- Chilean Metals Inc. to change its name to “Power Nickel Inc.” to reflect its focus on development of its James Bay High-Grade Nickel Copper Cobalt Palladium “Nisk” Project.

- Chilean Metals’ subsidiaries currently holding the Company’s Chilean assets will be separated and spun out as a new public company with all of its existing Chilean assets and sufficient capital for one-year of operations

- Chilean Metals will create a new subsidiary Consolidation Gold and Silver Inc. to be spun out as a separate public company where it will hold the option agreement on the Golden Ivan project and sufficient capital for one-year of operations

- Shareholders of Chilean Metals will participate in both new public companies and retain their current ownership interest in each Company

Chilean Metals Inc. (the “Company” or “Chilean Metals”) (TSXV:CMX)(OTC PINK:CMETF)(Frankfurt:IVVI) is pleased to announce that the board of directors has approved the Company’s plans to change its name to Power Nickel Inc. and to spin-off two independent public companies to carry forward with its existing Chilean and British Colombia mining assets.

Proposed Transaction Highlights

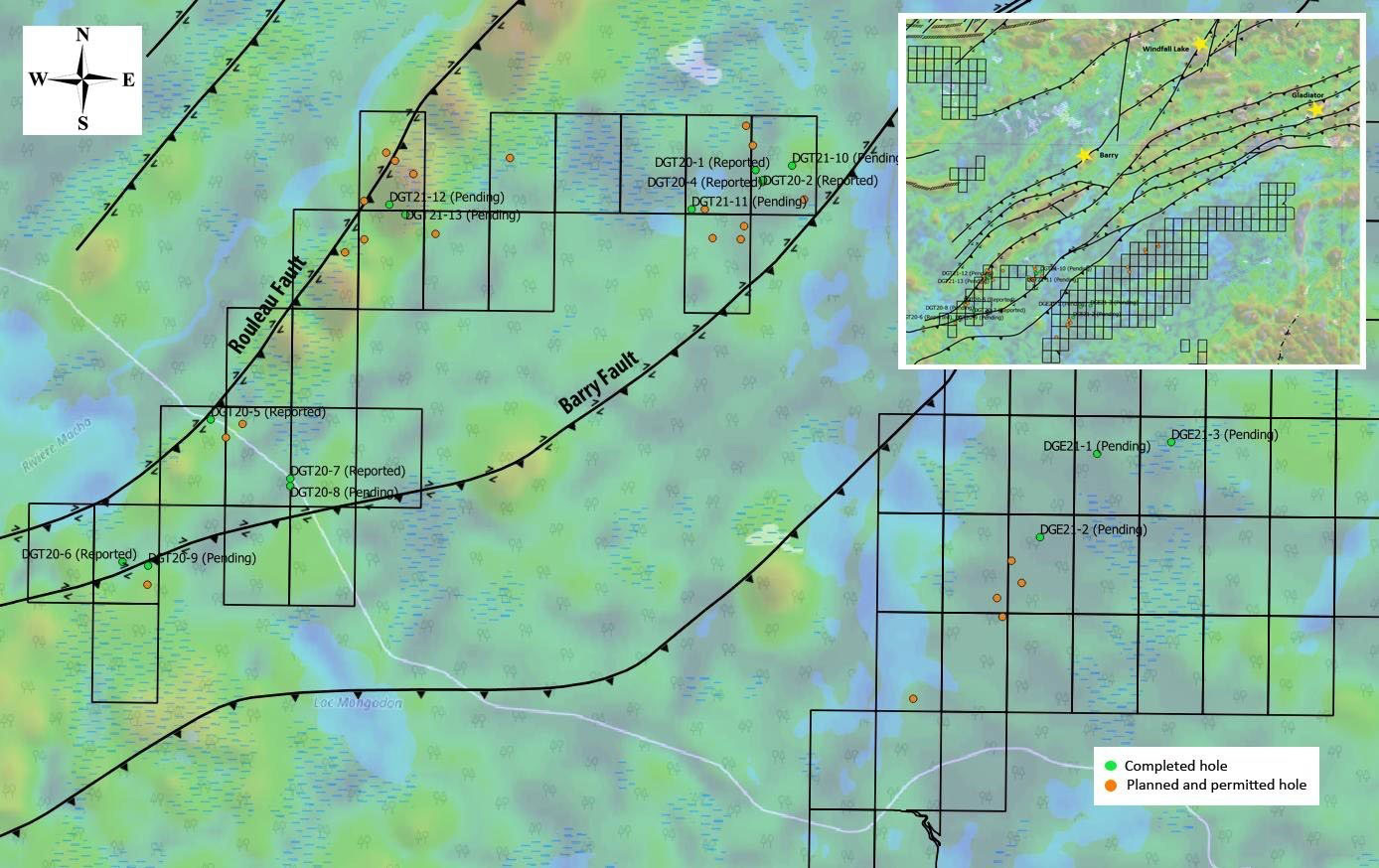

Chilean Metals to be renamed Power Nickel Inc. and will focus its efforts on the exploration and development of the Nisk project. On February 1, 2021 Chilean Metals completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corporation (CRE)(CRECF)(F12). These estimates at the Nisk project are of a historic resource and the Company’s geologic team has not completed sufficient work to confirm a NI 43-101 compliant resource. Therefore, the estimates cannot, and should not be relied upon.

Table ‑1: Historical Resource Estimate figures for respective confidence categories at the NISK-1 deposit, After RSW Inc 2009: Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec.

The information regarding the NISK-1 deposit was derived from the technical report titled “Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec” dated December 2009. The key assumptions, parameters and methods used to prepare the mineral resource estimates described above are set out in the technical report.

The NISK property comprises a large land position (20 kilometres of strike length) with numerous high-grade intercepts outside the current resource area. Chilean is focused on expanding its current high-grade nickel-copper PGE mineralization historical resource prepared in accordance with NI 43-101, identifying additional high-grade mineralization, and developing a process to potentially produce nickel sulphates responsibly for batteries for the electric vehicles industry.

- Shareholders of Chilean Metals will receive shares in the two public companies proposed to be separated out by the plan of arrangement, at ratios to be determined by tax and valuation considerations

- One public company is proposed to hold all the historic assets in Chile as follows:

- The 5600-hectare Tierra de Oro (TDO) property located about 70 Kms south of Copiapo. Historically about $6,000,000 has been spent exploring TDO with the most recent drill program completed and reported in January 2021 which highlighted a 2-metre section that returned 716 grams of silver and .45% copper.

- The 4300-hectare Zulema property located about 50 Kms southwest from Copiapo and adjoining the Candelaria Mine1 property (Over 950 Million Tonnes Copper, Gold & Silver according to NI- 43101 2018 report on Lundin Mining site)) An exploration program at the property in 2018 highlighted a garnet magnetite skarn with multiple lenses of Copper- Magnetite mineralization. Within the skarn, copper ranged from 0.12- 1.19% Cu and between 0.05 – 0.99g/t Au.

- The 9,000-hectare Palo Negro and Hornitos properties located in Region 3 about 30 Kms west of the Candelaria mine. The properties are currently the focus of a number of geophysical programs including magnetics and IP over portions of the property which have previously been highlighted to be of interest.

- Assets also include a 3% NSR royalty interest on any future production from the Copaquire Cu-Mo deposit, previously sold to a subsidiary of Teck Resources Inc. (“Teck”). Under the terms of the sale agreement, Teck has the right to acquire one third of the 3% NSR for $3 million dollars at any time. The Copaquire property borders Teck’s producing Quebrada Blanca copper mine2 in Chile’s First Region.

- Consolidation Gold & Silver Inc. will hold the previously purchased option to acquire the Golden Ivan project in the Golden Triangle. The Golden Triangle is host to numerous past and current mining operations and the region has reported mineral resources that total up to 67 million oz of gold, 569 million oz of silver, and 27 billion pounds of copper. Recent mineral development activity within the local area includes Ascot Resources recently funded Premier Gold mine3 (2.3 Million oz gold), which has received $105 million in project construction financing for the development of renewed operations at the historic exploited Premier Gold deposit. Other notable active projects in the local area include the neighbouring Silverado project, and Red Mountain, and Homestake projects amongst many others.4 Further to the north Pretivm’s Bruce Jack mine5 (4.2 million oz gold), and the neighboring KSM and Eskay deposits also have significant gold, silver, and copper resources that are yet to be realized.

- The property hosts two known mineral showings (Gold Ore, and Magee), and a portion of the past-producing Silverado Mine, which was reportedly exploited between 1921 and 1939. These mineral showings are described to be Polymetallic veins that contain quantities of Silver, Lead, Zinc +/- Gold +/- Copper. Numerous additional mineral occurrences, showings and past-producing mines are located in the immediate areas surrounding the property, further supporting the presence of widespread mineralization in the areas.

- The property is relatively underexplored. In 2018 Precision Geophysics completed an 88-line kilometre combined magnetic and gamma-ray spectrometry survey on behalf of the vendor (who optioned to Chilean Metals) Granby Gold Inc. Standard magnetic and radiometric data products were prepared and additional interpolate structural analyses were performed on the collected data. A number of areas of coincident magnetic and radiometric anomalism have been identified, additionally ‘structurally prepared’ zones are identified from the structural analysis interpolates. Such characteristics are widely regarded as favorable indicators of widespread hydrothermal alteration aka Porphyries and may aid in vectoring toward any causative source intrusions that may be located on the property. Three preliminary target areas of merit are established as a result of the survey and will be the focus of initial explorations at the site.

- Shareholders of the three entities should benefit from increased focus on core opportunities that appeal to each different investor base. As Chilean Metals grew through the acquisition of Nisk and Golden Ivan, it is anticipated that the two new public companies could similarly benefit on a go-forward basis.

Company CEO and Director Mr. Terry Lynch stated, “The result of this proposed transaction will be three stand-alone companies with attractive assets focused on specific opportunities to grow and create value for their shareholders. The driving force behind the change is to communicate in a very clear way our focus on the NISK Battery Metals project. It is rare to find a project with a historical resource that we believe has a credible chance to become a mine. The electrification movement in Automobiles and Industry is growing more and more every day and this growth will be very supportive to the price curves in Nickel, Copper, Cobalt, and Palladium. We look forward to concentrating our efforts on NISK and moving it from Historical resource through the mine development process as quickly as possible.