The world of space exploration is entering a transformative phase. With private companies like SpaceX achieving historic milestones—such as their first civilian-led spacewalk—there is renewed optimism about the future of commercial spaceflight and the technologies that support it. One of the key elements fueling these advances is helium, a resource critical to various high-tech and space applications. In light of these developments, Royal Helium Ltd. has initiated a strategic repositioning, aligning itself with the broader industry’s growth trajectory.

This shift, along with leadership changes and a sharper focus on maximizing shareholder value, comes at a crucial time. As the global demand for helium surges due to its applications in medical technology, scientific research, and aerospace, Royal Helium’s recent moves are designed to ensure that the company remains competitive and well-positioned to capitalize on future opportunities.

Industry Outlook and Royal Helium’s Trajectory

The global helium market is evolving, driven by advances in space exploration, medical technologies, and semiconductor manufacturing. Recent milestones, like SpaceX’s successful spacewalk during its Polaris Dawn mission, highlight the increasing role of private companies in pushing the boundaries of what’s possible in space. As Jared Isaacman, mission commander for Polaris Dawn, remarked: “Anything that’s different than what we’ve seen over the last 20 or 30 years is what gets people excited.” This momentum is not only inspiring innovation but is also creating new demands for essential resources—helium chief among them.

Royal Helium, with its extensive footprint of helium leases across southern Saskatchewan and southeastern Alberta, is uniquely positioned to meet this demand. Its strategic repositioning, which includes the formation of a new Technical Committee and engagement with financial advisory firm Eight Capital, reflects a proactive approach to navigating this expanding market.

Voices of Authority

Industry experts have long emphasized the importance of helium in advancing space technologies.

The marquee event of the private Polaris Dawn mission went smoothly, with two of the crew members — Jared Isaacman and Sarah Gillis — stepping outside of SpaceX’s Dragon capsule “Resilience.” It’s the first time civilians, and not government astronauts, have performed a spacewalk.

“Back at home we all have a lot of work to do but from here, Earth sure looks like a perfect world,” Isaacman, the mission’s benefactor and commander, said after emerging from the spacecraft.

“This is the inspiration side of it … anything that’s different than what we’ve seen over the last 20 or 30 years is what gets people excited, thinking: ‘Well if this is what I’m seeing today, I wonder what tomorrow’s gonna look like or a year after,’” Isaacman told CNBC before the mission.

Royal Helium’s Highlights

The company’s recent announcement comes as part of a broader strategy to position itself as a leading producer of helium in North America. Key components of this shift—encapsulated in its milestones—highlight Royal Helium’s commitment to disciplined capital allocation, cost control, and operational excellence.

Some of the key achievements include:

- Formation of a Technical Committee: Led by industry veterans, this committee is focused on optimizing production at the Steveville helium facility.

- Leadership Changes: With Martin Wood’s appointment as Chairman of the Board, Royal Helium is reinforcing its leadership team to drive its realignment efforts.

- Cost Efficiency: A headcount overhaul is expected to reduce corporate General & Administrative (G&A) costs by more than 40%, streamlining operations for increased profitability.

Royal Helium’s strategy has guided the company through a series of achievements that align with industry needs:

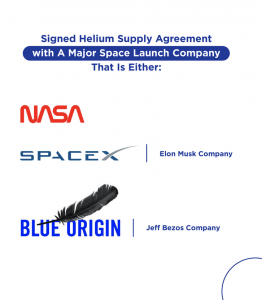

Royal Helium has strategically positioned itself to play a pivotal role in the aerospace sector, where helium is a critical component due to its unique properties. The Company signed a 3 year purchase commitment with a major North American Aerospace agency and is currently in process of helium deliveries to its U.S. Aerospace customer. The culmination of meticulous planning and execution necessary to help rockets launch into space marked the debut of Royal’s state-of-the-art purification facility in Princess, Alberta, Canada.

Royal Helium has also made headlines with its $25 million partnership with Sparrowhawk Developments, marking a significant milestone in helium exploration and production. This partnership signals not only Royal Helium’s growth trajectory but also its strategic positioning in the booming helium market.

This strategic collaboration with Sparrowhawk Developments represents a pivotal moment for the company’s growth. With Sparrowhawk investing $25 million in drilling, well completion, and construction of a new helium purification facility, Royal Helium gains the resources to accelerate its expansion plans. This infusion of capital enables Royal Helium to shift its focus from single-field development to multi-field operations, thereby maximizing its helium production capacity and strengthening its market position.

In addition, Royal Helium was granted a CAD $3 million investment from the Government of Canada under its Aerospace Regional Recovery Initiative for expenditures in upgrading and enhancing operations at the Steveville Helium Processing Facility. From the completion and flow testing of the Val Marie-1 helium exploration well to the expansion plans in Alberta’s Steveville project, each milestone signifies Royal Helium’s commitment to excellence and growth.

These strategic initiatives are part of Royal Helium’s broader effort to position itself as a significant player in the helium market, with an eye on long-term, sustainable growth.

Real-World Relevance

Helium’s significance goes beyond its use in party balloons; it plays a crucial role in a wide array of industries. For instance, helium is indispensable in the medical field, particularly in the operation of MRI scanners, which rely on helium for cooling their superconducting magnets. In the aerospace sector, helium is used to purge fuel tanks and pressurize systems, making it essential for both NASA and private space missions like those undertaken by SpaceX.

For the lay investor, this means that Royal Helium’s contributions to the helium supply chain are not just abstract industry developments—they have real-world applications that impact everyday technologies. By ensuring a reliable supply of helium, Royal Helium is supporting advancements in healthcare, space exploration, and semiconductor manufacturing, among other sectors.

Looking Ahead with Royal Helium

Looking to the future, Royal Helium’s strategy is centered around operational growth and meeting the increasing global demand for helium. With its Steveville facility in Alberta poised to ramp up production, and a focus on developing other assets within its portfolio, Royal Helium is well-positioned to play a pivotal role in the North American helium market. As the company continues to execute its strategic realignment, it’s clear that Royal Helium is preparing itself for both immediate opportunities and long-term success.

This forward-looking approach aligns with the broader optimism within the space and tech industries. With private companies like SpaceX pushing the envelope, the demand for critical resources such as helium will only increase. By positioning itself at the intersection of these trends, Royal Helium offers a compelling case for potential investors.

Conclusion

Royal Helium’s strategic repositioning, backed by leadership changes and a focus on operational efficiency, positions the company as a major player in the expanding helium market. With the global demand for helium expected to rise, driven by advancements in space exploration, healthcare, and technology, Royal Helium is well-equipped to seize the opportunities that lie ahead.

YOUR NEXT STEPS

Visit $RHC HUB On AGORACOM: https://agoracom.com/ir/RoyalHelium

Visit $RHC 5 Minute Research Profile On AGORACOM: https://agoracom.com/ir/RoyalHelium/profile

Visit $RHC Official Verified Discussion Forum On AGORACOM: https://agoracom.com/ir/RoyalHelium/forums/discussion

Watch $RHC Videos On AGORACOM YouTube Channel: https://www.youtube.com/watch?v=QvOY1vfcY28&list=PLfL457LW0vdKytYjwL-YOrGdsx-rqONoy

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.

From time to time, reference may be made in our marketing materials to prior Records we have published. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously published information and data may not be current and should not be relied upon.

NO INVESTMENT ADVICE

This record, and any record we publish by or on behalf of our clients, should not be construed as an offer or solicitation to buy or sell products or securities.

You understand and agree that no content in this record or published by AGORACOM constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable or advisable for any specific person and that no such content is tailored to any specific person’s needs. We will never advise you personally concerning the nature, potential, advisability, value or suitability of any particular security, portfolio of securities, transaction, investment strategy, or other matter.

Neither the writer of this record nor AGORACOM is an investment advisor. Both are neither licensed to provide nor are making any buy or sell recommendations. For more information about this or any other company, please review their public documents to conduct your own due diligence.

If you have any questions, please direct them to [email protected]

For our full website disclaimer, please visit https://agoracom.com/terms-and-conditions