Fabled Silver Gold Corp. (“Fabled” or the “Company”) (TSXV:FCO)(OTCQB:FBSGF)(FSE:7NQ) is pleased to announce updates of diamond drill holes SM20-07 – 11 from the on-going 8,000 meter drill program on the “Santa Maria” Property in Parral, Mexico.

Peter J. Hawley, CEO and President, remarks, “We are heading into areas never explored before, with new ideas to test our structure-on-structure theory over the Property. Hole SM20-07 intercepted two broad zones of northwest trending, never seen before, semi-massive marcasite, (pyrite) in hornfels, and to the east 225 meters, we tried to cross the major C1 regional north – south fault in the center of the Property.”

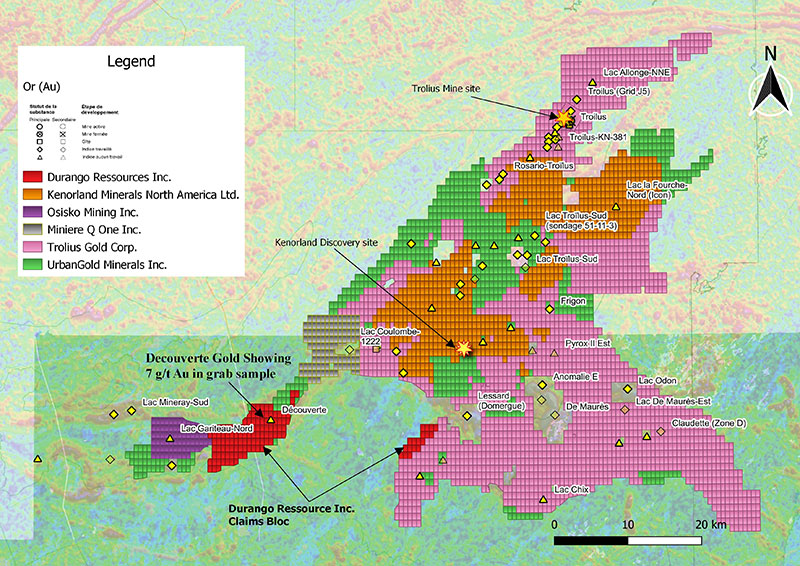

Hole SM20-07 was drilled at -50 degrees and 246.0 meters in length from same drill station as hole SM20-03 at an angle of 210 degree azimuth and designed to test the tail end of two northwest trending IP anomalies labeled IPSM-08. Northwest trending anomalies or structures have not been seen previously on the Property.

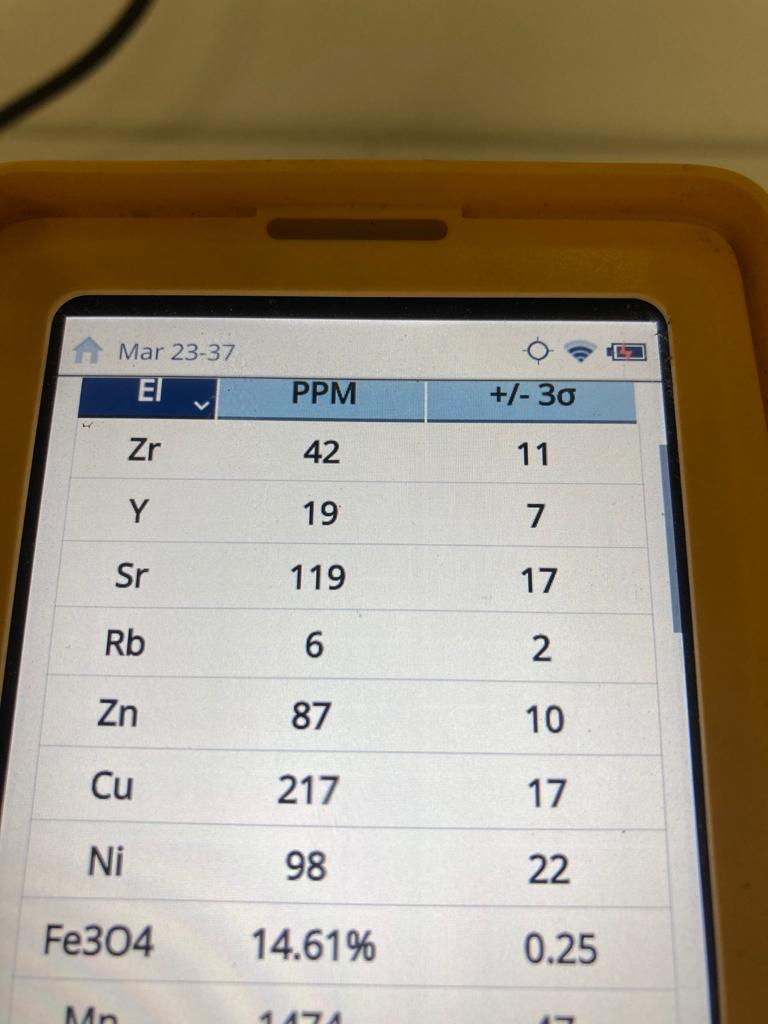

Drill results clearly demonstrate the cause of the two conductive zones, with a 19.90 meter intersection from 145.50 – 165.30 meters and a second 78 meter interval from 167 – 245 meters of greenish hornfels, (a metamorphic rock formed by the contact between a mudstone / shale (clay rich rock) and a hot igneous body, usually at shallow depths), with strong chlorite / sericite alteration with 25-30% marcasite, (white iron pyrite, FeS2). See Plan View of Drill Hole Locations below.

Drill hole SM20-08 was collared approximately 225 meters east of the drill station for holes SM20-4, 5, and 6. See drill plan below as designed to drill thru the interpreted main north – south structure at an oblique angle and hit the Santa Maria structure.

The hole was drilled with NQ size core, 1 7/8th inches at -50 degrees for a premature total depth of 64.18 meters where the hole was terminated by major faulting and could not be advanced further.

Drill hole SM20-08B was a re-entry into hole SM20-08 with larger PQ size drill core, 3.36 inches in diameter, to compensate for the massive broken structure, which allowed the hole to be drilled to a final depth of 234 meters and was successful in reaching its target. Currently all sampled drill core of interest is being tested. See Cross Section View below.

Drill hole SM20-09 was drilled with PQ size core from the collar, in anticipation of bad ground conditions, at -60 degrees for a targeted depth of -250 meters to hit the Santa Maria structure, as encountered in hole 8B and was terminated prematurely at 231 meters where not only did the hole collapse due to the fault but jammed the drill rods and a section of the drill string and bit was left in the hole.

Drill hole SM20-10 was designed to follow up on the hole SM20-8B targeted intercept but also to replace the loss of hole SM20-09.

HoleSM20-10 was drilled with PQ size core from the collar, in anticipation of bad ground conditions as seen previously, at -70 degrees for a targeted depth of -220 meters to hit the Santa Maria structure, as encountered in hole SM20-08B. The hole was successful in its objective and as such stopped at a total depth of 227.5 meters. Currently all sampled drill core of interest is being tested. See Cross Section View below.

Drill hole SM20-11 is located approximately 125 meters northeast of drill hole station 4 for holes SM20-08, 8B, 9, and 10. See Plan View of Drill Stations below.

The hole was drilled due west, 270 degrees, at -60 degrees targeting the intercept of the major north – south C1 regional structure at the right angle, 90 degree. The hole was successfully completed and drilled to a total depth of 258 meters.

New roads and drill pads have been completed and the drill is currently being moved to drill station 6 for hole SM20-12. See Plan View of Drill Stations below.

Peter Hawley continues, “We are systematically taking what was previously thought of as simple E-W high grade structure and re-evaluating, with numerous successes to date, in order to develop our new concept which is seen below in the “Plan View of Drill Station Locations over IP Anomalies”. Over the next few drill holes to test blue sky potential in the north of the Property should add to the new data base as we start to dial in the focus of the remaining drill program. With the Company well funded we will continue to explore all targets as they present themselves.”

Read More: https://agoracom.com/ir/FabledSilverGold/forums/discussion/topics/758317-fabled-reports-on-drill-holes-sm20-07-11/messages/2310474#message