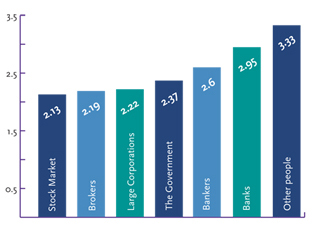

Good morning to you all and Happy New Year to you and yours. As most of you know, I like to share AGORACOM traffic data on a regular basis. Why? In the world of online investor relations, nothing speaks more about your ability to meet a client’s needs than the amount of traffic and overall engagement you are able to deliver. This is especially true in the small-cap space, which is full of investor relations pretenders that throw around all the right jargon but offer little to no substance.

To this end, I am very happy to announce our traffic results for the full year 2010. If a picture is worth a thousand words, this snapshot from our Google analytics is worth several million.

CLICK IMAGE FOR LARGER VERSION

THE TALE OF THE TAPE

(Figures for January 1, 2010 – December 31, 2010. All figures reported by Google Analytics)

- Unique Visitors 974,019

- Visits 6,486,371

- Page Views 55,556,593

- Pages Per Visit 8.57

- Avg Time On Site 7:46

- Number Of Countries/Territories 208

- Top 10 (Canada, USA, Germany, Netherlands, UK, Belgium, Sweden, Switzerland, Norway, Mexico)

The numbers look even better when you consider

- We built our model on quality vs quantity. As such, this is pure discussion. No spam, flaming and bickering traffic.

- We are only focusing on small-cap and mid-cap stocks …for now.

The continued strength in our traffic can be attributed to the following reasons.

1. Social Media

We have really turned on our social media efforts in 2010, which have resulted in:

- Twitter: A focus on great content has helped us generate 1,460 followers on our main AGORACOM Twitter Account. This is especially impressive when you consider the fact we have a 3.93:1 ratio of following:followers. In English, that means we’ve earned our followers, as opposed to simply racking up high totals by reciprocal follows.

- Our Facebook Fan Page now has over 475 Fans thanks to the great content (video, blog posts, tweets) we are feeding into it on a daily basis

SOCIAL MEDIA IS MEANINGLESS WITHOUT TRAFFIC

Furthermore, we’ve worked hard at cross-promoting our social media channels AND providing a variety of content on each. If you’re a small-cap company that is simply creating Twitter and Facebook accounts to post press releases, you are simply wasting your time (Beware Of …. Â The Rise Of Social Media IR “Experts” a.k.a Pretenders)

Cross-promote and differentiate so that investors have options to consume what is most important to them. Otherwise, investors simply won’t engage you. If you can’t do this internally, call me.

2. Cross-Promoting Great Content

We recently introduced a “News Flash” feature that allows us to provide investors in every corner of AGORACOM with breaking/important small-cap news as it happens. As a result, investors that may be focused on a particular HUB or group of HUBS on AGORACOM are discovering new ideas every day.

More than just lip service, click-through analysis shows these are a big hit with AGORACOM visitors and a good reason to both keep returning to the site and consuming our content.

3. Great Platform

Small-Cap Investors continue to flock to AGORACOM thanks to what we believe is the best small-cap community platform on the web. By providing Wiki and UGC tools to our members, we’ve put significant control into their hands and that has benefited the entire community. From adding/editing/updating content, to self-policing their own HUBS, members have created a small-cap community that is more informative and cleaner than any other small-cap site on the web. It isn’t perfect – but it is as close to perfect as you can get using today’s technology.

4. Mobile

We are seeing dramatic results from mobile devices that will be the subject of a separate blog post over the next few days. In the meantime, suffice it to say that mobile traffic is big and expanding rapidly as small-cap investors check in from the road, waiting rooms, the beach and any other place away from their PC. This is traffic we simply didn’t have a couple of years ago and we expect it to climb significantly for years to come. Hence, why we recently announced the launch of our iPhone Small Cap App.

DECREASE IN PAGE VIEWS

On the flip side, we have seen a decrease in page views over the same period last year that can probably be attributed to two items. First, one of our busier HUBS was Freewest Resources which was acquired by Cliff’s Natural Resources in Q1 2010 after a long and bitter battle with Noront Resources, which also happens to be a very busy HUB on AGORACOM.  As such, with Freewest being taken over, we haven’t had the benefit of page views for one of the prominent players within the Ring Of Fire, nor have we had the benefit of the debate between two very busy HUBS.

Second, as a result of our OSC matter, several of our high-profile client HUBS have been put on hold, leading to page view losses there as well.

Nonetheless, 974,000 visitors and 55,500,000 page views is pretty good for a slow year and we

CONCLUSION

Going forward, we’ll be adding further fuel to the fire via the following exciting initiatives:

* Rapid traffic expansion in 2011 as clients come back to AGORACOM.

* Our upcoming mobile push in Q1, including the launch of an Android and Blackberry App to complement our iPhone App and of course our Blackberry partnership

* Our next online conference in Q2

* An expanded content push (Holding our cards close to our chest)

* A greater social media push (Look for Facebook and Twitter integration announcements)

Thanks to our great clients and members for continuing to make AGORACOM the best community platform within the small-cap industry.

Regards,

George