expect more roars from the Lion Zone soon.”

Kenneth Williamson, Vice President of Exploration, emphasized the company’s commitment to precision-driven expansion:

“We are actively processing data from advanced geophysical techniques, which will enable us to step out confidently and uncover the zone’s full potential.”

Challenges and Considerations: Navigating the Road Ahead

While the results are promising, challenges remain:

- Exploration Risks: As with any mining project, geological variability could impact future results.

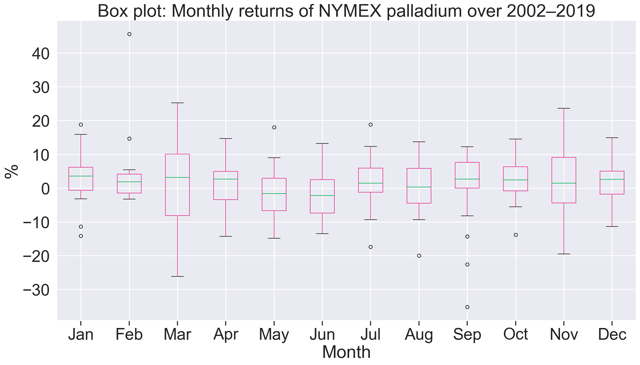

- Market Volatility: Fluctuating commodity prices may influence project economics.

- Operational Scalability: Scaling up to meet exploration goals will require sustained capital and technical expertise.

Power Nickel’s strategy of employing rigorous quality assurance and geophysical techniques demonstrates its proactive approach to mitigating these risks.

Conclusion: A Lion’s Leap Towards Mining Excellence

Power Nickel’s latest drilling results from the Lion Zone underscore the company’s ability to deliver exceptional exploration outcomes. With significant grades of CuEq and a clear strategy for expansion, Power Nickel is proving itself as a formidable player in the quest for Canada’s next major polymetallic mine.

YOUR NEXT STEPS

Visit $PNPN HUB On AGORACOM: https://agoracom.com/ir/PowerNickel

Visit $PNPN 5 Minute Research Profile On AGORACOM: https://agoracom.com/ir/PowerNickel/profile

Visit $PNPN Official Verified Discussion Forum On AGORACOM:

https://agoracom.com/ir/PowerNickel/forums/discussion

Watch $PNPN Videos On AGORACOM YouTube Channel:

https://youtube.com/playlist?list=PLfL457LW0vdLJgdyN9gnd7VKr4xMKBpQ7&si=DumfF-sMw_Uat7Ce

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.

From time to time, reference may be made in our marketing materials to prior Records we have published. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously published information and data may not be current and should not be relied upon.

NO INVESTMENT ADVICE

This record, and any record we publish by or on behalf of our clients, should not be construed as an offer or solicitation to buy or sell products or securities.

You understand and agree that no content in this record or published by AGORACOM constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable or advisable for any specific person and that no such content is tailored to any specific person’s needs. We will never advise you personally concerning the nature, potential, advisability, value or suitability of any particular security, portfolio of securities, transaction, investment strategy, or other matter.

Neither the writer of this record nor AGORACOM is an investment advisor. Both are neither licensed to provide nor are making any buy or sell recommendations. For more information about this or any other company, please review their public documents to conduct your own due diligence.

If you have any questions, please direct them to [email protected]

For our full website disclaimer, please visit https://agoracom.com/terms-and-conditions