Â

I first published this story in August of 2007 – but it is even more important today than ever before.

Now that AGORACOM Small Cap TV has cracked 400,000 views, one of the things we have noticed in our morning research is that small-cap companies continue to release news just at or before the open. This might have been a smart practice back in the day when only brokers could access press releases on their screens but it makes no sense whatsoever now that the web opens up your press releases to the entire world.

Why?

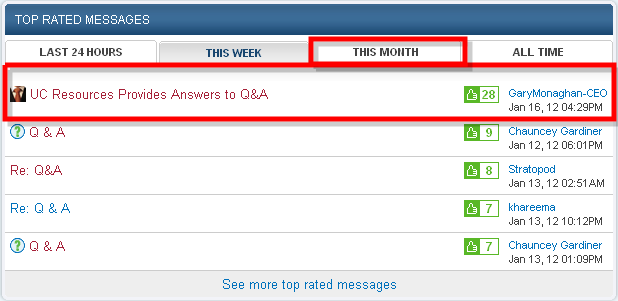

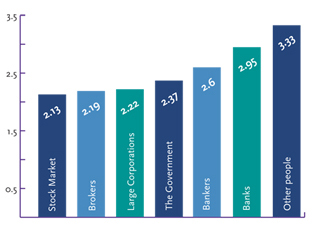

Folks, we are in a social media world (and never going back) in which investor communities are becoming invaluable sources of information for small-cap investors. As a result, small-cap and micro-cap information is being analyzed and discussed by and on AGORACOM, StockTwits, Twitter, Bloggers, Commentators, Podcasters, and Vloggers everyday.  Much of this collaboration takes place well before market open as online  investors prepare for their day.  The more time you give them to discover your news, the more time you give them to share it via their preferred networks …. for free!

THE LEAST THAT YOU COULD DO

Being the most recent news just prior to market open is no longer a smart strategy. Â It’s a dumb strategy. Â If you want your great news syndicated around the web by these incredible reporting sources, you have to give them a chance to see your news, digest it and report on it. That can’t happen at 9:15 because professional sources such as AGORACOM TV have a cut-off of 8:45 AM so that we can be published by 9:45. Â Individual investors also have the reality of a job that most begin by no later than 9:00 AM, which explains why most are doing their research between 7:30 – 8:30.

As such, if your press release is coming out at 9:30, you’ve robbed yourself of potential mass coverage by one or more sources that might have otherwise picked up your news and sent it right around the world.

Bottom line – put your news out by no later than 8:30 AM EST. In fact, somewhere between 8:00 and 8:30 AM EST makes the most sense …. unless shunning free coverage is actually part of your investor relations plan.

Best,

George