- 100% of the targeted metals were recycled in situ or selectively leached in solution

St-Georges Eco-Mining Corp. (CNSX:SX.CN)(OTC:SXOOF) (FSE:85G1) is pleased to disclose the results of its initial electric vehicle (EV) cathode material battery recycling tests aimed at specific car makers and OEM battery specifications.

As previously disclosed in a press release titled “Initial Recovery Battery Test Results” dated February 22, 2021, the Company has set aside a significant portion of its laboratories resources to be able to perform “(…) additional tests to optimize the process of recovery of critical elements (…) using synthetic compounds to move the development along faster.” In a subsequent press release titled “EV Batteries Recovery Tests Results: Lithium” dated March 18, 2021, the Company disclosed that it had “(…) completed EV battery characterization for the following car makers: Tesla, General Motors (GM), Ford, Toyota, and Nissan. The batteries were sourced from industry aggregators. The Company’s chemists and metallurgists created synthetic powder clones of the metal’s components allowing the testing’s acceleration (…)” Additionally, leveraging the support of some important stakeholders in the success of Company initiatives, St-Georges’ metallurgists were able to gather data on the composition of certain batteries in development or about-to-be commercially deployed in the coming year that are Lithium-Iron-Phosphate or LFP (LiFePO4) based. These not-yet-on-the-market batteries have been conceptually characterized, synthetically reproduced, and tested with the Company’s processing technology.

Four sets of battery category, covering all current car makers previously mentioned, along with the addition of the LFP batteries, have been processed in St-Georges’ contracted pilot-plant installations:

----------------------------------------- |Main Core Powder|Chemical Formula | |---------------------------------------| |LCO |LiCoO2 | |---------------------------------------| |LMO |LiMn2O4 | |---------------------------------------| |NMC |LiNi0.33Mn0.33Co0.33O2| |---------------------------------------| |LFP |LiFePO4 | -----------------------------------------

Cathode materials results

This initial test campaign’s objective was to determine which metals were put in solution from cathode materials using St-Georges’ proprietary acid-blend. From those experiments, it can be deduced that Lithium, Iron, Phosphate, Cobalt, Nickel, and Magnesium can be expected to be found in solution when using commercial batteries, on top of other metals such as Aluminium, Manganese, and Copper that can be recuperated in situ.

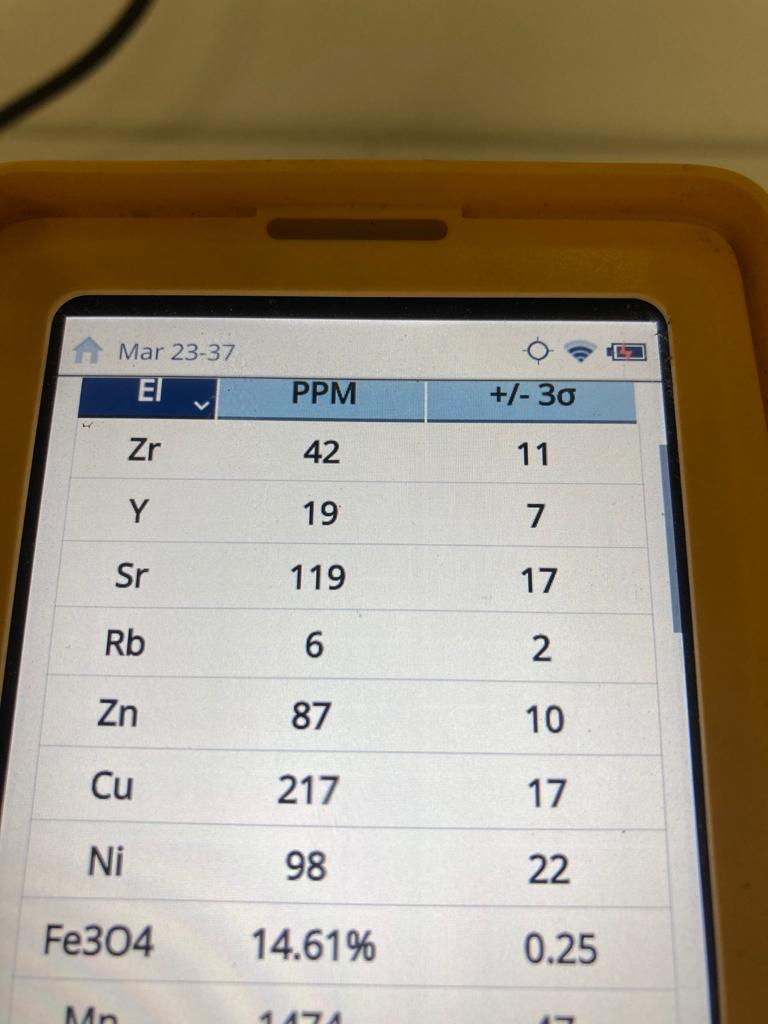

It is important to note that the LFP batteries might require a slightly different process to recycle 100% of the metals. Iron content generates a small amount of magnetism during the process while everything else remains in line with other battery compounds.