Labrador Gold Corp. (TSX-V: LAB) (“LabGold†or the “Companyâ€) is pleased to provide a review of its exploration activities completed during 2019. During 2020, LabGold intends to test the continuity of recently discovered mineralization at its Hopedale Project with a drilling program.

Roger Moss, President and CEO stated: “Exploration on both of our Labrador Projects during 2019 continued to successfully define areas of gold mineralization. These include the discovery of a new gold showing with assays from 1.67 to 8.26 g/t gold in grab samples at the Hopedale Project. This is located 500 metres along strike from the known Thurber Dog gold showing within a broader three kilometre stretch of anomalous gold in rock and soil. We look forward to continuing our systematic exploration, including drilling, of this mineralized system in 2020.â€

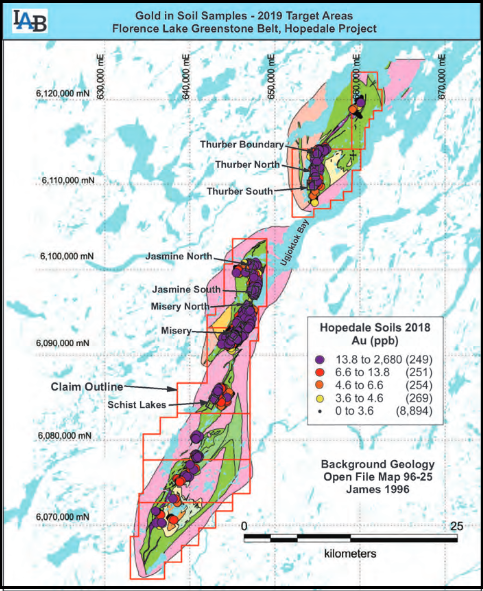

2019 Hopedale Project Highlights

- Discovered a new gold showing north of the Thurber Dog gold occurrence, grab samples from which assayed between 1.67 and 8.26 g/t Au.

- The Thurber Dog gold occurrence has assays in grab and channel samples from below detection up to 7.866 g/t Au, with 5 samples greater than 1 g/t Au and 16 samples assaying greater than 0.1 g/t Au.

- The discovery extends the potential strike length of gold mineralization by approximately 500 metres along strike to the north.The new showing occurs within a larger 3km trend of anomalous gold in rock and soil associated with the contact between mafic/ultramafic volcanic rocks and felsic volcanic rocks.

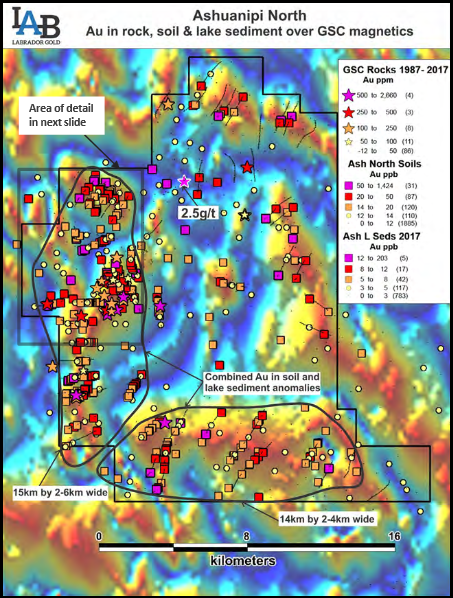

2019 Ashuanipi Project Highlights

- Discovered a gold enriched zone near a high grade (8,973ppb) soil sample taken in 2018.

- The zone is defined by anomalous gold in both soil (below detection up to 1,746ppb Au and including 12 samples over 100ppb Au) and grab rock samples (below detection up to 2.35 g/t Au) that cover an area of 450 metres by 450 metres.A second area of gold mineralization associated with garnet-bearing gossanous gneiss also shows potential.

- Grab rock samples show values from below detection to 0.68 g/t Au with 10 samples showing values greater than 0.1 g/t Au over an area of 200m by 120m within a larger anomalous area of gold in soil samples.

Note that grab samples are selected samples and are not necessarily representative of mineralization on the properties.

Location of the new showing, Thurber Dog, Thurber North and Thurber South occurrences within the 3km long mineralized Thurber trend:

New Showing with rusty zones due to the presence of pyrite and arsenopyrite:

What to expect in 2020

Hopedale Project

Exploration at Hopedale during 2020 will focus on determining the extent of the Thurber Dog mineralized trend. Such work would aim to fill in the gaps between showings over the three-kilometre strike length with sampling and VLF-EM surveys. LabGold also intends to carry out an initial drill program targeting prospective areas along this trend, including the new showing.

Ashuanipi Project

LabGold’s priority at Ashuanipi is to reach an agreement with the Matimekush-Lac John First Nation to enable continued exploration of the property. The 2019 election of the new Chief and Council has been challenged in Federal Court in Quebec with a court date scheduled for the end of February. As such, community engagement and negotiations are on hold until the court case is settled.

Borden Lake Extension Project

During 2019, Newmont Goldcorp announced the start of commercial production at their Borden Mine. The Borden Lake Extension project is located less than five kilometres from the Borden Mine along the southeast trend of the Borden Gold zone. Note that mineralization hosted on nearby properties is not necessarily indicative of mineralization that may be hosted on the Company’s property.

Given the start of mining at Borden, follow up of past results at the Borden Lake Extension project will be undertaken in 2020. Such work will likely include additional till sampling and geochemical surveys to better define the previously outlined anomalous zones as well as a reinterpretation of VLF-EM data using the latest inversion software. Due to the glacial cover in the area, overburden drilling, guided by results of this work, would be the best means to define targets for follow up diamond drilling.

Location of the BLE property and anomalous gold zones along trend to the southeast of Newmont-Goldcorp’s Borden Gold Zone.

All samples were shipped to the Bureau Veritas laboratory in Vancouver, BC, where they were crushed and split and a 500g sub sample pulverized to 200 mesh. Samples of 30g were analyzed for gold by fire assay with an atomic absorption finish and another 15g sample for 36 elements by ultratrace ICP-MS (inductively coupled plasma-mass spectrometry) following an aqua regia digestion. Over limit samples (greater than 10g/t Au) are re-assayed using fire assay with a gravimetric finish. In addition to the QA-QC conducted by the laboratory, the Company routinely submits blanks, field duplicates and certified reference standards with batches of samples to monitor the quality of the analyses.

Roger Moss, PhD., P.Geo., is the qualified person responsible for all technical information in this release.

The Company gratefully acknowledges the Newfoundland and Labrador Ministry of Natural Resources’ Junior Exploration Assistance (JEA) Program for its financial support for exploration of the Ashuanipi property.

About Labrador Gold:

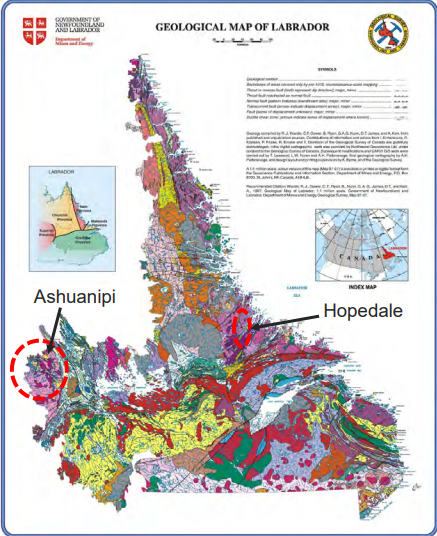

Labrador Gold is a Canadian based mineral exploration company focused on the acquisition and exploration of prospective gold projects in the Americas. In 2017 Labrador Gold signed a Letter of Intent under which the Company has the option to acquire 100% of the Ashuanipi property in northwest Labrador and the Hopedale property in eastern Labrador.

The Hopedale property covers much of the Florence Lake greenstone belt that stretches over 60 km. The belt is typical of greenstone belts around the world but has been underexplored by comparison. Initial work by Labrador Gold during 2017 show gold anomalies in soils and lake sediments over a 3 kilometre section of the northern portion of the Florence Lake greenstone belt in the vicinity of the known Thurber Dog gold showing where grab samples assayed up to 7.8g/t gold. In addition, anomalous gold in soil and lake sediment samples occur over approximately 40 kilometres along the southern section of the greenstone belt (see news release dated January 25, 2018 for more details).

The Ashuanipi gold project is located just 35 km from the historical iron ore mining community of Schefferville, which is linked by rail to the port of Sept Iles, Quebec in the south. The claim blocks cover large lake sediment gold anomalies that, with the exception of local prospecting, have not seen a systematic modern day exploration program. Results of the 2017 reconnaissance exploration program following up the lake sediment anomalies show gold anomalies in soils and lake sediments over a 15 kilometre long by 2 to 6 kilometre wide north-south trend and over a 14 kilometre long by 2 to 4 kilometre wide east-west trend. The anomalies appear to be broadly associated with magnetic highs and do not show any correlation with specific rock types on a regional scale (see news release dated January 18, 2018). This suggests a possible structural control on the localization of the gold anomalies. Historical work 30 km north on the Quebec side led to gold intersections of up to 2.23 grams per tonne (g/t) Au over 19.55 metres (not true width) (Source: IOS Services Geoscientifiques, 2012, Exploration and geological reconnaissance work in the Goodwood River Area, Sheffor Project, Summer Field Season 2011). Gold in both areas appears to be associated with similar rock types.

The Company has 57,039,022 common shares issued and outstanding and trades on the TSX Venture Exchange under the symbol LAB.

For more information please contact:

Roger Moss, President and CEO

Tel: 416-704-8291

Or visit our website at: www.labradorgold.com

Twitter: @LabGoldCorp