Introduction:

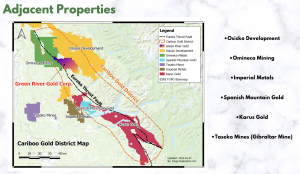

As gold prices soar to unprecedented highs amid expectations of Federal Reserve rate cuts, the precious metal’s allure as a safe haven and hedge against inflation is more robust than ever. Green River Gold Corp. (CCR) stands poised to capitalize on this bullish trend, leveraging its substantial 1,110 hectares of placer mining claims along with over 228 square kilometers of mineral claims. The company’s strategic alignment with industry advancements is a testament to its focus on maximizing returns and growth in an evolving economic landscape.

Industry Outlook and Green River Gold’s Trajectory:

Recent macroeconomic conditions have set the stage for gold’s remarkable rise, with a combination of higher inflation, anticipated rate cuts by the Federal Reserve, and central bank purchasing driving demand. In this dynamic environment, Green River Gold’s placer mining initiatives position it well within a thriving sector. By enhancing production capabilities and expanding operations, Green River Gold is strategically aligned with the industry’s upward trajectory.

Voices of Authority:

Ole Hansen, Head of Commodities Strategy at Saxo Bank, notes, “A cocktail comprising rate cuts and economic uncertainty has propelled gold to fresh records.” Green River Gold echoes this sentiment by ramping up its mining activities, betting on gold’s continued strength. The company’s strategy mirrors broader market trends, underpinned by strong central-bank buying and robust over-the-counter demand, reinforcing its potential for growth.

Green River Gold’s Highlights:

Green River Gold has taken significant strides in recent months. The company has expanded its placer mining operations, introduced new equipment to double production, and plans further strategic development across multiple sites. This expansion not only increases immediate cash flow but also supports the exploration of other critical minerals and precious metals. Green River Gold’s focus on diverse growth underpins its resilience in a fluctuating market.

Real-world Relevance:

Green River Gold’s contributions are directly felt in the current market landscape. With its mining activities in British Columbia, the company taps into a rich history of gold production while aligning with contemporary market trends. By ensuring steady production and exploring new mineral deposits.

Looking Ahead with Green River Gold:

The future looks promising for Green River Gold as it continues to align its strategies with positive industry forecasts. With gold expected to remain strong, driven by potential Fed rate cuts and continued economic uncertainty, Green River Gold’s growth plans are positioned to harness these favorable market conditions. The company’s ongoing commitment to innovation and expansion is poised to drive future success.

Conclusion:

As gold continues its upward climb, Green River Gold presents a compelling case for investors looking to benefit from the metal’s current and future performance. The company’s strategic initiatives and alignment with industry trends highlight its potential to be a key player in the gold market.

Source: https://ca.finance.yahoo.com/news/gold-holds-drop-inflation-data-235316909.html

YOUR NEXT STEPS

Visit $CCR HUB On AGORACOM: https://agoracom.com/ir/GreenRiverGoldCorp

Visit $CCR 5 Minute Research Profile On AGORACOM:https://agoracom.com/ir/GreenRiverGoldCorp/profile

Visit $CCR Official Verified Discussion Forum On AGORACOM:

https://agoracom.com/ir/GreenRiverGoldCorp/forums/discussion

Watch $CCR Videos On AGORACOM YouTube Channel:

https://youtube.com/playlist?list=PLfL457LW0vdLJgdyN9gnd7VKr4xMKBpQ7&si=DumfF-sMw_Uat7Ce

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.