Author Archive

WeedMD $WMD $WDDMFCEO CEO George Scorsis Talks FY2020 Results, Q1 2021 Growth, Inflection Point, & More $CRON $GTBIF $INDS $FAF.ca $WEED.ca

CLIENT FEATURE: Fabled Silver Gold $FCO $FBSGF to Spin-Out Fabled Copper Co. to Shareholders $CMMC $NDM $CS $GMBXF

Fabled Silver Gold (TSXV:FCO ) (OTCQB: FBSGF) is in the metal discovery business.

They recently added copper to the exploration menu with news of a spin out of their Northern B.C. assets into Fabled Copper Co., providing FCO shareholders with a new vehicle capable of making a metals discovery.

Fabled Silver Gold controls 100% of the Santa Maria Gold and Silver property in Mexico and is its flagship project. It is a high grade underground mine with a rich mining history and a Silver Equivalent 43-101 with 3.2million ounces Indicated and 1.1m inferred.

Now as far as silver projects go 3.2M ounces isn’t very big but when serial mine finder and industry stalwart Peter Hawley was presented with it in 2016, he came out of retirement saying “it was almost too good to be true” and “this is the one I’ve been looking for.”

Santa Maria’s best historical intercept to date is a reported 11meters of 1,672 g/t Silver & 3.74 g/t gold and ending in mineralization. Current exploration has demonstrated drill success from the very first holes with an incredible intercept of 10 ounces of silver over 6 meters. As a result of the drill success, Fabled increased their original program from 8,000m to a minimum of 9200m to drill from underground to firm up the known resource, and for “Blue Sky drilling” to explore the numerous anomalies unexplored on the property capable of demonstrating discovery potential.

Not only that, Santa Maria is definitely in a great “neighborhood” within the mining friendly jurisdiction of Parral that has produced over 250M oz silver. The Parral mining district is situated in the centre of the Mexican epithermal silver-gold vein districts. The belt has been recognized as a significant metallogenic province, which has reportedly produced more silver than any other equivalent area in the world. Grupo Mexico, as an example, are their neighbor and border the Santa Maria property. Grupo (GMBXF) valued at 38$Billion, is the largest mining corporation in Mexico.

Santa Maria is in the perfect environment for further discoveries and increased development, yet has never been systematically or thoroughly explored with modern methods, until now. FCO is currently conducting their first drill program to support the 43-101 and expect results flowing right through June. It’s an excellent project and a company maker.

So why are we switching to copper?

Peter thinks he can do it again, only this time with Dr. Copper, who is in a metals bull of its own, and with properties located in a very favorable mining jurisdiction, British Colombia, Canada

Fabled is spinning out its copper assets to be placed into a new public vehicle, Fabled Copper Co., and the assets are good, really good. They already demonstrate the necessary value to create an excellent copper exploration and development company. In this case, Fabled’s Northern B.C “Muskwa” copper assets act like a dividend for Fabled Silver Gold shareholders. A unanimous Board approval vaults the Muskwa Copper project directly into the forefront of investors’ attention. Current shareholders will receive a new share in Fabled Copper Co. for every 5 Fabled Silver Gold Shares. It’s an incredible bonus for shareholders as it generates a Newco to follow a completely different metal currently in its own bull market.

Shareholders will own shares in both companies, Silver and Copper, and benefit by allowing capital markets to ascribe value to the Muskwa copper project independent of the Company`s silver properties.

Alone, this is a great deal for shareholders, but what may be hidden amongst the capital markets excitement is the fact that the 100% controlled Muskwa project comprises 3 known deposits and over 20 copper occurrences.

This is not small scale. The exploration and development infrastructure is advanced, extensive really. Fabled is prepared to act very quickly and are already on task to define multiple exploration teams, outfitters, helicopter services to outline, and budget a July to September 2021 exploration program.

Sometime words convey the story, but in this case it is better to hear it and see it directly.

Watch this amazing 2 minute video with CEO Peter Hawley that captures the magnitude of the exploration potential and work accomplished to date. It portends a very bright future for a discovery for all shareholders near and dear to Fabled. Silver, Gold….or Copper.

CLIENT FEATURE: Tartisan Nickel $TN $TTSRF Drilling The Kenbridge Nickel Deposit in a Battery Metals Bull $FPX $TLO $CNC $FCC $CVE

Tartisan Nickel (CSE:TN) ( OTC PINK:TTSRF) isn’t like any other Junior Metals Exploration Company. They own several high quality positions in multiple junior mining companies that were placed years ago, most notably Eloro Resources, whose Bolivian Tin Porphyry Deposit is quickly developing into a world class asset.

A similar mindset came into play when Tartisan purchased the Kenbridge Nickel Deposit. It was before the current battery metals boon, and it came with tremendous foresight of future value based off a tangible asset. The Kenbridge deposit is an asset that any exploration peer would love to have to develop their company around, not only because of the tremendous value in place through infrastructure, known mineralization and future discovery/expansion potential, but because it is considered a “Class One Nickel”, which is the main driver of the Battery metals Boom.

EV batteries require premium materials such as nickel sulfide, for which production levels remain low. Nickel sulfate powder—produced from nickel sulfide ore—is a critical ingredient in the cathode formulation for lithium-ion batteries, and analysts expect to see a boom in demand as global automakers transition away from gas engines and into producing EVs. It is this demand that supports Tartisans intention to further de-risk Kenbridge through an updated PEA and exploration drilling to potentially discover new “Class1 ” nickel deposits

Why Tartisan Owns A World Class Nickel Project

The prior owner of the Kenbridge asset never fully realized its potential and a disinterested market discounted nickel until it fell below a value threshold. This is where a smart, forward thinking operator recognized not only its present value to the market, but its future potential as well. Enter Tartisan Nickel

The Kenbridge Deposit is Underexplored & Shows Considerable Exploration Promise

- Class One Sulphide + Kenbride + Potential New Discovery KN1 & KN2

The Kenbridge deposit has Total Measured & Indicated Mineral Resources 7.47 Mt at 0.6% Ni and 0.32% Cu for a total of 95 Mlb of contained nickel. An additional 0.99 Mt at 1.0% Ni and 0.62% Cu (22 Mlb contained nickel) were calculated as Inferred Mineral Resources.

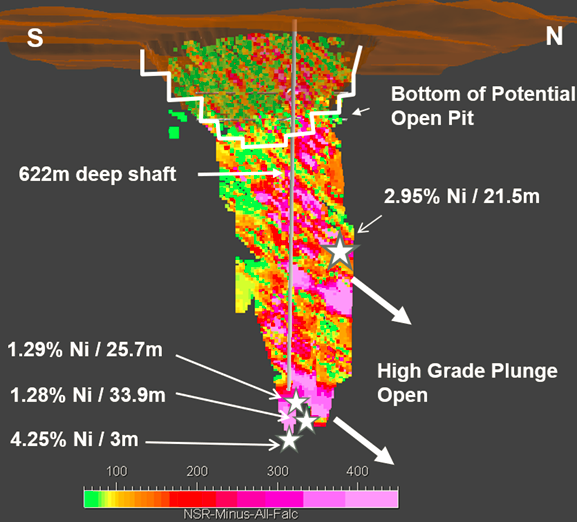

Kenbridge has an existing shaft to a depth of 2,042 ft (622 m), with level stations at 150 ft. (45 m) intervals below the shaft collar and two levels developed at 350 ft (107 m) and 500 ft (152 m) below the shaft collar.

Historical drill hole KB07-180 located on the north side of the Kenbridge Deposit intersected 2.95% Ni over 21.5 meters and the deepest hole (end of hole K2010 = 880 m below surface) intersected mineralization grading 4.25% nickel and 1.38% copper over 10.7 ft (3.3 m), indicating that the Deposit remains open at depth.

Why is this important?

It is very clear the deposit has much more to offer than its historical understanding.

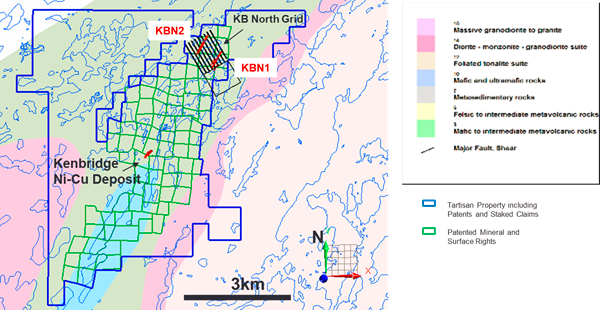

Tartisan recently performed a surface Time Domain Electromagnetic (“TDEM”) survey at Kenbridge North, 2.5km to the north of the Kenbridge Deposit, as well as borehole geophysics at the known Kenbridge Deposit. The Kenbridge North target is interpreted to represent similar rock types that host the Kenbridge Deposit. The same survey conducted on 2 historic drill holes suggest that conductive material does in fact continue to depth and to the north of Kenbridge Deposit.

Matching rock types kilometers apart using the same scientific study bodes well for future exploration success.

Discovering additional deposits can help improve all aspects of development, from lower CAPEX, improved economics and infrastructure.

Aster Funds Survey of Kenbridge Nickel Project

Tartisan CEO Mark Appleby said, “the survey picked out the Kenbridge Deposit and has shown the possible extension to the Kenbridge Deposit and three additional trends that relate directly to underlying geology and structure implicit in the Kenbridge Deposit. Of significant interest, the survey found two gold trends as well, which include the Violet and Nina historic gold occurrences. One of the occurrences is almost 54 hectares in size and covers almost all of three of our staked claims on the border of the Kenbridge property.”

The Kenbridge deposit has unexplored potential, through the extensive underground intersections that indicate the deposit remains open and possibly richer at depth, to the potential for new discoveries that can supply future battery metal demand.

The future looks very bright for those interested in this emerging smallcap Battery Metals explorer.

Tartisan Nickel Corp. plans to expand on these intersections, upgrade the Indicated and Inferred Mineral Resources and test high potential nickel exploration targets, such as the Kenbridge North Target.

VIDEO – GameOn Entertainment Technologies $GET.ca Brings Mobile and TV App Gaming to CSE, Backed by All-Star Leadership Team

GameOn Entertainment Technologies begins trading on the CSE this week under the symbol $GET, effective Tuesday, June 1.

The company has two core offerings: its flagship, consumer facing mobile and TV apps, and a white label solution for third parties.

GameOn’s flagship mobile and TV apps make it easier, faster and safer to “get in the game.” Compete with fans and challenge friends in free-play contests with cash prizes, powered by B2B distribution in homes and bars, with revenue being ad and sportsbook affiliate-driven.

To date, GameOn has:

- 100,000+ organic downloads

- 1,200+ reviews with a 4.5 average rating

- Is accelerated by Techstars_ and Comcast

- Won the All Star 2020 Chicago NBA Pitch Contest

In the Pipeline: Partnerships coming with Roku, Vizio, Samsung, Buffalo Wild Wings, Tokyp 2020, the Voice and LaLiga, among others.

Key company appeal:

- End-to-end build and management

- No additional lift for internal teams

- Less than 1-month turnaround to go live

- driving engagement, revenue and data

GameOn is a portfolio company of Victory Square Technologies (VST:CSE / VSQTF:OTC / 6F6:FWB), which builds, acquires and invests in promising start-ups, then provides the senior leadership and resources needed for fast-track growth.

- GameOn was purchased by V2 Games Inc, a portfolio company of VST, in December 2020. Following the asset purchase, the company was renamed GameOn Entertainment Technologies.

- VST head Shafin Diamon Tejani sits on the GameOn board

In February, the company appointed J Moses as Chairman. Moses, a respected game industry veteran who helmed BMG Games, which published the original Grand Theft Auto, has served as a Director at Take-Two Interactive since 2007.

GameOn Entertainment Technologies (GET) also boasts leaders from EA Sports, Intuit, Dapper Labs, Scopely, and the Brooklyn Nets. Santiago Jaramillo, Vice President of Product, spent 10 years building the EA Sports’ FIFA franchise and has worked on projects including NBA Top Shot.

Other notable Board members include Liz Schimel (Apple News, Conde Nast), Carey Dillen (YYoga, Boston Pizza) and GameOn CEO and Founder Matt Bailey (Brooklyn Nets, Barclays Center).

And industry leaders serving as advisors include: Mike Vorhaus (Vorhaus Ventures), Tim Cahill (CSO Aspire Academy, Professional Athlete), Sean Hurley, and Sabrina Carrozza (Sabrina LCP Communications).

So there’s an all-star team in place!

We sat down with Matt Bailey, GameOn’s Founder and CEO, to have him talk us through the company…

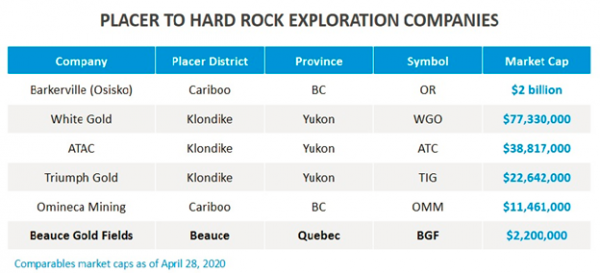

CLIENT FEATURE: Beauce Gold $BGF – The SmallCap Gold Company Poised to Make a Placer to Hard Rock Discovery $KG.ca $OSK.ca $TIG.ca $GSR.ca $ATC.ca $WGO.ca $OR.ca $KGC.ca

Beauce Gold Fields (BGF: TSXV) is going to discover where the gold from Canada’s first historical placer gold rush came from.

Beauce is very close to locating the hard rock source that created Canada’s first gold rush. The area Beauce controls produced the largest gold nuggets in Canadian mining history (50oz to 71oz) and if these nuggets were to be found today each would be worth over $100,000 at today’s gold price. Beauce controls 100% of the 6km trend where the first gold rush in Canada occurred and is very close to finding the source of Canadas first gold rush through drilling in 2021.

The presence of alluvial (surface) gold is a great indicator for a modern exploration company to search for the source. It is an indication of a large gold source close by and Beauce has proven this with a Paleoplacer Resource that is one of the largest un-mined Paleoplacer deposits in North America.

If successful Beauce will be able to prove a major discovery and the lode source for all surface gold ever found at the Beauce Gold Fields project area, while potentially developing an increasingly economic paleoplacer surface deposit.

3 Reason Why Beauce is Going is to Find The Hard Rock Source of Canada’s First Gold Rush

1. Multiple Peers Have Already Proven The Exploration Model Works

After decades of being overlooked, recent hard rock gold discoveries in the Yukon’s placer fields has led to a modern gold rush with major gold companies such as Goldcorp, Kinross, Barrick & Newmont investing hundreds of millions in Yukon juniors. Osisko Gold Royalties has invested $33 million in Barkerville alone. An easy peer review demonstrates the unexplored value that is a soon to be attraction to investors looking to capitalize on a proven exploration model, in an area without competition from peers that Beauce completely controls. An area that is waiting for a discovery to made.

Other companies have been very successful in leading the way for Beauce to demonstrate that placer gold has to come from a source, a source that is often superior to that which has already been found on surface.

2. The Project Area Has Seen No Modern Drilling For A Hard Rock Source.

Beauce controls the entire area, a 6 km long gold anomaly and fault zone

The project area hosts a six-kilometer-long unconsolidated gold-bearing sedimentary unit. There is gold in saprolite that indicates a close proximity to a bedrock source of gold along with the recent discovery of a fault underneath the historical gold placers, providing possible further exploration discoveries. All the signs point to a future drill program taking place.

Gold nuggets, geology, fault, angular gold – all point to finding the lode source (where it all came from)

Beauce controls an area that has never been systematically drilled for the hard rock source. Investors in 2021 are eagerly anticipating a drill announcement.

3. Beauce Already Has A Paleo Placer Gold Resource

Total gold potential ranges between 61,000 ounces to 366,000 ounces and is documented through the companies Beauce Paleo placer Project Business Model for Placer Mining (2015).

The Company has calculated a Gold Exploration Target for the entire historical placer channel ranges between 61,000 ounces (2,200,000 m3 @ 0.87g Au/m3) and 366,000 ounces* (2,200,000 m3 @ 5.22 g Au/m3).

If you think this is insignificant at first glance, the 2015 report pegs the all-in cost at US$630/oz at $1250 gold. Today gold is at $1900. The increase in the price of gold vastly improves the economic potential and development of the Beauce Paleoplacer deposit.

The cost to build the mine is only $8 million. This based of off a 2015 gold price of $1250 and an 8-year mine life that upon ccommencement of full-scale production the annual gold output should be between 8,000 oz. (base case) and 24,000 oz. This can generate annual cash flow between $6.5M (base case) and $25 Million. The operation is capable of producing around 40,000 oz per year within 4 years of commencing production.

At $1900 dollar gold, a modest 4000 ounces produced increases the revenue to $7.6 million from $6.5. At 24,000oz’s of production the revenue jumps to $45million. Enough to build a company, and certainly enough to fund exploring for where it all came from.

Click Here To Discover The Next Small Cap Canadian Gold Exploration Success Story

CLIENT FEATURE: Tajiri Resources $TAJ.ca A New Era of Gold Discovery $GXS.ca $EDV.ca $IMG.ca $GUY.ca

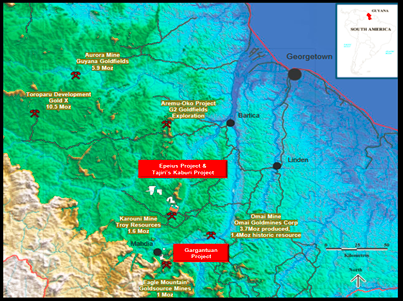

Tajiri Resources Corp. (TAJ.V) is exploring for world class gold deposits in Guyana

If you like companies whose management has a track record of gold discoveries, Tajiri is your company. Having already discovered around 20 million ounces through discoveries in Burkina Faso and…Guyana, where a high percentage of ythe ounces have been discovered.. Right where Tajiri is situated. Astute management acquired The Gargantuan and The Epeius-Kaburi Project where each show promise for a gold discovery.

The aptly named Gargantuan project was acquired due to its huge Artisanal mining footprint. Small gold miners have worked for the free, easy gold for over a hundred years. No one has found the source for all this gold.

Tajiri plans on changing that.

The Epeius-Kaburi Project is within a corridor of highly prospective ground adjacent to Troy’s Karouni Mine (discovered by Tajiri founder Dominic O’Sullivan) and put into production in 2017. They also have the Ohio Creek discovery that borders the Tajiri project area. Tajiri has many drill targets planned adjacent to significant drill intercepts along the property border with Troy, who have drilled holes as close as 5 meters from the property line.

Tajiri is a fundamentally strong exploration company with 2 properties in Guyana that could each wield major discoveries, supported by a management team that have a track record of discovering gold in Guyana.

3 Reason Why Tajiri is the next SmallCap to Discover

- Artisanal Mining Point Toward Larger Discovery Potential

The best place to find a large gold source is to look where its already been found. In this case the human footprint surrounding the gargantuan deposit has been around for over 100 years, believed to go as far back as 1860 and still produces a cumulative 35,000 ounces from small, independent miners. Tajiri is attempting to use this history to help in guiding where the source of the gold has come from. Until recently few had put the effort into finding where it has all come from, mostly due to the low hanging fruit effect. The gold is easy to find and there is a long history of it. Tajiri aims to find the source.

This is a classic picture analogy of a thousand words:

The amount of human activity required to alter the above paleochannel (where mother nature placed the gold through erosion) of the Mahdia River is staggering. Tajiri’s Gargantuan Project is interpreted to host the source of the gold produced from the artisanal workings in this picture and lies at an elevation that is above the extensive alluvial workings on the Mahdia River.

2. Management Has Discovery Record of 20Moz Gold in Guyana, West Africa and Australia

Management has astutely been cornering 2 extremely promising land packages in Guyana that may lead to Tajiri founder Dominic O’Sullivan’s next 20 million ounces. Dominic owns a large % of Tajiri and lives in Guyana, which plays a huge role in supporting the fundamental well-being of the company and has led to astute relationships that assisted in acquiring valuable and strategic land, at Gargantuan project as well as Epieus. A new era of gold exploration has begun for savvy investors

Through Dominic, management has invested around $2,400,000 in Tajiri since 2016 setting the stage for today by acquiring strategic land and preparing it for exploration success. The focus for the last four years has been on establishing a strong foundation for the company through acquisitions. It is early days in the gold bull and Dominic is here to stay as Tajiri is just getting started.

3. The Gargantuan and The Epeius-Kaburi Projects are Discovery Ready

The Gargantuan and Epeius –Kaburi projects set the stage for a new era in exploration, with both projects only requiring drilling to prove the value of the gold in the ground.

Gargantuan is prized for its Artisanal footprint, perhaps 4 -10 times larger than those associated with other Guiana Shield gold deposits in the 1 –10 Million-ounce range. The Gargantuan artisanal footprint is equaled by only one other, the Las Cristinas/Brisas deposit in Venezuela and that is 45 million ounces north of Gargantuan. Tajiri is clearly in the right exploration neighborhood. Guyana is host to multiple gold discoveries.

Tajiri’s Gargantuan property covers 6 km of a larger 12 km mineralized footprint that borders Goldsource on both sides of the trend where they have made recent discoveries through drilling. Thanks to Goldsource, Tajiri knows that the gold bearing rock runs north south and trends onto their sides of Gargantuan with only drilling required to confirm the scale of gold in the rock.

3a. Epeius-Kaburi Project

Troy Resources is drilling on multiple areas along the company’s Epeius Kaburi project border. Troy (ASX: TRY) is a small to midsize gold producer with a history of developing and operating mines. In July 2013 the Company acquired Azimuth Resources Limited which had discovered and delineated the Karouni Project in Guyana. The Company fast tracked development of Karouni with first gold production with 2017 being the first full year of production.

Why is this important? Dominic sold Azimuth that held the Karouni project to Troy. Tajiri now owns some of the most compelling exploration ground around the Karouni Mine and Troys property.

Tajiri has an excellent chance to be able to define satellite deposits within trucking distance of Troy’s mill where they are quickly running out of feed to run through it. Troy is looking for their own feed source, but due to their proximity to Tajiri’s border where they are drilling in many areas, it appears that Tajiri may have something that Troy is looking for. Tajiri has the potential to discover ounces next to an operating mine as trenching is investigating an area broadly on strike from ASX listed Troy Resource’s Limited’s Goldstar Prospect located on the southern boundary of the Project.

The area of investigation is resolving into three zones of mineralization:

A high-grade zone: The Magic Crack Zone (or the “MCZ”) which is associated with the contact of variably graphitic sediments and mafic volcanics where trenching to date has returned 2m @ 61.8 g/t Au, 1m @ 16.2g/t Au, 2m @ 9.2 Au, 2m @ 9.6g/t Au, 1m @ 4.2g/t Au and 6m @ 3.5g/t including 2m @ 8.0g/t Au over a strike length of 500m

A low-grade zone: The Pretty Ordinary Zone (or the “POZ”) which is associated with a series of small felsic and microdioritic/doleritic intrusives that presents as zones 2- 20m wide variably grading between 0.1 and 0.8g/t Au with rare values >1.0g/t, along with two better intersections near the MCZ of 12m @ 2.8g/t and 9m @ 0.9g/t including 5m @ 1.5g/t. This mineralization is associated with flat to shallow dipping quartz vein sets or in the better mineralized intervals with stockwork veining in or at the margins of the intrusive. Thus, the POZ may show considerable vertical grade variation related to density of horizontal vein sets and will require drill testing.

The newly discovered on strike extensions of Troy Resources Goldstar Prospect: The Goldstar Extended Zone (or the “GETZ”) which was intersected in Trench 13 and returned 12m@ 0.6g/t including 3m @ 1.0g/t and 13m@ 0.5g/t including 6m @ 1.0g/t Au. These intersections are located 880m to the northwest of and directly on strike from Goldstar where Troy has now commenced trial mining. The two zones are separated by approximately 35m across strike. Investigation of the strike continuity between Goldstar and the GEEZ will require drilling as the entirety of the strike of the GETZ between Trench 13 and Goldstar is covered by alluvium most of which has been heavily worked by artisanal miners.

Tajiri is an excellent company run by management that knows how to discover and define gold ounces for the benefit of the shareholder. It is in the company’s best interest as Dominic has a track record of discovery, and big ownership in the projects he supports.

Shareholders are in excellent hands leading them into a new era of exploration in Guyana.

Click Here To Discover Why Tajiri is Poised To Capture The Gold Market’s Attention

VIDEO – Datametrex $DM.ca $DTMXF CEO Talks Record-Breaking Q1 2021, AI Business, & More $PFM.ca $VQS.ca $SPOT.ca $ADK.ca

When it comes to small-cap companies, tech-focused Datametrex AI is in rarefied air; they have not one but two successful independent divisions each capable of being a company maker: COVID-19 test kit distribution, and AI-driven social media monitoring and discovery.

In our newest interview with Datametrex, we sit down with CEO Marshall Gunter to discuss the company’s record-breaking Q1 2021, their explosive AI business, their incredibly successful foray into the COVID-19 market, and more.

- Record Q1 Revenue of $19.04 Million up 2,253%

- Record Adjusted EBITDA of $10.68 Million up 1,548%

- Net Earnings of 9,560,351 up 1,425%

Check out the interview down below.\

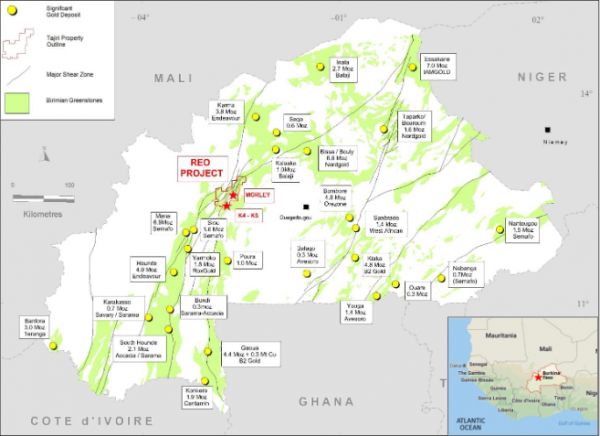

Client Feature: Tajiri Resources Client Feature: A New Era of Gold Discovery $GXS.ca $EDV.ca $IMG.ca $GUY.ca

Management Has Discovery Record of ~20Moz

Reo Gold Project in Burkina Faso is one of 2 Company making gold projects it its property portfolio.

- Maiden Drill Program:

- Project Focus: Morley and K4-K5 Prospects

Morley:

- Identified a potential high-grade gold bearing structure of 3-10m width and 400 metres in strike.

- MRTC0022’s 11 metres of 8.6 g/t Au including 3 metres at 30.9 g/t Au from 20 metres

- Previous drill and trench exploration identified high grade gold;

- MRTR001(trench) 11m @ 7.97g/t,

- MRRC005 10m @ 9.63g/t from 74m,

- MRRC040 5m @ 16.9g/t from 33m

There are clear signs of potential for a high grade near surface orebody similar in nature to other mines in the region.

K4-K5:

A large gold bearing system 4 x 5 km in size with 30,000m of previous drill data guiding current exploration.

Targeting 20 new zones for exploration follow up that correlate with the following past results

- MRRC0047 13m @ 2.47g/t from

- MRRB1608 12m @ 3.23 from 4m

- MRRC0081 16m @ 1.95g/t from 7m,

- 6m @ 2.27g/t from 54m,

- 13m @ 2.19g/t from 85m

- MRRC0091 10m @ 3.47g/t from 25m

Additionally, Tajiri will also test another 3-6 highly prospective targets with 1,500-2,000m of further drilling.

FULL DISCLOSURE: Tajiri Resources is an advertising client of AGORA Internet Relations Corp.

TAAT Global Alternatives $TAAT.ca $TOBAF sets Global Expansion Goals for its Beyond Tobacco offering, following UK deal & Nevada Facility Expansion $MO $PM $BATS

To understand the value proposition of TAAT, you first have to understand some recent massive trends in the Consumer Packaged Goods (CPG) space:

- Non-alcoholic beer has grown into a $18bn USD market

- The plant-based alternative meat market is projected to hit $74bn USD by 2027

What do they have in common? Providing consumers of the original products with almost the exact same experience (taste, smell, et cetera), without the negative parts of the original products.

Enter TAAT.

Tobacco is used by 1.3bn people worldwide, with a market that exceeds $930bn USD – many of whom wish to leave nicotine behind.

Under the administration of experienced leaders from the tobacco industry, TAAT™ Global Alternatives has developed a nicotine-free and tobacco-free smoking experience (known as TAAT™), which has already launched in the USA to tremendous feedback.

Now, the company has penned a major deal to launch its Beyond Tobacco™ cigarettes into the UK and Ireland, and recently leased two new Nevada facilities, increasing total space by more than 250%.

What does this mean for the firm’s distribution plans?

We sat down with TAAT CEO Setti Coscarella to find out…