In the realm of gold exploration and mining, one company stands out for its remarkable achievements and promising future – Loncor Gold. In a recent interview with Loncor Gold’s CEO, John Barker, we gained exclusive insights into the company’s significant milestones, its strategic vision, and the compelling investment opportunity it presents in the dynamic gold market.

A Leader in the Gold Industry

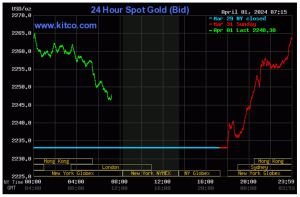

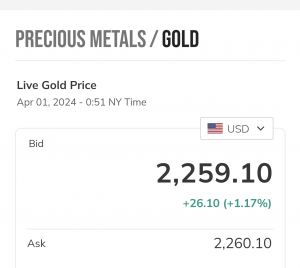

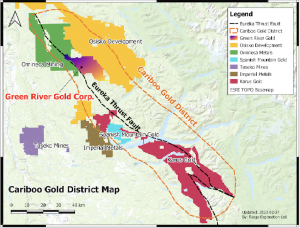

Loncor Gold (TSX: LN) (OTCQX: LONCF), has garnered attention as an undervalued gold exploration company with a substantial presence in the Democratic Republic of Congo (DRC). At a time when gold prices are soaring, Loncor Gold’s strategic positioning in the gold-rich DRC couldn’t be more opportune.

The company boasts control over approximately 4 million ounces of high-grade gold across its projects, with its flagship Adumbi gold deposit emerging as a world-class asset. Adumbi, the second-largest gold deposit in the DRC, holds immense potential with 1.9 million ounces of gold indicated and an additional 2.1 million ounces inferred. Moreover, Loncor Gold is about to possess $13.5 million in cash and short-term receivables, bolstering its financial strength and capacity for further growth.

Navigating Through Challenges with Resilience

In an industry characterized by volatility and uncertainty, Loncor Gold has demonstrated resilience and foresight. Despite operating in challenging market conditions, the company has remained steadfast in its pursuit of growth and value creation. CEO John Barker highlighted the company’s proactive approach, emphasizing their focus on expanding the business, preserving shareholder value, and seizing opportunities amidst market fluctuations.

Unveiling the Potential of Adumbi

Central to Loncor Gold’s success is the Adumbi gold deposit, renowned for its size, grade, and economic viability. With approximately 4 million ounces of gold under its control, Loncor Gold’s Adumbi deposit stands out as one of the largest and highest-grade projects in its peer group. The robust economics of the project, including a $1.3 billion after tax valuation and favourable production forecasts, underscore its significance as a value driver for the company.

Strategic Growth Initiatives

Loncor Gold’s strategic vision extends beyond its existing accomplishments, with a keen focus on further expanding the Adumbi deposit. The company’s plans to initiate an 11,000-meter drill program aimed at increasing the deposit size to 5 million ounces signal its commitment to unlocking additional value for shareholders. Moreover, with gold prices surpassing previous records, Loncor Gold is poised to capitalize on the favourable market dynamics and elevate its status as a key player in the gold sector.

Conclusion: A Bright Future Ahead

In conclusion, Loncor Gold’s remarkable achievements and strategic initiatives position it for a bright future in the gold industry. With a focus on maximizing shareholder value, expanding its resource base, and capitalizing on favorable market conditions, Loncor Gold is poised to emerge as a leading player in the global gold market. As investors seek opportunities in the precious metals sector, Loncor Gold stands out with tremendous potential and a compelling investment opportunity for those looking to capitalize on the enduring allure of gold.

YOUR NEXT $LN STEPS

$LN HUB On AGORACOM: https://agoracom.com/ir/LoncorGold

$LN 5 Minute Research Profile On AGORACOM: https://agoracom.com/ir/LoncorGold/profile

$LN Official Verified Discussion Forum On AGORACOM: https://agoracom.com/ir/LoncorGold/forums/discussion

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.

From time to time, reference may be made in our marketing materials to prior Records we have published. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously published information and data may not be current and should not be relied upon.

NO INVESTMENT ADVICE

This record, and any record we publish by or on behalf of our clients, should not be construed as an offer or solicitation to buy or sell products or securities.

You understand and agree that no content in this record or published by AGORACOM constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable or advisable for any specific person and that no such content is tailored to any specific person’s needs. We will never advise you personally concerning the nature, potential, advisability, value or suitability of any particular security, portfolio of securities, transaction, investment strategy, or other matter.

Neither the writer of this record nor AGORACOM is an investment advisor. Both are neither licensed to provide nor are making any buy or sell recommendations. For more information about this or any other company, please review their public documents to conduct your own due diligence.

If you have any questions, please direct them to [email protected]

For our full website disclaimer, please visit https://agoracom.com/terms-and-conditions