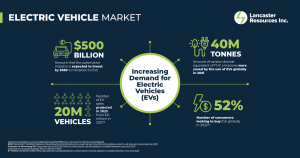

In the rapidly evolving landscape of sustainable energy, Lancaster Resources (CSE: LCR | OTCQB: LANRF | FRA: 6UF0) stands out as a dynamic exploration company dedicated to harnessing the potential of critical minerals essential for the global transition to electrification and decarbonization. With a clear focus on discovering and developing resources like lithium, Lancaster Resources is strategically positioned to contribute significantly to the emerging energy sector.

A Vision for a Sustainable Future

Lancaster Resources is committed to the exploration and development of critical minerals that are pivotal for the next generation of clean energy technologies. As the world shifts towards more sustainable energy sources, the demand for minerals such as lithium, which is crucial for battery production, has surged. Lancaster Resources aims to meet this growing demand through innovative exploration and environmentally responsible development practices.

Key Projects and Strategic Focus

Lancaster Resources’ flagship project, the Alkali Flat Lithium Brine Project, is a prime example of their strategic focus. Located in Lordsburg, New Mexico, this project spans approximately 5,200 acres and includes 260 mineral placer claims at the core of the Alkali Flats playa. The primary objective of this project is to produce Net-Zero Lithium using advanced direct lithium extraction technology powered by solar energy. This approach not only aims to provide a reliable supply of lithium but also aligns with global sustainability goals.

Company Highlights

- Alkali Flat Lithium Brine Project: Lancaster Resources received approval from the Bureau of Land Management (BLM) and the New Mexico Mining and Minerals Division (MMD) for their Plan of Operations. This project has the potential to drill up to three wells, with the maiden well expected in Q2 2024. The collaboration with BLM ensures strict adherence to access, safety, and environmental protection protocols.

- Strategic Partnerships: Lancaster Resources collaborates with industry leaders such as Hargrove Engineering and Lawrence Livermore National Labs to leverage cutting-edge technology and research for sustainable mining practices.

- Advisory Board Excellence: The company recently appointed Paola Rojas, a seasoned corporate advisor and investor, and Miguel Paucar, an expert with over 28 years of experience in the international mining sector, to its Advisory Board. Their extensive experience and strategic insights will be invaluable in guiding Lancaster’s growth trajectory and enhancing operational efficiencies and environmental compliance.

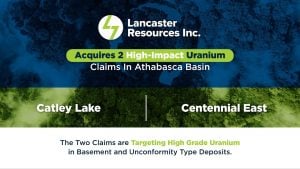

- Expansive Portfolio: Beyond the Alkali Flat Project, Lancaster Resources boasts a diverse portfolio that includes the Piney Lake Gold Property in Saskatchewan, the Trans-Taiga Lithium Property in Quebec’s James Bay lithium district, and uranium projects in Saskatchewan’s Athabasca basin.

Driving Innovation in Exploration

Lancaster Resources is not just focused on mineral extraction but is also driving innovation in exploration techniques. The use of advanced satellite hyperspectral acquisition, geospatial data aggregation, and AI-driven predictive modeling services underscores their commitment to leveraging technology for efficient and sustainable resource discovery. This forward-thinking approach positions Lancaster Resources at the forefront of the mining industry, enabling them to stay ahead of market trends and deliver value to stakeholders.

Environmental Stewardship and Sustainability

One of the core principles guiding Lancaster Resources is environmental stewardship. The company recognizes the importance of sustainable practices in mining and is dedicated to minimizing environmental impact. Their projects are designed to align with best practices in environmental management, ensuring that resource extraction does not come at the expense of the planet. By prioritizing sustainability, Lancaster Resources aims to set a benchmark for responsible mining in the industry.

Expertise and Leadership

Lancaster Resources’ management and technical team bring a wealth of experience to the table. With collective involvement in over 40 mineral discoveries and extensive experience in the exploration and development of projects across Canada, the American West, Mexico, and South America, the team is well-equipped to navigate the complexities of the mining industry. Their expertise ensures that Lancaster Resources is not only exploring promising opportunities but is also positioned to develop these resources efficiently and responsibly.

The recent addition of Miguel Paucar to the Advisory Board exemplifies this commitment. With over 28 years of experience in the international mining sector, Miguel has held significant roles in both underground and open-pit mining as well as geomechanics. His previous role as Mining Director at Sigma Lithium highlights his capability in advancing lithium extraction technologies and sustainability practices. His involvement is expected to enhance Lancaster’s operational efficiencies and environmental compliance.

The Future of Lancaster Resources

Looking ahead, Lancaster Resources is poised to make significant strides in the critical minerals sector. Their strategic projects, combined with a commitment to innovation and sustainability, position the company for long-term success. As the demand for critical minerals continues to rise, Lancaster Resources is well-placed to meet this demand while contributing to global efforts to reduce carbon emissions and transition to cleaner energy sources.

Conclusion

Lancaster Resources (CSE: LCR | OTCQB: LANRF | FRA: 6UF0) is more than just a mining company; it is a forward-thinking exploration firm dedicated to discovering and developing the minerals essential for the world’s energy transition. With a strong portfolio of projects, strategic partnerships, and a commitment to sustainability, Lancaster Resources is set to play a pivotal role in the future of the energy sector.

As Lancaster Resources continues to advance its projects and embrace innovative technologies, it remains a compelling opportunity for those looking to invest in the future of sustainable energy. The company’s dedication to responsible mining practices and its strategic focus on critical minerals make it a standout player in the industry, poised for growth and success in the years to come.

YOUR NEXT STEPS

Visit $LCR HUB On AGORACOM: https://agoracom.com/ir/Lancasterresources

Visit $LCR 5 Minute Research Profile On AGORACOM:https://agoracom.com/ir/Lancasterresources/profile

Visit $LCR Official Verified Discussion Forum On AGORACOM:

https://agoracom.com/ir/Lancasterresources/forums/discussion

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.